What is carbon capture and storage? EPA’s new power plant standards proposal gives CCS a boost, but it’s not a quick solution

By Soyoung Oh, Tufts University

The Biden administration proposed new power plant rules on May 11, 2023, that have the potential to be among the most stringent federal policy measures on coal, oil and gas power plants the United States has ever introduced.

The proposal would set new carbon pollution standards for existing power plants, effectively restricting their emissions of carbon dioxide, a greenhouse gas that contributes to climate change. Operators of fossil fuel power plants would need to find feasible and innovative ways to avoid excessive carbon dioxide releases.

That’s drawing attention to a relatively mature, but expensive technology: carbon capture and storage, or CCS.

Most CCS chemically separates carbon dioxide generated during fossil fuel combustion, compresses it and transports it through pipelines for storage, typically in geological formations deep underground. While CCS can be effective, it has some high hurdles on its path to widespread use.

I follow U.S. policies on CCS as a climate policy researcher. Here’s why power plant operators considering CCS have faced a tricky balance between the risks and return, and why CCS may be slow to expand.

CCS’s rocky path

In the past decade, power plant operators have had a rough time bringing CCS projects online in many parts of the world. Currently, there are only a handful of power plants in the United States with the capacity to capture and transport their carbon emissions, and most of their captured carbon is sent to oil fields for use in enhanced oil recovery.

Many power plant operators considered the technology too risky. And the high number of projects suspended or terminated has prevented economies of scale that could lower the costs.

Compared to capturing carbon dioxide (CO₂) from industrial processes, such as ethanol and ammonia production, where the concentration of CO₂ is high, power generation emissions have relatively lower CO₂ concentrations. This makes CCS deployment at power plants more expensive. The costs associated with compressing, transporting and sequestering the CO₂ are additional hurdles.

The good news is that capturing CO₂ is slowly moving down the cost curve. For instance, the cost of CO₂ capture in the first large-scale CCS power plant facility, Canada’s Boundary Dam coal plant launched in 2014, was US$110 per ton. By the time the second large-scale facility was built, that cost had declined to $65 per ton.

The trend is expected to continue. The expected payoffs for CCS have improved over time, particularly with tax credits included in the 2022 Inflation Reduction Act. The tax credits provide up to $85 per ton for sequestering CO₂ produced without capped credit until 2033.

The tax credits could be a boon for fossil-fuel-based power plants. But the payoff isn’t immediate. Until they successfully sequester CO₂, the power plant operators would need to bear the cost and risk of building a CCS network. Further, a research team at Harvard University estimates that the cost of carbon capture for gas power plants could still be uneconomical even with the tax credit.

Three big infrastructure challenges

The Environmental Protection Agency’s proposal might be able to address some of the issues. The proposed emission cap could lower the uncertainty around the need for CCS and catalyze the widespread adoption of CCS, helping lower the cost.

However, questions remain related to CCS infrastructure.

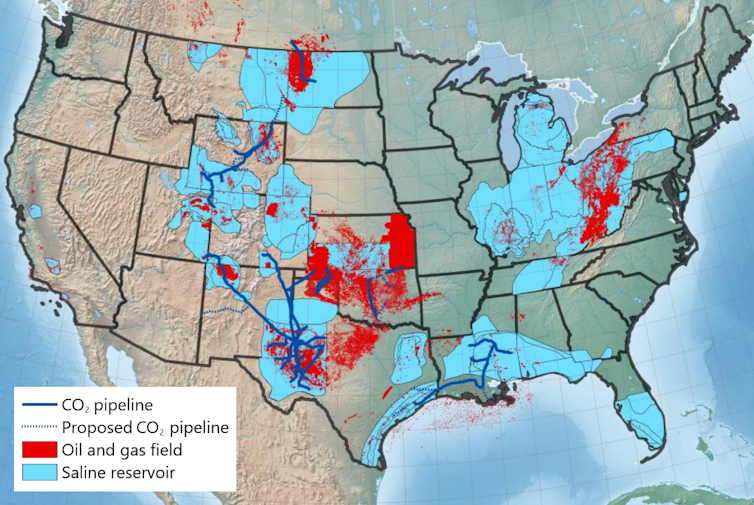

First, the pipelines to transport captured carbon aren’t yet in place. The Department of Energy’s Loan Program Office is supporting projects to construct CO₂ pipelines or other means of CO₂ transport, but they could take years to come online.

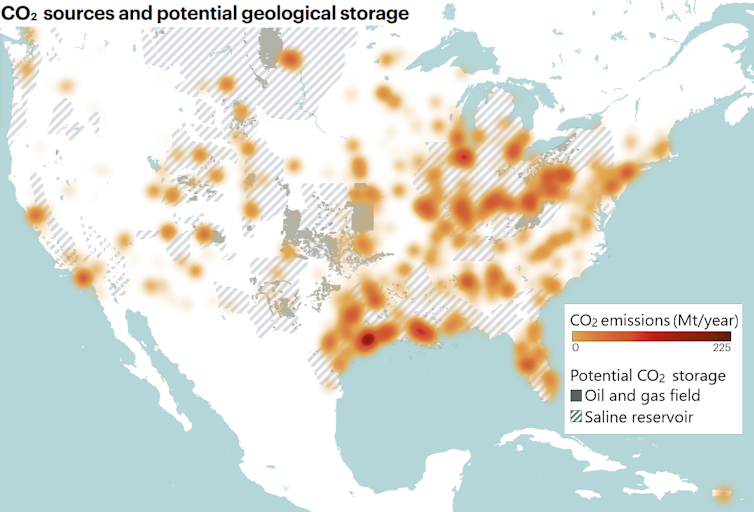

Second, CO₂ storage options are not evenly spread out across the country. Power plants in the Northeast, for example, lack nearby saline aquifers or oil and gas reservoirs. Researchers are exploring offshore reservoirs beneath the seafloor but are still assessing its potential.

Finally, the permit process has been a big limiting factor in expediting CCS deployment. The Inflation Reduction Act’s updated tax credits spurred a rush of CCS developers, but the EPA has not been able to process permits in a timely manner.

Despite these hurdles, the EPA is moving quickly. The Biden administration is under mounting pressure to enshrine stricter environmental regulations before the upcoming presidential election in 2024. The proposed rules will require a review process before they can be approved, and they are likely to face political headwinds and legal challenges.

Transforming the power sector

Fossil-fueled power plants account for about 25% of U.S. greenhouse gas emissions. With the Biden administration’s stringent policy measures in place, the United States would be closer to achieving its climate mitigation targets.

It will be challenging to scale from 12 to likely hundreds of CCS facilities needed to reach Biden’s goals of 100% carbon-free electricity by 2035 and net zero emissions by 2050. But while the EPA’s new proposal may not solve all problems for deploying CCS, it could be an important step to accelerate transforming the power sector.

In the absence of federal-level carbon taxes or emission trading systems in the U.S., this could be an effective way to send a clear signal to power sector players that it’s time to change.![]()

Soyoung Oh, Junior Research Fellow in Climate Policy, The Fletcher School, Tufts University

This article is republished from The Conversation under a Creative Commons license. Read the original article.