Cut stocks, buy gold and hold your CASH!!!

Cut stocks, buy gold and hold your CASH!!!

That is the advice from JPMorgan’s Marko Kolanovic, who’s team is advising their HNW clients to prepare for the worst – because the worst is what our Government is best at… “Hopes of a swift resolution to the US debt ceiling have somewhat bolstered market sentiment,” Kolanovic wrote in a note to clients. “Despite last week’s rebound, risk assets are failing to break out of this year’s ranges and if anything credit and commodities are trading at the lower end of this year’s ranges. With equities trading close to this year’s highs, our model portfolio produced another loss last month, the third loss in four months.”

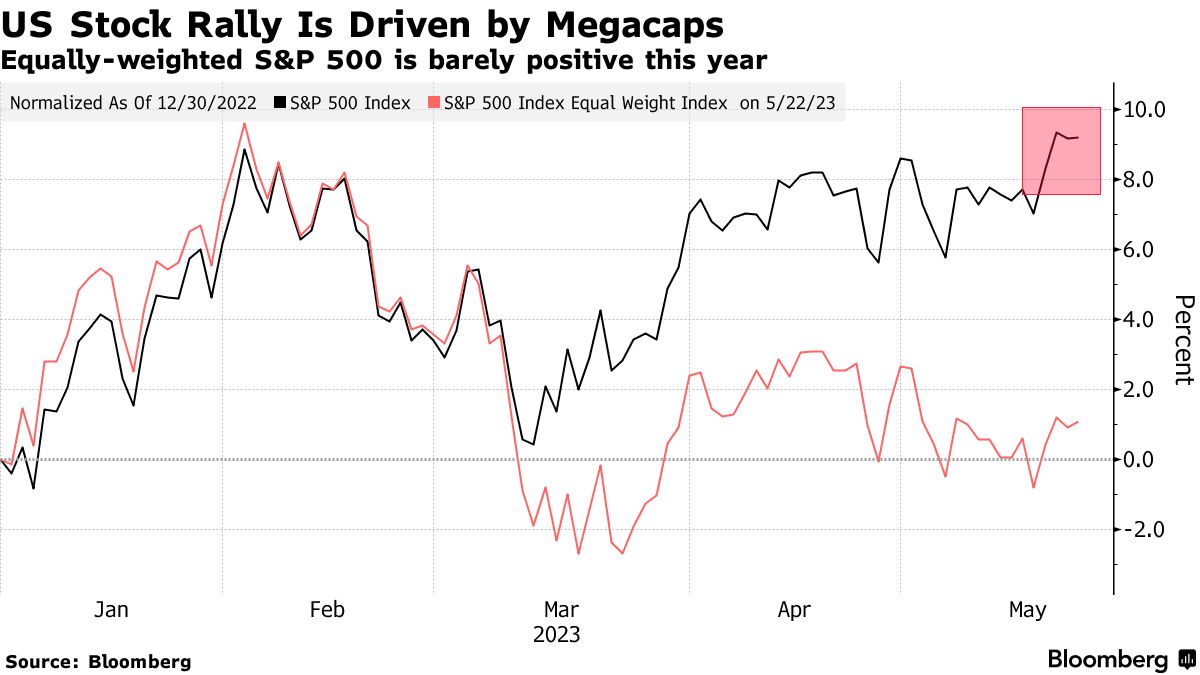

Kolanovic was one of Wall Street’s biggest bulls across much of the market rout in 2022, but has since U-turned on a deteriorating economic outlook this year, cutting the bank’s model equity allocation in mid-December, January, March — and now May. More broadly, Kolanovic and his team said equities appear disconnected from bond markets and softening economic data, in addition to debt-ceiling risks.

I can’t disagree with him, we cashed out all of our portfolios and are just now starting to rebuild them but, in light of the same news that is spooking Kolanovic, we added hedges that have turned us bearish yesterday – going into the holiday weekend.

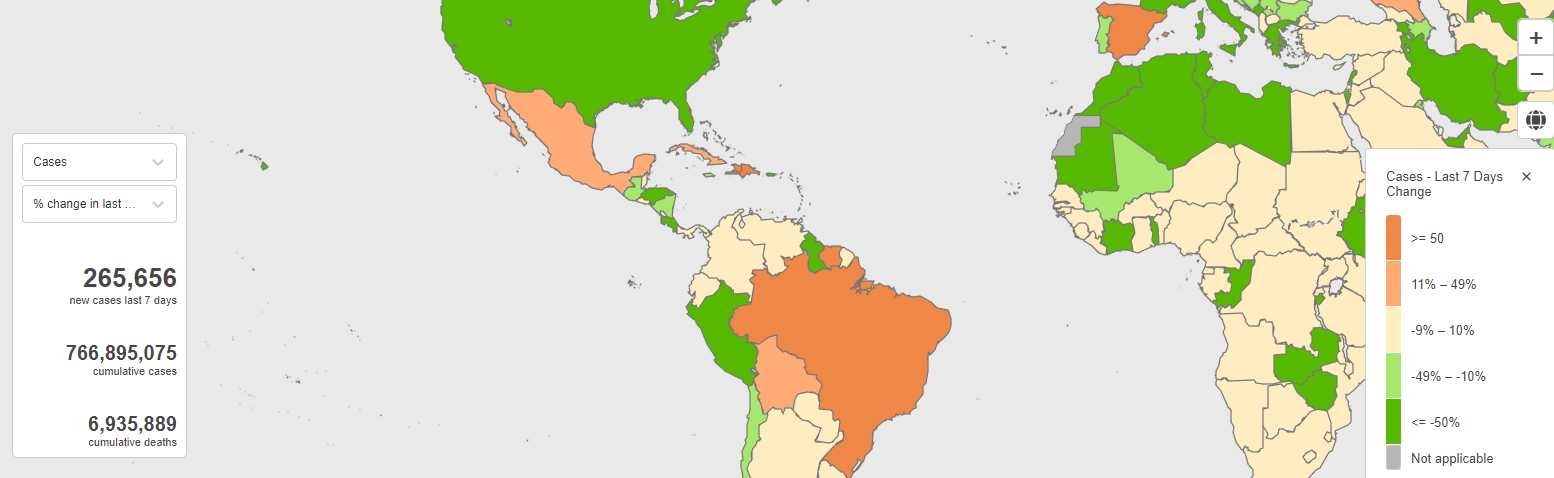

IF the Government doesn’t shut down, we will be pleasantly surprised – that’s a lot better than being UNpleasantly surprised if they do shut down, right? One additional factor that nailed it for my bearish bet is the renewed spread of Covid, which is up 22% in Russia in the past week, 73% in Brazil, 27% in Mexico, 26% in Bolivia, 100% in Spain, 100% in the Dominican Republic and Haiti and up 22% in Cuba.

And, if you don’t like hearing that, you really won’t like what WHO’s Chief warned about an even worse pandemic in our future. I say let’s just worry about the one that isn’t over before worrying about the next one, right? At the opening of the World Health Assembly in Geneva, Dr. Tedros said:

“The world was taken by surprise and found unprepared for the Covid-19 pandemic, the most severe health crisis in a century. We cannot kick this can down the road. If we do not make the changes that must be made, then who will? And if we do not make them now, then when?“

Of course we already have a plan that we’ve put into action and that is to raise the temperature of the Earth to a level that is inhospitable to the Covid virus – which happens to be 149 degrees – a goal we are on track to achieve by 2050 under our current climate policies… BRILLIANT!

Ron DeSantis is running for President and he promises to address the issue by packing the courts with judges who will outlaw any mention of Covid, which will make it go away like “Gayness” and, just to be sure, DeSantis says he will have the votes to raise the boiling point of water to 300 degrees – which will make the planet seem cooler by comparison – BRILLIANT!

Ron DeSantis is running for President and he promises to address the issue by packing the courts with judges who will outlaw any mention of Covid, which will make it go away like “Gayness” and, just to be sure, DeSantis says he will have the votes to raise the boiling point of water to 300 degrees – which will make the planet seem cooler by comparison – BRILLIANT!

Somehow Elon Musk is now backing DeSantis. For a Billionaire to back a politician who will cut taxes is a matter of simple math – an entire Presidential Campaign costs about $1Bn (legally the limit is $51,850,800 but HA!) and Elon Musk has averaged $39.84Bn in income in each of the past 5 years. If Ron DeSantis can pay Elon back with even a 5% tax decrease – that’s $2Bn a year for 4 years is $8Bn. Even if Musk backed DeSantis’ entire campaign – he could get back 8 TIMES his money, not to mention owning a President – which is even better than owning a Supreme Court Judge!

And why shouldn’t the richest people in America get to own American politicians? That’s how democracy works (according to Twitter).

Arrrrgh! Anyway, in other news: The Saudis have warned short sellers in oil to “watch out” as oil heads back to $75 – reigniting inflationary pressures around the World. This is coming a week before the next OPEC meeting and, last night, the API Report indicated a 6.8Mb draw in crude inventories, which would be the biggest drop since March if EIA confirms it at 10:30.

We also have the Fed Minutes this afternoon at 2pm and we’ll go over those in our Live Trading Webinar (Members Only). Tomorrow we get the 2nd estimate of Q1 GDP and the first estimate was 1.1% so we’ll see if it improved any but, judging from Earnings Reports and Economic Data – that doesn’t seem very likely.

Friday is a huge data day with Personal Income & Spending along with PCE Prices and Durable Goods seem like they are going to be terrible and then we’ll get Consumer Sentiment and see how that’s going into the long weekend but, this morning, Mortgage Applications are down 4.6% after being down 5.7% last week – so kind of falling off a cliff is how things are going…

Sure, the Fed is done raising rates, right?

And the economy is fine.