Things are getting nasty.

Things are getting nasty.

Yesterday, China’s Cyberspace Administration (sounds cool!) announced that Micron (MU)’s products sold in China have failed their months-long review. China claims there are security risks that threaten the country’s critical information infrastructure but that risk may be that MU chips don’t have surveillance backdoors or ways for the state to block information or that MU simply would not turn over their entire architecture for “review“.

Whatever the case – it’s another huge shot fired in the trade and tech war we’re having with China, which has very low (to none) transparency in their law and policies and this new thing seems to be something they just made up to attack MU but, if this is successful – it most certainly won’t be the last US company that comes under attack.

The US is not without sin as we have recently taken actions that include clamping down on the selling of certain semiconductor technologies to China on the grounds these products could be used for corporate or governmental espionage against the U.S. Last month, we even asked South Korea to not have its chipmakers fill the gap if China bans Micron’s products.

After going up last week on rumors they would pass China’s review, MU is down 5% this morning but maybe still not a bargain as China is a good portion of the company’s sales – as it is for other chipmakers like AMD, AVGO, NVDA and QCOM but it doesn’t end there, of course:

- 8,619 US companies are operating in China, according to China Briefing.

- 1,992 US-owned subsidiaries are based in China, as per Global Trade Alert.

- Tesla recorded $6.66 billion in revenue from its China operations in 2020.

- Apple’s revenue from China hit $40.31 billion in 2021.

- China has become Nike’s second-largest market, with Nike reporting $7.03 billion in revenue from Greater China in 2021.

- China’s Starbucks sales hit $5.2 billion in 2020.

- Qualcomm received 52% of its total revenue from operations in China in 2021.

- McDonald’s has more than 2,500 locations in China.

- KFC has over 7,000 locations in China.

- Walmart operates 400 stores and 21 distribution centers in China.

- Coca-Cola operates over 45 factories in China, employing over 48,000 local workers.

- 30% of US-based multinational corporations’ non-US employees are based in China.

- Pfizer’s China revenue reached $2.7 billion in 2020.

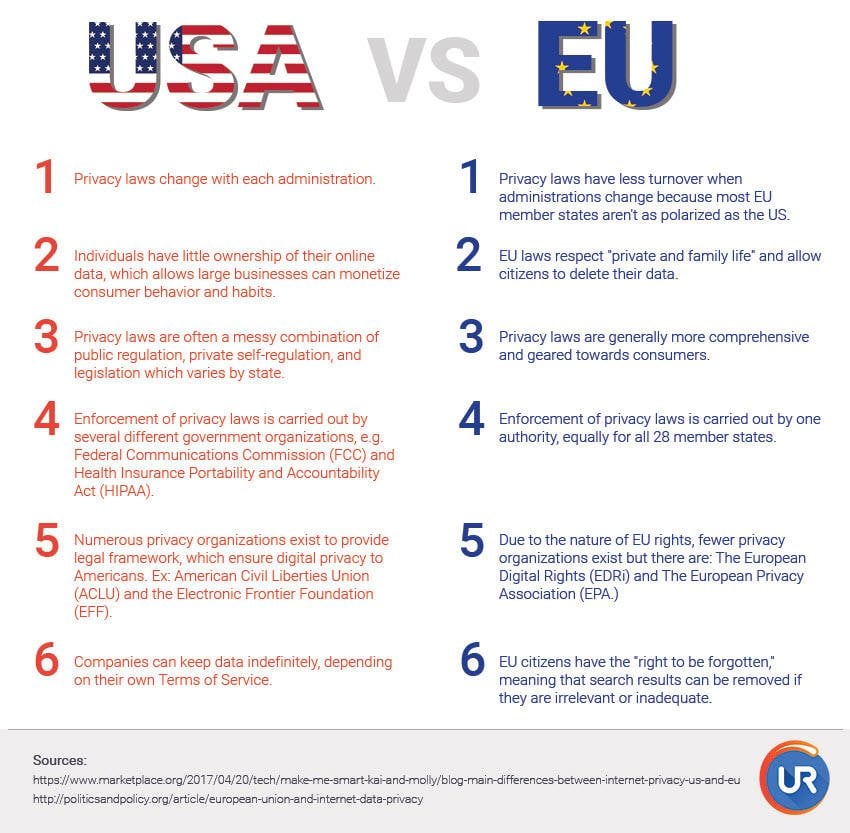

And it’s not just China we need to worry about. In this Age of Information, data is a valuable commodity and the EU just put that concept in the spotlight by fining our beloved Facebook (META) $1.3 BILLION for sending EU user information to the US.

The EU’s “Privacy Regulator” (sounds just as shady as China, doesn’t it?) said in its decision Monday that Facebook has for years illegally stored data about European users on its servers in the U.S., where it contends the information could be accessed by American spy agencies without sufficient means for users to appeal (hey, isn’t that what we claim China is doing?).

Meta said it would appeal the ruling and seek a stay to delay its suspension orders. “This decision is flawed, unjustified and sets a dangerous precedent for the countless other companies transferring data between the EU and U.S.,” Meta said in a blog post responding to the decision.

Hanging in the balance are tens if not hundreds of billions of dollars in trade in industries such as advertising, artificial intelligence, human resources and cloud services. The US and EU are working on “Digital Privacy Rules” to address concerns over U.S. government surveillance practices and provide Europeans with the right to challenge such practices.

We’ve all seen the pop-ups from European web sites that ask for permission to use our data – those are their rules and the US companies, so far, don’t have to follow them for US citizens but META has simply ignored them in Europe as well since 2020 – thus the fine.

The European Commission must approve the U.S. move to put the data-flow agreement into force, a process that could take approximately six months. Previous data agreements between the U.S. and the EU were rejected by the EU’s top court, and it is expected that this new pact will also face legal challenges.

The executive order includes a multilayered review process and establishes a new U.S. court, the Data Protection Review Court, for secondary review of cases related to data privacy. It specifies the conditions and safeguards under which U.S. intelligence authorities can access data transfers from the EU, including limitations on data retention and proportionate data collection methods.

So we will be monitoring the trade issues a bit more closely in June, META traders don’t seem to be phased this morning – Mark will just have to forgo buying a virtual beach house or building a virtual amusement park to pay the fine but, going forward, if META can’t scoop out your personal data and sell your soul to the highest bidder – what will they do for income?

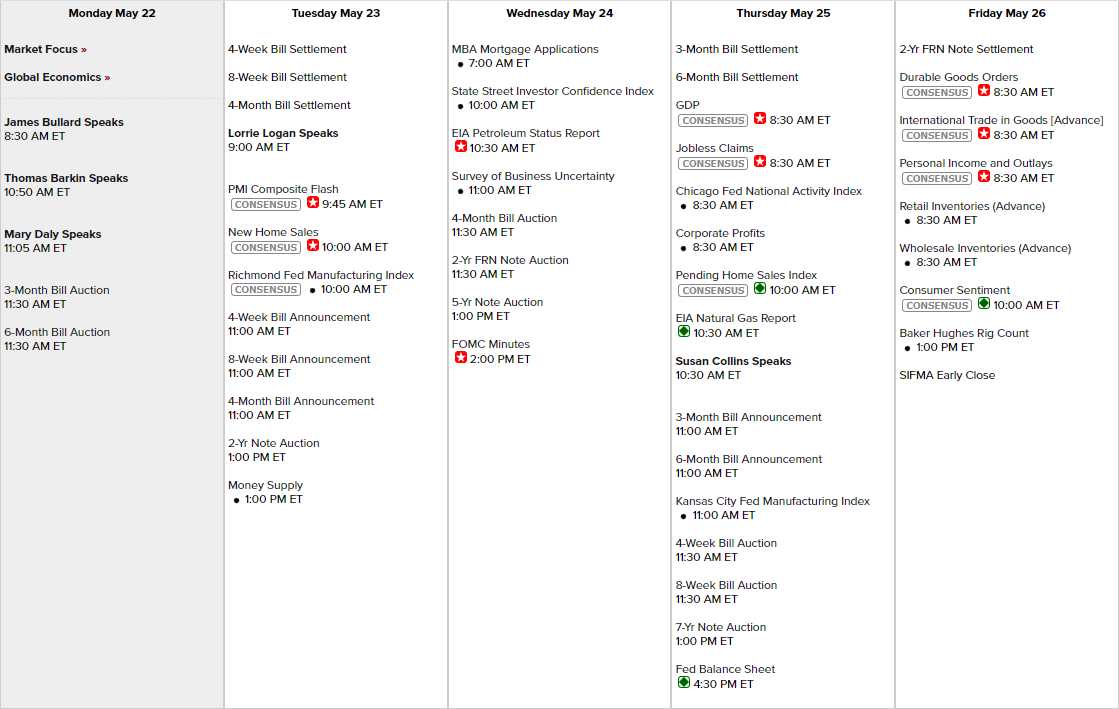

Meanwhile, back in the markets – It’s a busy data week with 3 Fed speakers this morning but just two more scheduled the rest of the week. The US has a lot of Notes to sell this week, so we’ll be watching those auctions and PMI tomorrow will be exciting along with Investor Confidence Wednesday, GDP Thursday and Durable Goods on Friday along with Consumer Sentiment.

And we won’t be bored for lack of earnings – look at all these guys still reporting:

So it should be a nice week and we are starting to fill out or brand new Member Portfolios. We added about 6 positions last week but we used to have over 100 so there’s plenty more fun to be had in the coming months – stay tuned!