Powell and Bernanke are speaking on Friday at 11 am.

Powell and Bernanke are speaking on Friday at 11 am.

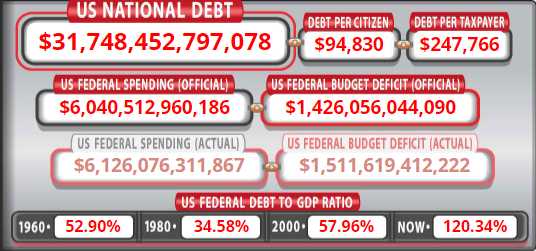

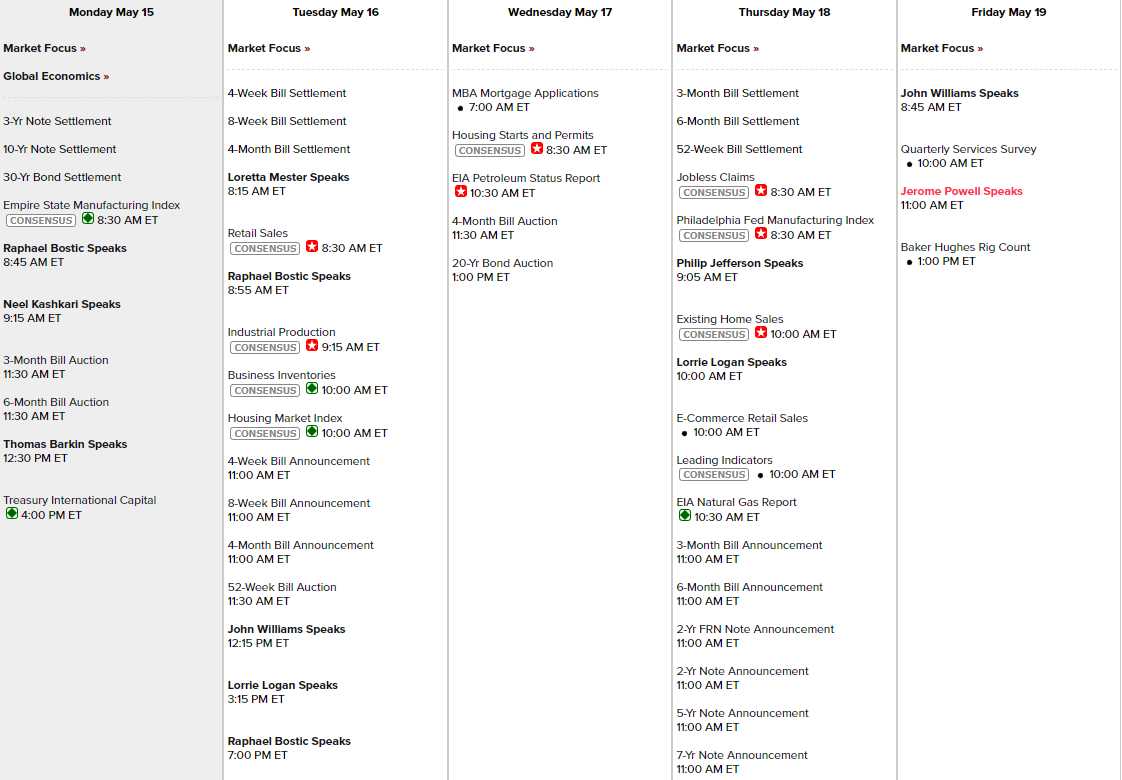

Before they have a go, we will hear from 11 Fed Governors this week – the most all year and that’s because, at any given moment, the talks on the debt ceiling may collapse – along with our economy. Due to the series of delays leading up to this point, the Government now has $88Bn worth of measures remaining to avoid default, down from $333Bn that were available.

Keep in mind that this is for a Government with a $6Tn budget that pays out $16Bn a day although, fortunately, May is a good month for tax collections though the money has, so far, drawn down faster than expected due to lower than expected rates of collections.

The debt limit is actually $31.4Tn so we are $348Bn over the limit already so the $88Bn we have left is up for debate but that’s the number the government is going for and the deficit is about $4Bn per day so, if we are very, very lucky, we have 22 days left until the Government is completely broke.

This is worse than the last shutdown because the last shutdown was declared when the Government still had $300Bn of reserves. This time we’ve blown through them ahead of the shutdown so this may be the last Social Security check Grandma sees for a while and, if you have any Medicare-funded pills or procedures scheduled – I’d move those up as well!

22 days is also when we will no longer to be able to pay interest on our bonds, which will place us in default and there will be no point in scheduling any more bond auctions – as we will not have the authority to sell more bonds. There are layers and layers to this catastrophe and they will begin peeling off very quickly and yes – we will all be crying!

Back to 2011, the debt ceiling debacle led to the first-ever downgrade of the U.S. credit rating. The threat of default loomed large, and Uncle Sam’s financial reputation took a hit, leaving investors jittery and markets rattled. In the end, a last-minute deal was struck, narrowly averting disaster.

Nonetheless, we did it again in 2013, which resulted in a 16-day government shutdown. It was a moment of political brinkmanship that showcased the ‘art’ of negotiation and left federal employees twiddling their thumbs. That cost the Government and additional $24Bn when our deficit was less than half what it is today.

So let’s buckle up for this rollercoaster ride of political brinkmanship. The outcome will have a domino effect on Global Financial Markets, Investor Confidence (which already collapsed last week) and the overall economic landscape.

So let’s buckle up for this rollercoaster ride of political brinkmanship. The outcome will have a domino effect on Global Financial Markets, Investor Confidence (which already collapsed last week) and the overall economic landscape.

Standard and Poors still has the US credit at AA+, not AAA and, keep in mind that a lower credit rating means higher borrowing costs and even more interest on our $31.7Tn in debt – that’s how idiotic our Government is being!

Meanwhile, Corporate Bankruptcies are already up 216% from last year and that is only through APRIL!!! UBS also found in a recent study that bankruptcies worth $10 million or more had a rolling average of about 8 per week. “Banks are battening down the hatches, hogging their bailout money instead of lending it out,” said Economist Peter St Onge, adding small business surveys reveal the biggest deterioration in lending since the 2008 crisis.

That means major banks will have to increase their loan loss reserves, which comes out of profits and further tightens conditions.

What other ingredients do we need for the kind of perfect storm that sank the economy in 2008? How about that, aside from the well-known, looming disaster in CRE – with 50% of leased office space currently unutilized and 1/3 of all leasable space already empty – we are now seeing signs of weakness in the housing market.

Financial institutions lost an average of $301 per loan they finalized in 2022 — in stark contrast to the $2,339 profit per loan that was reported in 2021 — equating to a 113% decrease, per Business Insider. The MBA noted this is the first time it’s seen profits in the red since reporting began in 2008. It’s yet another result of a very tenuous housing market in which there aren’t many available properties. Buyers and sellers are both holding out with interest rates soaring, now nearly double the 2-3% fixed APR the market had seen in recent years.

“The rapid rise in mortgage rates over a relatively short period of time, combined with extremely low housing inventory and affordability challenges, meant that both purchase and refinance volume plummeted,” Marina Walsh, vice president of industry analysis for the MBA, was quoted as saying in a press release. “The stellar profits of the previous two years dissipated because of the confluence of declining volume, lower revenues, and higher costs per loan.”

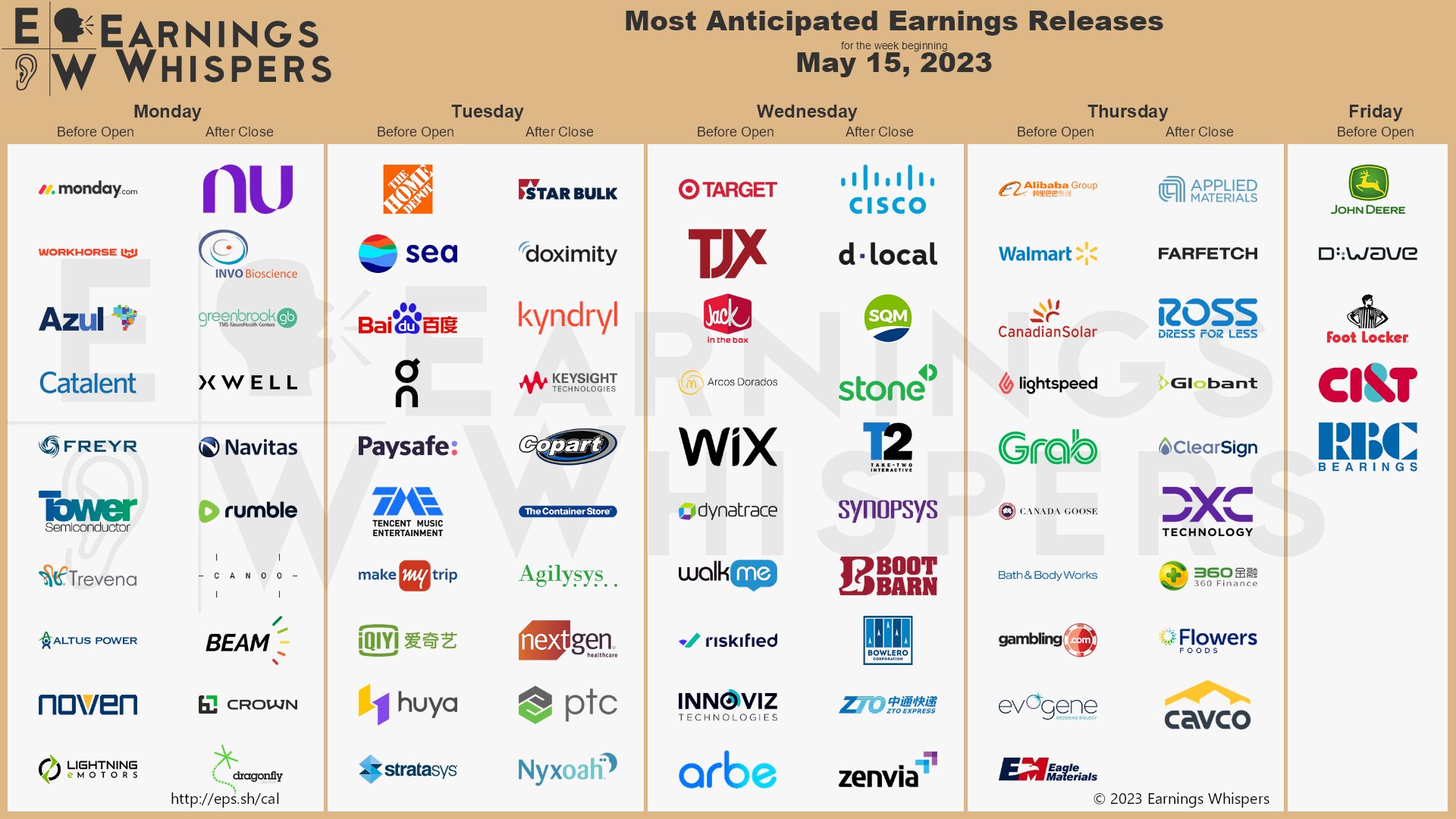

We will look for signs of this affecting companies in this week’s earnings reports, which are mostly about the Retail Sector:

“And the sign says “Everybody welcome come in, kneel down and pray”

But then they passed around a plate at the end of it all

And I didn’t have a penny to pay“ – Five Man Electrical Band