Three months ago, back in February, we had already warned that the Q4 “Fed Loan Officers Paints Dire Picture: Loan Standards Approaching Record Tightness As Loan Demand Plummets.”

Well, fast forward to today when the latest, just released Senior Loan Officer Opinion Survey on Bank Lending Practices showed that what was already an ugly picture turned much worse as both credit standards tightened further, while credit demand tumbled to levels not seen since 2009.

First, we look at what today’s closely-watched SLOOS survey revealed quantitatively for the first quarter of 2023 when, as everyone knows, no less than 3 major banks collapsed, requiring the biggest Fed banking system intervention since Lehman.

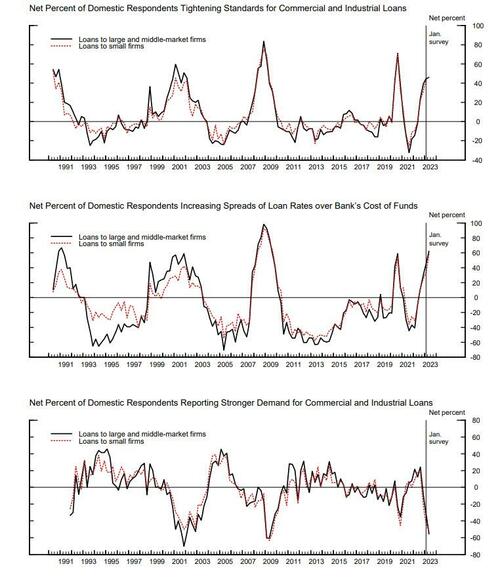

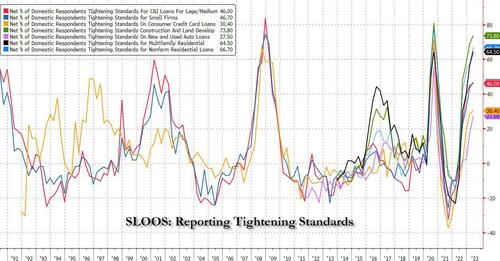

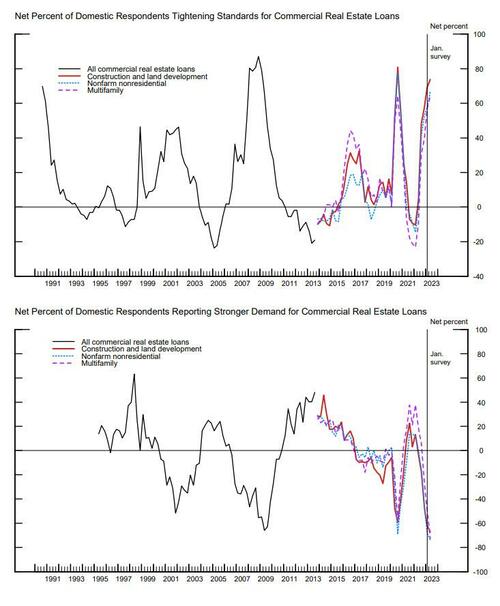

- Regarding loans to businesses, survey respondents reported, on balance, tighter standards and weaker demand for commercial and industrial (C&I) loans to large and middle-market firms as well as small firms over the first quarter. Meanwhile, banks reported tighter standards and weaker demand for all commercial real estate (CRE) loan categories.

- For loans to households, banks reported that lending standards tightened across all categories of residential real estate (RRE) loans other than government-sponsored enterprise (GSE)-eligible and government residential mortgages, which remained basically unchanged. Meanwhile, demand weakened for all RRE loan categories.

- In addition, banks reported tighter standards and weaker demand for home equity lines of credit (HELOCs). Standards tightened for all consumer loan categories; demand weakened for auto and other consumer loans, while it remained basically unchanged for credit cards.

Here is a snapshot of C&I supply and demand (broken down by small vs middle and large firms), as well as respondents indicating the spread on their loan rates is rising vs Fed Funds.

A closer look at lending standards reveals a picture that was perhaps not as dire as some had expected: recall earlier today we reported that Goldman’s Jan Hatzius expected the lending standards measure for C&I loans to tighten by 15.4pt to 60.2, reflecting an increase of 33.3pt to 77.0 for small banks and a more modest increase of 10.3pt to 56.0 for large banks. The actual number was not nearly as bad, with C&I standards posting just a modest tightening to 46.

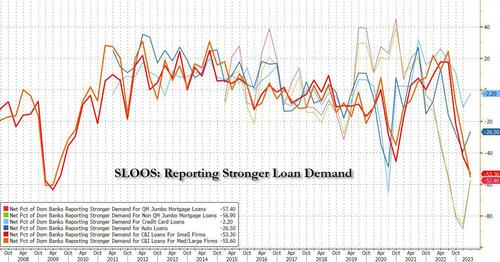

What little good news there was on the supply side was promptly wiped out on the demand side, where the net number of banks reporting stronger C&I loan demand tumbled to -53.30 from -31.30 in January, and not only below the lowest print during the covid crash, but matching the C&I loan demand hit during the depths of the 2008/09 financial crisis.

And while there was a surprising bounce in demand for other loan categories, such as Credit Card loans, auto loans, and Jumbo mortgage loans, one can argue that all the data reveals is a sudden shock for corproations, which refuse to borrow – and thus grow – until there is more stability, offset by surging loan demand by consumers who are loading up as fast as they can on credit card, auto and mortgage debt… just in time for the highest interest rates in a generation.

But wait there’s more: with everyone freaking out about commercial real estate, the April SLOOS included a special question inquiring about banks’ changes in lending policies for CRE loans over the past year; about the reasons why banks changed standards for all loan categories over the first quarter; and about banks’ expectations for changes in lending standards over the remainder of 2023 and reasons for these changes.

Not surprisingly, banks reported having tightened all the terms surveyed on all categories of CRE loans. For construction and land development loans, major net shares of banks widened the spread on loan rates, lowered loan-to-value ratios, and increased debt service coverage ratios; significant shares of banks decreased maximum loan size and market areas covered; a moderate net share of banks shortened the length of interest-only payment periods, and a modest net share of banks decreased maximum loan maturity. For nonfarm nonresidential loans, major net shares of banks widened the spread on loan rates and lowered the loan-to-value ratio; significant net shares of banks increased debt service coverage and decreased maximum loan size and market areas served; moderate net shares of banks shortened length of interest-only payment period and decreased the maximum loan maturity. For multifamily loans, major net shares of banks widened the spread on loan rates and lowered the loan-to-value ratio; significant net shares of banks increased debt service coverage and decreased maximum loan size; and moderate net shares of banks decreased the length of interest-only payment periods, market areas served, and maximum loan maturity.

Bottom line, and this should come as a surprise to nobody, banks reported tightening lending policies for all categories of CRE loans over the past year, with the most frequently reported changes pertaining to wider spreads of loan rates over banks’ cost of funds and lower loan-to-value ratios.

But what was far more concerning is that regarding the second set of special questions about reasons for changing standards on all loan categories in the first quarter, banks cited a less favorable or more uncertain economic outlook, reduced tolerance for risk, deterioration in collateral values, and concerns about banks’ funding costs and liquidity positions.

Finally, regarding the last set of special questions about banks’ outlook for lending standards over the remainder of 2023, banks reported expecting to tighten standards across all loan categories. Banks most frequently cited an expected deterioration in the credit quality of their loan portfolios and in customers’ collateral values, a reduction in risk tolerance, and concerns about bank funding costs, bank liquidity position, and deposit outflows as reasons for expecting to tighten lending standards over the rest of 2023.

In other words, while today’s SLOOS may not have been as dire as some had expected, the credit crunch is just starting as banks expect “to tighten standards across all loan categories.”

Finally, all of this assumes there will be no more bank failures which, as we exlained earlier today, is simply idiotic since the Fed continues QT…

anyone who says bank deposit flight can reverse while Fed is doing QT has zero idea how the financial system works pic.twitter.com/rcPFOIdOrz

— zerohedge (@zerohedge) May 8, 2023

… and will shrink the deposit base by about $95 billion every month (the pace of QT), primarily from small banks until such time as the Fed throws in the towel after many more regional bank failures.