With the bulk of Q1 corporate earnings now in the history books – and coming in much stronger than most, certainly permabear Mike Wilson, had expected – and with the key central bank decisions and econ data out of the way for the near future, two calendar highlights stand out this week: Wednesday’s CPI report in the US and today’s senior loan officer opinion survey (SLOOS).

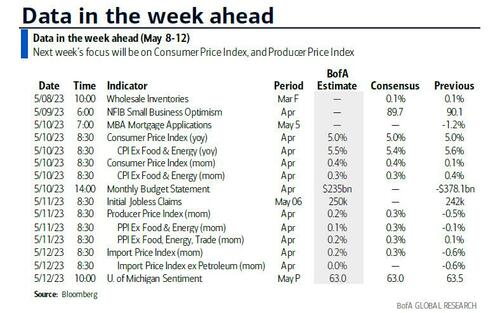

While we believe that today’s SLOOS will be the week’s most important event, many still are focusing on the CPI report, which according to economic consensus will rise by 0.4% leading to an annual increase of 5.0%; for core inflation, consensus expects a 0.3% print, and a 5.5% annual increase. Within core inflation, BofA expects core goods inflation rose by 0.2% m/m and core services inflation increased by 0.4% m/m.

One day after the CPI, on Thursday we get the PPI where consensus expects a 0.3% M/M headline PPI increase following the 0.5% drop in March. This would result in the y/y rate falling to 2.5% from 2.7%. The increase should be driven by a rise in energy and food prices. Excluding food and energy, core PPI will rise by a modest 0.2% m/m, reversing the prior month’s decline. However, this would lead the y/y rate to fall to 3.3% from 3.4%. Trade services (margins) were a big drag on core PPI in March, declining by 0.9% m/m, but BofA expects a more modest decline of 0.2% m/m this month. Last, look for core-core PPI, which excludes food, energy and trade services, to rise by 0.2% m/m or 3.4% y/y.

Turning to the all important SLOOS, which as Michael Hartnett shows last Friday is a leading indicator to virtually every key US data metric…

… Goldman expects that the lending standards measure for commercial and industrial (C&I) loans in the Fed’s April Senior Loan Officer Opinion Survey tightened by 15.4pt to 60.2, reflecting an increase of 33.3pt to 77.0 for small banks and a more modest increase of 10.3pt to 56.0 for large banks. This would bring the SLOOS’s measure of C&I lending standards to a level tighter than the dot-com crisis, if still less extreme than during the financial crisis or the height of the pandemic. A few more bank failures, however, and we will have a new record print. The April SLOOS typically reflects responses collected between the last week of March and the first week of April.

A day by day recap of the biggest global events is below courtesy of Rabobank

- Today: has the minutes of the BOJ March meeting, NAB business confidence/conditions in Australia along with building approvals. Germany has industrial production, seen -1.5% m-o-m. The ECB’s Lane speaks, and the Fed releases a senior loan officer opinion survey and the –ironic– 2023 financial stability report. The Fed’s Kashkari speaks on US minimum wages.

- Tuesday: has Aussie Westpac consumer confidence and Q1 retail sales ex-inflation as a feed into GDP, seen -0.5% q-o-q. China has trade data excepted to underline that it exports lots and imports less, and runs a staggering surplus that it sits on. The ECB’s Rehn, Centeneo, Lane, Vasle, Vujicic, and Schnabel all speak. We also get the Aussie budget, with the usual flourish of political theatre. The US NFIB small business survey has less flourish but is often as political – let’s see what it says about credit availability. The Fed’s Jefferson and Williams speak too. Chinese aggregate financing data will be out at some point from Tuesday onwards.

- Wednesday: sees final April German CPI, Canadian building permits, and the week’s highlight – US CPI, where the y-o-y headline is seen sticky at 5.0%, and the m-o-m is seen up 0.4% vs. just 0.1% in March. Core CPI is seen even higher at 5.8% vs. 5.6% in March, albeit up 0.3% m-o-m vs. 0.4% last time. The ECB’s Centeneo speaks again, and the US monthly budget statement is out.

- Thursday: has Chinese CPI, seen falling from 0.7% to just 0.3% y-o-y – which is what happens when supply vastly exceeds demand both at home and abroad. PPI is seen dipping from -2.5% to -3.2% y-o-y. Yes, deflation is an emerging problem in China. Imagine what happens if the US fully adopts industrial strategy and/or mercantilism! The ECB’s De Cos, Schnabel, and Guindos all speak, and the BOE meet to set rates. The US has weekly initial claims data and PPI, seen 0.2% m-o-m and 0.3% core, 2.5% and 3.3% y-o-y.

- Friday: closes the week with Kiwi inflation expectations, UK monthly GDP and March industrial production and trade data, and provisional Q1 GDP (seen 0.1% q-o-q, 0.2% y-o-y). The BOE’s Pill speaks, and we shall see how many he manages to offend this time round. The US has import and export prices, and Michigan consumer sentiment for May. The Fed’s Daly, Bullard, and Jefferson all speak.

Next, here is a visual recap of the main US events this week:

… and a detailed summary from Goldman which notes that the key economic data release this week is CPI inflation on Wednesday and SLOOS today. There are several scheduled speaking engagements by Fed officials this week, including remarks by New York Fed President Williams on Tuesday and by Fed Governor Waller on Thursday.

Monday, May 8

- 10:00 AM Wholesale inventories, March final (consensus +0.1%, last +0.1%):

- 02:00 PM Senior Loan Officer Opinion Survey, banks tightening C&I loans for large and middle-market firms, April (GS 60.2, last 44.8): We expect that the lending standards measure for commercial and industrial (C&I) loans in the Fed’s April Senior Loan Officer Opinion Survey tightened by 15.4pt to 60.2, reflecting an increase of 33.3pt to 77.0 for small banks and a more modest increase of 10.3pt to 56.0 for large banks. This would bring the SLOOS’s measure of C&I lending standards to a level tighter than the dot-com crisis but less extreme than during the financial crisis or the height of the pandemic. The April SLOOS typically reflects responses collected between the last week of March and the first week of April.

- 04:45 PM Minneapolis Fed President Kashkari (FOMC voter) speaks: Minneapolis Fed President Neel Kashkari will moderate a panel discussion on the minimum wage hosted by the Minneapolis Fed. On April 11th, President Kashkari argued that “it could be that our monetary policy actions and the tightening of credit conditions because of this banking stress leads to an economic downturn. … I’m not hoping for that, [but] … it would be unambiguously worse if we failed to get inflation back down.”

Tuesday, May 9

- 06:00 AM NFIB small business optimism, April (consensus 89.5, last 90.1)

- 08:30 AM Fed Governor Jefferson speaks: Fed Governor Philip Jefferson will take part in a virtual event hosted by the Atlanta Black Chamber. Moderated Q&A is expected. On May 1ˢᵗ, the media reported that the White House was likely to nominate Governor Jefferson to be Vice Chair of the Fed. In a speech on February 24th, Governor Jefferson noted that “labor compensation has started to decelerate somewhat over the past year but is still running too high to be consistent with returning inflation to 2 percent in a timely and sustainable fashion.” Governor Jefferson also stressed that a key difference between the current inflationary episode and the Great Inflation of the late 1960s and 1970s was that the Fed was now “addressing the outbreak in inflation promptly and forcefully to maintain credibility and to preserve the “well anchored” property of long-term inflation expectations.”

- 12:05 PM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will speak to the Economic Club of New York. Text and moderated Q&A are expected. On April 19th, President Williams noted that he still expected “growth to be positive this year, for the fourth quarter to fourth quarter GDP growth, but really modest. That’s where I come out by balancing an economy that seems to have still good momentum [with] the effects of tighter monetary policy here and abroad, and also the likely effects of tighter credit conditions.”

Wednesday, May 10

- 08:30 AM CPI (mom), April (GS +0.50%, consensus +0.4%, last +0.1%); Core CPI (mom), April (GS +0.47%, consensus +0.3%, last +0.4%); CPI (yoy), April (GS +5.09%, consensus +5.0%, last +5.0%); Core CPI (yoy), April (GS +5.59%, consensus +5.5%, last +5.6%): We estimate a 0.47% increase in April core CPI (mom sa), which would leave the year-on-year rate unchanged at 5.6%. Our forecast reflects a 4% jump in used car prices reflecting the auction-price strength in Q1, as well as a 0.8% increase in apparel prices reflecting a rebound in clothing spending and positive residual seasonality. We also expect another gain in the car insurance category as carriers continue to offset higher repair and replacement costs. However, we assume a pullback in travel categories (airfares -2%, hotel lodging -1%) due to softness in webfares and negative residual seasonality. We believe the March slowdown in shelter categories was genuine and reflects a waning boost from post-pandemic lease renewals. Accordingly, we look for similar monthly readings in April (we estimate rent +0.50% and OER +0.52%). We estimate a 0.50% rise in headline CPI, reflecting higher food and energy prices.

Thursday, May 11

- 08:30 AM Initial jobless claims, week ended May 6 (GS 245k, consensus 245k, last 242k); Continuing jobless claims, week ended April 29 (consensus 1,820k, last 1,805k): We estimate that initial jobless claims edged up to 245k in the week ended May 6. While the annual seasonal factor revisions that took place earlier this month appear to have resolved most of the seasonal distortions in initial claims, we believe the revisions may have intensified the distortions in continuing claims. Those distortions have likely contributed to the decline over the last few prints, and we estimate they could exert a cumulative drag on the level of continuing claims of up to 400k between April and September.

- 08:30 AM PPI final demand, March (GS +0.3%, consensus +0.3%, last -0.5%); PPI ex-food and energy, March (GS +0.2%, consensus +0.2%, last -0.1%); PPI ex-food, energy, and trade, March (GS +0.3%, consensus +0.3%, last +0.1%)

- 10:15 AM Fed Governor Waller speaks: Fed Governor Christopher Waller will discuss financial stability and climate change at a conference in Madrid. Text and moderated Q&A are expected. On April 14th, Governor Waller noted that “because financial conditions have not significantly tightened, the labor market continues to be strong and quite tight, and inflation is far above target, monetary policy needs to be tightened further.” Governor Waller also stressed that “how much further will depend on incoming data on inflation, the real economy, and the extent of tightening credit conditions.”

Friday, May 12

- 08:30 AM Import price index, April (consensus +0.3%, last -0.6%)

- 10:00 AM University of Michigan consumer sentiment, May preliminary (GS 64.0, consensus 63.0, last 63.5): University of Michigan 5-10-year inflation expectations, May preliminary (GS +3.0%, consensus +2.9%, last +3.0%): We expect that the University of Michigan consumer sentiment index rose to 64.0 in the preliminary May report. We expect that the report’s measure of long-term inflation expectations remained unchanged at 3.0%, reflecting the modest rebound in gasoline prices and uncertainty related to banking stress.

- 02:20 PM San Francisco Fed President Daly (FOMC non-voter) speaks: San Francisco Fed President Mary Daly will deliver a commencement address to the USC Sol Price School of Public Policy. On April 12th, before the FOMC’s May meeting, President Daly noted that “while the full impact of this policy tightening is still making its way through the system, the strength of the economy and the elevated readings on inflation suggest that there is more work to do.” Still, President Daly emphasized that “how much more time and how much additional slowing is coming is unclear.”

- 07:45 PM Fed Governor Jefferson and St. Louis Fed President Bullard (FOMC voter) speak: Fed Governor Phillip Jefferson and St. Louis Fed President James Bullard will take part in a panel discussion on monetary policy strategy at a conference hosted by the Hoover Institution. Text for Governor Jefferson’s remarks and audience Q&A are expected. On May 5th, President Bullard noted that the FOMC’s decision to hike by 25bp in May was “a good next step.” President Bullard also argued that “regional banks will do just fine coming out” of the current turmoil, and that a recession was “not the base case” in his forecast.

Source: Rabobank, BofA, Goldman