After a stellar 2Y auction yesterday, moments ago the US Treasury concluded the week’s second auction – an offering of $43 billion in 5 Year Notes. Unlike yesterday’s today which was a blowout across most categories, today’s sale was solid but nothing to write home about.

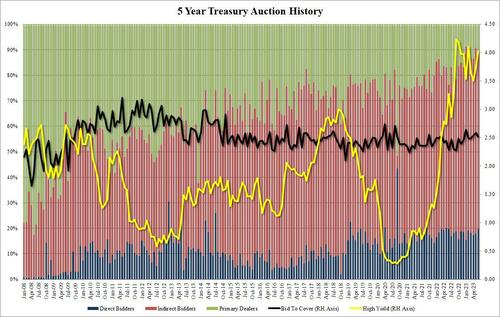

Pricing at a high yield of 4.019%, up from 3.749% in May and the highest since February’s 4.109%, the auction tailed the When Issued 4.012% by 0.7bps, the first tail for the tenor since February.

The bid to cover was 2.52, down from 2.58 last month and just below the 2.53 six-auction average.

The internals were also average, with Indirects awarded 68.1%, down from 72.7% and below the 70.1% recent average; and with the Direct award rising to 19.7%, the highest since Jun 2022, Dealers were left holding 12.2%, one of the lowest on record (but not the lowest – that was January’s 8.8%).

Overall, a mediocre auction but more than sufficient for government work.