“There are plenty of ways that you can hurt a man

“There are plenty of ways that you can hurt a man

And bring him to the ground

You can beat him

You can cheat him

You can treat him bad and leave him

When he’s down” – Queen

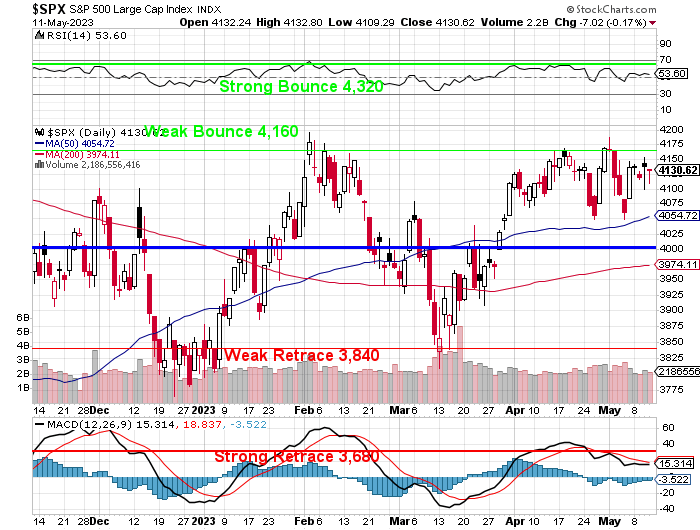

It’s been an uninspiring week, month and now, year in the markets as we opened last May at 4,150 on the S&P 500 and we’re a bit under that this morning as well. The highest the market has been is 4,300 briefly last August – but that ended in disaster and we have only grasped at 4,200 since – and that did not end well so far either.

At some point you might think that the market is trying to tell us something and that something is that the 5% Rule™ has once again NAILED IT! because 4,160 is EXACTLY the Weak Bounce Line we predicted in March of 2020 – during the Covid crash and so this is the same range we’ve been very successfully using to help make our investing decisions for the past 3 years. We’re VERY comfortable with where things are.

In this particular cycle, we chose to take the money and run as we topped out last month as we were miles ahead of our targets and we aren’t sure when we’ll get the next chance to see 4,160. Now that we’re through earnings (mostly), it actually turns out that Banks had a RECORD quarter for profits (thanks to $2Tn in bailouts that we paid for) and, overall, earnings for the S&P 500 (75 still to report) are down only 0.7% vs down 5% that was projected.

| Sector | Earnings Beat Rate | Earnings Surprise Rate | Revenue Beat Rate | Revenue Surprise Rate |

|---|---|---|---|---|

| Communication Services | 88.9% | 14.9% | 77.8% | 4.2% |

| Consumer Discretionary | 83.3% | 14.6% | 80.6% | 4.8% |

| Consumer Staples | 76.0% | 8.9% | 68.0% | 2.2% |

| Energy | 75.0% | -7.4% | 75.0% | -1.4% |

| Financials | 79.7% | 29.8% | 71.2% | 3.9% |

| Health Care | 78.6% | 10.4% | 77.4% | 2.9% |

| Industrials | 81.8% | 17.7% | 81.8% | 3.9% |

| Information Technology | 86.1% | 12.0% | 86.1% | 3.7% |

| Materials | 76.9% | -1.6% | 69.2% | -0.6% |

| Real Estate | 72.7% | -0.9% | 63.6% | -0.4% |

| Utilities | 66.7% | -1.8% | 66.7% | -0.2% |

Notice that, after all their whining about inflation, Consumer Discretionary stocks managed to raise their revenues 4.8% – squeezing their customers – while, on the other end, they squeezed their vendors so hard that they ended up making 29.8% more profits! Ah Capitalism – the Dominatrix of Democracy!

If Capitalism is the Dominatrix of Democracy then Communication Services must be that ball they shove in your mouth with a gag around it so the neighbors can’t hear you scream. They too are abusing their Consumers (which are all of us) and making 14.9% more money doing it. Information Technology, of course, the the phone we’re using while we’re gagged – because we just can’t stop – ever…

Energy Companies, on the other hand, have gone submissive this quarter – with less revenues and less profits. Materials and Real Estate are down and that’s alarming for the Economy as that money is being drained by Consumer Staples.

Insight/2023/05.2023/05.01.2023_Earnings%20Insight/04-sp-500-revenue-growth-q1-2023.png?width=1227&height=707&name=04-sp-500-revenue-growth-q1-2023.png)

So, in short, 11% of the S&Ps total Revenue Growth of -0.7% has come from the Financials and their $2Tn bailout. Is that honestly a reason to be excited about the S&P for Q2? Not unless there’s another $2Tn coming – and the quarter ends in 45 days!

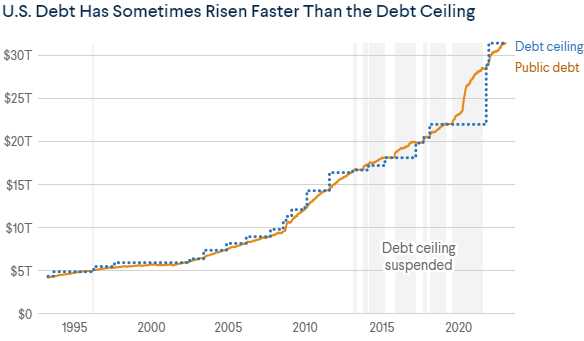

No, what actually ends in 45 days (or maybe 15) is the United State’s ability to pay Social Security Checks or 3M Federal Employees – that will immediately suck about 10% out of the US Economy so even one month of a shutdown will cost us 1% of our GDP, which will then raise our debt by $2Tn – VERY counterproductive.

Halting the Government will also skyrocket our borrowing costs and that too will cost the Government hundreds of Billions of Dollars of additional interest charges – not to mention the effect on Businesses and Consumers who have variable-rate loans. With no Social Security money coming in – it will be like another rent and mortgage holiday – only without all the nice forgiveness we enjoyed last time the market plunged 30%.

Halting the Government will also skyrocket our borrowing costs and that too will cost the Government hundreds of Billions of Dollars of additional interest charges – not to mention the effect on Businesses and Consumers who have variable-rate loans. With no Social Security money coming in – it will be like another rent and mortgage holiday – only without all the nice forgiveness we enjoyed last time the market plunged 30%.

Still we PROBABLY won’t default and, even if we do, it PROBABLY won’t go on too long but, if we do – it would be catastrophic and, like any smart gamblers, we know that even a small chance of a wipeout is a good reason to take our money off the table – so we did.

So far, the May market action has not given us much reason for FOMO. Yesterday, for example, only one out of 4 stocks actually closed positive – it’s a very narrow “rally” – if that is even the term for “not failing.”

Speaking of failing, Consumer Sentiment has not been, let us say, great since 2020 but we are off the lows that market the last two Recessions so – yay us – I guess. We’ll see if we can beat April’s very low bar of 63.5 but I don’t see how we will if the polling was done less than a week ago – while banks were still failing.

Speaking of failing, Consumer Sentiment has not been, let us say, great since 2020 but we are off the lows that market the last two Recessions so – yay us – I guess. We’ll see if we can beat April’s very low bar of 63.5 but I don’t see how we will if the polling was done less than a week ago – while banks were still failing.

Hopefully all of that nasty bank stuff is behind us and $2Tn was enough to fix things – THAT we seem to have money for… PACW is not dead yet and that’s good enough for traders and the talking heads in the Financial Media to sound the “all clear” signal, because who wouldn’t look at this chart and say “Healthy!”?

Almost a healthy as WAL:

So happy Friday everyone and enjoy your worry-free weekend!

-

- Phil