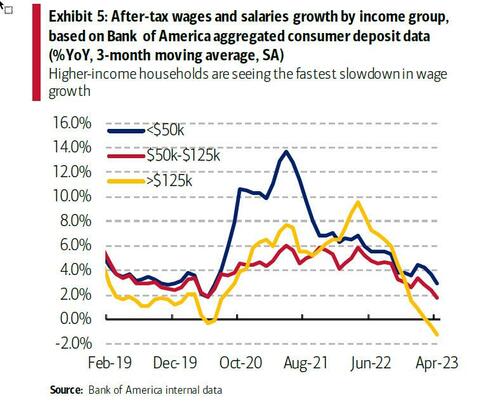

Over the weekend, we reported that the bottom finally appears to be falling from under the US consumer, where the high-end income household – which until recently had been propping up the broader deceleration in lower-income Americans – appears to have hit an income brick wall, leading to the first decline in wages in three years for those earning over $125,000…

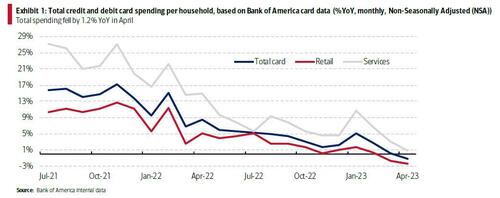

… which in turn led to the first spending decline since February 2021: according to Bank of America’s latest debit and credit card data, total card spending per household was down 1.2% year-over-year (y/y) in April…

… and is only partially explained by the y/y drop in gas prices.

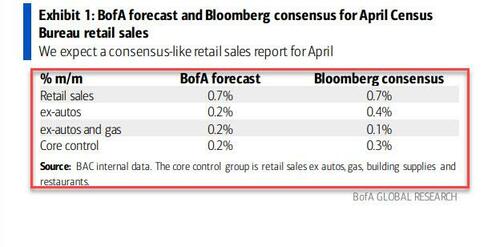

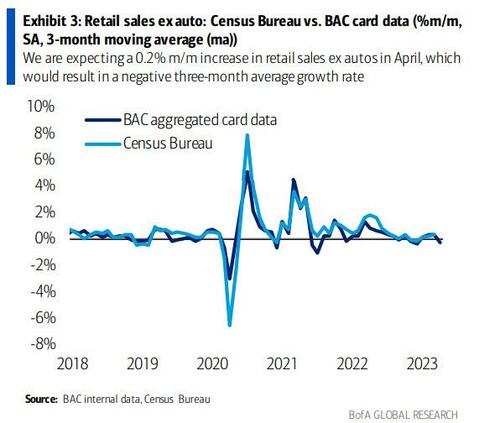

Does that mean that tomorrow’s retail sales report will be another disaster? Not just yet: according to BofA’s economists, tomorrow the census bureau’s retail sales report – the most important report of the week – will show a modest increase of 0.2% m/m in retail sales ex-autos and core control retail sales figures for April, both coming in just below expectations.

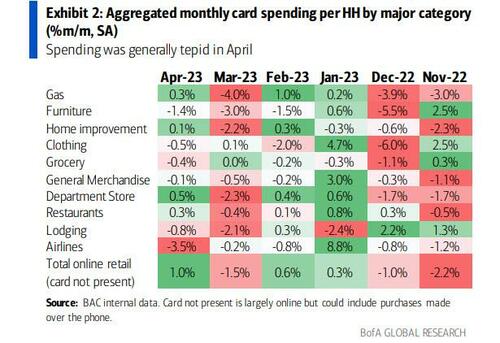

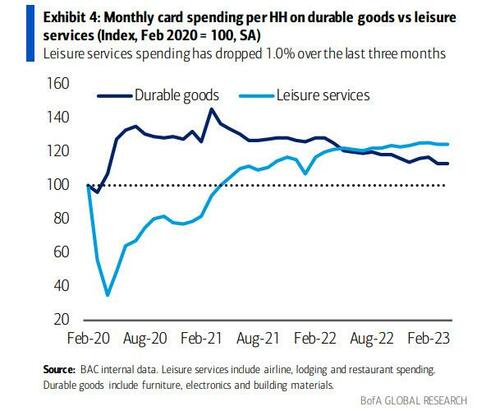

What is more concerning, is that what until recently was the strongest spending category, leisure services, appears to have peaked. According to BofA, on a m/m SA basis, online retail (card not present) and department stores saw the strongest growth, while airlines, furniture and lodging were the weakest categories.

We will get a better sense over the summer of whether the reopening tailwind to leisure services has run its course. Meanwhile, durable goods spending continues its relatively steady decline after peaking more than two years ago.

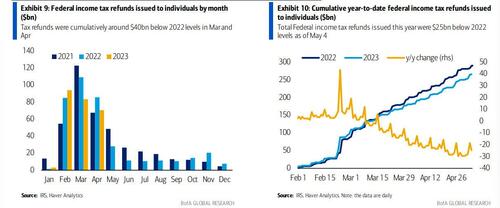

Spending weakness is usually the result of a decline in incomes, and this time is no different. According to BofA, weakness in tax refunds was likely a headwind to spending once again in April. The Internal Revenue Service reports that it issued $70.5 billion of Federal individual income tax refunds in April, compared to $85.3bn in April 2022. This shortfall of around $15bn amounts to 0.9% of monthly disposable income, and comes on the back of an even larger $25bn shortfall in March.

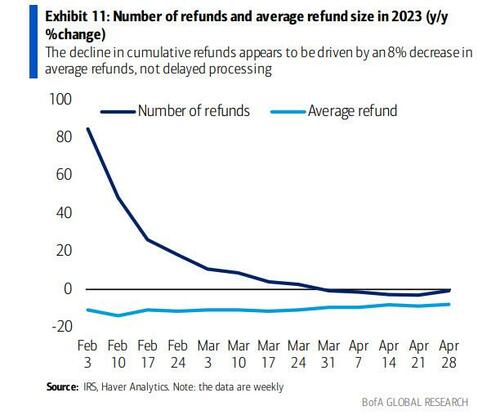

The next chart shows that the average number of refunds issued was close to 2022 levels at the end of April. However, the average refund size has been 8% smaller than it was last year. This suggests to BofA that total refunds are unlikely to catch up to 2022 levels as more returns are processed.

The silver lining is that BofA’s headline retail sales forecast of 0.7% is driven by the sharp pickup in auto sales in April: this should support total consumer spending growth on the month. However, the BAC card data suggest that other spending categories look soft. As discussed above, services demand appears to be slowing. And if the bank’s retail sales forecast is correct, growth in real (i.e., inflation-adjusted) retail sales ex-autos would be close to zero in April. Therefore, BofA continues to expect positive but weak GDP growth in 2Q 2023 and a mild recession thereafter.

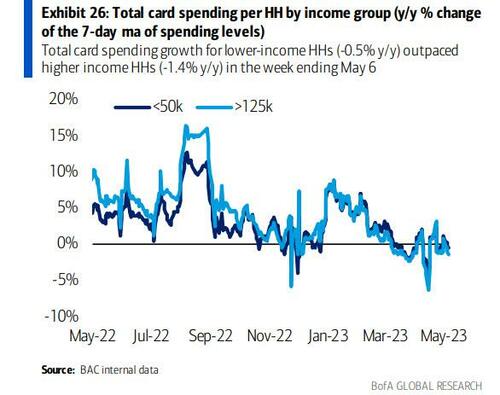

Meanwhile, as the bank’s economists search for the key downward inflection point, it is monitoring the spending patterns of lower-income households, who would be most impacted by an economic shock. So far, lower-income HHs continue to outperform higher income HHs in terms of y/y spending growth…

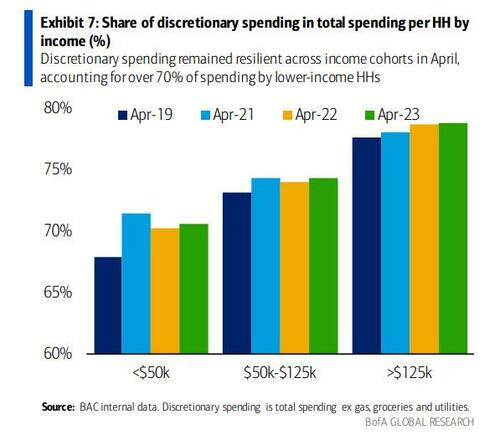

… and they are still allocating a larger share of total card spending to discretionary items than they did in 2019.

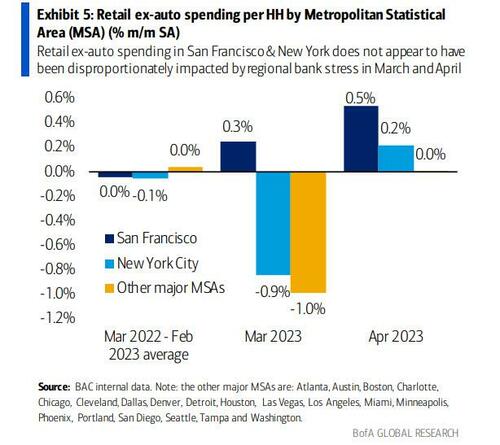

Finally, BofA is also watching for signs of the impact of regional bank stress, but so far it finds that San Francisco and New York, the headquarters of the three failed domestic banks, outpaced the other major metros in terms of retail ex-auto spending in both March and April.

Much more in the full report available to pro subs in the usual place.