It’s only been a month?

It’s only been a month?

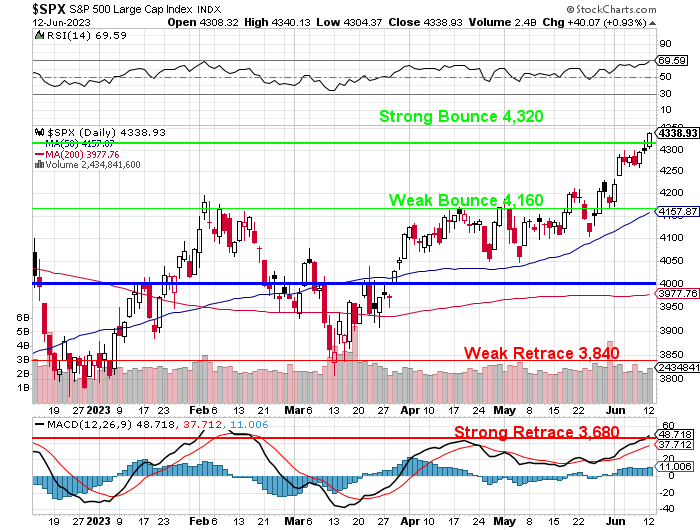

Boy how time flies! We just started our new Member Portfolio series last month and already we have dozens of new trades to discuss. At last month’s review we were at 4,200 on the S&P 500 and, this morning, we’re at 4,338 – so up 3.2% on the index is a nice environment for adding new positions – so far.

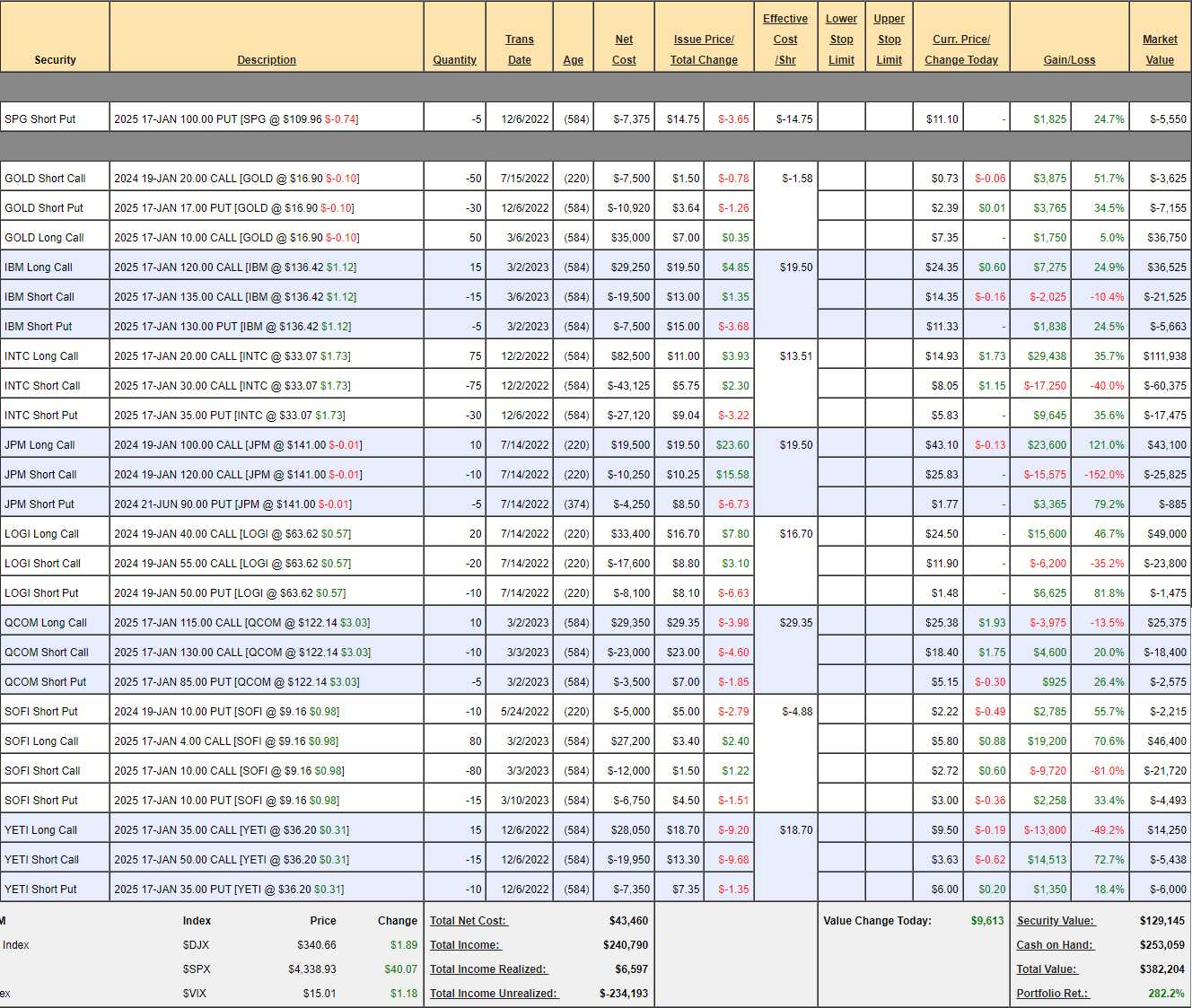

We do still have the Money Talk Portfolio, because we only trade it on the show and I won’t be on again until later this month. In last month’s review, we were at $338,849 and, as of this morning, we’re at $382,204, which is up $43,355 (12.7%) in our portfolio which has not been changed since the last time I was on the show on March 1st.

-

- SPG – I love this mall operator and we promised to buy 500 shares at net $85.25 but no such luck and we expect the remaining $5,550 to expire worthless and drop in our pockets.

-

- GOLD – Our favorite gold miner. Still very under-priced at $16.90 but we played it very conservatively so we’re 70% in the money on our $50,000 spread at net $25,970 so there’s still $24,030 (92.5%) left to gain and we’re very confident.

-

- IBM – Another one of my favorite stocks. We’re in the money on this $22,500 spread but the net is only $9,337, which means we have $13,163 (140%) left to gain if IBM simply stays over $135. Aren’t options fun?

-

- INTC – Still sleepy but waking up. This is a $75,000 spread we’ve had all year and it’s up nicely at net $34,088 and it’s almost entirely in the money but we still have $40,912 (120%) left to gain in another no-brainer trade you can still add.

-

- JPM – Boy, this portfolio is full of my favorite stocks! That’s because we can’t adjust them for a quarter at a time – so they’d better be rock-solid picks! This is a $20,000 spread from way back last July and it expires in January. Currently at net $16,390, there’s just $3,610 (22%) left to gain but it’s a pretty sure thing and we don’t need the cash or margin for anything else.

-

- LOGI – We’re deep in the money on this $30,000 spread and it’s net $20,375 with $9,625 (47.2%) left to gain but that’s by January so very worth keeping and even good as a new play if you’d like to make 47.2% in 7 months.

-

- QCOM – Lagging way behind AVGO in recognition this Q which means there’s still an opportunity. We’re only up a little at net $4,400 on this $15,000 spread so there’s $10,600 (240%) left to gain if QCOM can make it to $130 in 18 months.

-

- SOFI – At last our patience has paid off! As you can see from the puts, we started this one last May and we doubled down when it went the wrong way (we knew it was wrong!) and now it’s going the right way at net $17,972 on our $48,000 spread that is almost 100% in the money with $30,028 (167%) left to gain if we can get over that $10 mark. We started this one at net $3,450 so it’s already up 8.7x!

-

- YETI – Our Trade of the Year for 2023 has pulled back again and now we’re at just net $2,812 but the good news is we started at net $750 – so we’re already up 275% and were up 300%, which was our goal for our Trade of the Year. Our 2025 target is $50 and that will pay us $22,500 for an upside potential of $19,688 (700%) but this is the only trade in the portfolio I feel uncertain about.

Overall though, it’s a very strong portfolio that you shouldn’t have to touch and, overall, we have net $129,145 in positions and $253,059 (66.2%) in CASH!!! and we expect to make $157,206 (41%) if the markets continue higher over the next 18 months.

We have plenty of CASH!!! for new positions but, with the upside potential we have in some of the above positions – we can probably just buy more of the same. We’ll see when I’m on the show…

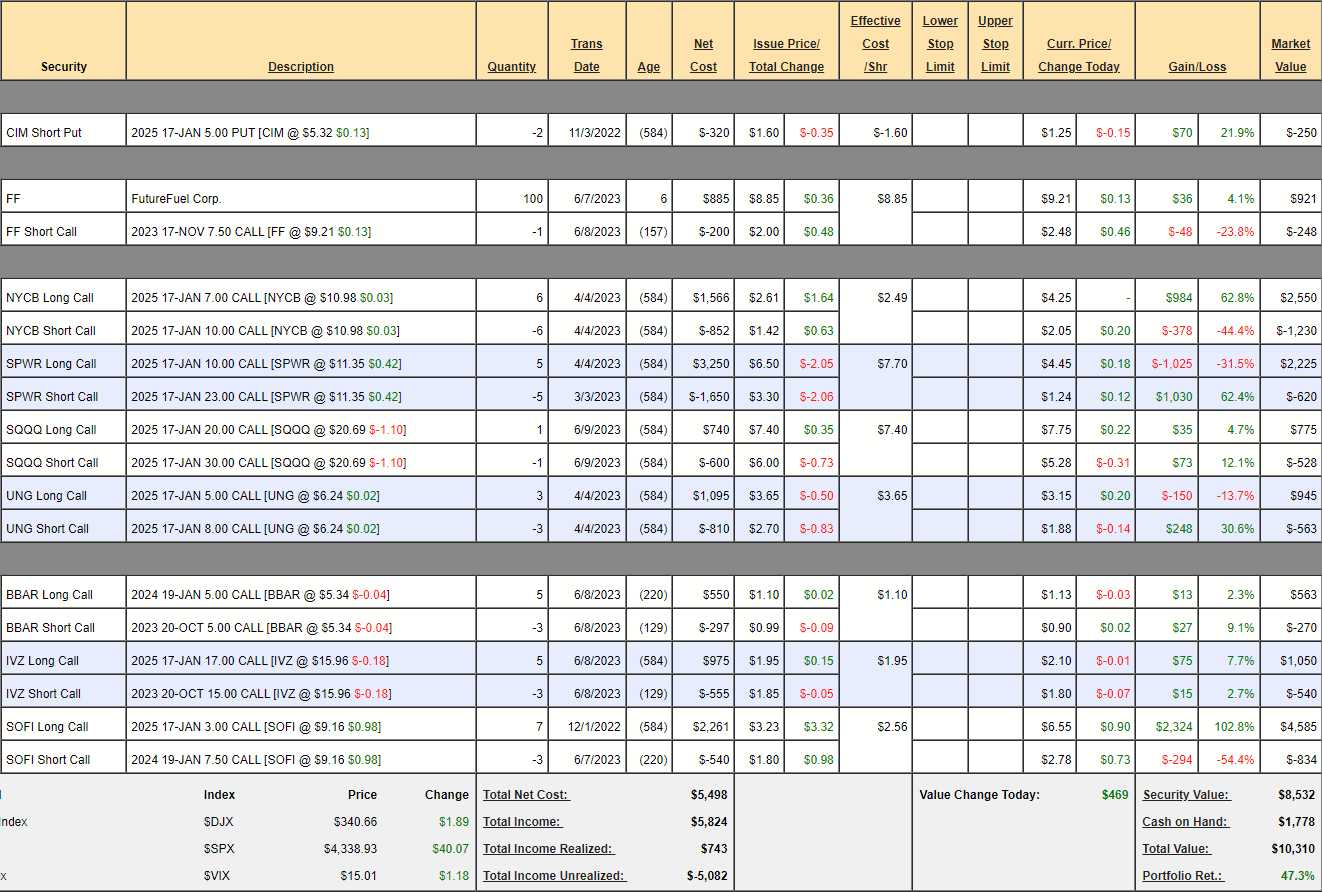

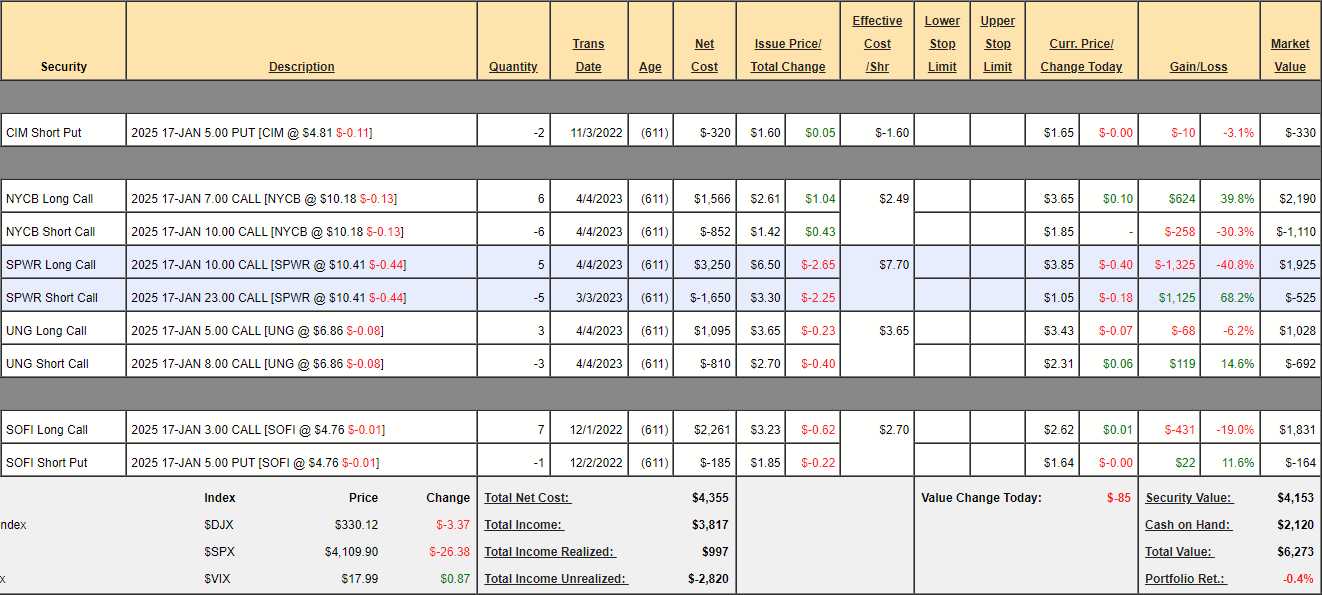

I just reviewed our $700/Month Portfolio last week and we discussed it in great detail in last week’s Live Trading Webinar as well. Interestingly, we were at 30.5% ($9,133) on the 7th and now, one week later, we’re at 47.3% ($10,310). At this rate, we’ll hit $1Bn, not $1M in 30 years. Well, Buffett did it – why can’t I?

I want to point out that, on May 17th, in month 9, this portfolio was DOWN $27 (-0.4%) and we made some adjustments and added a few positions and ALL of that money was made in less than 30 days. That is not a brag – just pointing out that sticking to our plan and using the dip to our opportunity combined with PATIENCE did pay off in the end.

See, SOFI was right there and, later this year, I’ll be telling your how SPWR was right there too! Buy good value stocks and give them time – that’s my “trick” to making money consistently!

Butterfly Portfolio Review: It’s funny to review the portfolio on June 13th, when we only started it on May 19th but here it is. The Butterfly Portfolio is our most consistent performer over the years and embodies our “Be the House” strategy for investing:

-

- AAPL – We paid net $28,150 for this 920-day position and we used 94 days (10%) selling the September calls, which are now half in the money. For now, we consider them protection for our gains on the long side and eventually we will roll them if we have to. Meanwhile, the plan is to sell 9 more sets of short calls over time and, if we make an average of just $3,000 per set – then the $60,000 spread will be net free!

-

- IP – Just added last week and we’re fortunate we only 1/2 covered. We’re waiting for $35 or $40 before we start selling short calls.

-

- PFE – I’m a little concerned we break too far over $40 and the short calls burn us but too early to worry about it as they are still 100% premium.

Income Portfolio Review: The goal of this portfolio is to generate $2,000 per month from a $150,000 Retirement Account to almost double a typical Social Security check. I do this so my Mom’s friends don’t have to deplete their savings to keep up with inflation but it’s great for anyone who wants to save and also likes to spend some of it.

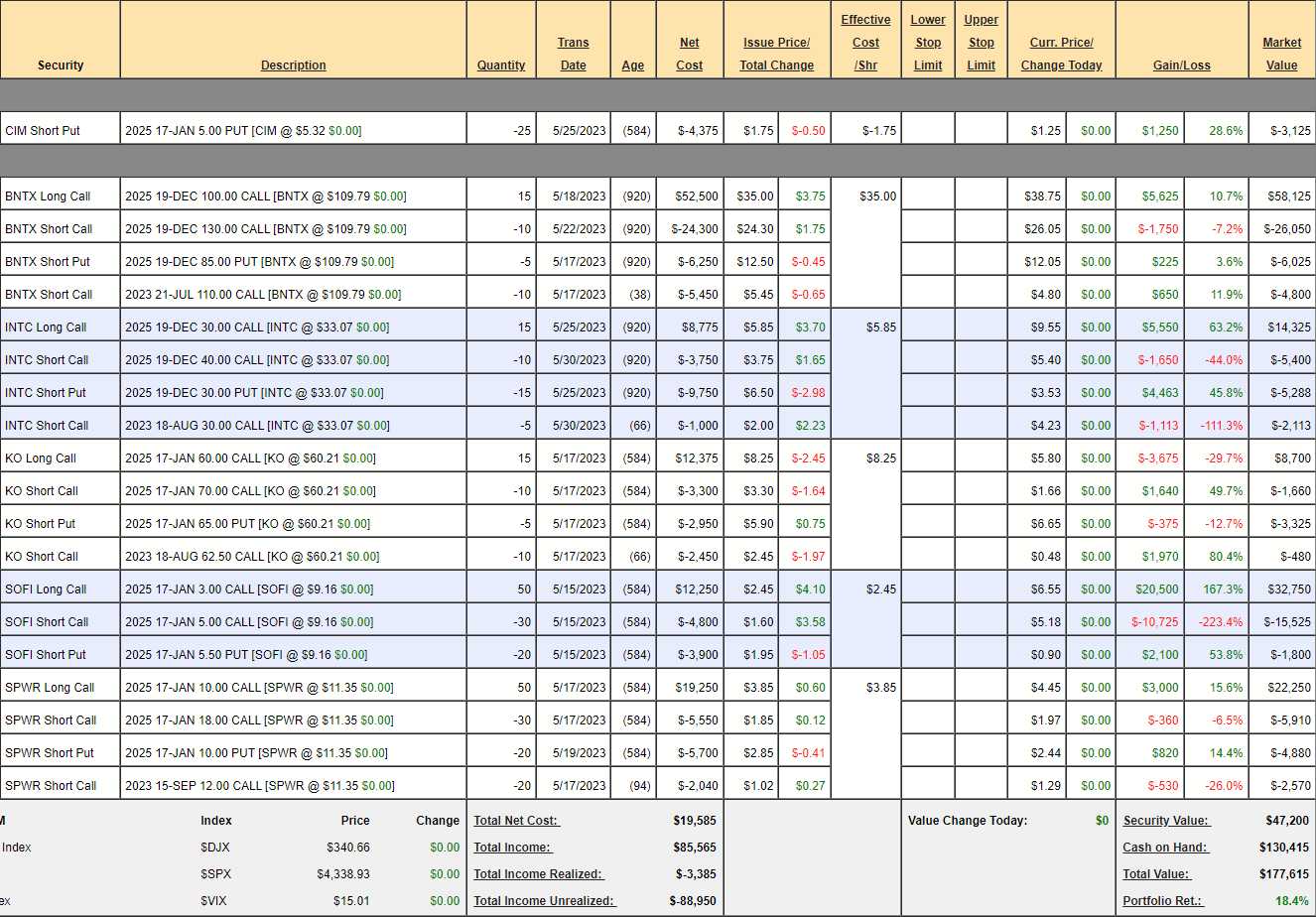

It’s only our first month and our goal is to make about 3% monthly to stay ahead of the withdrawals but we’re already up 18.4% at $177,615 – so well ahead of schedule already!

-

- CIM – Same as the $700 Portfolio only bigger. Why? Because it’s a fantastic deal! $3,125 expected to gain ($173/month).

- BNTX – It’s a $45,000 spread at net $21,250 but what we really care about is the $5,450 we sold the July $110 calls for. If all goes well, we make $4,800 more by July 21st and that covers us for June and July by itself! While it would be a nice bonus if we make the other $23,750 (112%) on the spread – as long as we’re making $2,000/month selling short calls it’s mission accomplished!

-

- INTC – Here we have a $15,000 spread at net $1,524 so it’s a 10-bagger if all goes well and we’ll have to roll the short calls along so we don’t count on them for anything at the moment. Although the trade itself is very profitable already – it’s not in the way we want to profit for the income aspects.

-

- KO – This is a $15,000 spread at net $3,235 and we’re actually losing a bit on our main spread so far but we’re making the short call money, which is great! At this pace, in two months we’ll make $480 ($240/month) more but we sold those calls for $2,450 and they already paid for our June withdrawal.

-

- SOFI – We were waiting for a good time to sell short calls and now we’re up $11,875 (334%) in our first month – that’s crazy! It’s only a $10,000 spread if we had fully covered so all bonus money here. As the whole portfolio is ahead of schedule, there’s no need to sell calls at this moment but I’m looking at the Oct $10s, that are now $1.23 and the $9s are $1.65 so I think if we can sell 10 Oct $10s for $1,650 – we should certainly do that as that’s almost a whole month’s income right there.

-

- SPWR – Like SOFI, we are waiting patiently for them to move up. We’re about even so far and it’s a $40,000 spread at net $5,960 so great upside potential (571%) and we did sell the short Sept $12s for $2,040 and it looks good for collecting $800/month.

So, looking at SPWR while it’s right here – we have a $2,570 balance on the short Sept calls (94 days) and, if all goes well, they will contribute $800/month to our income. That happens if SPWR is flat or down or in any way under $12. If SPWR goes up, we’ll have to roll the short calls but our spread can gain up to $34,040 at $18 – that doesn’t suck but it won’t be short-term income.

That’s why we track our monthly expectations and, per above, we’re looking good for $6,013 over the next few months so we’re on track for the income and any gains in the actual portfolio are a nice bonus – maybe we can bump it up to $3,000/month next year!

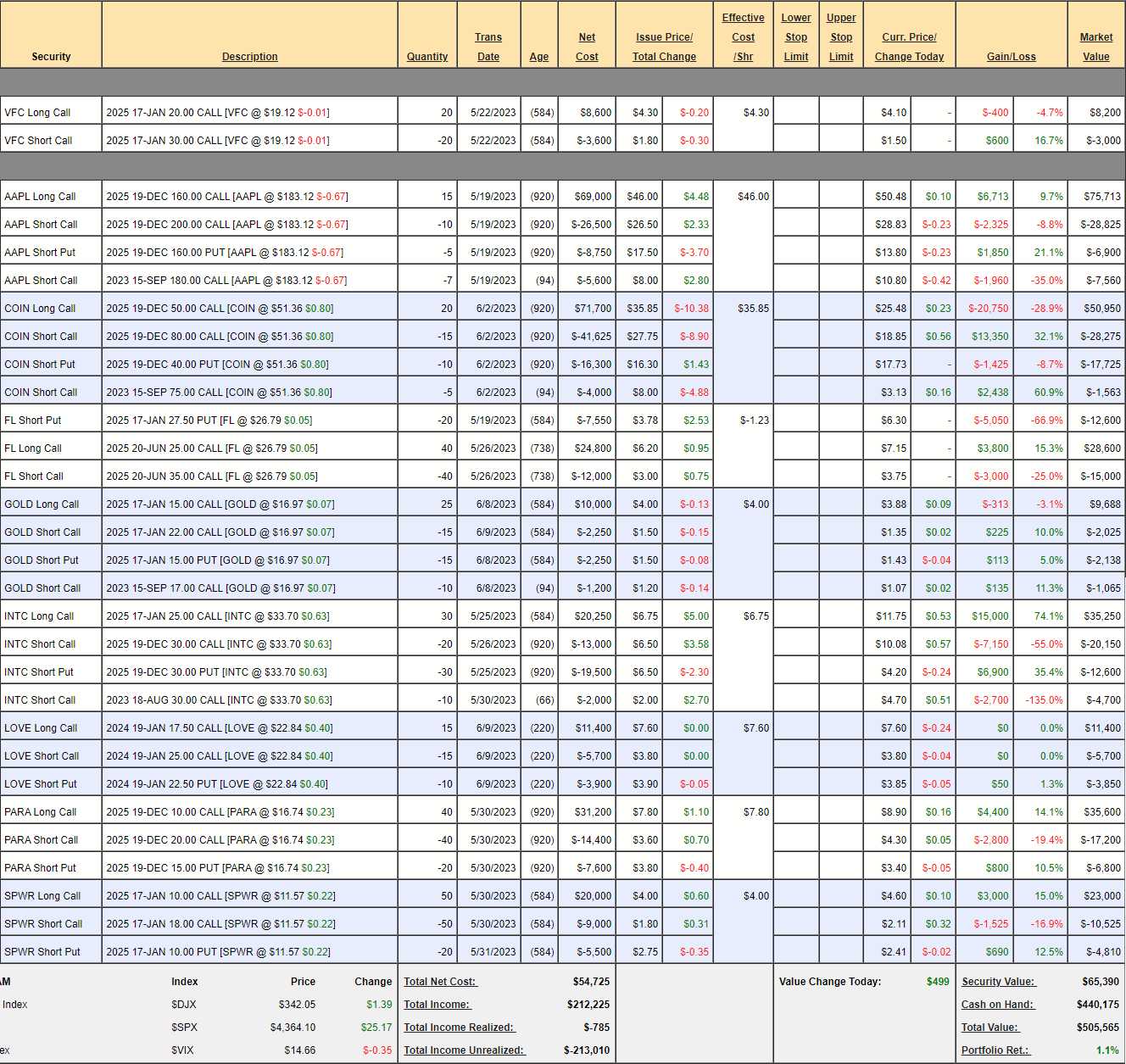

Long-Term Portfolio Review: We started trading on the 19th last month and we’re up a sad 1.1% so far. Blame FL and COIN for our troubles – had they not lost about $5,000 each – we’d be doing nicely but we don’t play the LTP for short-term gains and we do take the risks here – hopefully leading to the big bucks.

We’ve only deployed $65,390 so over 85% of our buying power left to spend and here, more so than our other portfolios, we are constantly looking to see if we can/should improve those losing positions:

-

- VFC – Q1 was pretty good but no real impact (5/23). To me, it’s a valuation disconnect we’re going to be willing to stick with and now I don’t mind selling puts so let’s sell 10 of the VFC 2025 $20 puts for $4.70 ($4,700) and that gives us an overall net $300 entry on the $20,000 spread.

-

- AAPL – We are two over-covered on the $60,000 spread so I’m not too worried and certainly not worried enough to pay (7 x 7.50 =) $5,250 worth of premium to buy back the short $180 calls out of fear. Those calls are $10.80 and the Jan $195s are $9 – so that’s our roll and I’m fine with that (as our main play goes in the money).

-

- COIN – Being sued by the FCC and we’re down net $6,387 and the good news is it’s a net $9,775 trade and we sold $4,000 for 105 out of 931 days on the 2nd so it’s a nice little money machine but there is a risk it could go a lot lower. Our big risk is the short puts so let’s buy them back for $17,725 and take the $1,425 loss and we’ll buy back the 5 short Sept $75 calls at $3.13 for a $2,438 profit and we’ll sell 10 of the Jan $65 calls for $9.30 ($9,300) so now our net is $19,763 on the $60,000 spread with no margin and we’re going to collect $9,300 in 6 months selling short calls. I think it’s worth the risk staying in.

-

- FL – I think $25 is a good floor and the thing that is really hurting us on this trade is the 2025 $27.50 puts and they are -$12,600 but I don’t think that target is at all crazy – so I take this unrealized hit to our portfolio with a huge grain of salt. In fact, let’s sell 10 more of the 2025 $27.50 puts for $6,300 and spend under $10,000 to roll the 40 June 2025 $25 calls at $7.15 to the 40 of the June 2025 $20 calls for $9.50 for (net $9,400) and now that we have a $60,000 spread we can sell 10 (1/4) Oct $27.50 calls for $2.30 ($2,300) to help pay for all those improvements. Net-net is $800 and we’re $20,000 deeper in the money on our longs.

-

- GOLD – We’re a little bit ahead but nothing to brag about. The first thing I look at is whether the long calls are worth improving and the $15s are $3.88 and the $10s are $7.25 so no way to that roll. As a rule of thumb we want to pay less than 0.50 on the $1. So, nothing to do but wait for the Sept calls to expire. Yawn…

-

- INTC – Thank goodness for this one, it’s a big winner. Gotta love the aggressive put selling – nice conviction by me! The short $30 Aug calls are annoying but we’ll roll out of them and they’re covered. Our best move here is to roll our 20 short Dec 2025 $30 calls at $10.10 ($20,200) to 20 short Dec 2025 $37 calls at $7 ($14,000). That’s going to cost us net $6,200 to widen our spread by $21,000, which takes pressure off our short calls as well. That being the case, we can roll the 10 Aug $30 calls at $4.70 ($4,700) to 15 of the Oct $33 calls at $3.50 ($5,250). If we can roll up $3 every two months for a profit – we’ll be fine!

-

- LOVE – Brand new trade and already up $50! Earnings were good but guidance was cautious so we’ll watch and wait for another quarter.

-

- PARA – We might have caught the dead bottom but we’ve thought so before. Net $13,400 on the $40,000 spread.

-

- SPWR – We’re a little ahead and it’s a $40,000 spread at net $7,665 so huge upside potential if they can get it in gear. I don’t want to sell against them until they are back around $20, which would be over our goal.

So it’s a large amount of unrealized potential in the LTP so far and nothing else.

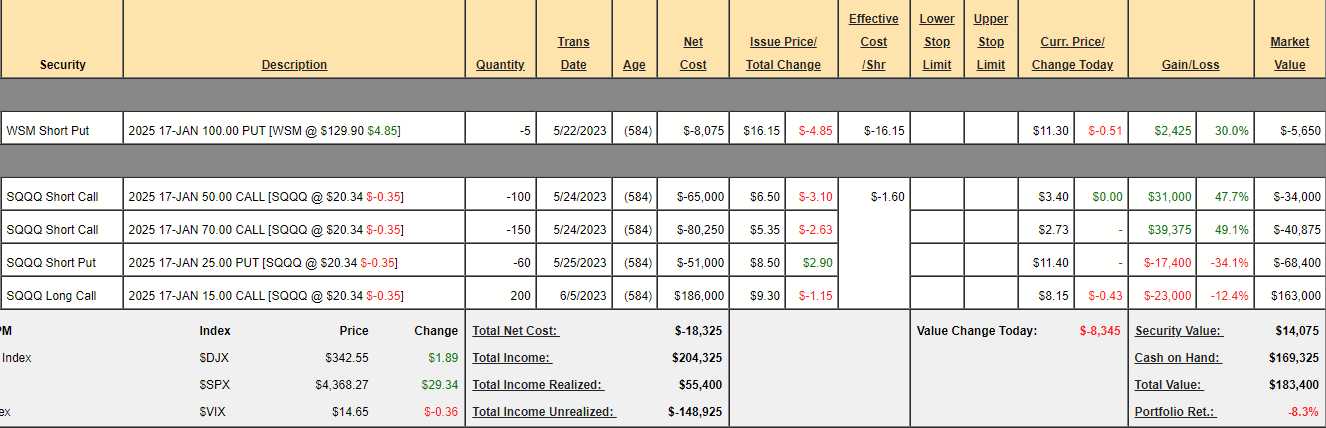

Short-Term Portfolio Review: $183,400 is down $16,600 (8.3%) so far and that’s what we expect in an up market but we’re too bearish at the moment. We cant blame WSM – that’s a long so it must be SQQQ, right?

-

- WSM – As I said, looking good. Short put trades are nice ways to offset the hedges and keep cash in the portfolio.

-

- SQQQ – We simply don’t have enough longs to justify the hedges. Still, a lot of this is changes in the VIX we can’t control. We had a net $10,250 credit on the spread that pays $340,000 if the Nasdaq drops 20% – that’s our insurance. Let’s say we stay flat. Then we’re $100,000 in the money and we’re assigned 6,000 shares at $25 for a $5 ($30,000) loss and the short calls expire worthless – net $70,000. I’m fine with a flat market.

- If the Nasdaq goes higher and wipes us out, we’re up the net $10,250 we paid for the spread and we’ll be assigned 6,000 shares of SQQQ at $25 ($150,000) but we’ll roll it and cover it long before that. I’m fine with an up market and we just need to make sure we make $450,000 in the LTP to cover it.

- If the Nasdaq goes down, it has to drop 50% before SQQQ hits $50 and we’d be $700,000 in the money and another $200,000 in the money before we hit $70 and have to start giving back. The puts would expire worthless, so I’m fine with an up market too.

- At the moment, the spread is net $19,725 and the only dumb thing we could do here is buy it back just because it LOOKS unfavorable due to variations in the premiums of the positions we have. Strategically – it’s perfect!

So our main issue is we’ve been too bearish, leaving us with too many SQQQ hedges and not enough LTP longs but the other portfolios are already doing well. Solution is sell more short puts and take a few more LTP plays that will make $100,000 in a flat or up market and we’ll be right on track.