The Dow is back below 33,000.

The Dow is back below 33,000.

I know that, if you listen to the cheerleaders on Financial Media channels, you would think we’ve been having a rally but, in fact, the Dow has dropped 1,250 (3.6%) since mid-April – which was not actually very long ago.

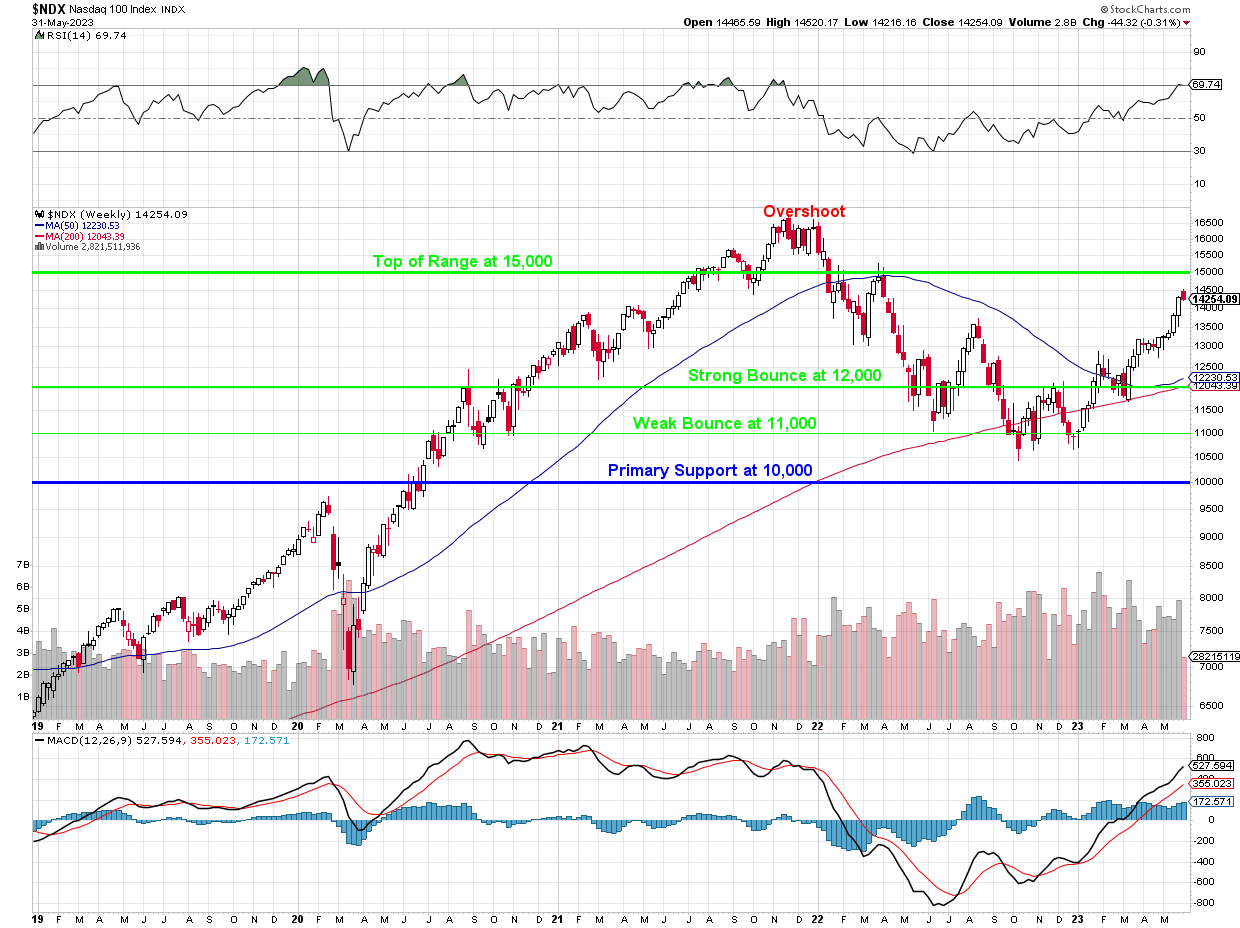

The Nasdaq, of course, has been on fire, thanks to NVDA etc. During the month of May, the Nasdaq has gained 11.5% – topping out at 14,500 so far and that’s up $3 TRILLION in 30 days – mostly based on NVDA making $670M more then expected in Q1. For Q2, NVDA has said they expect to make $1.04 ($2.63Bn) per $380 share. If they keep that up for the year, they will only be trading at 120x earnings!

Now that is, specifically, what NVDA is doing to deserve their $250Bn bump in market cap but what has the rest of the Nasdaq done to deserve a $2.75 TRILLION bump in 30 days? No seriously, this is not rhetorical… I’ve tried Google and Open AI and Bing and Bard and I can find NOTHING to justify $25.3Tn in valuation for the Nasdaq 100.

On January first, the Nasdaq 100 was at 11,000, which was 24% lower than it is now and that was $19.2Tn in market cap and 23.7x earnings. Other than NVDA and a few others – earnings haven’t actually improved and now we’re trading at 30x earnings – which seems a bit high to me.

Now we cashed out our old portfolios at about 13,000 on the Nasdaq so perhaps this is 10% sour grapes but I thought 13,000 was overpriced in April and I still think 13,000 is overpriced now – despite the promise of AI. One day, sure, AI can make a 10% difference in the Nasdaq – but not 6 months after it was released! That’s just silly…

The Dow components (which include MSFT and AAPL (and IBM, CSCO and INTC, who also benefit from AI) know this and that’s why we have such a divergence in the indexes and I think it’s a LOT more likely the Nasdaq sobers up and snaps down than the Dow gets giddy and starts a 30% run to catch up.

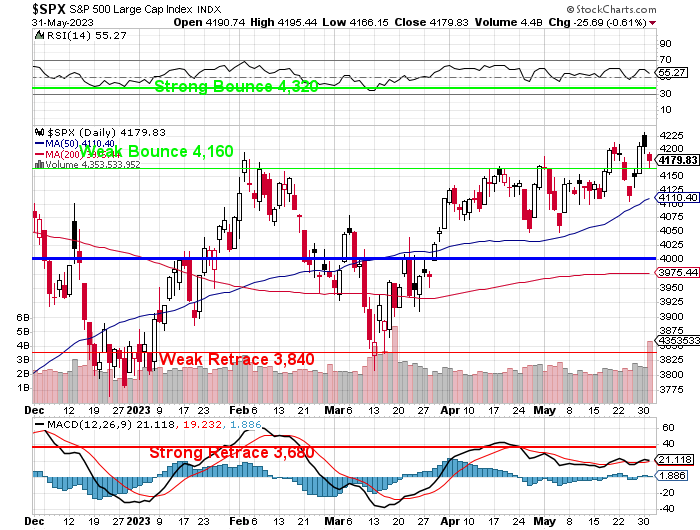

The S&P 500 is more in the middle with a $36Tn valuation that is 24x earnings (16x is the historical average) and those earnings include almost all of the Nasdaq 100 so, if the Nasdaq 100 is up $3Tn in 30 days and the S&P 500 is flat – then the other 400 components of the S&P 500 have LOST $3Tn (10%) of their valuation over the same time period. Oops – where’s our rally?

Not only do we seem to have a Debt Deal (we’re getting $4Tn more of it!) but the Fed has been talking about a possible pause in June and even that is not enough, so far, to get us back to the highs. What do they want from us – profits?

Well, it is June already so we can now start looking forward to Q2 earnings, which kick off after the holiday. Meanwhile, just this morning, we got the ADP Report showing 278,000 new jobs which blew the doors off the 200,000 predicted by leading Economorons and Jobless Claims were flat so the Fed has no excuse there to pause rates.

AI hasn’t boosted Productivity so far as that came in at MINUS 2.1% in Q1 after being MINUS 2.7% in Q4 and Unit Labor Costs are up 4.2% and together, that’s a DISASTER for Corporate America. Pop quiz hotshots – what happens to Profits when Productivity is Down and Labor Costs are up? Yep, too obvious to discuss so we can only HOPE this will be solved with AI before we repeat the cycle of 2006-2009.

- In other news:

- Stocks may have put the debt ceiling behind them, but here are more risks to the 2023 market rally

- Debt-ceiling deal seals end to student-debt moratorium — a nearly $400-per-month shock to budgets.

- Capital Account: A Debt-Ceiling Deal That Doesn’t Deal With Debt.

- ‘Potent liquidity squeeze’ threatens stock market once debt-ceiling deal is done

- Fall Of American Empire & Descent Into A New Dark Ages

- A Breakdown of America’s Stagnating Number of Births

- Beige Book Shows US Economy Turning More Sluggish

- Where Is the U.S. Economy Headed? Follow the Money

- ECB Warns Rate Hikes Are Putting Market Stability at Risk

- Everywhere You Look in China Are Signs of More Market Misery

- Oil Slumps as Weak Chinese Data Dominates Market Sentiment

- WTI Extends Losses After API Reports Big Surprise Crude Build

- Billionaire Perot Warns of Real Estate Recession as Loans Dry Up

- Investors Slam Brakes on US Home Purchases as Profits Dry Up

- Workers on Why They’re Not Coming Back to the Office

- Wall Street Banks Are Using AI to Rewire the World of Finance

- Hedge Funds Are Deploying ChatGPT to Handle All the Grunt Work

- Mood Darkens at Macy’s as Retail Spending Slows

- Carbon Footprint Of Lab-Grown Beef “Orders Of Magnitude” Worse Than Traditionally Raised: Study

- Major Grocery Chain Struggles To Survive Amid Wave Of Thefts

- Chick-fil-A Faces Growing Backlash Over ‘Diversity, Equity, And Inclusion’ Efforts

- Bud Light’s Sales Implosion, Explained (By Mises)

- The Data Science Behind Raising Fast Food Prices

- Citi Strategist Says Tech Stock Rally Is Now at Risk of Fizzling Out

- Nasdaq Triggers A New Volatility Correlation Sell Signal

- Coastal Town Brings Mass Litigation—and an ‘Existential Threat’—to Chemical Giants.

- AI-Mania Meltup In May Hides Recession Signals From Commodities & Credit Curves

Be careful out there!