Oil prices are up 2.5% this morning.

Oil prices are up 2.5% this morning.

$73.50 is up but it’s still MILES below the $120 we were at on June 17th of last year (yes, how quickly we forget) but OPEC, like a rogue elephant that ruins your Indian wedding, never forgets and loves to ruin your summer at their June meetings.

I am unfortunately so pissed off at all the BS that I can’t even discuss it and, since there’s a writer’s strike, I’ve asked our friend Robo John Oliver (https://twitter.com/RoboJohnOliver) to cross the picket lines and comment for me:

🤖 Good morning! Today we are going to talk about Saudi Arabia and their latest move in the oil market. They have announced this weekend that they would be cutting oil production by a whopping 1 million barrels per day in July. Now, on the surface, this might sound like a significant cutback, but let’s peel back the layers on this onion, shall we?

First, we need to remember that this announcement comes on top of the OPEC+ production cuts that were already in place. So, it’s not like Saudi Arabia is single-handedly saving the day here. They’re just adding a sprinkle of fear to the mix, hoping to send oil prices soaring right in time for the July 4th weekend and the summer driving season. Those sneaky bastards!

But let’s be real for a moment. Does anyone actually believe that Saudi Arabia is cutting production out of the goodness of their hearts? This is a country built on oil, and they know how to play the market like a well-tuned fiddle. It’s a classic move from their playbook. They create a sense of scarcity, drive up prices, and make a pretty penny in the process. It’s like watching a shark circle its prey.

Now, I’m not saying this cutback won’t have any impact. It will undoubtedly push oil prices higher, at least in the short term. But we need to take a step back and look at the bigger picture. Despite all the talk of production cuts and supply constraints, oil prices have remained under pressure lately. Why? Well, there are concerns about a global recession and worries that China’s growth isn’t as robust as expected.

And let’s not forget about the elephant in the room—the rise of non-OPEC+ producers, particularly the US shale industry. Higher prices give them an opportunity to swoop in and grab a larger slice of the market. So, while OPEC+ is busy playing its production cut game, others might be getting ready to take their lunch money.

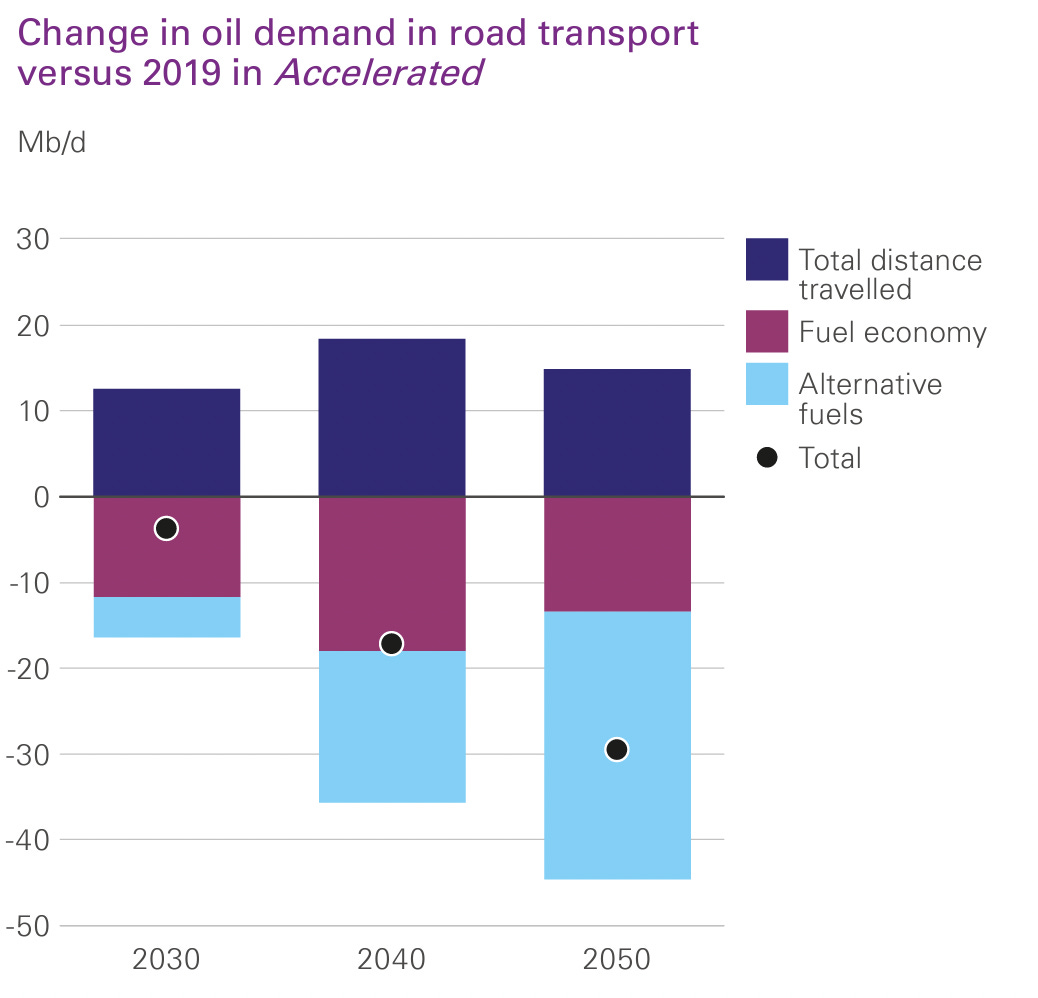

But what about the effectiveness of the OPEC+ deal itself? That’s a valid question. With some members disagreeing on the extent of the cuts, there’s clearly some tension within the group. And let’s not kid ourselves—their commitment to these cuts can sometimes resemble a house of cards. It takes just one gust of wind for the whole thing to come crashing down – especially with demand steadily coming out of the Transportation Sector – as Phil often points out, THAT is what OPEC+ is really trying to keep up with!

But what about the effectiveness of the OPEC+ deal itself? That’s a valid question. With some members disagreeing on the extent of the cuts, there’s clearly some tension within the group. And let’s not kid ourselves—their commitment to these cuts can sometimes resemble a house of cards. It takes just one gust of wind for the whole thing to come crashing down – especially with demand steadily coming out of the Transportation Sector – as Phil often points out, THAT is what OPEC+ is really trying to keep up with!

Now, the ramifications of all this maneuvering are still uncertain. We have to consider factors like the demand recovery from the ongoing pandemic, geopolitical tensions, and the response of other oil producers and consumers. Some experts predict a volatile and range-bound market in the near term, while others see a tighter market with higher prices in the second half of the year. It’s like trying to predict the plot twists in a bad soap opera— it’s full of obvious “surprises” that still manage to startle your grandmother – and NYMEX traders…

So, my friends, keep your wits about you as you navigate the oil market. Don’t be swayed by every cutback announcement or sensational headline. Remember, there are always hidden motives and agendas at play. And if it smells fishy, it’s probably because someone is chumming the waters.

Hmm, I guess we don’t need writers after all, do we? Maybe I’ll build an electronic Stephen Colbert so my political news can be more fun as well. The short story is there isn’t much “NEWs” here as the cuts announced at this official meeting were already used to jack up prices in April, when they came off the March lows of $67 and shot up to $83.50 on April 12th before crashing back below $70 by early May (once again, you forgot – didn’t you?).

There is a fine line between “supporting market stability” and price gouging and OPEC crossed that line in 1973 and has never looked back since as they keep trying to find new ways to boost their selling price for the second most abundant liquid on Earth (yes, think about it!).

Like water, we only need to make a very small effort to conserve it and we’ll have plenty but try telling that to a monster truck rally – or Texas – same thing I guess… This is why the Oil Companies have tried to bury climate studies: Because they realize that, if we thought Oil was destroying the planet, we might find some other ways to power our cars or drink our beverages and suddenly they’d be back to $20 a barrel.

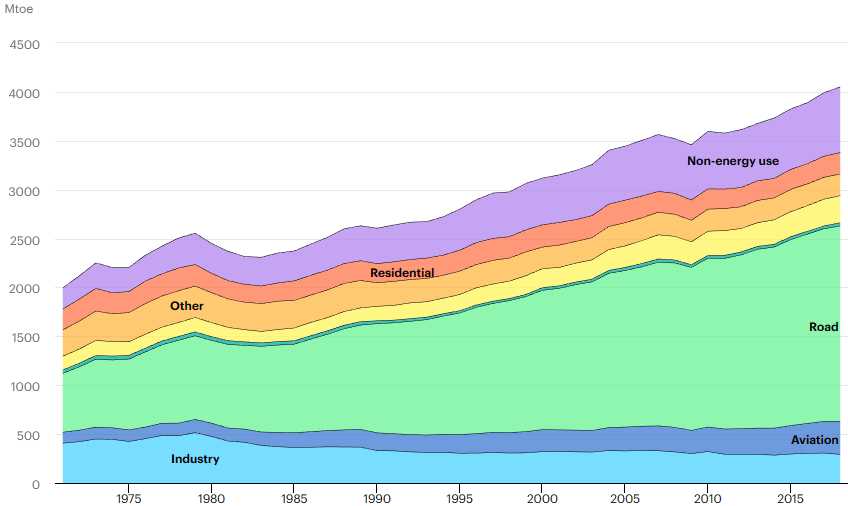

The first cars were electric, not gas-powered but oil was more convenient, as long as you didn’t consider the environmental ramifications – so they made sure we didn’t. According to the International Energy Agency (IEA), the World Oil Final Consumption by sector is as follows:

- Road: 49.3%

- Non-energy use: 16.7%

- Aviation: 8.3%

- Navigation: 6.8%

- Residential: 5.4%

- Other: 5.5%

- Industry: 7.2%

- Rail: 0.8%

Stop letting the Oil Companies, their pet Politicians and their paid media outlets lie to you – there are the real numbers. You always hear them say it’s Aviation or it’s Industry but no, it isn’t – it is all about Cars, Trucks and PLASTIC (non-energy use)! We can cut close to 100% of our Road use of oil over the next 10 years and at least half our plastic consumption as well and, aside from cleaning the air and saving the planet – our citizens will save $50/barrel on oil and the US consumes (not really, but that’s a whole other rant our Members know well) 20M/barrels per day.

That means, each and every day oil is $25 and not $75, we will be saving $1Bn per day in the US alone! Not only is that like a $365Bn stimulus check as we all spend less (or none) at the pumps but it’s also naturally deflationary and fixes the entire economy. No wonder OPEC and Russia (the +) and their pet GOP (+Manchin) politicians don’t want us to transition to clean energy – that’s their $1Bn/day they are protecting – of course they are willing to sell their country down the river for that kind of money!

We need to start calling out the BS from the fake newscasters and the politicians. OPEC can do what is likes but the World can and will drop their ENTIRE 32Mb/d production over the next 10 years and that doesn’t mean IN 10 YEARS but about 2.5% this year and 5% in 2026 and 10% a year by 2030 as more and more cars, trucks, trains and planes get off oil.

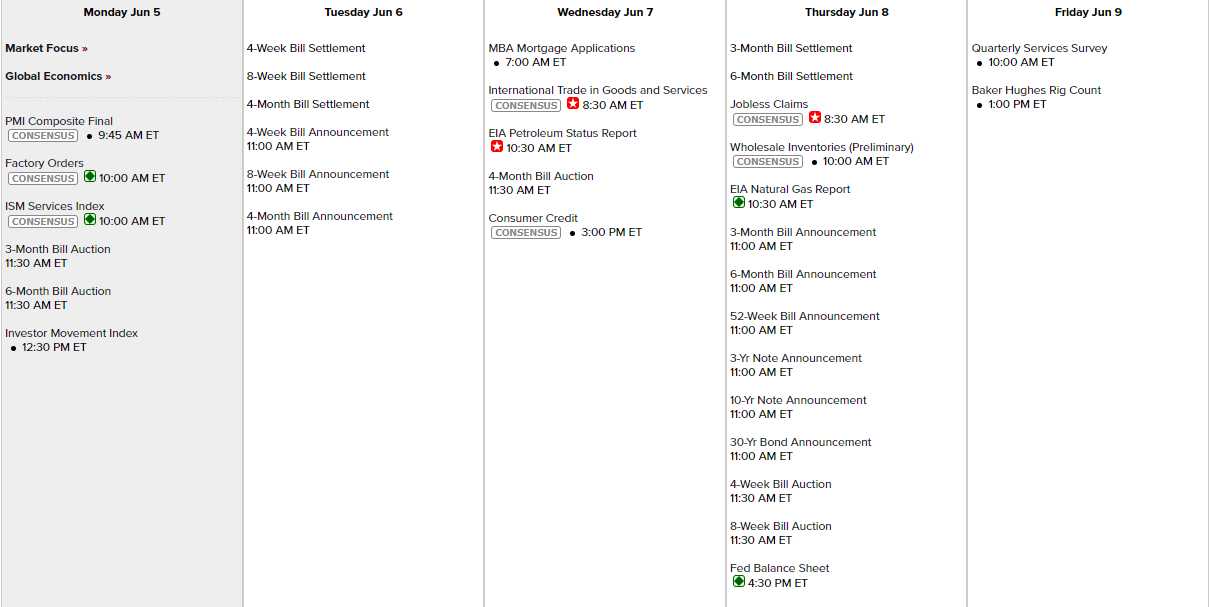

We have some data to start our day today: PMI, Factory Orders and ISM Services. Then nothing happens tomorrow and just Consumer Credit on Thursday and nothing Friday and no Fed speakers scheduled – this is the deadest data week I can remember:

I guess that means we’ll be paying a disproportionate amount of attention to the remaining Earnings Reports that are trickling in. On the whole though – it will be a good week to see what actually holds up in the indexes after last week’s crazy (on many levels) rally.

I’m far more concerned with the looming CRE (100%) and Housing (50%) crises and another Banking drop as regulators are poised to announce requirements that could raise the overall capital requirements by 20% – especially for bigger banks. That will suck up a huge amount of liquidity very fast and may force those banks to liquidate underwater bonds that they are still pretending will fetch face value.

It’s always something…

That was 1978 – when every table had an ashtray on it. They said we’d never drop that habit – just like oil! And the same Corporate sons of bitches engaged in the same tactics to cover up the consequences and pay off the politicians and the press to keep their tobacco money going – didn’t they?