So much for worries the Fed will continue hiking.

In the first refunding auction of the week, and the first coupon auction of May, moments ago the Treasury sold $40 billion in 3Y paper in an absolute stunner of an auction which was a blowout record breaker in more than one category.

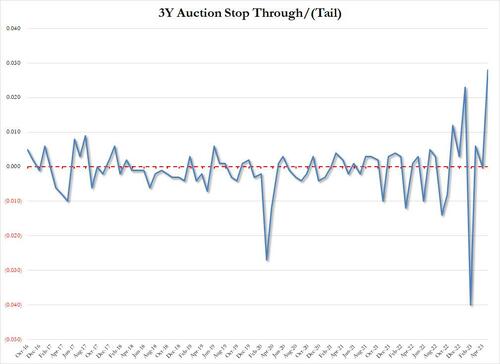

Starting at the top, the auction priced at a high yield of 3.695%, a sharp drop from last month’s 3.810%, but more importantly, it stopped through the When Issued 3.723% by 2.8bps, which was the biggest stop through on record (with data going back to 2016).

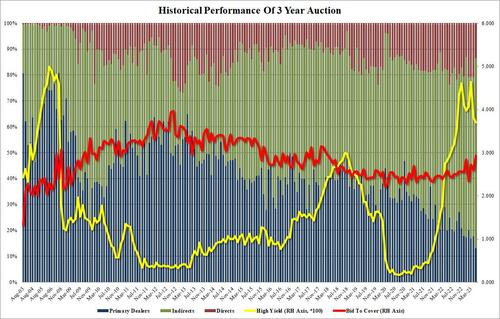

The bid to cover was another stunner: at 2.929, it was a huge jump from the 2.595 in April, and was the highest since March 2018.

The internals had even more records, with Indirects taking down 73.3%, up sharply from 61.3% last month and the highest on record. On the other side, Primary Dealers were awarded just 13.0%, the lowest on record, and leaving Directs with 13.66%, the lowest since January.

Overall, the metrics of today’s sale suggest that this was the strongest 3Y auction on record, which is to be expected since demand for paper – with the US sliding into a recession – has not actually decline, as the recent jump in 10Y yields was entirely a function of rate lock hedging not fundamentals. And with every passing week, more capital will flow into duration as not even all the accounting gimmicks and Biden admin data sleight of hand will be able to mask the fact that the US economy is headed for a crisis of historic proportions, one which will send yields right back down to 0%.