What a performance!

What a performance!

Once again the S&P 500 is testing the 4,200 line – as it did in early February, mid-April and early May. Now it is late May and here we are again and, after the March crash to 3,840 (our weak retrace line) the next time we pulled back to 4,060 (100 points BELOW our weak bounce line) and the second time we pulled back to 4,060 and, hopefully, this time is different – but I doubt it.

Yesterday’s volume was anemic at 60M on SPY. That’s 60% of Thursday or Friday’s volumes and that may be the story of the week as it’s Memorial Day Weekend, with Monday being a bank and market holiday. There’s actually nothing impressive about 4,200 on the S&P when 4,320 is our weak bounce goal.

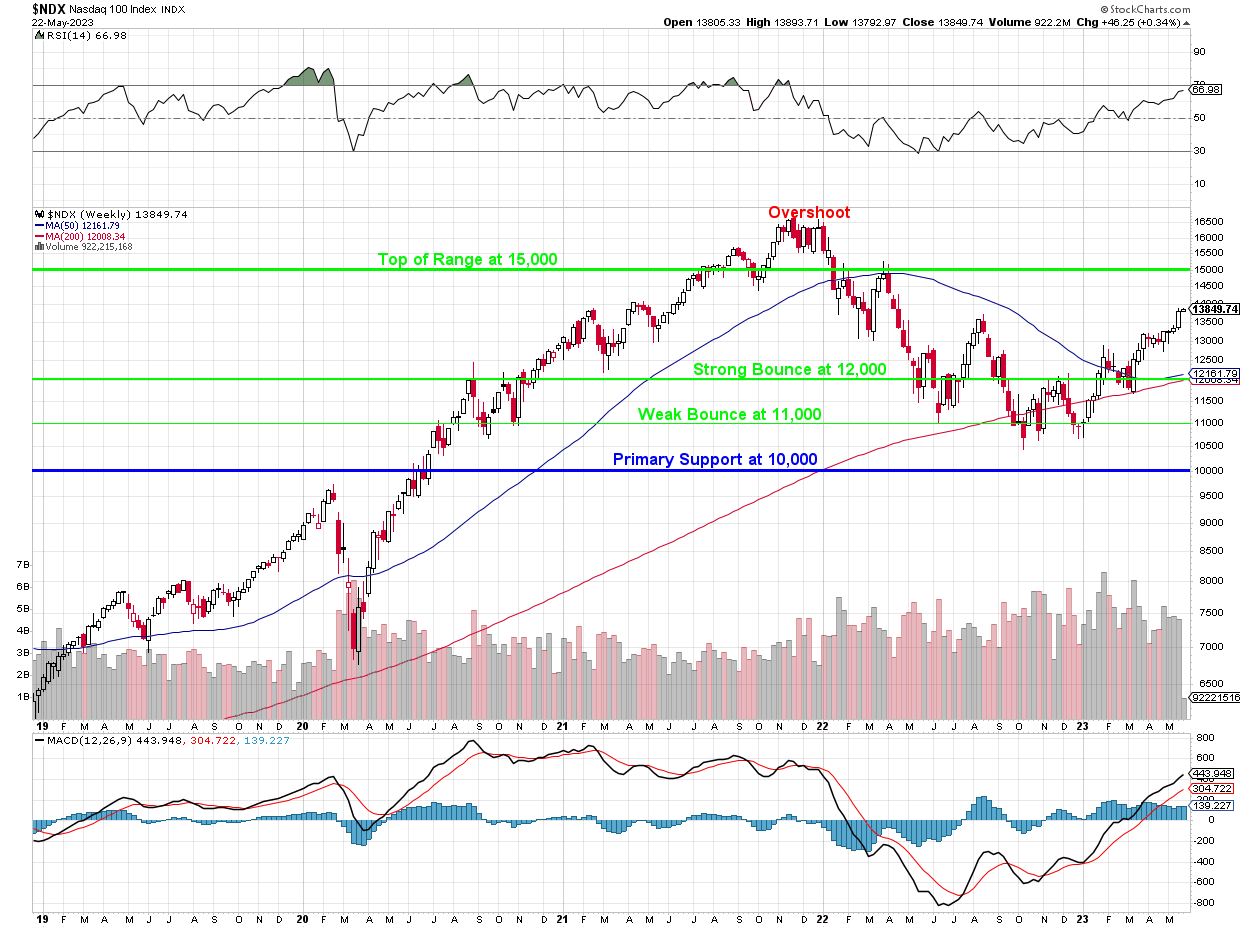

While the S&P 500 has been range-bound since the Fall, the Nasdaq has been all uphill since March – despite the fact that it was cash needs of Tech companies facing hard times that led to the financial melt-down we had in February in the first place. Don’t look for logic in the markets – it pays no attention to short-term facts.

Just because the market doesn’t follow short-term logic, it does not mean we can use logic to select our hedges. The Nasdaq may not have any obvious resistance here but the S&P does so the Nasdaq may follow the S&P lower if it’s rejected again. Below 13,000, the Nasdaq has no real support until it’s own Strong Bounce Line at 12,000 but that’s more than 10% below the current level.

So, if we’re going to hedge, the Nasdaq is the Icarus of the group – flying a bit too close to the sun. We only have about $250,000 worth of exposure so far in our long portfolios and that would be if everything went to zero so let’s say, at this stage, we’d like $500,000 worth of protection against a 20% drop in the Nasdaq. That will allow us to more then double our longs without worrying about the insurance.

SQQQ is the 3x Ultra-Short ETF for the Nasdaq and it’s currently at $25.30. If the Nasdaq drops 20%, then SQQQ should go up 60% to $40.48:

As a straight-up hedge, we could do the following:

- Buy 200 SQQQ 2025 $25 calls at $9 ($180,000)

- Sell 200 SQQQ 2025 $50 calls at $6 ($120,000)

That would be net $60,000 for $500,000 of protection and it’s a perfectly fine way to hedge EXCEPT the net Delta of the 2 calls is 0.68/0.48 = 0.20 so a $15 pop in SQQQ will only gain you $3 on the spread ($60,000) even though, if the calls were to expire at $40, the spread would actually be worth $300,000. The gains would not be apparent unless the Nasdaq goes down and stays down into Jan, 2025.

That’s fine if your intentions with your longs are to absolutely hold the positions in a market downturn as either the longs will recover or you’ll get paid out on the hedge BUT your portfolio will LOOK ugly while you wait and your buying power will be reduced.

So, let’s see what we can do differently:

-

- Buy 200 SQQQ 2025 $20 calls at $10.25 ($205,000)

- Sell 100 SQQQ 2025 $50 calls at $6 ($60,000)

- Sell 150 SQQQ 2025 $70 calls at $5 ($75,000)

- Sell 100 SQQQ 2025 $20 puts at $5 ($50,000)

We still make $300,000 at $40 but now our delta is 2x 0.68, 1x 0.24/1x 0.48, 1.5x 0.40 so a bit more in our favor in the short run and now we’re only spending net $20,000 of our CASH!!! and the 100 puts counteract the 50 “uncovered” short calls so, in a Portfolio Margin Account, this is not a stressful hedge. It accomplishes what we want it to so that’s going to be our play in the Short-Term Portfolio (STP).

Our worst-case scenario is the Nasdaq keeps going higher and SQQQ goes below $20 and we’re obligated to own 10,000 shares of SQQQ for $20 ($200,000) but our longs will make more than that and it’s highly unlikely we’ll lose all of the $200,000 – we can always sell more calls.

To the upside, we’re not in any trouble until SQQQ is over $70 but we’d have $300,000 + $500,000 from the long calls (less the $20,000 we put in) and every $10 over $70 would cost us $150,000 but $70 is 180% over $25 so the Nasdaq would have to drop 60% before that triggers and, since the market has breakers – we will have many opportunities to roll the short calls or buy more longs.

We have already offset a good part of our $20,000 cash outlay by selling 5 WSM 2025 $100 puts for $16.15 ($8,075) and, if the market goes up, those are likely to expire worthless and, if the market goes down, we will roll our loss to the Long-Term Portfolio (LTP) – where we will be THRILLED to start as WSM position at net $83.85 (25% off the current price) on 500 shares ($41,925).

The key to good hedging is having a well-balanced portfolio(s) where you know EXACTLY how much you will make or lose depending on various market scenarios. Our Money Talk Portfolio, for example, was reviewed last week at $338,949 and we are 75% in CASH!!! with $187,000 of upside potential between now and 2025 so, in a good market, we should make about $10,000 per month. The past week has been very good and we’re already at $347,694 – up $8,745 in less than a week – ahead of our projections.

The more we get ahead of our projections the more we should hedge. As a rule of thumb, we tend to add about 1/3 of our unrealized gains ($3,000 in this example) to more hedges – in order to lock in what we can. You will see how we do this over the next 2 years as there will be many adjustments to both our short and long positions over time.

At the moment, I like having the shorts a bit ahead of the longs because we still have the Debt Ceiling and Inflation and the War and Covid is coming back… etc.

Hedging lets us sit back and enjoy the ride!