Hedge funds may be finally piling into stocks just as the S&P breaks out above the 4,200 resistance level (because Wall Street “pros” always sell low and buy high), but unable to shake the conviction that the economy is headed for the crapper, they are ramping up their shorts in other assets to brace for what is coming, and nowhere more so than in oil where bearish hedge fund bets just hit the highest in 12 years.

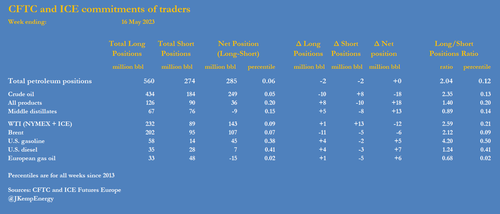

As Bloomberg shows, the trading positions of hedge funds and other non-commercial traders are at the most bearish levels since at least 2011 across a combination of all major oil contracts…

… and in bets that are perhaps most indicative of recession expectations, speculators’ combined views on diesel and gasoil – fuels that power the economy – are near the most bearish levels since early in the Covid-19 pandemic.

That said, positioning in gasoil and US diesel ticked slightly higher in the latest week, while commercial traders who work for the producers as well as other merchants of crude, aren’t so bearish, with some even reducing hedges against a potential price drop.

Still, “it’s pretty remarkable to see this type of positioning,” Greg Sharenow, who manages a portfolio focused on energy and commodities at PIMCO, told Bloomberg in an interview.

The gloom over the oil market this year – a sharp contrast to last year’s Ukraine war-driven meltup – has come from multiple directions, including expectations that the Fed’s rate hikes will provoke a contraction (oddly enough, this has not impacted stocks or bonds) and China’s disappointing rebound from its Covid-19 restrictions. Add in the threat of a US default if politicians fail to raise the debt ceiling and the possibility that OPEC+ may not deliver all the output cuts they’ve pledged, and traders have no shortage of bear scenarios to choose from.

While investors are positioned for a significant business cycle downturn hitting petroleum consumption and prices in the remainder of 2023, prices for fuels such as gasoline and diesel are expected to hold up better than crude because fuel stocks are well below long-term seasonal averages and refineries are already processing more crude than usual according to Reuters analyst John Kemp.

The extreme extent of the financial traders’ bearishness raises the risk of volatility if the OPEC and its allies decide to cut production further. That scenario will surely set off another brutal squeeze that forces bears to rush to exits, sends the price of oil soaring and worsens inflation.

Meanwhile, Goldman projects any large gains in oil prices could unleash as much as $40 billion worth of buying in US crude and Brent alone from trend-following commodity trading advisers; however for now the only direction CTAs are pushing oil is lower.

What is odd is that while hedge funds are positioned for a significant business cycle downturn hitting petroleum consumption and prices in the remainder of 2023 and have picked oil and only oil to express their bearish bets having been burned one too many times on their stock shorts, the underlying physical markets aren’t reflecting the dire state that traders are preparing for. On the contrary: refineries are processing the most crude for this time of year since the pandemic began, China crude demand is record high, air travel is rising just about everywhere, and gasoline demand in the US is now at the highest level since December 2021. At the same time, fuel inventories are below seasonal norms for gasoline and diesel in the US, and OPEC+ cuts and Canadian wildfires have limited crude supply.

The International Energy Agency recently hiked its expectations for global oil demand growth this year on China’s post-pandemic rebound, which, despite a strong gain in consumer usage, has failed to live up to optimistic forecasts. That’s because industrial demand has been the central focus for traders, and weakness in manufacturing and trucking has kept them from going long on diesel.

“Traders are focused on China recovery, specifically if the increase in consumer-led consumption can meaningfully outstrip weakness in industrial demand,” said Rebecca Babin, a senior energy trader at CIBC Private Wealth.

While a reversal of the bearish sentiment doesn’t appear imminent, a continued decline in inventories may help oil beat other asset classes.

“If you do genuinely believe that we’re in a capital-disciplined and under-investing environment, then when the economy does stabilize, commodities, and oil within that, are likely to outperform over an extended period of time,” Pimco’s Sharenow said.

In a note from Wells Fargo equity reearch, the bank writes that while its model implies a Q2 2023 build, the bank has not seen that in the US or other weekly data. In fact, its tracking of US/ARA and floating inventories (crude + products) indicates a modest draw since 3/31, with The most recent reports from China indicate draws from their oil storage to support local refining demand. And while visibility into China’s refined product stocks is murky, stronger crack spread trends imply no unusual refined product builds have occurred.

As such, the bank’s base case assumption remains a modest recession by YE’23. If the economy avoids that outcome, “then an undersupplied oil market becomes a more likely event… This implies risk/reward for oil prices (and by extension, energy equities) is tilting more favorably as the calendar reaches mid-year.”

Goldman agrees and writes that “inventory draws appear to have started” among global visible stocks, signaling a turning point for the market; the bank adds that oil price weakness has been driven by stronger-than-expected supply from Russia and record releases from US strategic reserves. And of course relentless shorting by hedge funds who are poised for another bruising short squeeze in the weeks ahead.

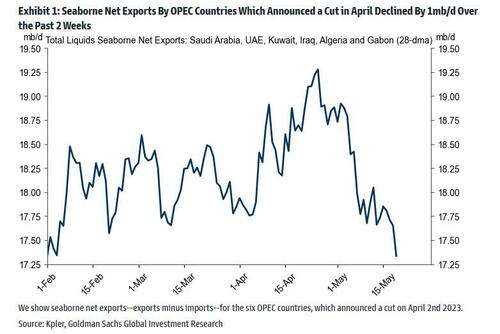

Finally, while hedge funds are betting that OPEC is quietly overproducing and exporting much more than their recent quota permits, a recent update by Goldman Sachs shows that bears may be in for a very rude awakening, as seaborne net exports by OPEC countries which announced a cut in April have finally tumbled by over 1mmb/d over the past 2 weeks.