By ZeroHedge

Update (1400ET): The Financial Times reports that OPEC has barred several media groups from attending its crucial production meeting in Vienna this weekend, in a move officials said was driven by Saudi Arabia

Reporters from Reuters, Bloomberg News and Dow Jones, the publisher of The Wall Street Journal, have been denied invites to Opec’s Vienna headquarters, according to people familiar with the matter.

The ban is unusual and no reason has been given for excluding the media groups, but people familiar with the decision said it had been instigated by Saudi Arabia’s energy minister, Prince Abdulaziz bin Salman.

Are they readying a surprise cut announcement and don’t want any leaks?

* * *

If it was Russia’s intention to send oil tumbling after its oil minister last week said that OPEC+ has no intentions of cutting production, in the process inviting another round of shorts and bearish CTAs, well… mission accomplished: on Wednesday oil tumbled more than 3% following the latest dismal Chinese PMI data, and followed a 4.4% drop on Tuesday the black gold is now on pace for its worst month since November 2021. But the real driver behind the latest dump is the reversal of last week’s speculation that an OPEC+ cut may be coming following a thinly veiled threat by the Saudi energy minister.

Still, many were surprised by the speed and ferocity of the latest drop and as Goldman trader John Flood writes overnight, “we were peppered with questions today on weakness in oil/broader commods complex.”

His retort: “sentiment around both muted Asia refining margins + European industrial recovery are headwinds. The potential US debt deal includes a resumption of US student loan repayments beginning in Sept which could weigh on discretionary spending and shows you how glass half empty the mkt has become.”

Then there are the technicals: Goldman’s futures strats estimate that CTAs are short $10 billion oil contracts, so positioning remains fairly, even though last week’s OPEC headline around warning speculators to “Watch Out” appears to have added some length early in the week , which this will is once again coming unwound after Novak’s comments.

As for this weekend’s OPEC meeting, Flood writes that “it feels like expectations are pretty low. If they cut, it helps the front but builds spare capacity, if they don’t, the mkt might wonder if $70 moves from a floor to a ceiling. All of this suggests any froth that might have been added last week has come out.”

A more in-depth take was published this morning by Goldman’s commodities team (available to pro subs in the usual place), in which Jeffrey Currie and Daan Struyven write that they “expect the nine major OPEC+ producers which announced voluntary production cuts in April to keep production unchanged, but utilize some partly offsetting hawkish rhetoric.”

One possibility, according to Goldman, is to officialize these voluntary cuts, and broaden the cuts to smaller producers. While constraints on production of these smaller producers imply only a modest hit from a broader announcement to actual output, the bank suspects the alliance will want to signal strong cohesion.

Meanwhile, Goldman forecasts a hold for major producers because they likely first want to observe the impact of fresh cuts which just started this month (actually, they haven’t as Russia has been cutting output only verbally, while its exports remain near record high). As an aside, OPEC has never cut within three months of a previous cut with stocks as low as today.

“Signs that the market remains on track for H2 deficits, incomplete Russia compliance, and several recent comments by OPEC+ and US energy policymakers also support a hold” according to Goldman., which lays out these four reasons why the major producers are likely to roll over output.

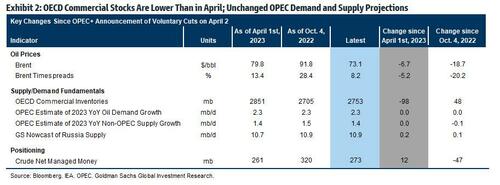

- First, OPEC projections and inventories data suggest the market remains on track for large and sustained deficits in H2 with unchanged OPEC production. OPEC, the IEA, and our team all continue to predict that solid global oil demand growth will outpace non-OPEC supply growth this year (Exhibit 2).

- Second, our Russia supply nowcast suggests that Russia production has fallen by less than the 500kb/d pledged. The Wall Street Journal also reports that “Saudi officials have complained to senior Russian officials and asked them to respect he agreed cuts”. We suspect that OPEC policymakers will likely first want to see stronger evidence of full Russia compliance before announcing any deeper cuts.

- Third, several recent comments by OPEC+ policymakers also point to a hold. For instance, Iraq’s Energy Minister said that “there will be no additional reduction.”

- Fourth, recent comments by US Energy Secretary Jennifer Granholm that the US could start repurchasing oil for the SPR after June, and the announcement of a modest SPR purchase of 3mb suggest that OPEC’s frustration with Western energy policies—which likely contributed to the surprise cut in April—may have edged down.

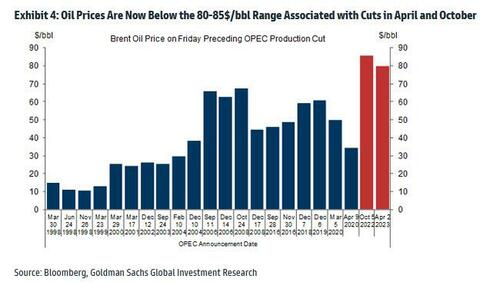

All that said, Goldman sees a “sizeable 35% subjective probability” that the major OPEC producers announce deeper cuts on Sunday because oil prices are clearly below our $80-85/bbl estimate of the OPEC put. Very low positioning, the Saudi determination not to give speculators free rein, and the decision to meet in person also suggest that deeper cuts will likely be discussed.

Looking further out beyond Sunday’s meeting, Goldman believe that elevated OPEC pricing power should allow the group to deliver additional cuts if oil prices were to remain below $80/bbl in H2.

Goldman is not the only one to assign non-trivial and rising odds of a rate cut: according to RBC, OPEC+ may agree to a “lean cut” to output when the group meets this weekend “given the softness in oil prices and the ongoing need for higher revenues in producer countries.”

In a note by RBC’s Helima Croft, he writes that “the decision to hold an in-person gathering in Vienna raises the prospect the group could implement a deeper cut to support prices” although maintaining current output levels is also on the table.

Croft notes that “OPEC+ doesn’t want to be overtaken by macro headwinds and souring market sentiment” and while there’s a corner of the market that thinks OPEC+ may return to a market share approach, “there’s no sign Saudi Arabia is seeking to repeat the March 2020 price war with Moscow.”

Finally, a third bank also chimed in overnight, when Standard Chartered said in a note that while “fundamentals in the global oil market do not provide a case for OPEC+ output cuts, the poor macroeconomic environment does.”

OPEC+ ministers could adopt a patient approach and keep current targets in expectation of higher prices as market tightens, wrote analysts including Emily Ashford and Suki Cooper who also note that if the group wants to be cautious, they could respond to concerns of macro-led shorts and make a further precautionary cut to signal that any likely macroeconomic downside has been covered.

“We think the decision is finely balanced; while we detect no strong appetite among ministers for further cuts, we also detect no appetite to allow macro-led investors free rein to open up the downside for oil prices.”

More in the full Goldman note available to pro subs.