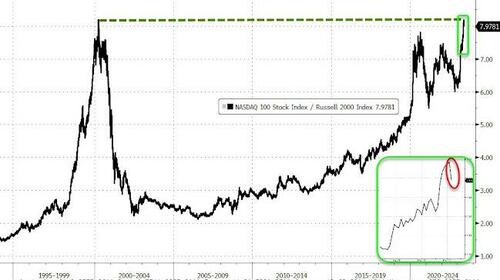

On a day when the euphoric AI mania is taking a break (which hasn’t stopped the Nasdaq from hitting fresh 52 week highs), market flows have reversed modestly out of tech and into small caps, which are surging and reversing just a little of that record QQQ/RTY skew …

… on the back of aggressive buying of energy (which had been shorted furiously for the past few months) and especially small banks, with the KRE exploding higher, and rising for a 3rd straight week.

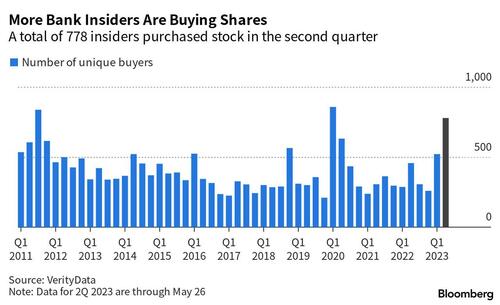

And while we wait until today’s 4:15pm release of the latest bank deposit and loan data to see if such buying is indeed justified at a time of a persistent bank jog, there is a group of investors that isn’t waiting: bank insiders are buying shares in their own companies at the fastest pace since the covid crash, a strong vote of confidence in the industry after the collapse of four regional lenders earlier this year.

While one can debate if management knows something that others don’t, and as a reminder the management of SVB and FRC were completely clueless about what was coming and lost everything in just days, the number of buyers has already jumped to 778 in the second quarter through May 26 from 524 in the first three months of the year, according to Bloomberg which cites data from research firm VerityData, and which said the surge is being driven by small and midsize banks. More purchasers stepped up even as share prices sank to multiyear lows in early May.

Another measure of insider sentiment is the buyers-to-sellers ratio, which compares unique insider buying to unique insider selling. The average quarterly ratio for banks since 2011 has been 1.8 to 1, according to the report. So far in the second quarter, the ratio is at a record high of 14.7 to 1.

“Insiders in this group are expressing a strong belief that the regional-banking system as a whole is sound, that there’s not a danger of a wide-scale collapse,” Ben Silverman, director of research at VerityData, said in a Bloomberg interview.

“This is the type of insider signaling you want to see in a sector when it goes down,” Silverman said. “As an investor, if you feel that these are good banks that will be here for the long run, then it’s a buying opportunity.”

“This signifies long-term confidence in these banks’ ability to weather whatever near-term storm there might be.”

In theory, yes it does, but is that merely to convince others to also buy (herd psychology works damn well in such cases), or is it because management actually believes that their stock prices are undervalued. Or, perhaps, management knows nothing and is simply hoping that the Fed will not let any more banks fail.

Whatever the answer, insiders aggressively bought shares of their own companies following the collapse of regional banks including SVB Financial Group’s Silicon Valley Bank in March, pausing only when rules barring insider trading near the release of quarterly results kicked in at the end of the quarter. Buying steadily increased again when the trading window reopened, with May levels exceeding March, according to the data.

The second quarter has so far been the most active period for insider buying in the industry since the first three months of 2020, when stock prices plummeted at the onset of the Covid-19 pandemic, according to the report.