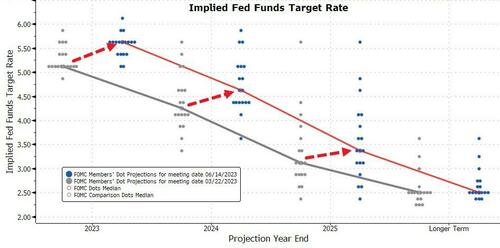

A ‘pause’ in rate-hikes and a far more hawkish dot-plot than expected spooked markets and then Powell monotonously meandered through his press conference, seemingly providing something for doves to cling to (though we are not sure what).

Powell emphasized that the inflation fight is still a priority: “Without price stability, the economy doesn’t work for anyone.”

“There’s just not a lot of progress in core inflation.”

“We want to see it moving down decisively.”

But:

“Risks for inflation are still to the upside.”

Powell says the process of getting inflation back to the 2% target “has a long way to go,” but don’t call this ‘pause’ a skip…

“The skip — I shouldn’t call it a skip.”

And finally, to ensure the doves are clear:

“It will be appropriate to cut rates at such time as inflation is coming down really significantly. And we’re talking about a couple of years out.“

“I think, as anyone can see, not a single person on the committee wrote down a rate cut this year — nor do I think it is at all likely to be appropriate if you think about it.”

“Inflation has not really moved down. It has not reacted much to our existing rate hikes. We’re going to have to keep at it.”

The result of all that was a fair amount of chaos.

First things first, rate-change expectations rose (hawkishly) with all rate-cuts for 2023 now priced-out and the odds of a hike by September significantly higher…

Source: Bloomberg

Stocks were even more wild, dumping on the statement/SEP, rallying at the start of Powell’s presser, only to reverse back as he noted ‘no rate cuts forecast by anyone’ and failed to actually offer a dovish bone to the market. The Nasdaq managed gains on the day while Small Caps and the Dow were hit hard (the latter hurt by UNH also) and late-day weakness dragged the S&P red but managed to pull back to unch at the close…

Nasdaq pushed ahead of Small Caps once again, reversing more of last week’s reversal in favor of Small Caps…

With a big OpEx right ahead of us, optionsland is a little chaotic also but today’s 0-DTE traders faded any gains off the PPI aggressively and were right…

VIX was smashed lower to a 13 handle!

Banks were dumped but investors rushed to the new safe-haven – AI stocks…

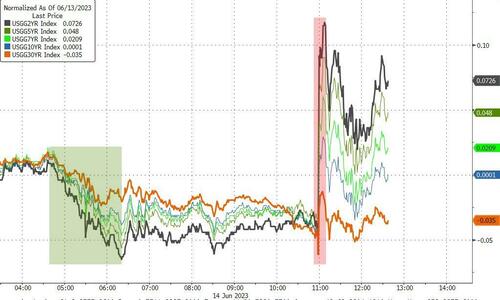

Utter chaos in bond-land with PPI taking yields gradually lower early on. The FOMC statement sent yields vertical – especially at the short-end – leaving the long-end actually lower on the day…

Source: Bloomberg

The yield curve (2s30s) plummeted to its most inverted since right around the SVB collapse…

Source: Bloomberg

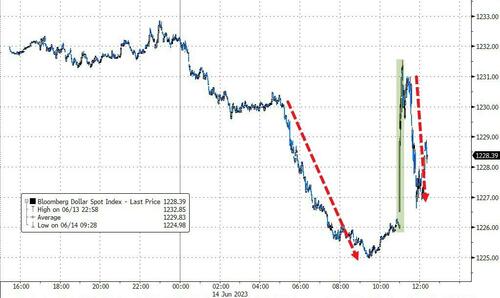

The dollar ended lower – tumbling on the soft PPI, spiking on the FOMC statement, then fading back during the presser…

Source: Bloomberg

Gold ended unchanged but had a violent day, rallying on PPI, dumping on FOMC then bouncing then fading…

Oil ended lower on the day with WTI testing down near a $67 handle intraday, hit by Iran headlines, strong inventory builds and the hawkish Fed…

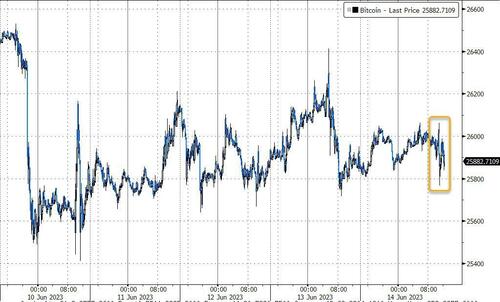

Perhaps most shockingly, crypto was the least volatile asset-class of the day…

Source: Bloomberg

Finally, did we just make the blow-off top on this AI cycle?

Source: Bloomberg

Maybe The Fed didn’t like the decoupling from tighter financial conditions after all?

Source: Bloomberg

Now we need to hear the follow-up FedSpeak to set the narrative.