Ahead of a potentially chaotic week with CPI, FOMC, and Quad-Witch OpEx, today was relatively ‘quiet’ on the headline-front.

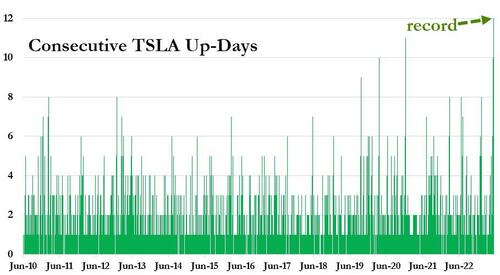

Tesla’s stock price rose for the 12th straight day – the longest winning streak in the company’s history…

…now up over 100% YTD…

Source: Bloomberg

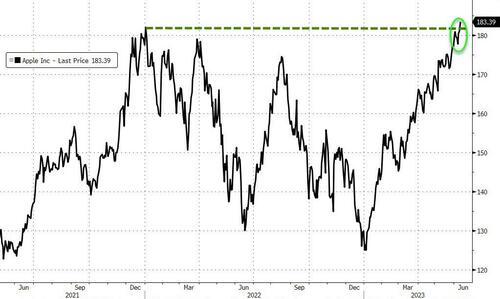

Apple broke out to a new all-time record high…

Source: Bloomberg

And that helped drag Nasdaq to outperform, as The Dow and Small Caps lagged. But all the majors ended green. NOTE the wild swings in Russell 2000 around the cash open…

As Nasdaq continued to reverse last week’s losses relative to Small Caps…

Source: Bloomberg

With 4320 a key level – linked to the JPM Collar – it appears 0-DTE traders aggressively bought puts as the S&P neared that level, but failed to inspire any downside momentum… and in the end being forced to unwind (prompting 0-DTE call-buying)…

And today’s winning lottery ticket goes to…

Citizens, KeyCorp, and Truist were all hammered today – weighing on the overall bank index – on margin (NIM) compression, rising charge-offs, and lowered revenue guidance respectively…

Last week’s surge in value relative to growth has now been erased…

Source: Bloomberg

VIX rose back to a 14 handle today (despite the gains in stocks) reverting higher after VVIX’s decoupling…

Source: Bloomberg

VIX1D soared today – just as it did ahead of last month’s CPI…

Source: Bloomberg

Treasuries were mixed today with the short-end outperforming. The last hour saw buying across the curve though which left only 10Y and 30Y yields marginally higher…

Source: Bloomberg

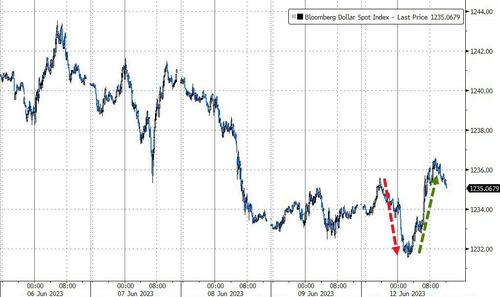

The dollar ended higher after weakness overnight, with the green back bid thru the US session…

Source: Bloomberg

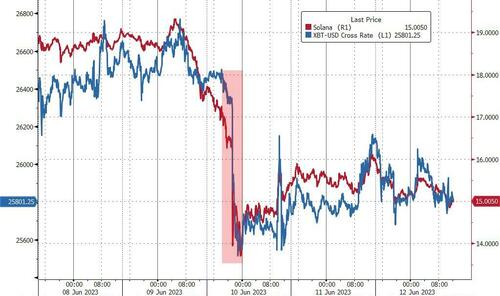

Crypto is down from Friday, after a total SNAFU liquidation on Saturday took the entire asset-class down in minutes…

Source: Bloomberg

Gold dropped again today, erasing last week’s spike…

Oil prices tumbled today – not helped by Goldman slashing their year-end forecast – with WTI testing a $66 handle, its lowest close since March…

Finally, stocks continue to look through tightening financial conditions…

Source: Bloomberg

…hoping beyond all rationality for The Fed’s next handout.