“I’ve seen the needle and the damage done

“I’ve seen the needle and the damage done

A little part of it in everyone

But every junkie’s like a settin’ sun” – Neil Young

At the moment (8am) the S&P 500 is down 80 points for the week – this chart shows half the damage over the lasts 3 sessions but we closed at 4,480 last week. There wasn’t much data – just Powell speaking and making it clear (to those who couldn’t read the tea leaves in last week’s FOMC statement) that there would, in FACT, be two more rate hikes – at least.

As if to punctuate his point, the ECB raised rates 0.25% and promised another 0.25% next month while the BOE jumped in with 0.5% right away. Inflation is out of control in other countries and not in the US, only because we don’t measure it properly here (see: “Inflation-Fighting Thursday – BOE Says What the Fed Won’t“). Anyone who actually lives in the US is well-aware of Inflation and how much it is taking from them.

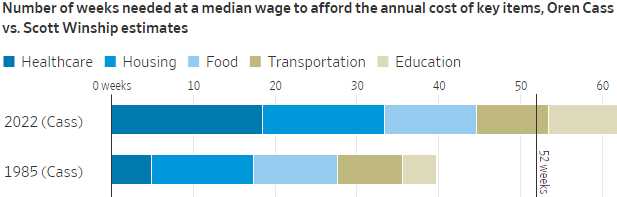

This chart is a good indication of what’s happened to Disposable Income as a median wage worker could cover his basics in 40 weeks in 1985, when I graduated college. Now it takes 62 weeks – 55% more work – to pay for the same amount of things. This is the path towards slavery for everyone in America – except, of course, the Top 10%.

Those extra 12 weeks we had after we paid our bills were our vacations, our fun cars, our nice stuff, our nights out, our happy Christmases, our home improvements, our retirements and our charities. Now the average family is 10 weeks (19.2% of their wages) in debt before they can even cover their cost of living. Forget retirement, these people are going to be lucky to die before they go bankrupt.

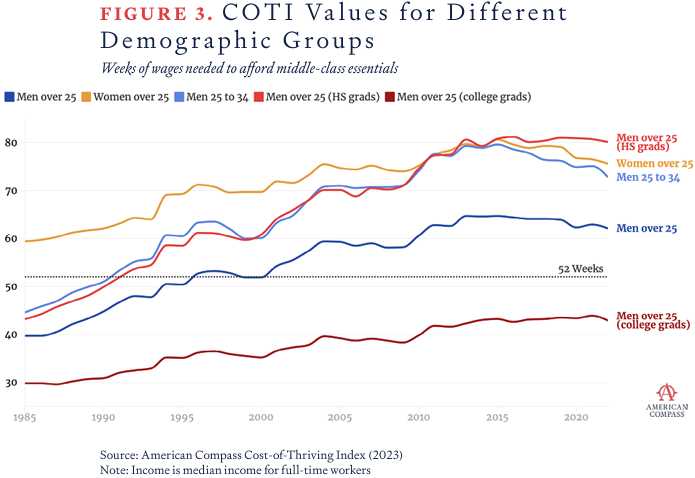

In fact, the only demographic group that’s able to make ends meet currently are MALE College Graduates over 25 years old – we live in a VERY different World than the rest of you:

Of course, the catch in American Society is that you come out of college $200,000 in debt these days – so you need those extra 12 weeks for the first 10 years just to pay that off. It’s not an accident that it works that way – can’t have our young, educated people wondering off into the wild and becoming artists or writers, can we? Straight to work in the Corporate grinder or else!

That’s also from the early 80s – we saw this coming. My youngest daughter is doing her first internship with a big insurance company and she was describing the horror of the work experience and how she feels like she’s been tricked into preparing for this horrible existence and I laughed at her and showed her this video and now she gets it! Father and daughter bonding – you can’t beat it…

I’ll pay good money to spare my children from the fate of 40 more years of America going straight to Hell and I suggest you do the same. We’ve already bequeathed them a burning planet – let’s at least let them have a little fun while that’s even possible.

To that end, we have a little action on our Watch List as Ford (F) just picked up a $9.2Bn loan from the Department of Energy to build a Battery Plant that will ultimately employ 7,500 people – so more than $1M per job created. We’ve had our eye on F on our Watch List and now we’re going to pull the trigger with the following trade for our Long-Term Portfolio (LTP):

-

-

- Sell 20 F Dec 2025 $12 puts for $2 ($4,000)

- Buy 50 F Dec 2025 $10 calls for $5 ($25,000)

- Sell 50 F Dec 2025 $15 calls for $2.75 ($13,750)

-

That’s net $7,250 on the $25,000 spread so we have $17,750 (244%) upside potential if F can just get back over $15 in the next 30 months. At the moment, at $14, we’re $20,000 in the money to start – not bad!

See, there’s always something to buy – we’ve got to keep our kids off that treadmill!

Have a great weekend,

-

- Phil