Down goes the Dollar!

Down goes the Dollar!

Since Europe opened this morning, the Dollar has dropped 0.5% and the US “agrees” to add 15% to the National Debt over the next 24 months and then drop that crisis right into the next President’s (or maybe the same President’s) lap as he starts his term in January of 2025.

If you have taken Econ 101 or if, perhaps, you have heard of the concept of Economics or if you have ever played Monopoly – it may occur to you that spending 10% more money than we have for the next two years can very easily lead to inflation and, for those of you with advanced degrees – you may conclude that it would be about 7.5% inflation per year for the next two years.

That’s OK, because the Fed Funds Rate is 5%, so bond investors are being partially compensated for inflation but it is not at all likely the Fed will be able to get rates below 5% any time soon, now that we’ve committed to creating $2Tn more debt in the next fiscal year starting…. NOW!

See? We only had $1Tn in debt in fiscal 2023 and they authorized $4Tn more after negotiating for 6 months. That seems kind of crazy but more money is more money and the markets seem to like it – or maybe they just like the Dollar being down 0.5% – kind of hard to tell at the moment.

I don’t want to spend too much time on the “Deal” as it still may not pass. Our official deadline at the moment is June 5th for a shut-down and the fact that it used to be October and got moved up to June because we’re collecting less and spending more than expected should be, in itself, a huge red flag but sure – $4Tn more debt will fix it, right?

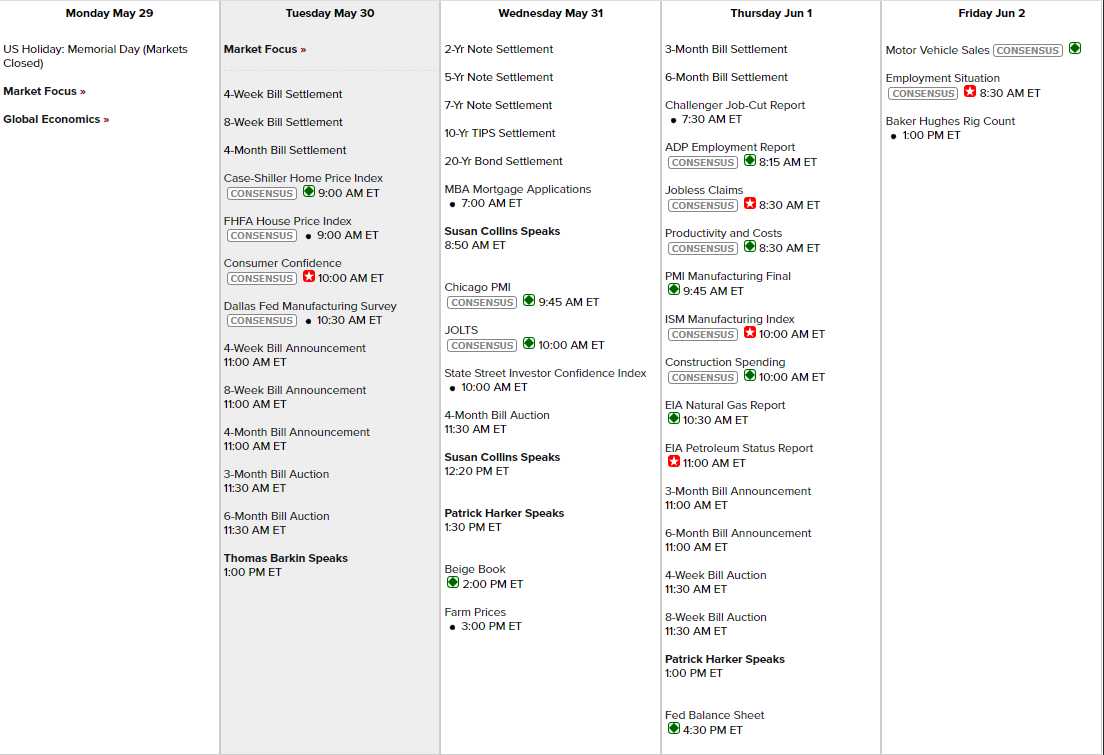

There will be 5 scheduled Fed speakers this week along with Housing Data and the Dallas Fed this morning. Tomorrow we get Chicago PMI, Investor Confidence and the Beige Book, Thursday is Productivity, Manufacturing PMI and Construction Spending and Friday is the Big Kahuna – Non-Farm Payrolls – lots of fun to be had:

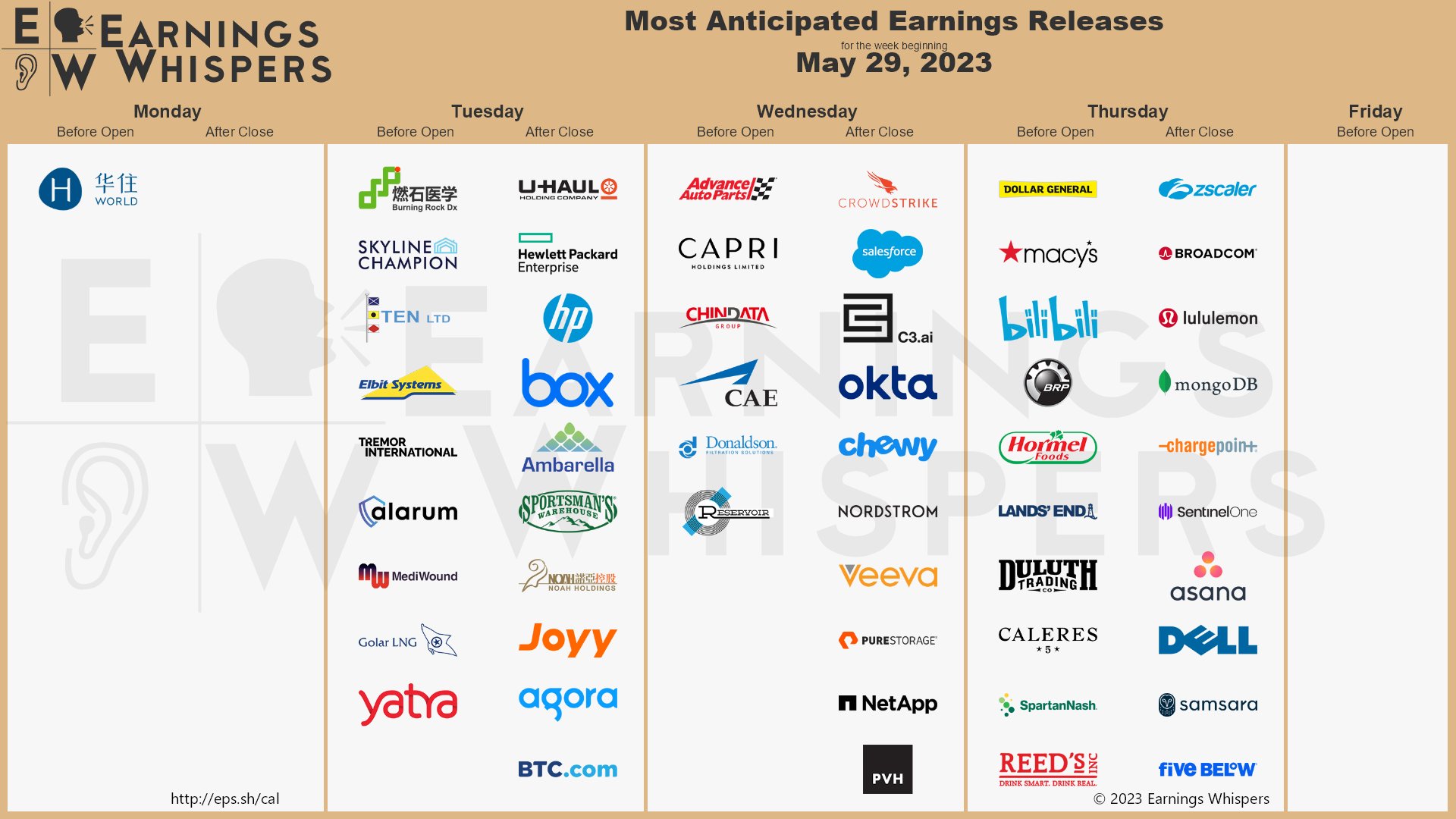

And, of course, earnings reports are still trickling in:

Speaking of earnings. While it’s all very exciting that the country probably won’t shut down next week – what has that actually done to make the market better? So far, for Q1 of 2023, S&P earnings are 2.1% LOWER than they were in 2022, when we spent most of the year around the 4,000 mark. 63 S&P 500 companies have guided down and 41 have guided up in this cycle and the FORWARD P/E Ratio is at 17.8 – historically very high with the index at 4,205 as of Friday’s close.

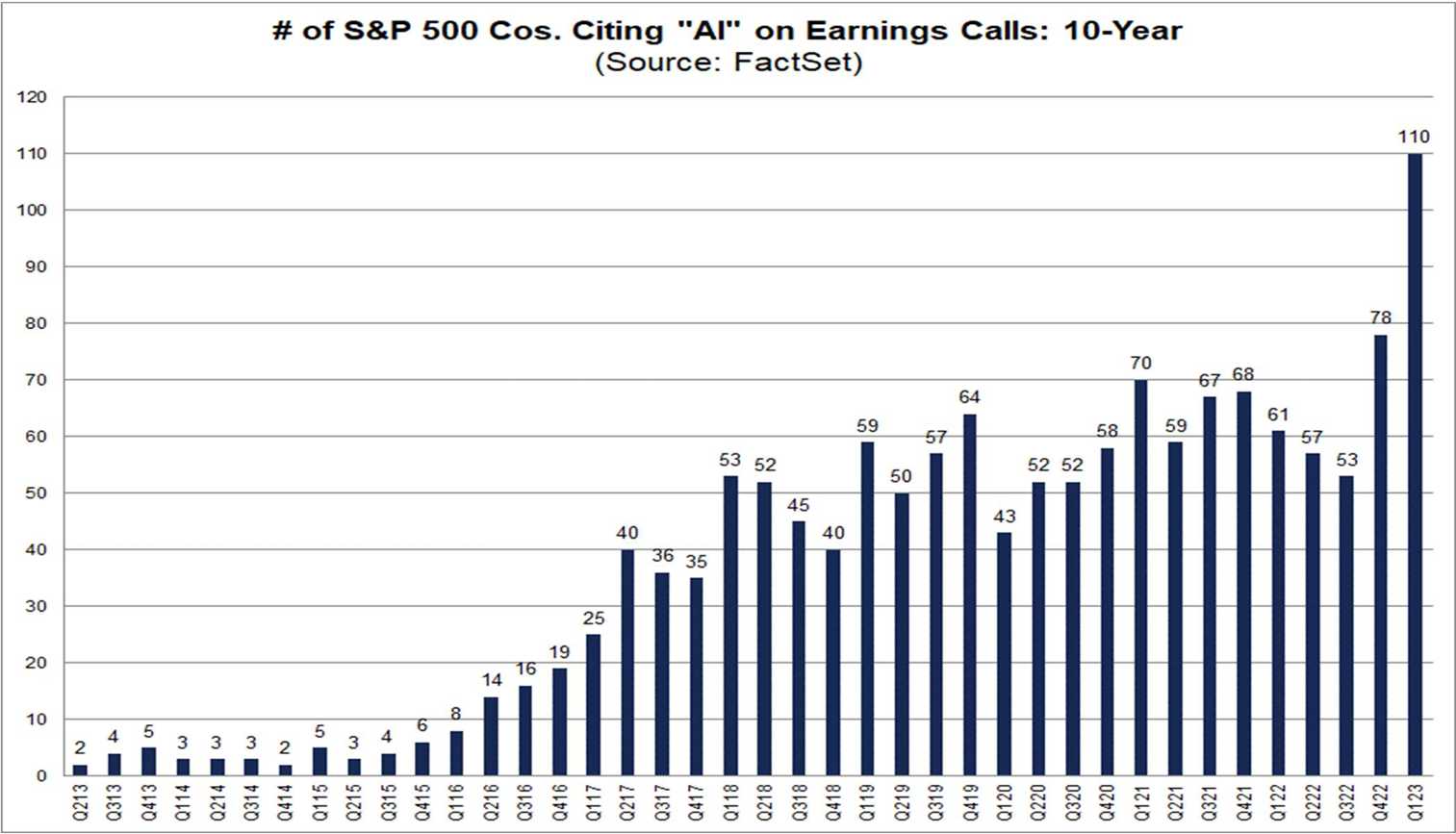

Why then, do investors seem so happy with stocks at the moment? Why it’s the record-breaking number of times companies mentioned “AI” in their conference calls – 110!

Saying “AI” in 2023 is like saying “Dot Com” in 1999 – how can you lose? Clearly AI is the Future and, 24 years later, we can say all those “Dot Com” people were right as well – even if 90% of those companies failed anyway – the “Dot Com” itself did endure.

I’m a huge fan of AI but, as I warned our Members about 3D Printing, Biotech, Crypto and NFTs – you can’t just jump into things because it’s a hot trend – there have to be some actual earnings underneath. At the moment, traders are jumping on any bandwagon that strikes up a tune but they haven’t even signed the Debt deal and now we’re acting like there’s not a care in the world as people rush to bet on the new, shiny thing.

Just be careful out there.