By Simon White, Bloomberg Markets Live reporter and strategist, as published on ZeroHedge

US banks’ tightening of lending conditions points to a significant slowdown in bank credit extended, while non-bank credit will become more expensive as spreads widen.

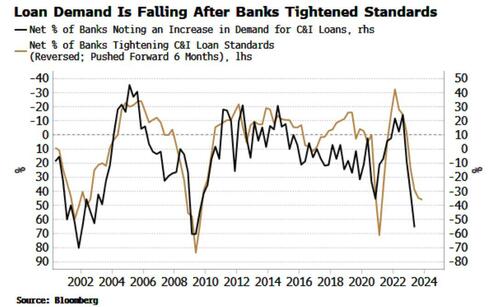

The latest Senior Loan Officer Opinion Survey was released Monday. Often the different aspects of the survey are conflated, but they are best understood by noting that lending in the US follows a well-defined sequence. Lending standards are the most leading part. These have been tightening and lead loan demand by about six months.

The latest survey showed only a slight further tightening in banks’ lending standards, and a much sharper drop off in loan demand. But this was anticipated as lending standards had tightened sharply over the last 18 months.

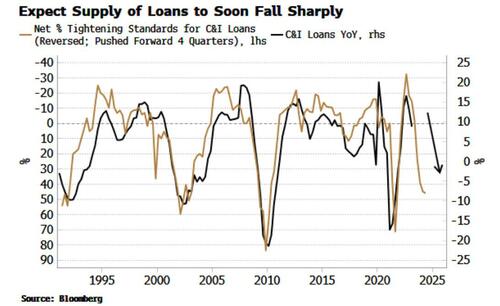

Demand for loans then leads supply of loans. There is about a six-month lead in this relationship (using C&I loans as a proxy for loan growth overall), and the drop in loan demand points to a sharp fall in loans over at least the rest of this year.

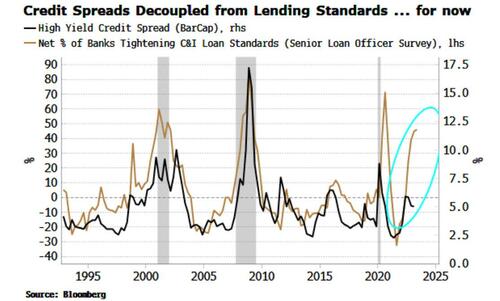

Typically, credit spreads and bank-lending standards track each other closely. The latter’s data is survey based and therefore backwards looking. But banks are likely to take their cues from credit markets – a live, continuously updated indication of the market’s view of credit risk – when deciding on the conditions for the loans they extend.

However, thus far in this cycle they have decoupled. This is likely to do with the Fed warehousing duration risk. Despite almost a year of QT, the Fed’s balance sheet still harbors almost $8 trillion of fixed-income risk that the public would otherwise hold.

The banks might be expected to take on a good chunk of this burden, but they are also jettisoning fixed-income risk. The rapid rise in interest rates and deterioration in overall credit conditions are making them reluctant to shoulder too much of this potential tsunami of upstream duration risk.

Instead, the non-bank public – non-financial corporations and households – are holding an increasing share of total US debt. This will stress company balance sheets. Credit spreads have been insulated from much of the rising duration risk as the Fed has raised rates, but this is changing and will soon be reflected in potentially much wider spreads.