Just kidding, the markets are closed.

Just kidding, the markets are closed.

On June 19th, 1865 (not even 100 years before I was born), America became one of the last countries to officially abolish slavery – we’re very proud of that, apparently. I wonder if we’ll have an Earthteenth when America finally does something about Global Warming – if any of us are still around to celebrate it.

I am sorry about all the bad news about the planet dying, by the way – it’s just that there’s a lot of it and it does seem kind of important – not that you’d know it living in America, where Greta Thunberg is an object of derision, rather than a celebrated environmental hero. Of course, this is often the case of people who speak truth to Power – when Power manipulates the narrative and turns the other people against the truth-tellers.

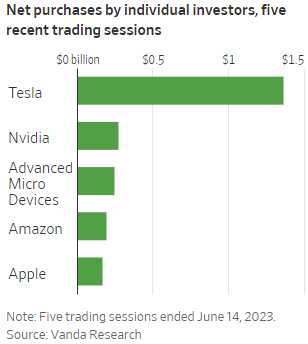

Unfortunately, the truth can be a bummer – like on Wednesday, when we were talking about what a very small net amount of money was moving the market – literally building a house of cards – especially out of the Nasdaq. Now the WSJ agrees with me and they have a nice chart to illustrate it.

Unfortunately, the truth can be a bummer – like on Wednesday, when we were talking about what a very small net amount of money was moving the market – literally building a house of cards – especially out of the Nasdaq. Now the WSJ agrees with me and they have a nice chart to illustrate it.

Just 7 stocks have driven ALL of the S&P 500’s positive returns this year and two of them are Alphabet (GOOG, GOOGL), who are up 39% each. NVDA is up 184%, META up 133%, AMD up 100%, CRM up 68%, TSLA up 136% and MSFT up 54%. AMZN is also up 50% and AAPL is up 41% but that’s a lot for a $2Tn company – now $3Tn in an index of 500 stocks where the total value is just under $40Tn.

As you can see with TSLA, which went from $160 to $260 (up 62.5%) in the last 5 sessions – it only took $1.4Bn of positive inflows to push the stock up $317Bn – that’s a lot of leverage! As I noted last week – simply because SOME shares traded at an implied $825Bn valuation on Friday, all 3.16Bn shares are now marked at $260.50.

What will happen if those 3.16Bn shares go out and try to actually get $260.50 per share should there be bad news on TSLA and you may suddenly see a crash of truly biblical proportions but, for now, it’s a nice fantasy number – one of several we are basing a fantasy rally on – keep that in mind!

At least with TSLA there has been volume along with the move up this year, you can see all the tall green lines in the buying. Not so much GOOG, which had a lot more volume on the way down than up.

So keep an eye on those volume charts and make sure there has been sincere interest in the stock you are chasing – not just a splash… SMH is a good example of this – the semiconductor ETF has NVDA as it’s top stock (17% of the ETF), so of course it’s up but look how much less volume there has been this year going up than last year going down – that’s a sign of a very weak foundation.

We’re likely to run into the same resistance here ($155) as we did in 2021 and if you have NVDA or other semis in your portfolio, SMH makes a nice hedge. The way I would play it is:

-

- Sell 10 SMH 2025 $200 calls for $9 ($9,000)

- Buy 10 SMH 2025 $180 puts for $33.50 ($33,500)

- Sell 10 SMH 2025 $160 puts for $21.50 ($21,500)

That’s net $3,000 on the $20,000 spread that’s 100% in the money with $17,000 (566%) upside potential if SMH fails to hold (or even get to) $160. Portfolio Margin on the short calls is $9,300 so it’s a nice little hedge to protect your semi investments.

Speaking of semis – INTC is no longer sleepy and that’s a shame as it was going to be our 2024 Stock of the Year if it was still below $35 but it’s breaking out now to join its brothers in stock heaven.

- In other news that’s been going on this weekend:

- US National Debt Hits All-Time High Of $32 Trillion

- McCarthy’s Next Trick: Averting a Government Shutdown

- Blinken Meets Top China Diplomat as Trip Sees Positive Start

- China Tech, Yuan Fall as Stimulus Hopes Unanswered: Markets Wrap

- China’s Small Businesses Are Hit Hard as Economic Recovery Falters

- Ukraine’s Offensive Will Likely Be a Slow, Costly Grind

- Why Inflation Around the World Just Won’t Go Away

- In Argentina, Inflation Passes 100% (and the Restaurants Are Packed)

- Where Housing Prices Have Crashed and Billions in Wealth Have Vanished

- How Much America’s Biggest Companies Are Paying Their Workers

- Melinda French Gates Says World Debt Woes Need Bold Action Now

- Musk Says Biden’s Call for More Taxes on Rich Won’t See ‘Action’

- Lots of Hiring, Not So Much Working

- Oil Edges Lower as Investors Wait for Detail of China Stimulus

- Five Key Charts to Watch in Global Commodity Markets This Week

- Climate Authoritarianism: WEF Wants 75% Fewer Private Car Owners By 2050

- Lies, Damn Lies, And UFOs: Deciphering The Truth Hidden Amid Decades Of Propaganda