Let’s get ready to rumble!

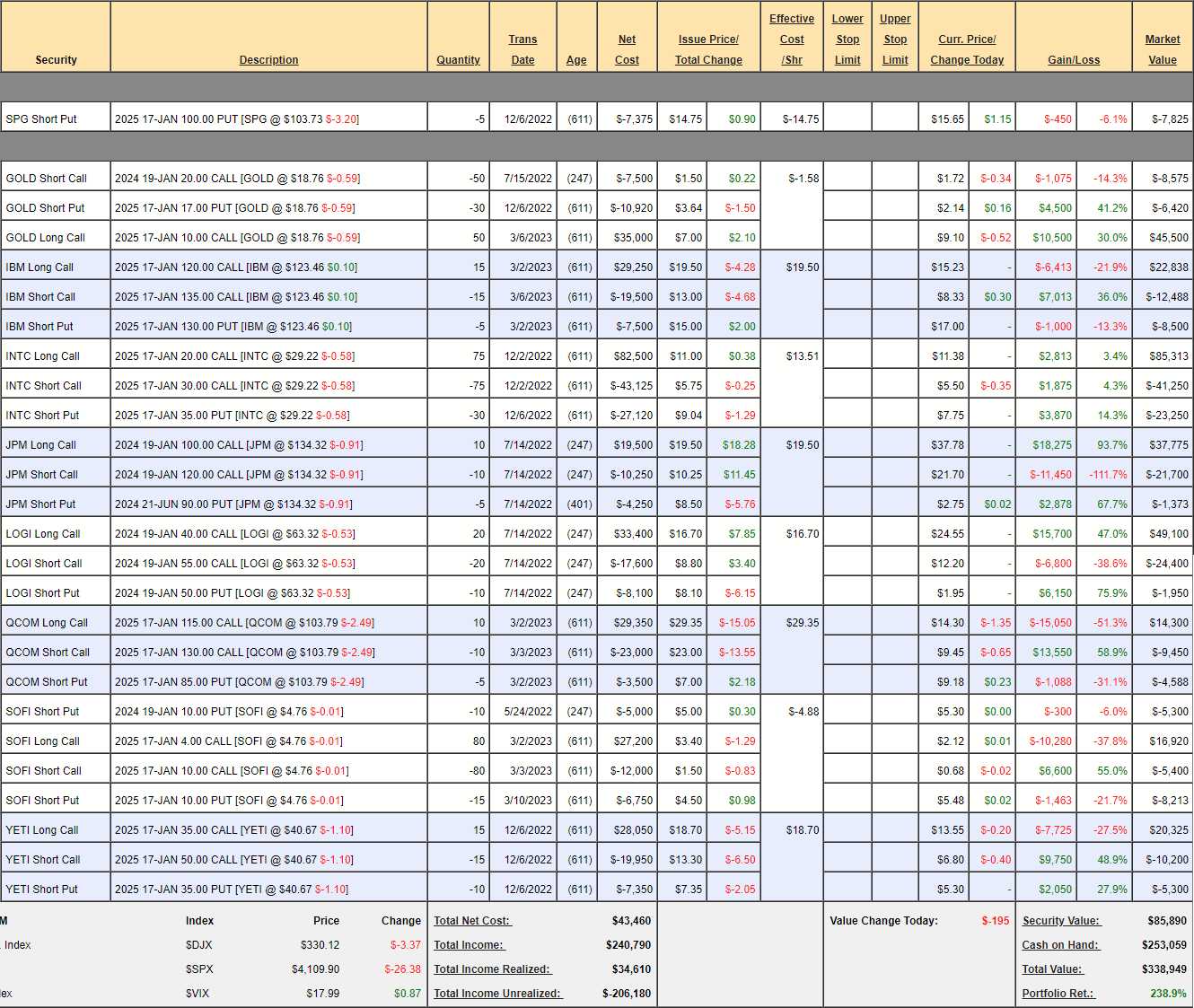

Last month, we decided to cash out and wait until after Q1 earnings to start a new batch of portfolios for our Members. We still have the Money Talk Portfolio, because we only trade it on the show and I won’t be on again until next month. In last month’s review, we were at $356,801 and, as of this morning, we’re at $338,849, which is down $17,952 (5%) in our untouched portfolio so figure that’s what we saved by cashing out the rest.

The portfolio is still up 238.9% overall and that is since November 13, 2019 so 42 months and 5% a month is pretty much our average gain. Here’s where those positions stand at the moment:

Nothing has changed since last month (so read my notes over there) and, although the portfolio is 75% CASH!!!, the positions we have have $187,000 of upside potential over the next 18 months and that’s 10% a month if all goes well – so not a bad collection of stocks…

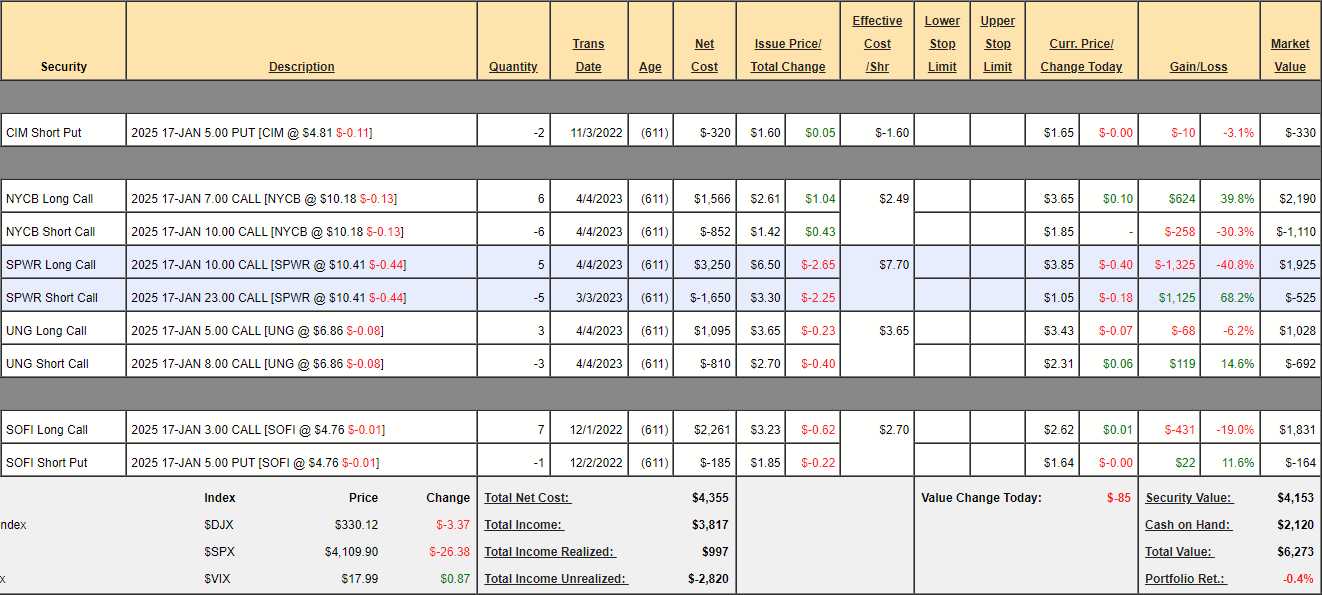

We also still have our $700/Month Portfolio, which has made no gains in 9 months but it’s a 360-month plan and the good news is we’re building a strong base. The intention of this portfolios is to ride out times of trouble as part of the lesson. We just did a review last on Thursday, the 4th but here’s how we look this morning:

The upside potential of these 5 positions is over $10,000 over the next 18 months so we’re just fine overall as our goal is to make 10% a year or more and get to $1M over 30 years. If you haven’t stated yet – you haven’t missed anything!

Early next month, we will add another $700 to the portfolio and, if they stay this low, we’ll be buying more SOFI and more SPWR. There’s no need to add new positions when your old ones are still on sale!

SPWR, for example, is down considerably but our overall position is only down $200 as we have the short calls protecting our long position. At this point, we could buy back the short calls for just $525 to lock in our $1,125 gain, sell 10 of the $18 calls for $1.80 ($1,800) and buy 5 more of the $10 calls for $3.85 ($1,925) all for net $650. The original spread would have returned $4,000 at $18 against the original $1,600 spent but now we are in for $2,250 on an $8,000 spread with $5,750 in potential gains vs the original $2,400.

And yes, I know the original was up to $23 but it looks like that was unrealistic, right? We’ll see what happens next but it’s hard to imagine all these stimulus packages aimed at solar aren’t going to rub off on SPWR – just a little. By the way, this trade isn’t official yet, we have to wait for our turn next month but you can see how we take advantage to build a base that can explode our profits in the future.

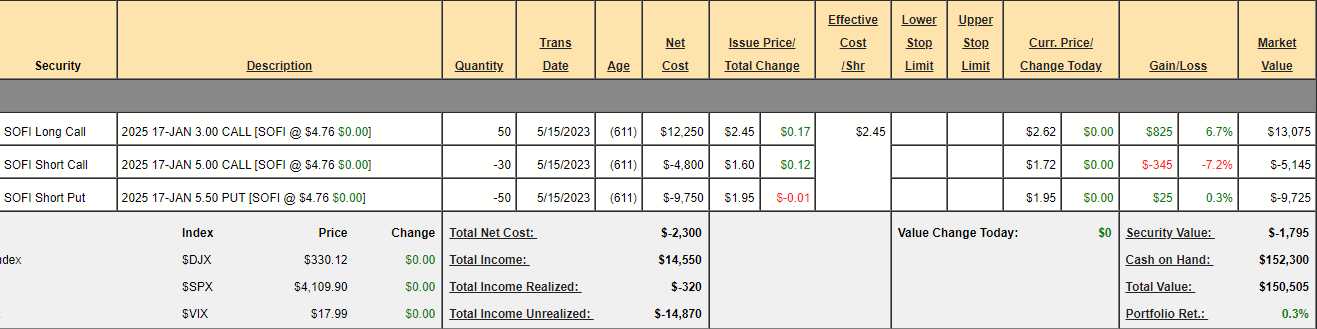

As to SOFI – well that is the first position we added to our brand-new Income Portfolio on Monday. It was also a Top Trade Alert that day so don’t say I didn’t tell you so! The purpose of the Income Portfolio is for my Mom’s friends to be able to make a fairly steady $6,000 per quarter WITHOUT touching their principle. I have been mortified by the terrible gains people are getting in their retirement accounts so my goal is to get them an extra $2,000 a month – essentially doubling their Social Security returns.

The idea of this set-up on SOFI is, when the stock picks up again, we begin to sell short-term calls for income. Our net outlay was $3,550 in cash and $740 in margin (PM account) and our worst-case is being assigned 2,000 shares of SOFI at $5.50 ($11,000) and losing the whole $3,550 so $14,550 is our commitment and our portfolio is divided into 10 allocation blocks of $30,000 ($300,000 total buying power presumed).

At the moment, we set aside the full allocation block for SOFI but, if SOFI takes off before we buy more, we can release that 1/2 block for other things. If all goes well, we’ll get $10,000 back from the position at $5 in 18 months for a $6,450 (181%) profit and, as SOFI goes higher, we can sell 20 more short-term calls for hopefully 0.50 per quarter and generate $1,000 per quarter in income – wouldn’t that be nice?

Notice the spread is super-conservative as it’s $8,750 in the money to start (aren’t options fun?) and the stock only needs to gain 0.24 by Jan 2025 for us to win on the spread and 0.50 more than that for the puts to expire worthless. If that doesn’t happen – that’s what our allocation block is for!

So far, it’s been two days and we’re up $490, so we’re off to a good start but we need $2,000 for the month to stay on pace so let’s add a couple of new trades:

The first Top Trade Alert we had after cashing out was Coca Cola (KO) on April 24th. It was a net $7,375 spread and now it’s net $7,485 so we haven’t missed much and it’s a great trade for all the reasons discussed at the time so let’s add that (with minor changes):

-

- Sell 5 KO 2025 $65 puts for $5.80 ($2,900)

- Buy 15 KO 2025 $60 calls for $8.35 ($12,525)

- Sell 10 KO 2025 $70 calls for $3.50 ($3,500)

- Sell 10 KO Aug $62.50 calls for $2.50 ($2,500)

That’s net $4,625 on the $15,000 spread so there’s $10,375 (224%) upside potential at $70 and we’ve used 93 of our 611 days to collect $2,500 and we’ll have 6 more chances to sell and make up to another, let’s say $12,000 selling short-term calls. Our risk is being assigned 500 shares at $65 ($32,500), which would be a full allocation block.

What’s different about this spread to our Top Trade Alert is we’re being a bit more aggressive on the put sale (because the difference if assigned isn’t much and we can always roll and I’d rather have the money now) and more aggressive on the short-term calls (which balance out the put risk) and we tightened the spread to reduce the risk if KO plunges back to $60.

The 2025 bull spreads main purpose is to prevent us from getting burned on a sudden move higher against our short-term calls but KO is a large cap and doesn’t tend to jump up or down very quickly – which makes it ideal as an income trade. If all goes well and we can keep collecting $2,500 per quarter – we’re getting near goal with only 2 allocation blocks… allocated.

Other recent Top Trade Alerts were SOFI (got ’em), BNTX is a bit much at $105.60 but I’m thinking about them, GNRC also a bit much at $112 – not value-wise but for a smallish portfolio. NYCB is too volatile for this portfolio but I love them, CSCO is worth considering, SPWR must go in and YETI is another good one.

OK, so now we have some ideas we’ve already vetted recently so let’s look at BNTX:

One of the keys is “Can I sell puts?” and $105.60 is a problem. The VIX was higher when we called the trade at $21 for the Dec 2025 $100 puts and they are now $18.50 but the $85 puts are $12.50 and use $2,755 in margin to collect $6,250 – I think we can work with that!

- Sell 5 BNTX Dec 2025 $85 puts for $12.50 ($6,250)

- Buy 15 BNTX Dec 2025 $100 calls at $35 ($52,500)

- Sell 10 BNTX Dec 2025 $130 calls for $24.50 ($24,500)

- Sell 10 BNTX July $110 calls for $5 ($5,000)

We’re in this spread for net $16,750 and we’re committed to owning 500 shares at $85 ($42,500) so this is where that 1/2 allocation block we had left from SOFI is going. The upside potential on the $30,000 spread is $13,250 (79%) but our eye is on the prize of being able to sell $5,000 of premium over just 65 days – that makes our whole quarter!

This is a trade that needs to be monitored carefully but it’s worth it. If BNTX does well, we can buy back the short puts with a 50% gain and release the allocation block while still having the income-producing spread. For now, it lowers our net entry cost and protects us against a jump that benefits the July calls we sold – which are only 50% covered.

I don’t want to overdo it so SPWR will be our last pick for this week. It’s our Stock of the Decade but we go in and out as they go in and out of favor in the market. At the moment, they are considerably out of favor at $10.41 so let’s make the following play:

- Sell 20 SPWR 2025 $10 puts for $2.85 ($5,700)

- Buy 50 SPWR 2025 $10 calls for $3.85 ($19,250)

- Sell 30 SPWR 2025 $18 calls for $1.85 ($5,550)

- Sell 20 Sept $12 calls for $1 ($2,000)

That’s net $6,000 on the $40,000 spread so $34,000 (566%) upside potential and we’re only using $1,192 in margin on the put side while collecting $2,000 over 121 days. 5 sales like that can add $10,000 to our gains and we’re 100% covered. Clearly we’re being bullish but we’ll either make money selling short-term calls or make money on our spread or both and the worst-case scenario is owning 2,000 shares for net $26,000 – $13/share and there’s another allocation block committed.

So now we’ve committed 4 of our 10 allocation blocks and here’s the summary:

- SOFI – 1/2 Block used for $6,450 (181%) upside potential and $1,000 quarterly income potential.

- KO – 1 Block used for $10,375 (224%) upside potential and $3,500 quarterly income potential.

- BNTX – 1.5 Bocks used for $13,250 (79%) upside potential and $7,500 quarterly income potential.

- SPWR – 1 Block used for $34,000 (566%) upside potential and $2,000 quarterly income potential.

So, if all goes well, our $150,000 portfolio using 40% of it’s buying power can make $64,075 (42.7%) in a bullish market over 18 months while generating up to $14,000 in quarterly income when we only need $6,000 so another $8,000 x 6 quarters would be $48,000 added to the portfolio for a total gain of $112,075 (74.7%) over 18 months PLUS the $6,000 x 6 ($36,000) in planned withdrawals.

That’s a good start and now comes the boring part as we are essentially going to wait a couple of months and see how our first round of sales performed. If all goes well (and it rarely does), Grandma will get $6,000 in Mid August and the portfolio will still be positive! If not – well that’s what the other 6 blocks are for….

It all starts with a trading plan – just like we did it back in 2019 – after the last time we cashed out and started again.