You can’t keep a good currency down.

You can’t keep a good currency down.

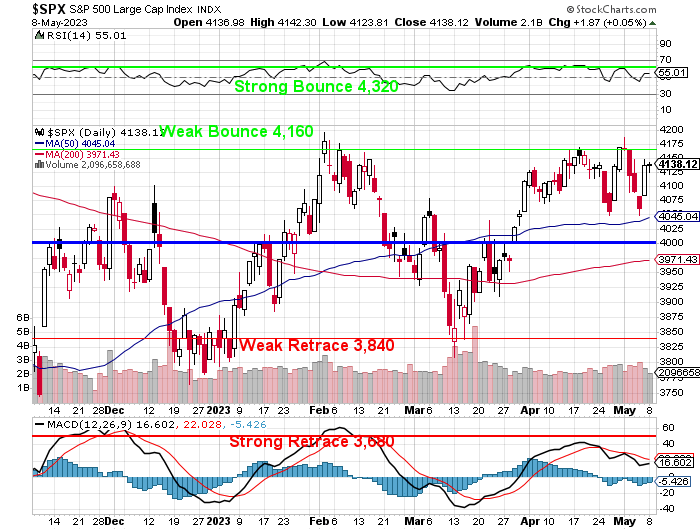

As I pointed out to our Members in yesterday’s Live Chat Room, the entire rally since early March has been driven by a 3.8% drop in the Dollar, from 105 to 101 yesterday and now, not surprisingly, it’s bouncing and (as fans of the 5% Rule™ know), even a weak bounce will pop us to 101.8 and that’s going to cause significant damage to the indexes. More likely, we will at least test 102.6 (strong bounce) and that’s up 1.5% from Friday and that’s going to cause a 2.5% drop on the S&P, which topped out below it’s own strong bounce at 4,160 (told you so!) and that would be back to 4,056, which is down another 100 points from here – nasty!

It certainly doesn’t help that 25 companies missed their Earnings this morning – that’s out of about 70, so close to 40% including APO, DUK, FSR, HAIN, HNST, PLUG, SEAS, SQSP, WMG and WE still does not work…

Shel-Bot was correct about LCID in yesterday’s Morning Report – they did indeed miss last night and he predicts ABNB will miss this evening and TDD tomorrow – so we’ll see how it goes. Also missing and/or guiding lower last night were: DDD, ACAD, ADTN, ACM, AVTA, BHF, BWTX, DNLI, FN, FGN, FORG,HLIT, HLIO, HI, HBM, HPP, IFF, JELD, KMPR, KFRC, MRVI, MWA, PLTR, PRAA, SWKS, TALO, TASK, VECO, WDC and XNCR – that’s 30. This is a LOT of misses.

We’re still getting shaky economic data from China and that’s got people worrying. The Hang Seng is down 10% and that’s a recovery from 15% at the March lows while the Shanghai, like the S&P – is back to testing it’s highs for no particular reason – so there’s a long way to tumble if things get real again. Over the past 2 years, the Hang Seng has fallen 30% behind the S&P overall:

Slowing Exports from China seem to be reflecting an overall cooling of Global Growth and Demand, especially from China’s major trading partners such as the US and Europe. China’s Exports grew at a slower pace in April than in March, while its Imports contracted sharply, suggesting that its external sector is losing steam. China’s imports fell sharply in April, while exports rose at a slower pace. Inbound Shipments fell 7.9% (y/y) in April, extending the 1.4% decline in March, while exports slowed as well, but still up 8.5% from last year’s Covid comparisons.

The downturn in imports suggests that the World Economy cannot rely much on China’s usual domestic engine of growth, and the country’s export-oriented economy has been largely self-contained and not felt by the rest of the World. The recent official Manufacturing Purchasing Managers’ Index for April showed new export orders contracting sharply, underlining the challenge facing Chinese policymakers and businesses hoping for a robust post-Covid economic recovery. Iris Pang, chief China economist at ING, said that the Global Economy is deteriorating and will weaken China’s manufacturing sector, and it is likely that the government will step in to support the manufacturing sector’s labor market through fiscal stimulus.

The downturn in imports suggests that the World Economy cannot rely much on China’s usual domestic engine of growth, and the country’s export-oriented economy has been largely self-contained and not felt by the rest of the World. The recent official Manufacturing Purchasing Managers’ Index for April showed new export orders contracting sharply, underlining the challenge facing Chinese policymakers and businesses hoping for a robust post-Covid economic recovery. Iris Pang, chief China economist at ING, said that the Global Economy is deteriorating and will weaken China’s manufacturing sector, and it is likely that the government will step in to support the manufacturing sector’s labor market through fiscal stimulus.

And, of course, what we have been seeing in headlines over and over again recently is Chinese manufacturers are beginning to lose business to India, South Korea and (gasp!) Taiwan as the constant Government interference and random regulations weigh on the performance and prospects of various sectors, such as Tech, Education, Gaming, and Real Estate. The Chinese government has been tightening its oversight and control over these industries, imposing fines, bans, restrictions, and reforms that have eroded their profitability and valuation.

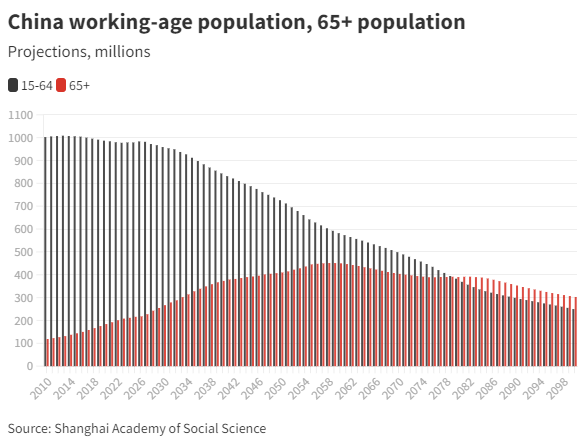

At the same time, demographic challenges pose long-term risks to China’s economic growth and social stability. China’s birth rate has fallen to a record low, while its population is aging rapidly and its labor force is shrinking. This could undermine China’s potential output, fiscal sustainability, innovation capacity, and social welfare.

At the same time, demographic challenges pose long-term risks to China’s economic growth and social stability. China’s birth rate has fallen to a record low, while its population is aging rapidly and its labor force is shrinking. This could undermine China’s potential output, fiscal sustainability, innovation capacity, and social welfare.

To get a real idea of what kind of catastrophe China is heading for (and in some ways the entire World – even not accounting for the impacts of Global Warming – which may drop our survival numbers considerably), let’s take a look at the demographics inside that 66% drop in population:

This is over the next 70 years, folks! We aren’t going to have to wait for 2099 to see the whole thing collapse. Once you have less than 2 working people for each person over 65 you are pretty much Florida – and China simply doesn’t get enough tourists to offset the demographic disadvantages.

Notice how the decline of population and the advance of seniority are both accelerating right about now and the next 20 years are going to be brutal for China – but also most of Europe, Japan and the US. Russia is a whole other situation as well…

China’s most pressing problem is they built housing and infrastructure for 2Bn people and in 20 years they’ll have less than 1.5Bn. China already is littered with empty cities and unused airports, power plants and rail lines and, like the US, China is a country that will be severely impacted by Climate Change – a crisis in progress that they can’t afford to ignore – even if the US still has their head in the sand about it.