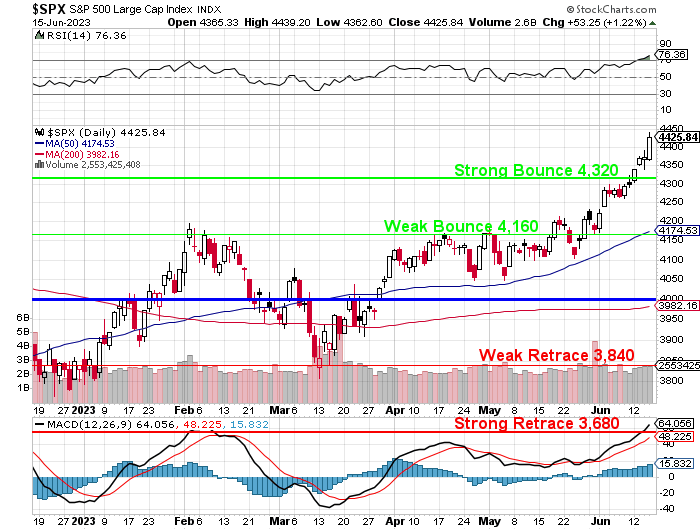

What a rally!

After retesting the Weak Retrace Line during the March banking crash, the S&P has been on a tear – consolidating under our weak bounce line from April to May and now exploding up to almost the Strong Retrace Line of the higher range around 4,800, which would be 4,480 – followed by the Weak Retrace Line at 4,640.

Once we actually get over 4,480, it will be time to shift the blue line of the chart to that line and that’s fair as we’ve had a lot of inflation in the 3 years we’ve been using 4,000 as our base so let’s add 10% for that alone and we solved the housing crash with a quick $2Bn from the Fed and the Government – that’s a nice bit of stimulus.

We also did not have another major Covid outbreak and Commercial Real Estate is not collapsing (yet) and China is now massively on-board the stimulus bandwagon and the Fed is not too far from being done raising rates – that’s could be good for another 10% – and that (4,800) will be the new top of our expected range, most likely.

In the last few years, stocks have beaten the crap out of every other investing category and a lot of that is due to the combination of $11Tn of Government Stimulus that was thrown at the Covid crisis, when people were locked in their home (not buying or selling them) and Treasuries were paying nearly 0% and no one was using Cash or Oil or Gold very much – Stocks were literally the only game in town and the S&P 500 has blasted from 2,750 in 2019 to 4,425 this morning – a gain of 1,675 (61%) in 4 years.

By comparison, the S&P 500 was at 1,500 in 2007 and it went up 60%, to 2,400 in 2017 – a 10-year journey. Of course we had also been at 1,500 in 1999, so maybe an 18-year journey to gain 60%.

In addition to the stimulus (which he also threw at Corporations and the already rich), we can thank President Trump for his decreases in Corporate Taxes, which led to “increased earnings” as Trump’s refusal to collect taxes from Corporations or people who were as rich as Corporations (coincidentally, himself) led to record Corporate after-tax profits as well as the greatest expansion of our National Debt in history – huzzah!

In addition to the stimulus (which he also threw at Corporations and the already rich), we can thank President Trump for his decreases in Corporate Taxes, which led to “increased earnings” as Trump’s refusal to collect taxes from Corporations or people who were as rich as Corporations (coincidentally, himself) led to record Corporate after-tax profits as well as the greatest expansion of our National Debt in history – huzzah!

It’s a 3-day weekend in the US (Juneteenth) and next week is a light data week with mainly housing information. We get earnings from FDX, LZB, KEY, WGO, KBH, DRI, and KMX but the real highlight will be Powell testifying to Congress Wednesday and Thursday along with nomination hearings for 2 new Fed Governors (Lisa Cook and Philip Jefferson).

Have a nice, long weekend!

-

- Phil