What ever happened to “Irrational Exuberance“?

What ever happened to “Irrational Exuberance“?

Way back in 1996, when cell phones were the size of a brick and only made phone calls, Fed Chairman Allan Greenspan had become concerned about the the dot-com bubble that was driving the market to record levels due mainly to psychological factors – rather than fundamental valuations. On Dec 5th, 1996, he said:

“But how do we know when irrational exuberance has unduly escalated asset values, which then become subject to unexpected and prolonged contractions as they have in Japan over the past decade? And how do we factor that assessment into monetary policy?“

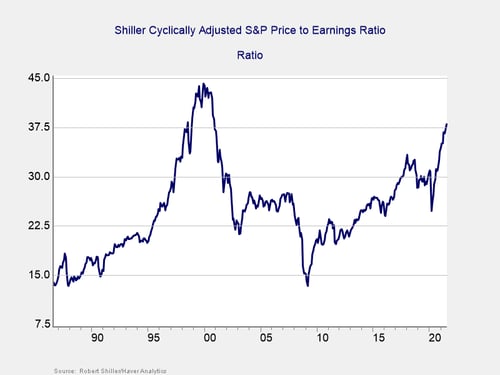

As you can see from the chart above, Greenspan was wrong as the rally didn’t stop for 3 more years but he was also right, as we crashed back to that level 6 months later. I’m a value guy too and I work hard not to be ahead of the curve but here we are back at 15,000 on the Nasdaq and 4,400 on the S&P – as traders are betting AI will boost the economy and the Fed is not only going to pause – but to reverse their rate hikes.

I agree that AI is going to lead to massive booms in Productivity – but that will not be without problems (like massive human lay-offs). It also won’t happen this quarter or this year in any meaningful way but that was also the case with the Internet Revolution – traders were very happy to pay for the promise of things to come – until real estate got hot and they began chasing that market instead as the dot-com bubble burst.

Once again we find ourselves in a situation where rates are rising but the P/E of the Nasdaq, especially since the beginning of the year, has been going wild as we started the year at 11,000 so 15,000 is up 4,000 or 36%. We thought 13,500 was silly in May and cashed out our portfolios but here we are – up another 10% in the month that followed.

And the S&P 500 is following right behind and, once again, the valuations are getting silly at 37.5x. That’s for the S&P 500 – not the Russell, not the Nasdaq – it’s simply too high and it WILL correct – but when? That’s what Greenspan meant when he said “Irrational Exuberance” but, as any married man know, telling someone they are irrational and them stopping the behavior are certainly NOT directly connected!

And the S&P 500 is following right behind and, once again, the valuations are getting silly at 37.5x. That’s for the S&P 500 – not the Russell, not the Nasdaq – it’s simply too high and it WILL correct – but when? That’s what Greenspan meant when he said “Irrational Exuberance” but, as any married man know, telling someone they are irrational and them stopping the behavior are certainly NOT directly connected!

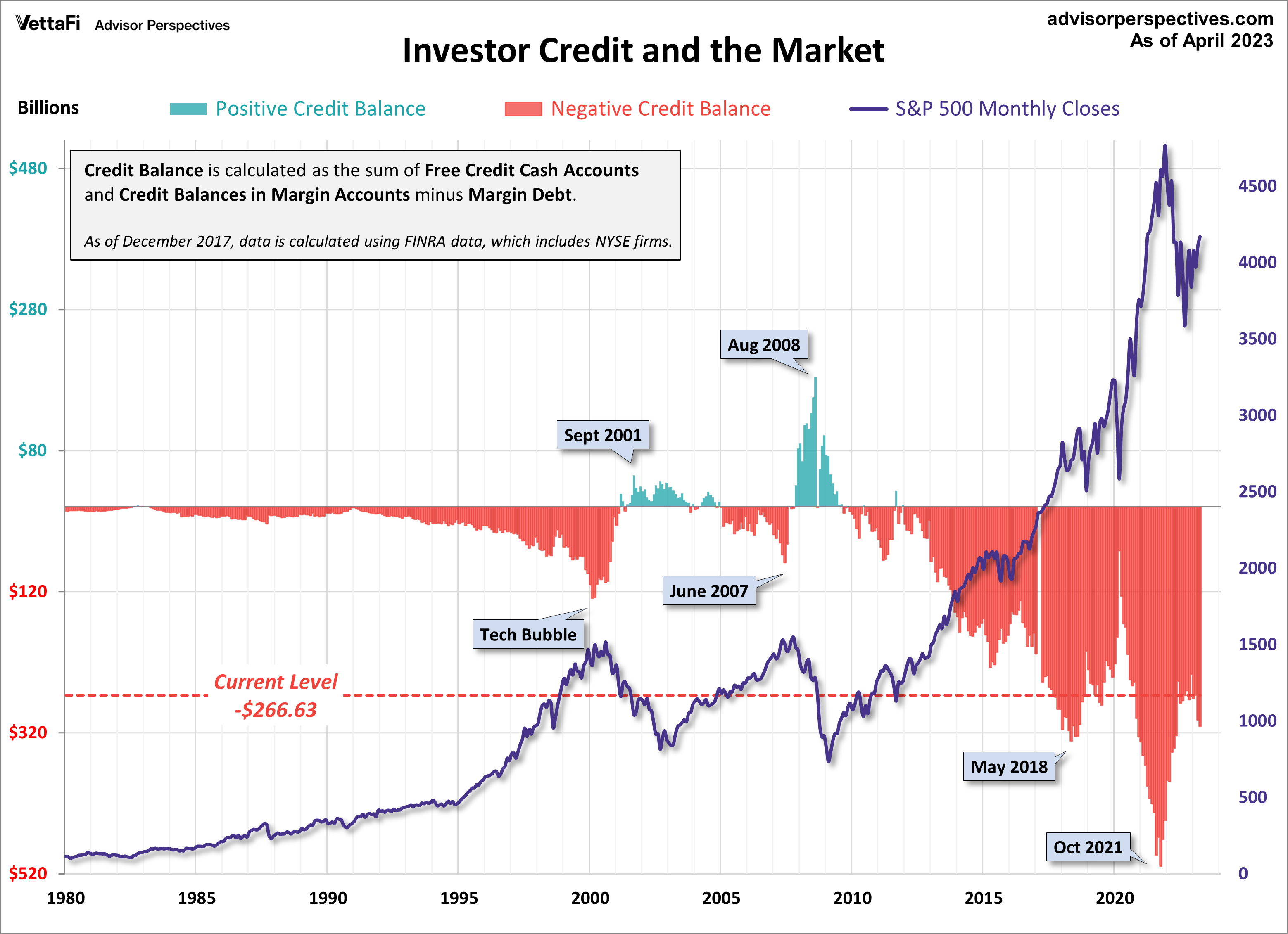

I am once again having to explain to people why I don’t like stocks that are trading at 100x their earnings again – that’s a very bad sign for the market. Another TERRIBLE sign for the market is margin debt, which is at record levels so, if we do have a correction – it’s going to be a TERRIBLE one!

The margin debt follows the index gains and the P/E rise because they are all connected and that is because THERE IS NOT ENOUGH MONEY IN THE WORLD TO JUSTIFY THESE VALUATIONS – so the banks have to create money to lend to the traders to play with the over-valued stocks. Yes, it’s that simple.

AAPL, for example, is valued at $2.88 TRILLION at the moment and, at the start of the year, it was $55 (30%) lower than it is now, at $2Tn. The market cap of the entire company is determined by whatever yesterday’s last trade was – which is patently insane in the first place but let’s break it down a bit.

55M shares of AAPL trade on the average day and AAPL stock is now $183 and it was $130 and the average of the year is, let’s say $155. That means, each day $8.5Bn worth of AAPL stock is traded. Now, as you can imagine, some stock is bought and some stock is sold and it’s the imbalance that drives the stock price. On any given day that imbalance will roughly resemble the move in the price of the stock – 1%, 2%, 5% – whatever.

EVEN IF we were to assume that 100% of the AAPL transactions were buys over the 110 trading days of the year so far (ridiculous assumption), that would only account for the inflow of $935Bn. Still not realistically but if every single day 10% of the traded volume represented inflows – we’d be at $93.5Bn but AAPL jumped $850Bn in “value” during that period.

But ALL the AAPL shareholders believe they have been enriched. What happens if 10% of them decide to sell $288Bn worth of shares? That would give you an ACTUAL 30% daily outflow ($288/935) for the next 6 months. But what if traders don’t want to wait 6 months to find buyers? What if the buyers aren’t buying? What if their own accounts are getting margin calls?

This is what happened to the market in 2000 and 2008 and here we are in 2023 – as irrational as ever.

As we navigate the current market landscape, it is essential to exercise just a bit of prudence and skepticism. While AI may indeed lead to substantial advancements and productivity gains, we must remain cognizant of the potential risks associated with euphoric market sentiment. Greenspan’s concept of “Irrational Exuberance” continues to resonate, reminding us to question prevailing valuations and brace ourselves for the inevitable corrections ahead.