Solid US housing data was offset by weak Chicago Fed National Activity Index data, poor labor market signals (claims), dismal LEIs, and ugly Kansas City Fed Manufacturing data as a wave for hawkish central bank action prompted an odd assortment of actions across asset classes – dollar strength, yield curve compression, VIX hammered lower, long-duration stocks bid, commodities and bonds dumped, banks sold, bitcoin flat.

Nasdaq strongly outperformed with Small Caps lagging (huge 2% divergence) as The Dow ended flat with the S&P green…

As that pairs trade surged back up to recent highs…

Another day, another dump and pump for ‘most shorted’ stocks – though we note the strength of the bounce is getting weaker…

Source: Bloomberg

0-DTE traders fought the uptrend in Nasdaq all day… and failed…

But, VIX was clubbed like a baby seal, hitting a 12 handle intraday….

Banks extended their losses on the week (after the surge in deposit outflows reported last Friday)…

Treasuries were dumped across the curve – up around 7-8bps – leaving all yields higher on the week with the short-end underperforming on the week…

Source: Bloomberg

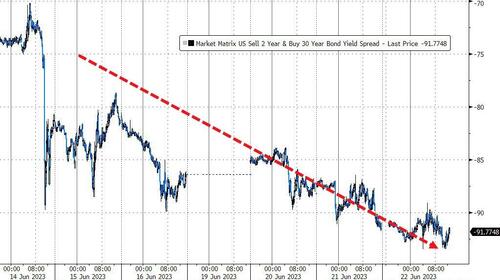

The yield curve compression continues to signal recession (along with all the macro data above)…

Source: Bloomberg

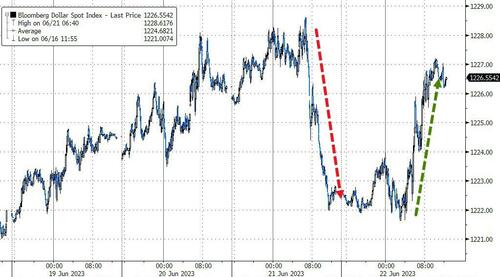

The dollar surged back today, erasing yesterday’s weakness…

Source: Bloomberg

The dollar gains weighed on gold which tumbled to fresh 3 month lows…

Finally, we note that NVDA was red on the day, having gone nowhere for a week…

Makes you wonder eh?

Or is that just too easy?