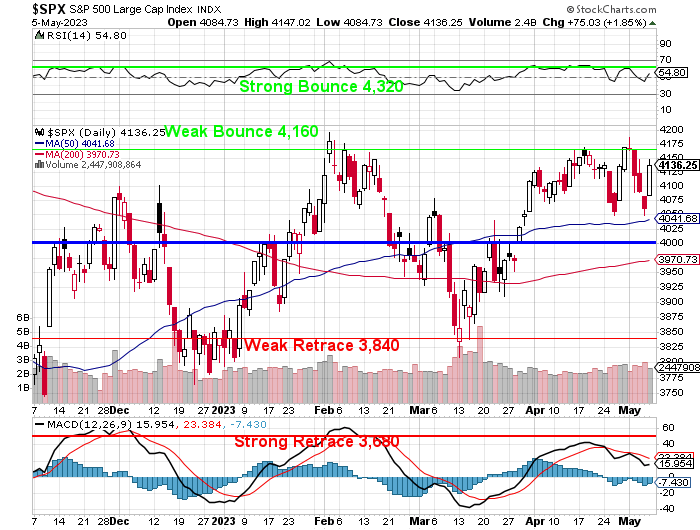

4,160.

A lot of you have forgotten that that is the Weak Bounce line on the S&P 500 and that’s what we’re testing this week – after last week’s very sudden, and misguided reaction to more jobs. This week, we’ll see if there’s also more inflation that the market can misinterpret as well.

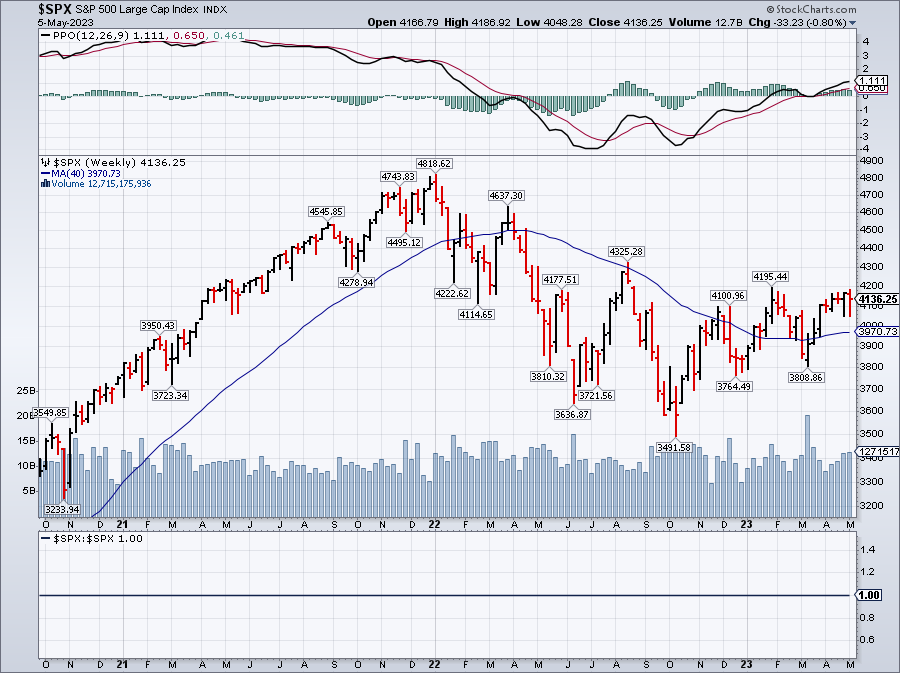

In the bigger picture, it’s a lot more clear that this is all only, so far, a weak bounce off the 200-day moving average, which is only just now recovering to our 4,000 base-line (and weakly at that). In other words – Don’t Get Excited!

Earnings season has not been the catastrophe it was shaping up to be with the banking crisis. That’s because the banks that would have reported hundreds of Billions of Dollars worth of losses have been absorbed and those losses have been bailed out already – so no losses to report.

With bank losses swept under the rug and 85% of the S&P 500 having now reported, 79% have beaten Earnings expectations (which were very low) with 75% beating Revenue expectations – also very low. Profits are down 2.2% overall but were forecast to be down close to 5% so again, we are crushing the low expectations.

Only 79 companies out of 425 that have reported have given guidance at all and 56% of that guidance was lower than expected but the market has recovered once again to test our Weak Bounce line at 4,160 so, hopefully, 4th time (this year) is a charm!

Berkshire Hathaway is a nice proxy for the S&P 500 and the reported nice earnings on Saturday of $8.1Bn for Q1, up 12.6% from last year and that was entirely driven by a $911M profit increase in their Insurance Business (Geico, etc.) which benefited from higher rates on their reserves – which was our entire premise for investing in insurance companies.

Shel-Bot has been getting very good at breaking down reports so here’s his take on Berkshire’s quarterly report:

⊗The Good:

-

-

- The company’s insurance business had a strong quarter, with a profit of $911 million, up from $167 million a year ago1. The company also benefited from higher insurance investment income, which rose 68% to $1.969 billion from $1.170 billion2.

- The company’s equity security investments, such as Apple, increased in value by $23.4 billion in Q1 2023, compared to a loss of $771 million in Q1 20222. The company also recorded a net remeasurement gain of $2.4 billion related to its acquisition of an additional 41.4% stake in Pilot Travel Centers2.

- The company’s cash hoard increased to $130.6 billion at the end of Q1 2023, up from $128 billion at the end of Q4 20221. The company repurchased $4.4 billion worth of its own stock in Q1 2023, up from $2.8 billion in Q4 20222.

- The Bad:

- The company’s railroad business, BNSF, saw its earnings decline to $1.247 billion from $1.371 billion a year ago2, due to lower volumes and higher fuel costs1. The company’s energy business, Berkshire Hathaway Energy Company, also reported lower earnings of $416 million, down from $775 million a year ago2, due to the impact of severe winter storms on its operations1.

- The company’s operating earnings increased by only 12.6% in Q1 2023, compared to 23% in Q4 2022 and 32% in Q3 20222. This was below the expectations of some analysts who expected a faster recovery from the pandemic-induced slowdown1.

- The company’s revenue growth was also modest at 5.4% in Q1 2023, compared to 9% in Q4 2022 and 14.8% in Q3 20222. This was partly due to the challenges faced by some of its other controlled businesses and non-controlled businesses that were affected by lower demand and supply chain disruptions2.

- The Ugly:

- The company revealed that it sold about $6 billion worth of Chevron stock in Q1 2023, reducing its stake in the oil giant by 20%3. The company did not disclose the reason for the sale, but some analysts speculated that it could be due to environmental or valuation concerns3. The sale also raised questions about the company’s capital allocation strategy and its ability to find attractive investment opportunities3.

- The company’s net earnings of $35.5 billion in Q1 2023 were largely inflated by the unrealized gains from its equity security investments, which are subject to market fluctuations and do not reflect the underlying performance of its businesses2. The company’s chairman and CEO Warren Buffett has cautioned investors to not pay attention to these gains or losses as they are not indicative of the company’s true value2.

- The company’s share price underperformed the S&P 500 index in Q1 2023, gaining only 4.9% compared to the index’s 7.7% increase2. This was despite the fact that the company’s book value per share increased by 10.6% in Q1 2023, indicating that the market may be undervaluing the company or expecting more growth from it2.

-

Again, nothing to actually get too excited about. As Buffett notes, these gains are ethereal at best…

What I want to see in Berkshire’s annual report is an underlying strength in the performance of their subsidiaries that is augmented by the performance of their holdings – that was not the case at all:

-

- Insurance: GEICO, General Re, Berkshire Hathaway Reinsurance Group, Berkshire Hathaway Primary Group, National Indemnity Company, etc.

- Railroads: BNSF Railway Company

- Utilities: Berkshire Hathaway Energy Company, which includes MidAmerican Energy Company, NV Energy, PacifiCorp, Northern Powergrid, etc.

- Manufacturing: Acme Brick Company, Benjamin Moore & Co., Clayton Homes, Duracell, Forest River, International Metalworking Companies (IMC), Johns Manville, Lubrizol Corporation, Marmon Holdings Inc., Precision Castparts Corp., etc.

- Consumer Products: Brooks Sports, Fruit of the Loom, Garanimals, H.H. Brown Shoe Group, Justin Brands, See’s Candies, etc.

- Service: Berkshire Hathaway HomeServices Cancun Properties, Business Wire, Charter Brokerage LLC, FlightSafety International Inc., NetJets Inc., TTI Inc., etc.

- Retailing: Borsheim’s Fine Jewelry, Helzberg Diamonds, Jordan’s Furniture Inc., Nebraska Furniture Mart Inc., RC Willey Home Furnishings Inc., Star Furniture Company Inc., etc.

If Buffett’s companies are underperforming – how do you think the guy down the block is doing?

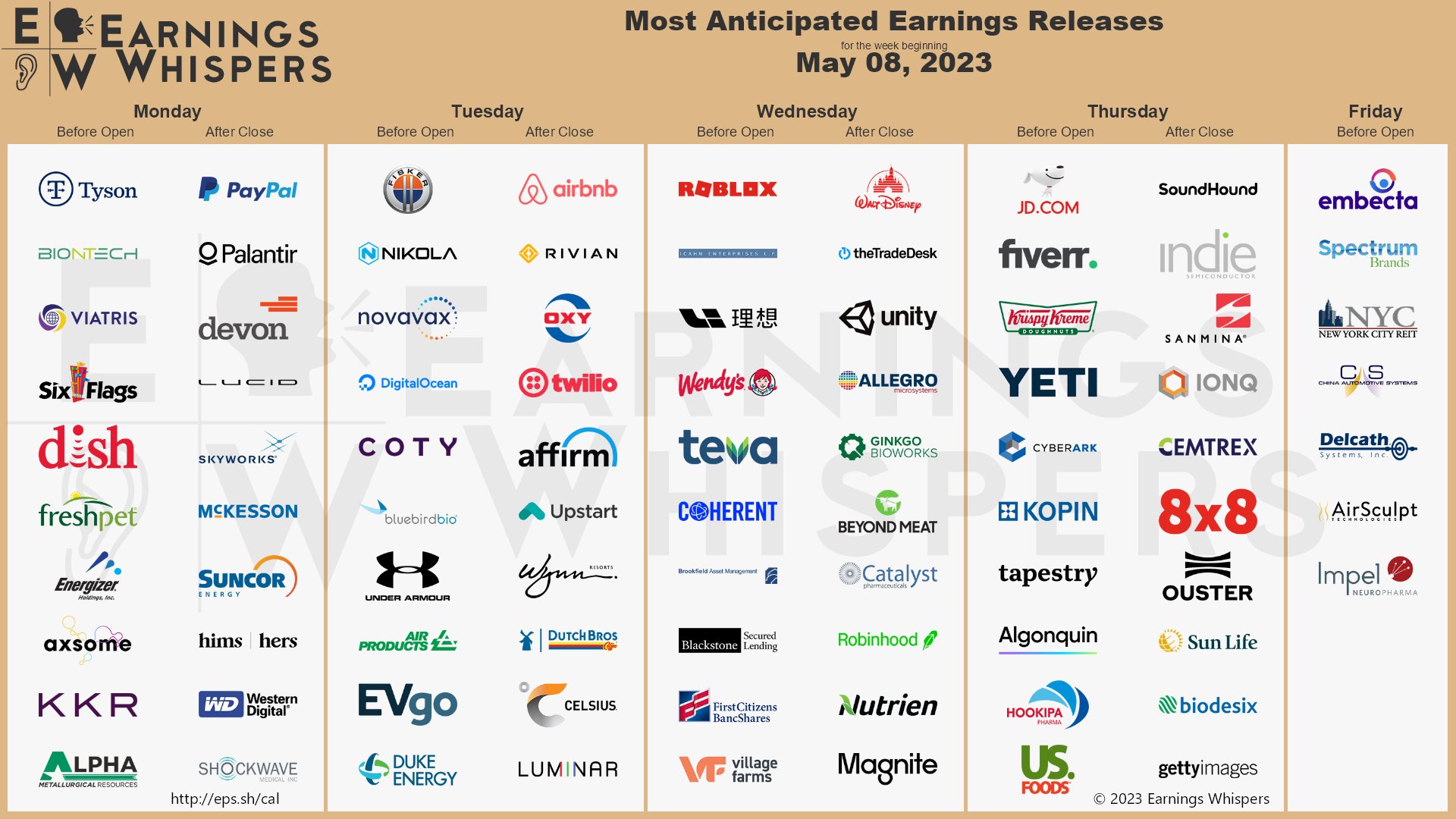

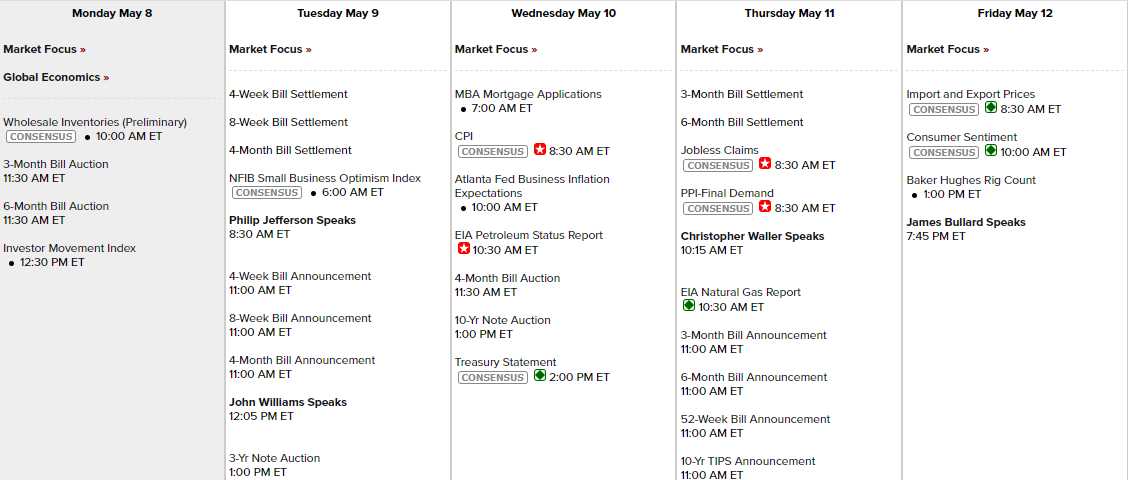

The economic data is fairly light this week but CPI on Wednesday morning is critical – as is the 10-year note auction which follows it. PPI on Thursday and Consumer Sentiment Friday and we’re at the tail end of earnings season with the S&P 500 pretty much done this week:

I’ve been trying to teach Shel-Bot how to analyze the markets for me so, this week, I’ve asked him what 5 companies are most likely to miss this week.

⊗ Here is what I found:

-

- Lucid Motors (LCID): The electric vehicle maker is expected to report its first-quarter results on Monday, May 8, after the market close. Analysts expect the company to report a loss of $0.28 per share on revenue of $0.001. The company has not delivered any vehicles yet and is facing production delays and supply chain challenges due to the pandemic and the global chip shortage2. The company also faces intense competition from Tesla and other EV players in the market2. Therefore, the company may miss its earnings expectations or provide a weak outlook for the rest of the year.

- Airbnb (ABNB): The online travel platform is expected to report its first-quarter results on Tuesday, May 9, after the market close. Analysts expect the company to report a loss of $1.07 per share on revenue of $717.4 million3. The company has been struggling with the impact of the pandemic on its core business of short-term rentals and travel experiences4. The company also faces regulatory hurdles and legal challenges in some of its key markets, such as New York and San Francisco4. Therefore, the company may miss its earnings expectations or provide a cautious outlook for the recovery of the travel industry.

- The Trade Desk (TTD): The digital advertising platform is expected to report its first-quarter results on Wednesday, May 10, after the market close. Analysts expect the company to report earnings of $0.77 per share on revenue of $214.8 million5. The company has been facing headwinds from the changes in the online privacy landscape, such as Apple’s iOS 14.5 update and Google’s plan to phase out third-party cookies6. The company also faces increasing competition from Google and other ad tech players in the market6. Therefore, the company may miss its earnings expectations or provide a lower guidance for the future growth of its business.

- Robinhood Markets (HOOD): The online brokerage platform is expected to report its first-quarter results on Wednesday, May 10, after the market close. Analysts expect the company to report earnings of $0.16 per share on revenue of $522.2 million. The company has been dealing with the backlash from its controversial decision to restrict trading on some popular stocks during the GameStop saga in January. The company also faces regulatory scrutiny and legal actions from various authorities and customers over its trading practices and disclosures. Therefore, the company may miss its earnings expectations or provide a negative outlook for its user growth and profitability.

- Uber Technologies (Uber): The ride-hailing and delivery giant is expected to report its first-quarter results on Thursday, May 11, after the market close. Analysts expect the company to report a loss of $0.54 per share on revenue of $3.28 billion. The company has been facing challenges from the pandemic’s impact on its mobility segment, which saw a decline in demand for rides due to lockdowns and social distancing measures. The company also faces regulatory uncertainty and labor issues in some of its key markets, such as California and Europe. Therefore, the company may miss its earnings expectations or provide a weak outlook for its recovery and growth prospects.

I hope this list helps you identify some of the companies that are most likely to miss their earnings and why that are scheduled to report for the week of May 8, 2023.😊

We’re still on the sidelines and waiting to see how things turn out but, according to our Watch List, there are still plenty of bargains to be had and the only think that would rush us is a clear break over 4,160 that holds for the week along with 1,800 being re-taken on the Russell.

The world is changing fast – let’s try to enjoy the ride…