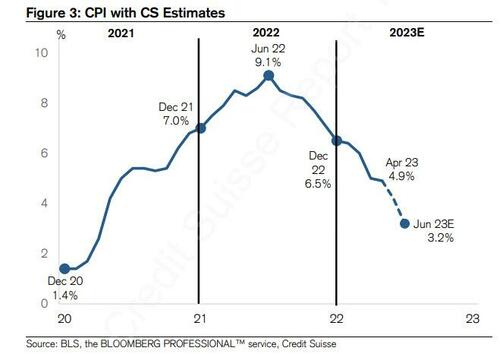

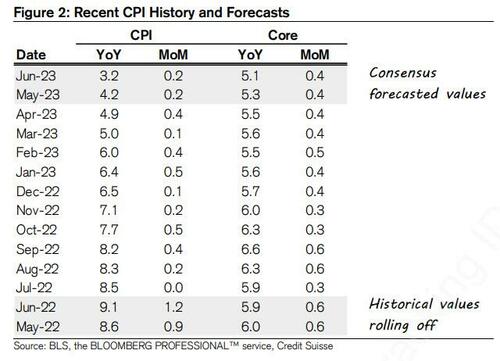

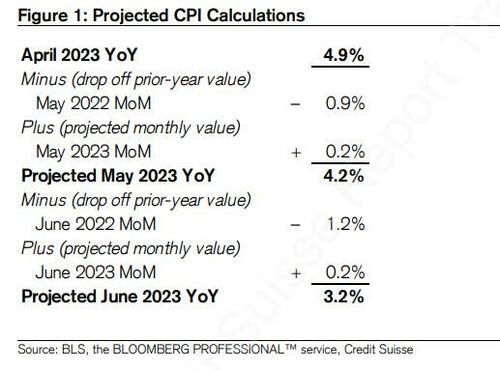

Earlier today, we said that tomorrow’s CPI print is “the event of the week in terms of potential vol as it could impact final pricing for the FOMC and impact terminal pricing as well” (a full preview is coming shortly). And while the actual inflation number may come in fractionally below or above expectations, what markets are focusing instead on – and the reason for today’s frenzied market meltup which sent risk assets to a fresh 52-week high, is what traders expect will happen not just tomorrow but over the next 2 months. That’s because according to calculations by Credit Suisse chief strategist Jonathan Golub, while tomorrow’s CPI print may come in just above the median consensus forecast, at 4.2%, it is next month’s number that will be the shocker. According to Golub, the June number (which will be released on July 12) will print at 3.2%.

Should this play out as expected, Golub writes, “this would represent one of the greatest drops experienced in a 2-month period over the past 70 years. Historically, similar declines have only occurred during periods of economic upheaval, such as the onset of COVID, the Great Recession, and in 1975 during the Great Inflation.”

There is, however, one big caveat: this particular drop will not indicate some economic calamity has been unleashed, instead it merely represents a favorable base effect. As Golub explains, “it is important to note that this expected decline is the result of base effects, rather than a shift in incoming inflation, and should not be extrapolated into the future.” As a result, the now defunct Swiss bank whose research division will soon become part of UBS, does not believe that “this likely decline will result in any shift in Fed policy.”