Strap yourselves in!

Strap yourselves in!

Though we did ad a few new plays to our Member Portfolios last week, on the whole, we’re still waiting until the dust settles on the Fed and then the Juneteenth and July 4th holidays – after which we’ll be back for summer Earnings Reports and a plethora of opportunities to buy stocks.

The betting has swung towards a Fed pause on Wednesday but I don’t think the data indicates that. There’s a meeting on Wednesday and then July 26th and September 20th so skipping this meeting gives the Fed just two chances to raise rates the whole summer and September is a bit close to the elections and Nov 1st (the next meeting) is WAY too close and Dec 13th ruins Christmas. I think the Fed would rather raise 0.25% now and see what happens later than blow this chance and risk some very bad choices later.

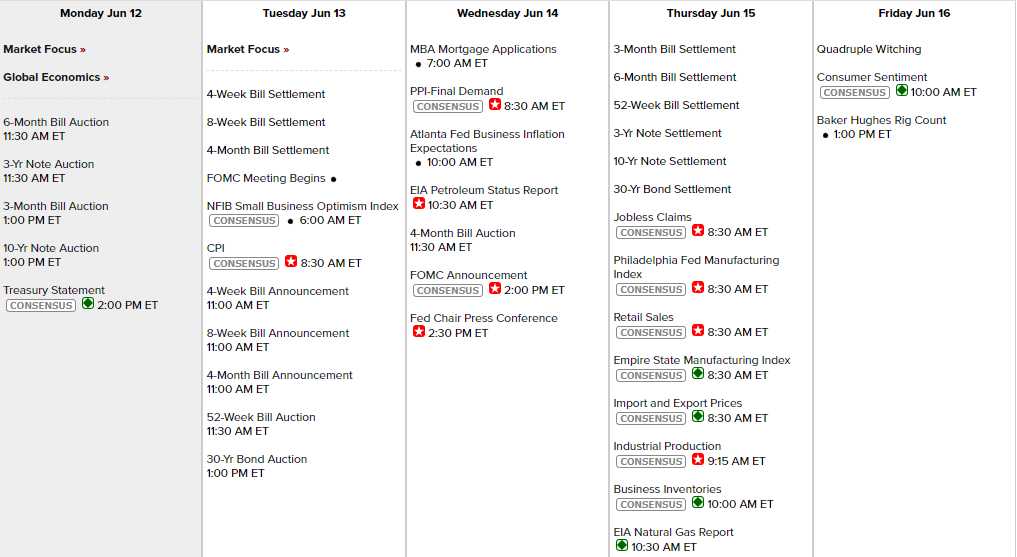

The latest reading on CPI was up 4.9% and the core was up 5.5% – MILES over the Fed’s 2% target. We get May CPI tomorrow and the Fed decides on Wednesday – so that report is likely to make or break the decision. The May 26th PCE report was UP 0.2%, at 4.4% from April’s 4.2% so that’s going the wrong way too.

Other data for the week includes PPI ahead of the Fed, the Philly and NY Fed Reports on Thursday along with Retails Sales and Industrial Production and Friday is a Quad Witching day and a 3-day weekend along with a Consumer Sentiment Report, which has been an ongoing train wreck – now back at the 2009 levels (when we thought the Global Financial Market was about to collapse – that low!).

See, you need that 2nd chart for context to understand how bad things really are. USUALLY, you are already in a Recession when the Consumers are this freaked out about their conditions. That’s the other big bet the bulls are making – no Recession! This is despite the FACT that the Eurozone is in a Recession with German GDP down 0.3% in Q1 and Ireland down 0.7% for examples and Japan, which is the World’s 3rd-largest economy was -1% in Q1 after falling 0.9% in Q4 – RECESSION!

So Japan is having a Recession and Europe is having a recession and China doesn’t look too happy and Russia is a disaster and we are escaping a Recession how? It sure isn’t because our Consumers are confident or inflation is under control or wages are keeping pace with inflation or our Government has balanced the budget….

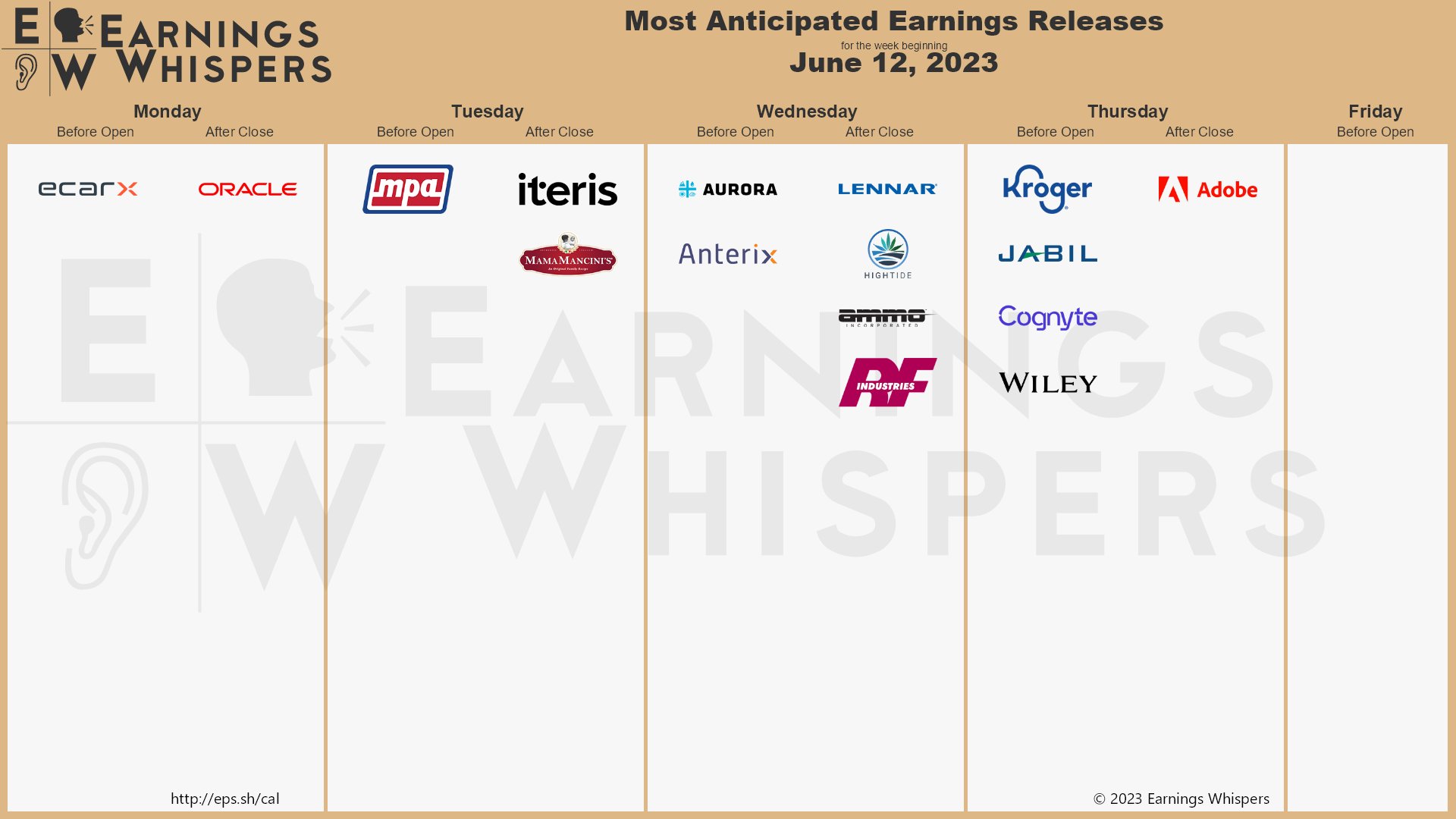

Meanwhile, we’re getting in some late/early earnings reports from some big companies this week and that’s going to give us a good indication on whether or not conditions are improving. Sure we have ORCL and LEN and KR and ADBE but the star of this week’s earnings will be Mama Mancini’s Holding (MMMB). which we started buying at $1.22 back in June of last year, when I said “MMMB is stupidly cheap again at $1.22. Small little company but a great value down here.”

Even at $2.66 (up 118%), MMMB has just $96M in market cap and last year they made $2.3M but this year should be $5.2M (20x) and next year $7.5M (12.8x) so it’s still a good time to get into a fast-growing little company that makes excellent meatballs.

MMMB doesn’t have any options but BFI does – but they aren’t very active. This is another one we’ve been following for a while and they’ve gotten cheaper – at $1.59, which is $42.5M and they LOST $103M last year and they’ll lose about $34M in the next two years but sales are now $180M so, if they can pull this out and make 10% – this will be quite a deal down the road.

The way I would play BFI is to buy the stock and sell the Jan $2.50 calls for 0.25 as that drops the net to $1.34 and then, in Jan, sell the July $2.50s for 0.25 and we’re down to $1.09 and then, in July, sell the Jan 2025 calls for 0.25 and then you have the stock at net 0.84, etc. As long as they don’t go BK, you’ll either own the stock for net $0 eventually or you will get called away at $2.50 with a very nice profit. Aren’t options fun? Let’s do that with 2,000 shares in our Income Portfolio as it will be fun to track and we’re collecting 15.7% on our first sale and it gets better from there!

In other news this weekend:

- Ukraine’s dam collapse is both a fast-moving disaster and a slow-moving ecological catastrophe

- Fed Is First to Reach Crucial Junction in Global Inflation Fight

- How a hawkish Fed could kill a baby bull-market rally in U.S. stocks

- As Fed Signals Rate Pause, Powell Will Have to Placate Hawks

- Fed Will Keep Rates High Thanks to Inflation Fueled by Corporate Greed

- Goldman’s Low US Recession Odds Get It Wrong, Bond Investors Say

- Investors Are Making Two Key Assumptions That Are Wrong

- Hartnett: “We Still Remain Bearish Because The Math Does Not Add Up”

- There’s More Trouble Coming for Regional Banks

- Oil Holds Losses Amid Demand Woes as Goldman Cuts Outlook Again

- Oil Traders Are Daring to Defy Market Kingpin Saudi Arabia

- Saudi Oil Minister Says OPEC+ Is Tackling Market ‘Uncertainties’

- Commodity Prices Debunk The “Blame Ukraine” Excuse For Inflation

- “Roadway Is Gone”: Tanker Explosion Destroys I-95 Bridge In Philadelphia

- Port of Seattle closed due to ILWU labor strife

- Tesla’s Shrewdest Product Is Proving to Be Its Charging Network

- Retail CEOs Signal Rising Alarm as Theft Eats Away Billions in Sales

- CEO Talk Of “Shrink” Hits Record On Earnings Calls Amid Nationwide Shoplifting Crisis

- Times Square Is a Tourist Hot Spot. Its Small Businesses Are Flailing.

- Taiwan Extends Two-Year Rise in US Chip Exports Despite Downturn