By Ven Ram, Bloomberg markets live reporter and strategist

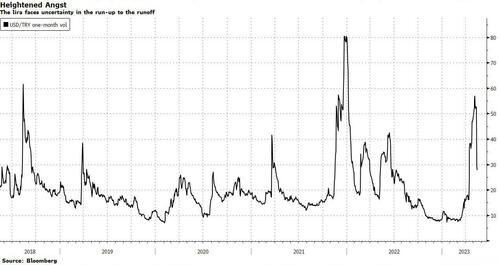

Turkey’s currency markets are on tenterhooks as the possibility of a runoff presidential vote opens up two weeks of uncertainty.

One-month volatility on the lira has surged to 48%, meaning the markets are braced for a possibility that the lira may decline to as much as 24.12 per dollar from 19.65 now. Preliminary results on Monday showed President Recep Tayyip Erdogan with a lead of more than 2 million votes but still without enough to avoid a second round on May 28 against rival Kemal Kilicdaroglu.

The central bank’s back-door interventions to prop up the lira since December 2021 reached nearly $177 billion in April ahead of the elections, with the tally amounting to some $30 billion in April alone, according to Bloomberg Economics. Meanwhile, combined foreign-investor holdings of Turkish stocks and bonds amounted to less than $24 billion on the Friday before the vote, a far cry from levels of above $150 billion a decade ago.

Over in Thailand, it’s a different story, with the baht advancing on news that opposition parties are on course to wrest power from the nation’s military-backed government. While there is still much short-term uncertainty, the baht — which tumbled below 38 per dollar last year — looks on course to consolidate its gains in 2023 given the optimism surrounding the domestic economy.