Commercial REIT’s are down 60% since Covid began and 40% of that has come in the past year – long after Covid has gone as habits have changed and Companies seem unable to even force workers back to the office when they try.

The shift towards remote work has led to a significant decrease in the number of workers in downtown offices, negatively impacting investments tied to downtown Real Estate and Public Transportation. As a result, Bonds linked to New York subways and buses are being undervalued, and downtown-focused Real Estate Investment Trusts are trading at less than half of their pre-pandemic levels. Investors are, in turn, demanding higher interest rates to hold office-building debt. These trends have implications for city finances, as they strain traditional revenue streams such as Property Taxes, Taxes on Wages Earned within city limits, and Fares from office workers’ commutes.

The decline in downtown investments also has social consequences, with cities facing budget gaps and potential austerity measures. Public spaces are emptier, and there are concerns about an increase in homelessness and the mentally ill occupying transit stops and streets. Analysts are closely monitoring downtown areas and are particularly cautious about debt from certain Northern urban centers and large California cities.

There are already indicators of investor unease, such as higher yields on bonds backed by commuter fares and increased interest rates for low-rated commercial mortgage-backed securities. Defaulted commercial mortgage-backed securities related to office towers in major cities further contribute to the negative sentiment. REITs which focus on downtown office buildings have seen significant declines in share prices.

Boston Properties Inc. (BXP): The largest publicly traded office REIT in the U.S., with a portfolio of 196 properties totaling 51.6 million square feet in Boston, Los Angeles, New York, San Francisco, and Washington, D.C. Their stock dropped over 60% since last year and may actually be oversold but it’s very hard to determine what a proper bottom should be. $55 is still $8.6Bn and they will be lucky to make $400M this year or next – not at all cheap for a REIT – even in good times.

SL Green Realty Corp. (SLG): The largest office landlord in Manhattan, with a portfolio of 96 buildings totaling 40.6 million square feet. That stock had dropped 75% since last year and has bounced back to down 66.6% and that may be a sign – but probably not a good one! SLG is not making a profit at the moment, losing roughly $150M against a $1.7Bn valuation.

Hudson Pacific Properties Inc. (HPP): Is in about as much trouble as the name would suggest. They are a West Coast-focused office REIT, with a portfolio of 53 properties totaling 19 million square feet in Los Angeles, Orange County, San Francisco Bay Area, and Seattle. Their valuation has fallen from $4Bn in 2021 to $683M today but they have $4Bn in debts and they are losing $25M per quarter – NOT GOOD!

Vornado Realty Trust (VNO): Is also running in the red. VNO is a major owner of office and retail properties in Manhattan, with a portfolio of 78 properties totaling 29.7 million square feet. Running in the red with a massive $7.5Bn in debt, we may see their book value of $5.8Bn be tested in a sell-off.

Highwoods Properties Inc. (HIW): Is a Southeast-focused office REIT, with a portfolio of 125 properties totaling 11.8 million square feet in Atlanta, Charlotte, Nashville, Orlando, Raleigh/Durham/Triangle Park and Tampa. This is the proverbial baby that was thrown out with the bathwater as they are in the hot market but still down 50% but $22.89 is $2.4Bn and they’ll make about $120M so right at 20x but I think they are a good growth play. They pay a $2 (8.74%) dividend too!

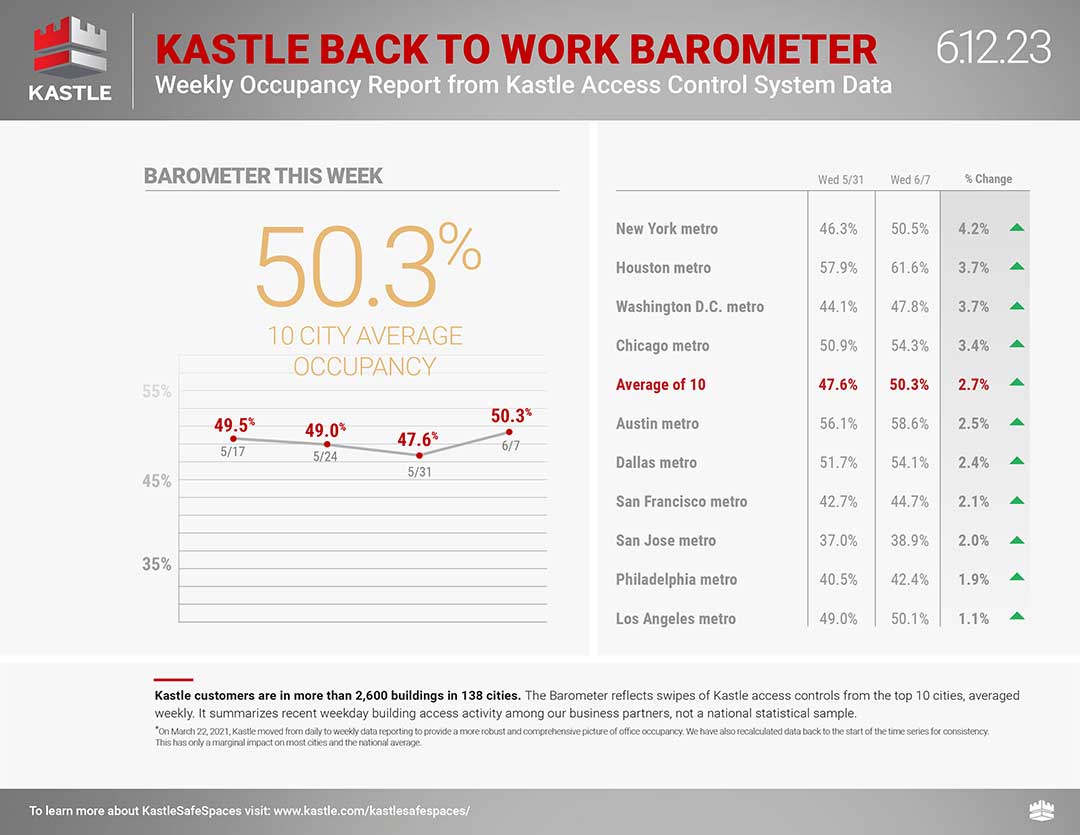

The value of downtown office buildings is challenging to assess due to limited sales and locked-in lease agreements. Estimates do suggest that the value of office property across U.S. cities is 38% lower than pre-pandemic levels, resulting in a loss of about $500 Billion but it could be worse as the office spaces that are occupied are under-utilized as well. If the 50% absent workers don’t return – THEN what is the real value of these empty buildings?

Lower property values may lead to challenges to tax assessments, potentially reducing tax revenue from office buildings. This presents city officials with the choice of collecting less revenue or increasing the burden on other taxpayers. Office-building property taxes typically account for about 10% of major cities’ revenue but much more in places like Manhattan, where Commercial Space outnumbers Residential. The financial struggles are particularly pronounced for other older Northeastern, Midwestern, and California cities with high debt loads and pension liabilities.

Although cities are not going broke and still house wealthy individuals and companies, the potential long-term impact of the shift to remote work on city budgets is severe. Cities have already seen declines in spending and revenue, and Federal Aid provided during the pandemic has run out. As a result, Investors are increasingly looking for opportunities in suburban bonds in low-tax Southern and Western states that have attracted companies and workers from Northern cities.

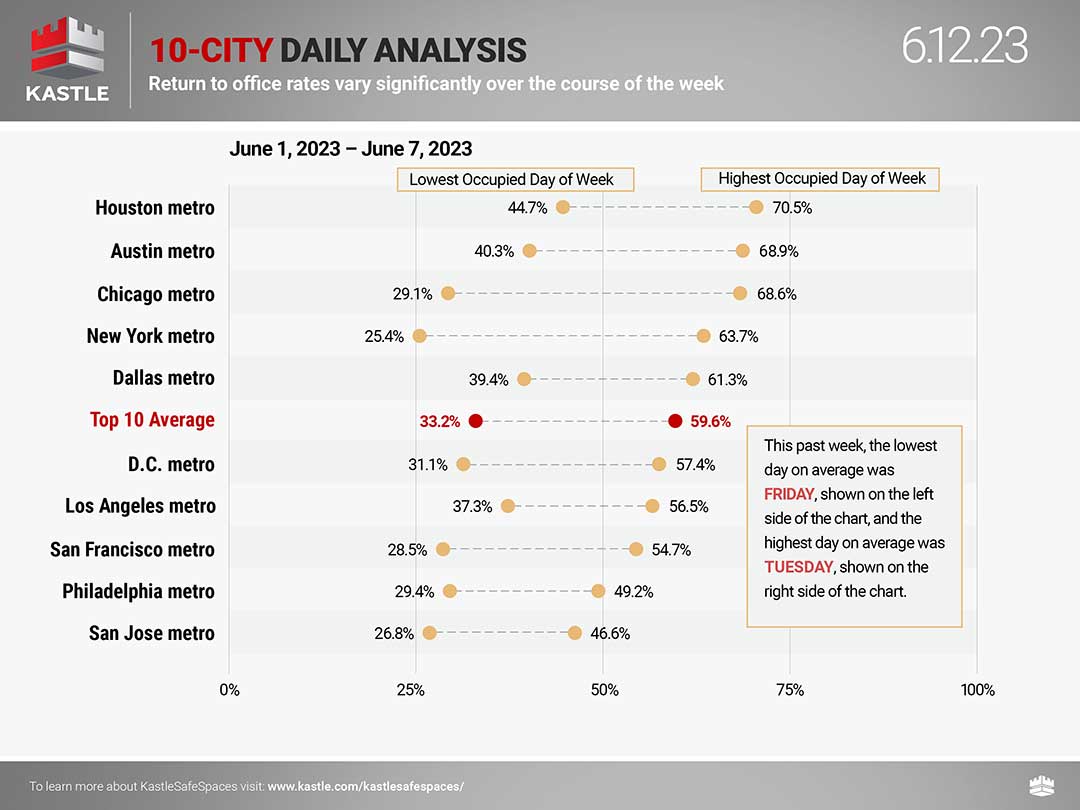

San Francisco, Philadelphia and San Jose, in particular, has been heavily affected by the tech industry’s embrace of remote work and subsequent layoffs. Vacancy rates for office space have increased, and ridership on public transportation has declined significantly – leading to more lost revenues. The city’s budgetary risks have led to credit downgrades, and landlords are appealing for reduced tax values on office properties, potentially reducing property tax revenue.

It’s not just the REITs that suffer – it’s the thousands of businesses that used to feed and service all those office workers – a lot of them are closing their doors as workers fail to return and aid money runs out and Pandemic Loans are called due. Look at all those cities where less than 30% of the workers show up on Friday (left column) – what businesses are going to survive that loss for a sustained period of time?

CRE in general is a very large other shoe that is going to drop down the road. What’s saving us for now is the long length of standing rental agreements but, as they come due for renewals – it’s kind of obvious what is going to happen – isn’t it?

We do have some earnings to enjoy this week and we’re only two weeks away from proper Earnings Season again – that’s exciting! All eyes are on FDX this evening but I’m very interested in what KBH has to say tomorrow and DRI on Thursday should also be good insight for their sector.

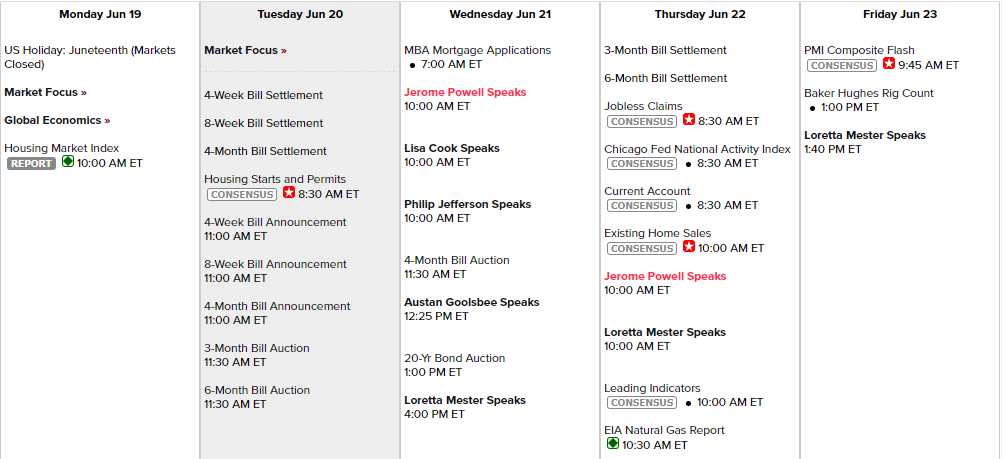

On the data front, we have Mr. Powell’s Flying Circus performing for Congress tomorrow and Thursday – so that should be fun. In case that doesn’t go well he has Loretta Mester speaking after him on Wednesday and Thursday and, just for good measure, on Friday as well and 3 other Fed Governors will speak on Wednesday as the Fed is VERY concerned about being taken the wrong way by the markets this week.