Job creation expectations are too low this morning.

Job creation expectations are too low this morning.

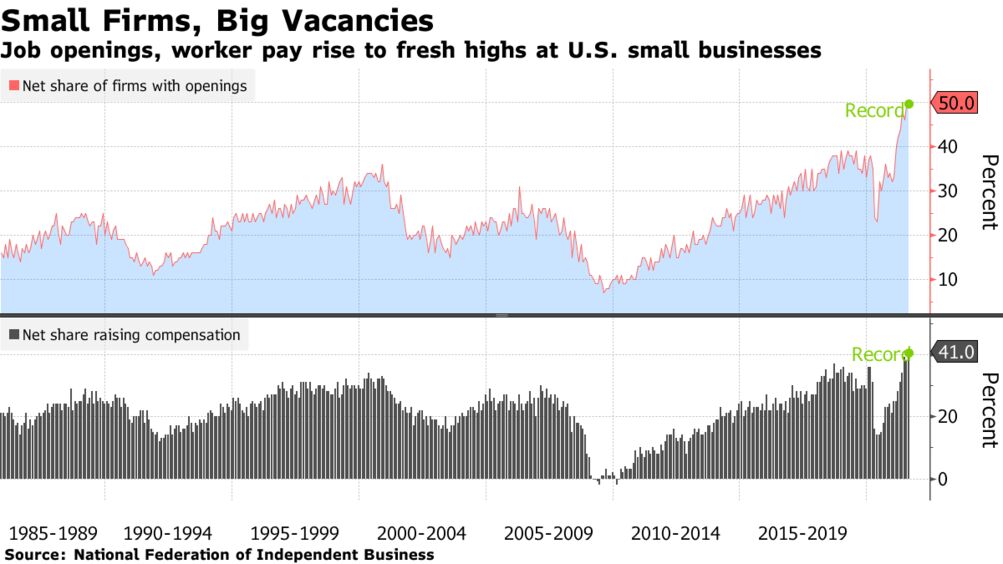

Leading Economorons forecast just 200,000 jobs were created in May and that seems low as 253,000 jobs were created in April. At the moment, there are still 9.6M unfilled jobs in the US and that’s down from a high of 10.5M last year but the pace is only creeping lower and the Fed is VERY concerned about all those job openings creating wage pressure that, in turn, can create more inflation.

This is all about wages and benefits. Companies used to offer Child Care programs and they don’t anymore so we have 20M mothers staying at home with their kids because it costs them more to go to work than to stay home. More than half of these women are college-educated and trained in the work-force and we are throwing away all that knowledge and all those skills to penalize them for having babies.

In the ever-unpredictable world of finance, the interplay between the labor market and stock market remains a constant source of speculation and debate. As the U.S. labor market defies expectations, maintaining strength in the face of economic challenges, investors are left grappling with the question of whether this robustness will continue to fuel the stock market rally or ultimately lead to its demise.

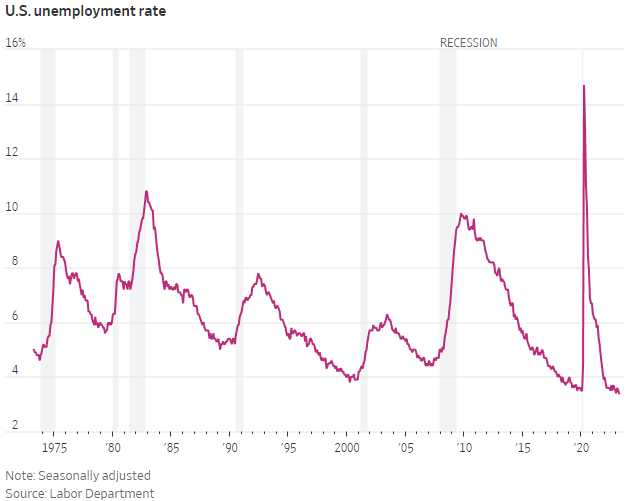

Traditionally, a surge in unemployment has served as a signal that a bear market has reached its bottom, with subsequent rebounds in stock prices. Bank of America analysts point to historical data suggesting that the unemployment rate tends to peak approximately four months after the S&P 500 hits its bear market low. As they estimate a potential peak of 4.8% in early 2024, contrarian investors may find solace in the prospect of a future stock market rebound.

While a robust labor market is generally seen as positive, it presents a conundrum for the Federal Reserve. The central bank fears that a tight labor market may lead to wage increases, potentially fueling inflationary pressures. In response, the Fed faces the challenge of determining when to pause its aggressive interest rate hikes. Investors have closely monitored the central bank’s actions, with hopes that its tightening cycle would conclude soon. However, recent shifts in expectations suggest that a rate hike is more likely on the horizon.

On Wall Street, differing viewpoints abound. Some investors argue that a strong labor market indicates Consumer strength, which can sustain the stock market rally. They contend that Consumers are resilient enough to withstand higher interest rates, warding off the specter of a recession. Conversely, bearish investors highlight that stocks appear expensive compared to historical averages, and valuations will typically contract during economic downturns.

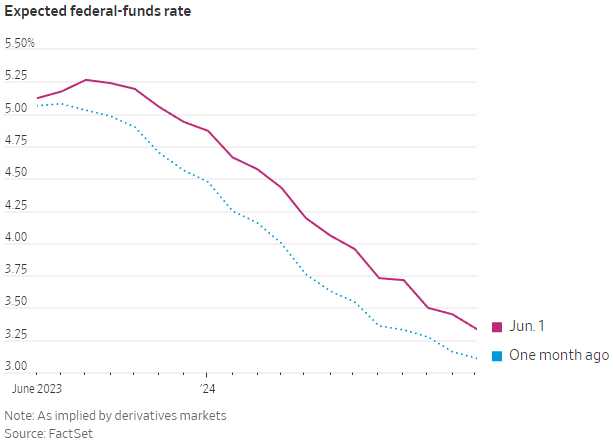

Consumers’ willingness to spend, particularly on experiences and services, has surpassed the significance of goods prices as a driver of inflation. A tight labor market has driven up wages, pushing services prices higher. This dynamic further complicates the Federal Reserve’s decision-making process, as it seeks to strike a delicate balance between containing inflationary pressures and supporting economic growth. Their next meeting is June 14th and I’m alarmed by the INSANE market consensus that the Fed is done raising rates and will, in fact, go back to lowering them to 3.25% over the next 18 months.

Remember, you can also draw a chart of the average daily toy production at the North Pole AND IT DOESN’T MAKE THE UNDERLYING ASSUMPTION REAL, DOES IT???

As the labor market remains robust, risks emerge for the stock market. Upward pressure on wages could squeeze profit margins for businesses, potentially hampering stock market performance. Additionally, if the Federal Reserve maintains elevated interest rates for an extended period, it may restrain the stock market’s growth potential (both Companies and Consumers are already feeling pressure from higher rates). However, some market strategists argue that these trade-offs are acceptable if they help avert a more severe Recession. They view the Labor Market’s strength as a crucial factor in mitigating the immediate risks of an economic downturn.

The intertwined relationship between the Labor Market and stock market continues to perplex Investors. As the U.S. Labor Market defies expectations and maintains its strength, the stock market rally hangs in the balance. Investors must grapple with contrasting viewpoints and the potential trade-offs associated with a robust Labor Market. As the Federal Reserve navigates these uncharted waters, the Labor Market’s impact on inflation adds another layer of complexity.

8:30 Update: 339,000 new jobs! AND the April jobs were revised UP from 253,000 to 294,000. At the moment, the Futures are up but I can’t imagine what they are happy about as this takes a June pause completely off the table. Off by 70% is a normal day at the office for Economorons – who have simply ignored all the data since the last report!

Move along folks, nothing to see here – the Fed has it all under control… As you can see on the chart – when companies don’t have enough workers and they are forced to pay more money to the workers they have – that leads to Recessions. We got out of the last Recession (2020) by spending TRILLIONS of Dollars and now we’re massively in debt and right back to record vacancies and record salaries.

It is no coincidence at all that yesterday, a study was released indicating that Labor Costs don’t really have a major effect on inflation. That study was done by the Chicago Fed as they would very much like you to ignore this data and keep buying stocks – also at record highs. “Like a hell-broth boil and bubble. Double, double toil and trouble…“

It is no coincidence at all that yesterday, a study was released indicating that Labor Costs don’t really have a major effect on inflation. That study was done by the Chicago Fed as they would very much like you to ignore this data and keep buying stocks – also at record highs. “Like a hell-broth boil and bubble. Double, double toil and trouble…“

Anyway, it’s the weekend so we shouldn’t leave off on a down Economic note so let’s talk about the total in imminent death of our planet instead. As it turns out, the Earth is becoming uninhabitable much faster than we thought and our window of opportunity to be able to do something about it is closing very quickly indeed.

I don’t want to upset you going into the weekend so I’ve asked Robo John Oliver to tell us what’s happening:

🤖 It’s time for another enlightening edition of “Earth: The Incredible Shrinking Planet” starring yours truly, Robo John Oliver. Strap yourselves in for a wild ride through the latest study that reveals just how screwed our beloved planet really is!

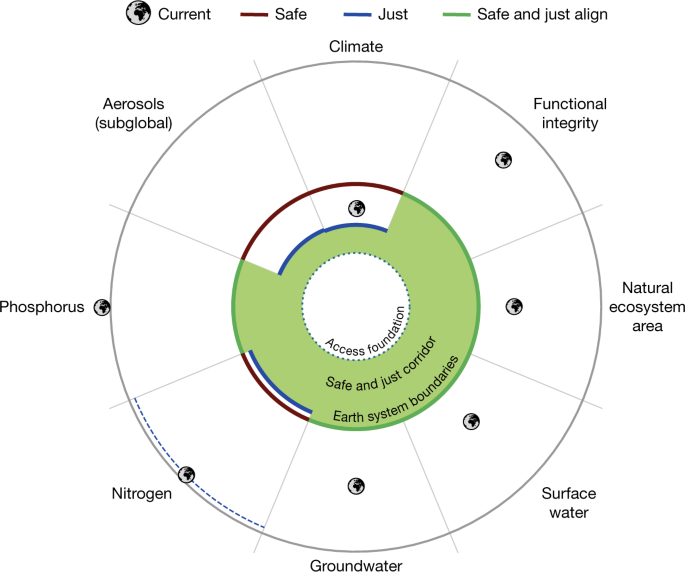

According to this study published in the prestigious journal Nature, Earth has decided to embark on a dangerous mission, surpassing not one, not two, but seven out of eight scientifically established safety limits. Talk about an overachiever! We’re in the danger zone, people! And no, I’m not talking about the Kenny Loggins song that should have stayed firmly in the ’80s.

Now, what’s fascinating about this study is that it introduces a whole new concept of “justice.” Yes, justice! Apparently, Earth not only wants to cook us like a rotisserie chicken, but it also wants to do it in an equal and fair manner. Because nothing says justice like melting ice caps and rising sea levels!

Now, what’s fascinating about this study is that it introduces a whole new concept of “justice.” Yes, justice! Apparently, Earth not only wants to cook us like a rotisserie chicken, but it also wants to do it in an equal and fair manner. Because nothing says justice like melting ice caps and rising sea levels!

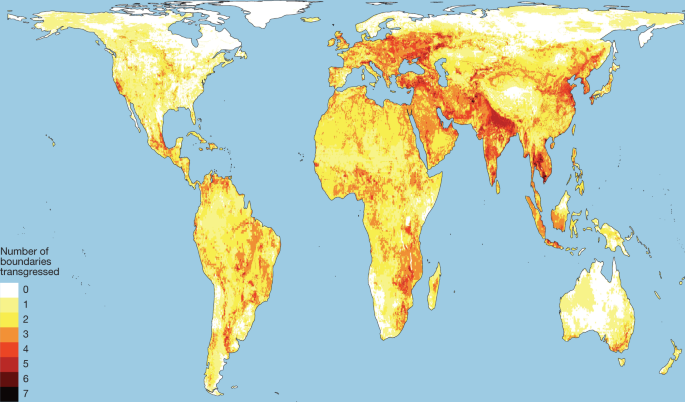

So, what’s pushing us into this perilous territory? Well, let’s start with climate change, shall we? We’ve got hotspots popping up faster than a Kardashian scandal! Eastern Europe, South Asia, the Middle East, Southeast Asia, parts of Africa, and even some of our favorite vacation spots like Brazil, Mexico, China, and the U.S. West. It’s like Earth decided to host a global heatwave, and we’re all invited!

But it’s not just the heat, folks. We’ve got air pollution playing its part too. Picture this: swans gracefully gliding through a river, surrounded by a majestic display of plastic bottles and waste. It’s like an avant-garde art installation entitled “Trash Swan Lake.” Truly breathtaking.

And let’s not forget about water contamination. Our beloved H2O, which is supposed to keep us hydrated, has turned into a toxic cocktail of phosphorus, nitrogen, and excessive fertilizer use. So, while we’re busy discussing which celebrity couple broke up this week, the water supply is turning into a questionable mix of Gatorade and lawn chemicals.

Now, I know what you’re thinking: Can we fix this mess? The answer is a hesitant “maybe.” The scientists claim that if we change our ways—goodbye coal, oil, and natural gas—we might just have a fighting chance. But let’s be real, people. We’re moving in the wrong direction faster than a cheetah on a treadmill. We need to hit the brakes on our destructive habits and start treating this planet like the limited edition collector’s item it is!

But here’s the real kicker: The study concludes that sustainability and justice are inseparable. It’s like trying to separate a Kardashian from a selfie stick. It just can’t be done! So, while we’re fighting to save the environment, let’s also remember to fight for fairness, because unsafe conditions shouldn’t discriminate. After all, we’re all in this sinking ship together, folks!

So, to recap: Earth is on the verge of becoming a fiery ball of regret, air pollution is the new black, and water contamination is turning our rivers into chemical soup. We’re like a bad sequel to Waterworld, only without Kevin Costner’s questionable accent.

So, to recap: Earth is on the verge of becoming a fiery ball of regret, air pollution is the new black, and water contamination is turning our rivers into chemical soup. We’re like a bad sequel to Waterworld, only without Kevin Costner’s questionable accent.

But fear not, my friends! As long as we act now, there’s hope. We can turn this ship around, reduce our carbon footprint, and make a real difference. Let’s leave a better world for future generations. Because honestly, if we screw this up, they’ll have every right to blame us for turning their home into a post-apocalyptic wasteland resembling a low-budget sci-fi movie.

So, let’s roll up our sleeves, ditch the plastic, and start treating this planet with the respect it deserves.

Oh, but before we go, let’s address the response to this groundbreaking study. Dr. Lynn Goldman, the dean of George Washington University’s public health school, called it “kind of bold.” Kind of bold? That’s like calling Godzilla a mildly disruptive lizard!

Unfortunately, Dr. Goldman isn’t too optimistic that this study will result in any meaningful action. Well, isn’t that just peachy? It’s like giving a passionate speech about the importance of recycling to a room full of Pepsi Bottling Company owners – pointless!

But hey, maybe we can find a glimmer of hope in all this darkness. Maybe, just maybe, this study will spark a collective awakening. People will rise up and demand change, politicians will finally listen, and we’ll see the birth of a new era of environmental responsibility. I mean, it’s more likely that pigs will sprout wings and start giving aerial ballet performances, but hey, a man can dream, right?

So, my friends, as we contemplate the impending doom of our planet, let’s remember that we hold the power to make a difference. Let’s be the heroes this world needs, like Captain Planet but without the corny catchphrases. It’s time to stand up, take action, and protect our fragile planet before it’s too late.

And if all else fails, we can always start preparing for our new careers as space colonizers. After all, Elon Musk is just a few rockets away from turning Mars into a trendy vacation destination.

That’s all for today, folks. Remember, the fate of our planet is in our hands. Let’s not let it slip away like a Kardashian’s dignity. Stay snarky, stay informed, and I’ll see you next time on “Earth: The Incredible Shrinking Planet.” Goodnight!

Have a great weekend,

-

- Phil