Credit card rates in Brazil are 450%.

Credit card rates in Brazil are 450%.

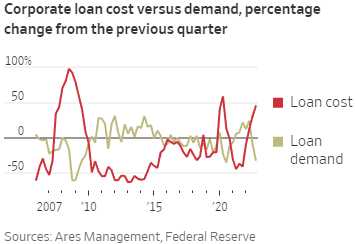

It’s not a “spike” – they are “only” up 84% since last year. Installment payments average 200% but the Central Bank’s benchmark rate is only 13.75% – it’s just not possible to get it if you are not a banker. As you can see from the chart on the right, US Corporations are already slowing borrowing by 40% as rates have more than doubled in the past year and, much like Brazil’s Central Bank – the Fed is nowhere near having inflation under control – as much as they like to pretend they do.

220M people live in Brazil and the average household makes $7,272 and household debt is roughly 49% of that income, with 1/3 of Brazillians’ monthly wages going to debt service. Default rates are currently running 6.2%.

That sounds bad, right? But in America, the average household debt is 145% of our income and 5.7% of those debts are delinquent – so far. 36.3% of US household income went to paying off debts last year. Why is that? Because Americans LOVE to own homes – whether we can afford them or not. Cars too, we tend to have one for every single person who can drive.

| Debt Type | 2022 Average Consumer Debt Balance |

| Mortgage debt | $230,000 |

| Home equity line of credit (HELOC) | $40,000 |

| Student loan debt | $40,000 |

| Auto loan debt and lease | $22,000 |

| Average credit card debt | $6,000 |

| Personal loans | $18,000 |

| Total average balance | $102,000 |

Overall, the US has 836 cars for every 1,000 people for a total of 276M cars for 330M people – that’s kind of nuts when you think about it. China has 226 cars per 1,000, South Korea 485, UK 600, Japan 624, Germany 628 – that’s about normal – we’re not normal…

We also love big, giant houses with rooms we don’t even use. Why do houses still have dining rooms? Who dines? Anyway, I’m not here to critique our lifestyles but to consider the implications of that lifestyle since we are worse off than Brazil in every way but one – Interest!

We also love big, giant houses with rooms we don’t even use. Why do houses still have dining rooms? Who dines? Anyway, I’m not here to critique our lifestyles but to consider the implications of that lifestyle since we are worse off than Brazil in every way but one – Interest!

While everyone has been bitching and moaning about the Fed raising rates, their 5.25% Fed Funds Rate is still a gift when our neighbors in Mexico are at 11.25, Chile is 11.25%, Brazil 13.75% and Argentina will pay you 91% interest if you lend them money – but nobody will…

On the other end of the spectrum, Japan has a NEGATIVE 0.1% interest rate so you have to pay THEM to lend them your money. Japan is 300% of their GDP in debt – they can’t afford to pay you 1% – they already use almost 1/2 of their Government’s revenues just to service the debt that they have.

Historically, global rates have shown some degree of convergence over time, especially among advanced economies that share similar economic conditions and policy frameworks. For example, the trend in the world real interest rate for safe and liquid assets fluctuated close to 2% for more than a century.

Rates are still extremely low and that is mainly due to the fact that higher, more realistic rates would bankrupt Citizens, Corporations and even Governments – all of whom are currently carrying record amounts of debt.

We still have not solved the wage issues, with minimum wages in 20 US States still at $7.25 per hour. Even if you got paid for all 40 hours and nothing was taken out of your check – that would be $290 for a human being to live for 7 days including rent, health care, transportation, food, clothing, utilities… This is not the way we should be treating Humans – is it?

We still have not solved the wage issues, with minimum wages in 20 US States still at $7.25 per hour. Even if you got paid for all 40 hours and nothing was taken out of your check – that would be $290 for a human being to live for 7 days including rent, health care, transportation, food, clothing, utilities… This is not the way we should be treating Humans – is it?

We should not call this slavery – because the slaves didn’t end up in debt after working all week and having nothing to show for it – but there will be a rebellion. Already we’re seeing sharply rising crime rates, especially shoplifting as we dangle the trappings of wealth (like food, clothing and medicine) in front of those who can’t possibly afford them.

Retail Theft is up to $94.5Bn annually, according to the National Retail Federation and, of course, rather than paying their employees enough money to be able to afford to BUY the things they want – Retailers are spending Billions cracking down on security. That’s because there are 26 MILLION of our fellow Americans who get hourly wages and giving them $1,000 worth of stuff would cost $26Bn – but Corporate America has decided it’s more fun to arrest them than pay them since our tax Dollars pay for the arrests, not the management.

Of course, Retail Sales are $7Tn and if you raised prices by 1%, that would leave you with $70Bn and allow you to distribute that to 26M workers so about $2,700 each – a 20% increase in salary all the way to $8.70 an hour!

As you can see this is a very big problem and it’s NOT going to go away if we ignore it. One way or another, we end up paying for the poverty we create and there are MILES to go before we’re even beginning to address DECADES of underpaid workers, underfunded public and private pensions, lack of infrastructure, etc. – and we haven’t even thought about doing something about Global Warming.

Good luck with those low rate dreams and – if those don’t work out – BRAZIL!