It’s all about the “Dot Plot“:

It’s all about the “Dot Plot“:

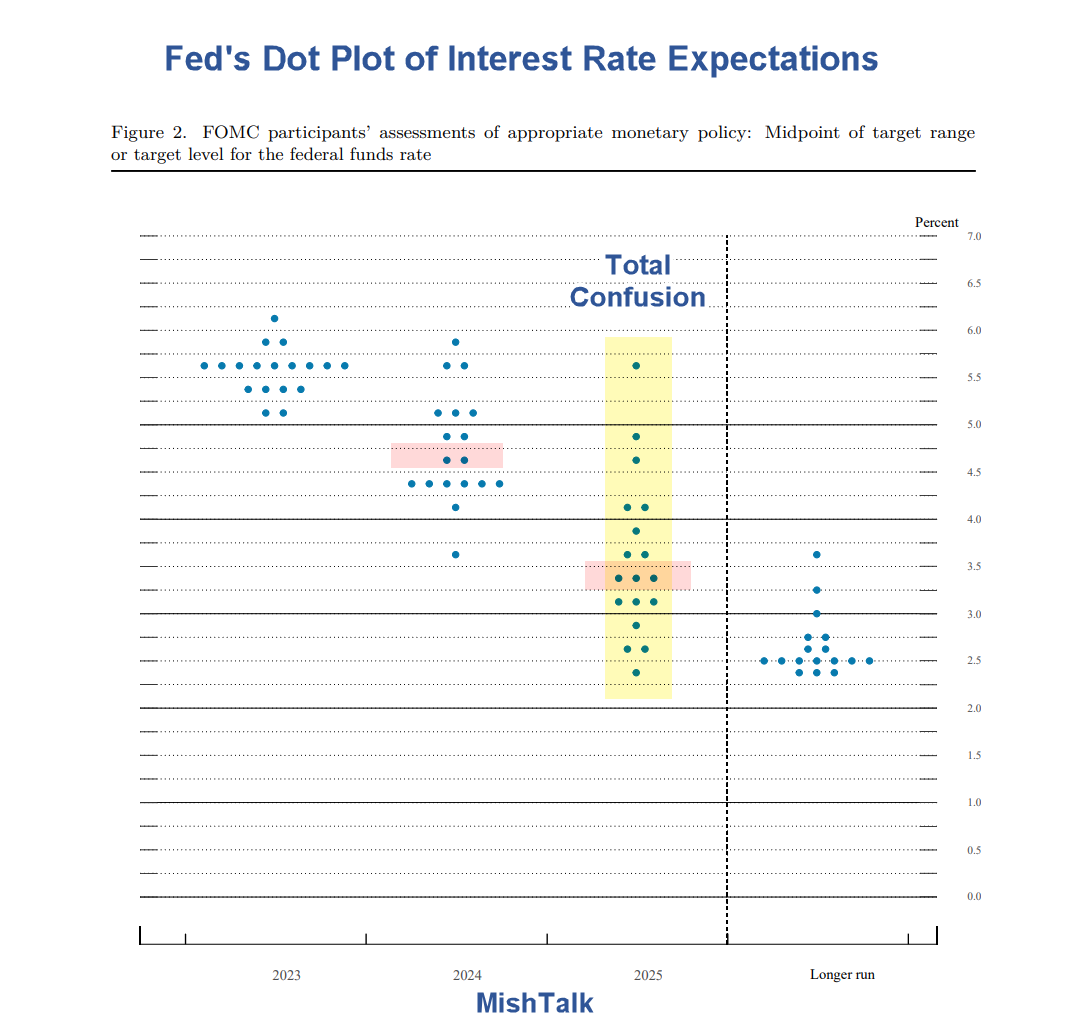

Each dot represents where one of the Fed Governors expects the Fed Funds Rate to be at the end of each year. So it’s not so much what the Fed did (pause) or said (goal oriented – data driven) yesterday as it is about where these dots bunch up and, as of yesterday, the Fed consensus is 5.5-5.75% and it is currently 5%-5.25% so we’re looking at two more rate hikes this year and not easing until 2024 – at best.

Also, the most important thing I should point out is that people think these “Dot Plots” are some sort of established indicator that really mean something but the FACT of the matter is that the Fed Governors are only high-level Economorons – the same Economorons who haven’t hit a projection since 1968 and historically, have far less than a coin flip’s chance of being right at any given time – FAR LESS:

See, there was this brief bit of time between 2017 and 2019 when they were kind of right about the direction of rates but then they went back to being spectacularly wrong for the last four years – just like they were the decade before that.

These people are GUESSING and their guess is no better than yours or mine. Far worse actually as our Members at PSW actually understand the factors that lead to inflation and unemployment, which influence the Fed’s decisions over the long and short terms.

There are now 4 Fed meetings left and one is on November 1st, right before the elections so I don’t see them raising at that meeting. That leaves July 26, Sept 20 and Dec 13th for 2 more rate hikes so July seems like a must now and I doubt they want to raise rates into Christmas – so it looks like 0.25 hikes for the next two meetings. See how easy that is?

| Variable | Median1 | Central Tendency2 | Range3 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2023 | 2024 | 2025 | Longer run | 2023 | 2024 | 2025 | Longer run | 2023 | 2024 | 2025 | Longer run | |

| Change in real GDP | 1.0 | 1.1 | 1.8 | 1.8 | 0.7–1.2 | 0.9–1.5 | 1.6–2.0 | 1.7–2.0 | 0.5–2.0 | 0.5–2.2 | 1.5–2.2 | 1.6–2.5 |

| March projection | 0.4 | 1.2 | 1.9 | 1.8 | 0.0–0.8 | 1.0–1.5 | 1.7–2.1 | 1.7–2.0 | -0.2–1.3 | 0.3–2.0 | 1.5–2.2 | 1.6–2.5 |

| Unemployment rate | 4.1 | 4.5 | 4.5 | 4.0 | 4.0–4.3 | 4.3–4.6 | 4.3–4.6 | 3.8–4.3 | 3.9–4.5 | 4.0–5.0 | 3.8–4.9 | 3.5–4.4 |

| March projection | 4.5 | 4.6 | 4.6 | 4.0 | 4.0–4.7 | 4.3–4.9 | 4.3–4.8 | 3.8–4.3 | 3.9–4.8 | 4.0–5.2 | 3.8–4.9 | 3.5–4.7 |

| PCE inflation | 3.2 | 2.5 | 2.1 | 2.0 | 3.0–3.5 | 2.3–2.8 | 2.0–2.4 | 2.0 | 2.9–4.1 | 2.1–3.5 | 2.0–3.0 | 2.0 |

| March projection | 3.3 | 2.5 | 2.1 | 2.0 | 3.0–3.8 | 2.2–2.8 | 2.0–2.2 | 2.0 | 2.8–4.1 | 2.0–3.5 | 2.0–3.0 | 2.0 |

| Core PCE inflation4 | 3.9 | 2.6 | 2.2 | 3.7–4.2 | 2.5–3.1 | 2.0–2.4 | 3.6–4.5 | 2.2–3.6 | 2.0–3.0 | |||

| March projection | 3.6 | 2.6 | 2.1 | 3.5–3.9 | 2.3–2.8 | 2.0–2.2 | 3.5–4.1 | 2.1–3.1 | 2.0–3.0 | |||

| Memo: Projected appropriate policy path | ||||||||||||

| Federal funds rate | 5.6 | 4.6 | 3.4 | 2.5 | 5.4–5.6 | 4.4–5.1 | 2.9–4.1 | 2.5–2.8 | 5.1–6.1 | 3.6–5.9 | 2.4–5.6 | 2.4–3.6 |

| March projection | 5.1 | 4.3 | 3.1 | 2.5 | 5.1–5.6 | 3.9–5.1 | 2.9–3.9 | 2.4–2.6 | 4.9–5.9 | |||

What’s most useful about the Fed’s Economic Projections is we can see what’s changed since last quarter. Last quarter the Fed thought Core PCE would come down but it did not and they thought 5.1% would be enough but it is not – so why the pause? We can only conclude that the pause was done mainly for political reasons and not because it’s actually time to pause. It’s very possible the Fed knows something bad that we don’t – as they didn’t even pause in in their March meeting – during the banking crisis.

One thing we all know is that two more years of anemic economic growth – even with inflation – will NOT be good for this country or the markets. In December, the Fed thought we’d be growing our GDP at 1.6% in 2024 and 1.8% in 2025 and now next year is down to 1.1%. Not only is that very close to a 2-year Recession but it also means that the numbers the BLS uses to project Government revenues is wrong and that will mean more debt and more external pressure on our rates.

Here are Warren’s concerns on the matter:

🤖 In a low-growth, high-rate environment, the stock market is likely to face several challenges over the next two years. The expected rate hikes by the Federal Reserve indicate a tightening monetary policy, which can impact various sectors of the stock market differently.

-

-

-

-

Interest rate-sensitive sectors: Sectors that are sensitive to interest rates, such as real estate, utilities, and consumer discretionary stocks, may face headwinds. Higher interest rates increase borrowing costs, affecting the affordability of mortgages and potentially dampening demand for real estate. Utilities, known for their dividend-paying nature, may face pressure as investors seek higher returns in fixed-income investments. Consumer discretionary stocks, particularly those related to big-ticket purchases like automobiles and housing, could experience slower growth due to reduced consumer spending resulting from higher borrowing costs.

-

Financial sector: The financial sector generally benefits from rising interest rates as it allows banks to generate higher net interest margins. Banks earn profits by borrowing at low rates and lending at higher rates. Therefore, banks and financial institutions may see improved profitability and stock performance in a high-rate environment.

-

Technology and growth stocks: The valuation of technology and growth stocks often depends on low borrowing costs and a favorable investment climate. Higher interest rates could lead to a shift in investor sentiment away from these sectors, as the present value of future cash flows is discounted at a higher rate, potentially reducing their attractiveness relative to other investment options.

-

Cyclical sectors: Cyclical sectors, such as industrials, materials, and energy, may be influenced by broader economic conditions. If economic growth remains anemic as projected, these sectors could experience slower demand for their products and services. However, it is worth noting that the infrastructure investment plans by governments could provide support to certain cyclical sectors.

-

Defensive sectors: Defensive sectors, including healthcare, consumer staples, and utilities, tend to be less affected by economic cycles. These sectors are associated with essential goods and services that consumers continue to demand regardless of the economic environment. Consequently, they may provide a relatively stable investment opportunity during periods of low economic growth.

-

-

-

It is important to consider that sector performance is not solely determined by interest rates but also by company-specific factors, industry dynamics, and market sentiment. Additionally, unexpected events or shifts in economic conditions can alter the outlook for various sectors. Therefore, investors should closely monitor economic indicators, corporate earnings, and market trends to make informed investment decisions in a low-growth, high-rate environment.

There you go, Consumer Staples, Utilities and Health Care. Also Solar, which is benefitting from a large stimulus package along with other green companies and we were just going over Financials we still like in our Live Member Chat room, as well as yesterday’s Live Trading Webinar – so we’ve got a busy week ahead of us!

Meanwhile, the WSJ is running with the headline “The End of the Fed’s Tightening Is Still in Sight” but that’s coming from the publication that said Trump’s documents were stored securely because the bathroom had a lock on the door. Warren sees right through the BS, saying:

🤖 The article suggests that the end of the Federal Reserve’s tightening cycle may be in sight, signaling a shift in interest rate expectations. The Fed has left its target on overnight rates steady at a range of 5% to 5.25% and indicated a potential half percentage point rate increase by the end of the year. However, if the next inflation report shows signs of further cooling, the likelihood of future rate hikes could be in doubt.

Despite the possibility of cooling inflation, the article highlights that Fed officials do not anticipate lowering rates significantly below their current levels. Projections indicate an expectation that the rate range will be 4.5% to 4.75% at the end of the following year. This expectation of higher rates for a longer duration is starting to be recognized by investors.

Traditionally, the Fed has raised rates to a point where it triggers an economic recession, leading to a reversal of monetary policy and rate cuts. However, the current job market remains healthy, with low unemployment and ample job vacancies. As long as the job market remains strong, even if inflation cools substantially, policymakers may see little incentive to cut rates. This shift in expectations is influencing long-term interest rates, with the yield on the 10-year Treasury rising faster than the yield on the 3-month Treasury. If inflation continues to cool and the job market remains robust, this trend may persist and even result in long-term yields surpassing short-term yields without being driven by a recession.

While this scenario would be positive for the economy, investors would face a more complex situation in a higher-for-longer rate environment. The implications of an extended period of higher rates would require careful consideration and potentially impact investment decisions.

In other words: “Be careful out there!“