Here we are again:

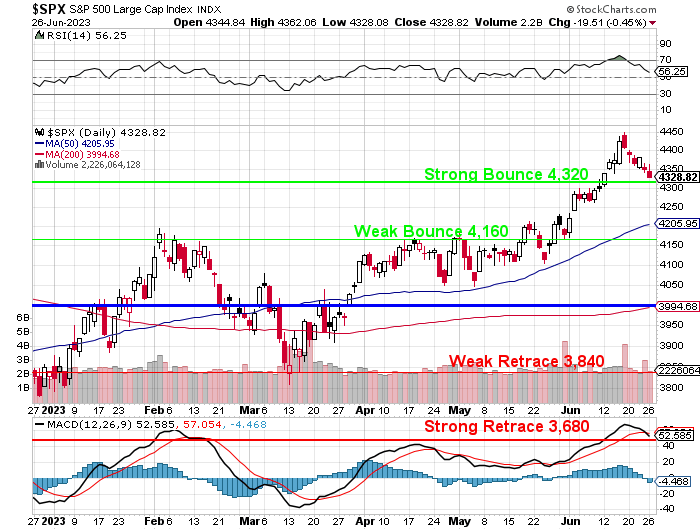

If this is a real rally and we’re heading back to 4,800 (that’s right – we’re still far from our highs) then the Strong Bounce Line (of the fall from 4,800 to 4,000) at 4,320 should provided support as it marks the spot where we slip back into the bottom 40% of the 4,000 to 4,800 range. Surely a strong market can stay out of the bottom 40%, right?

Should the market NOT be able to stay out of the bottom 40% – then it’s NOT strong. That seems really obvious, right? If your temperature is 98.6 degrees, then you are fine and we know 3.4 degrees higher (102) is about where you need to go to the hospital but also 3.6 degrees lower (95) marks hypothermia and also you need to go to the hospital.

People don’t think of stocks as being “too hot” but we try to teach our Members at PSW that stocks can indeed be too hot but it’s the support lines we’re talking about now as below those lines indicates the market is sick and in need of hospitalization – that’s why we watch them carefully.

Notice that MACD line on the bottom of the chart – it got REALLY HIGH but look what almost always happens when the MACD line tops out – you can get quite the retrace and pretty much the moment we fail to hold that Strong Bounce Line for a full 2 sessions – you can be sure we’ll be testing the Weak Bounce Line at 4,160 before the MACD is likely to reset.

In the longer-term chart, we’re also exhausting that MACD line and the RSI above as well. You may be tempted to look back at 2020 and 2021 and see how we just went up and up and up but that was because the Government spent $11,000,000,000,000 stimulating the economy during those years. Now the Fed is actively trying to DEflate the economy – that is the OPPOSITE of what was happening in 2020 and 2021.

Still, the 200-week moving average held up very well in October and it’s risen 226 (6.2%) points since then – which is roughly keeping up with inflation. We can assume that’s going to be a very solid support line and, at this pace, the 200 wma should cross 4,000 just about the end of the year. That means it’s not that likely we’ll have more than a 10% correction – unless some new bad thing happens.

So, we are back to waiting on Q2 earnings (July 14th) and this morning we heard from KFY, who beat by a penny but guided down, SCHN, who beat by 5%, SNX, who missed by 5% and gave awful guidance and WBA, who missed by 7% and gave awful guidance.

SNX and WBA are both down 10% and even poor SCHN is down – and they did a nice job! WBA is a stock we have played in the past but it’s not in our current portfolios. Back at $28.50 this morning is getting interesting again so let’s see what’s going on:

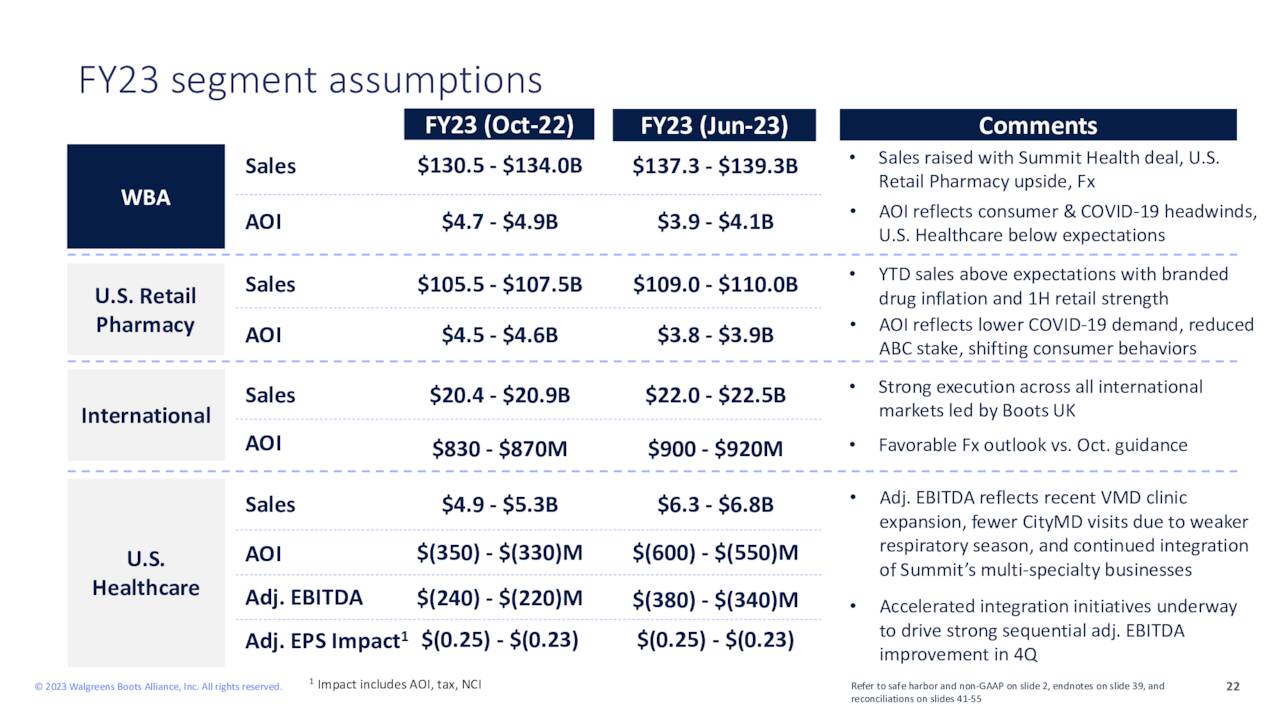

Walgreens Boots Alliance (WBA) is valued at $25Bn at $29/share and last year they made $4.3Bn and this year and next they were supposed to make around $4Bn and that makes sense as Covid is winding down and they got some of that $11Tn in stimulus giving everyone shots and such for the last two years. That’s over – deal with it!

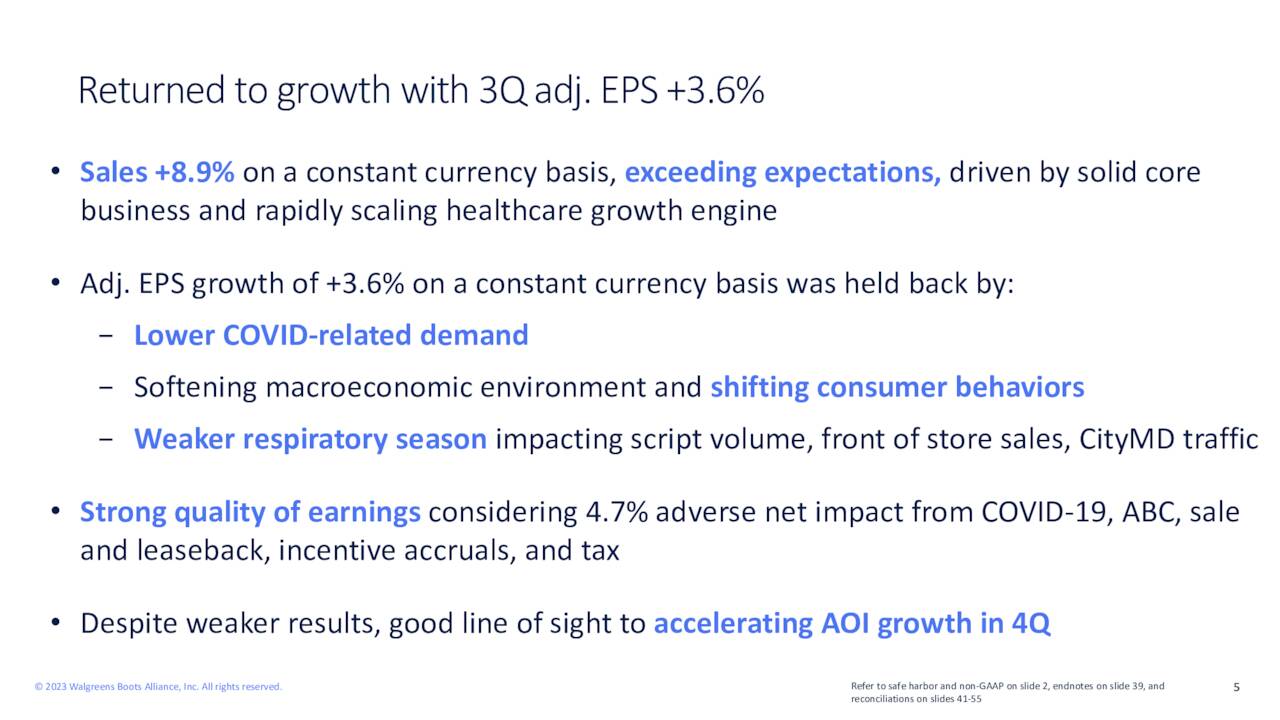

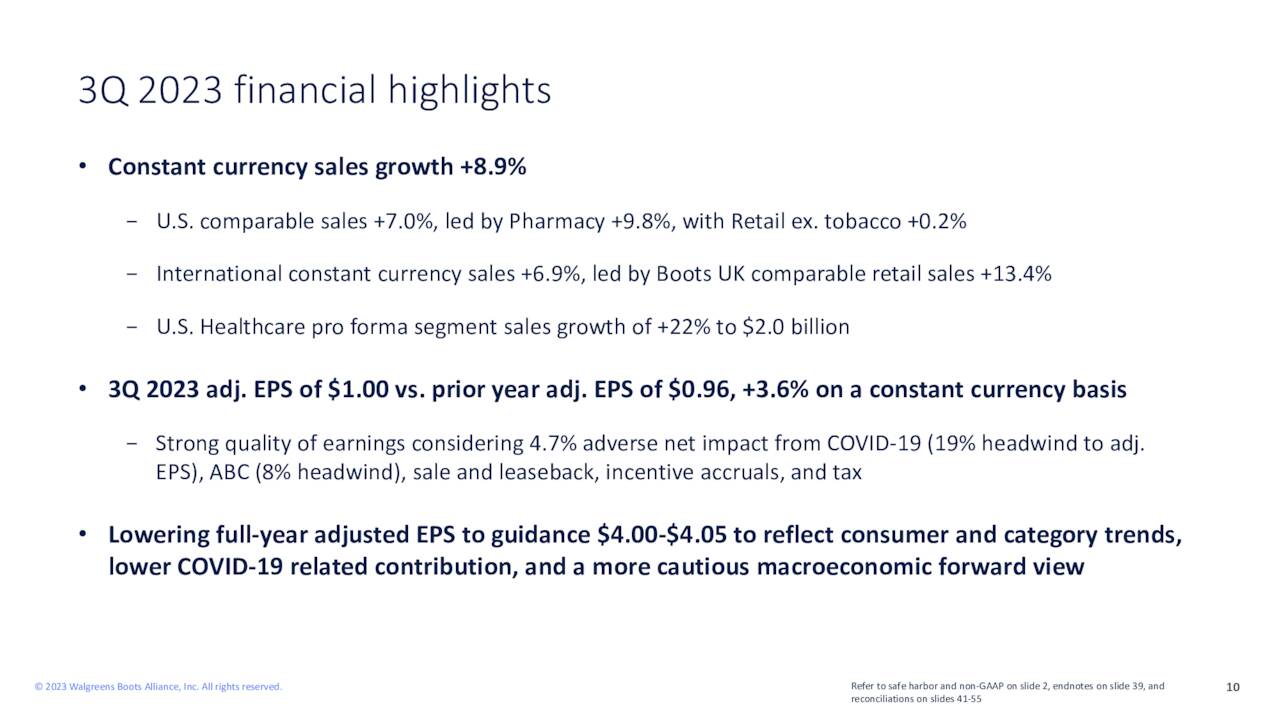

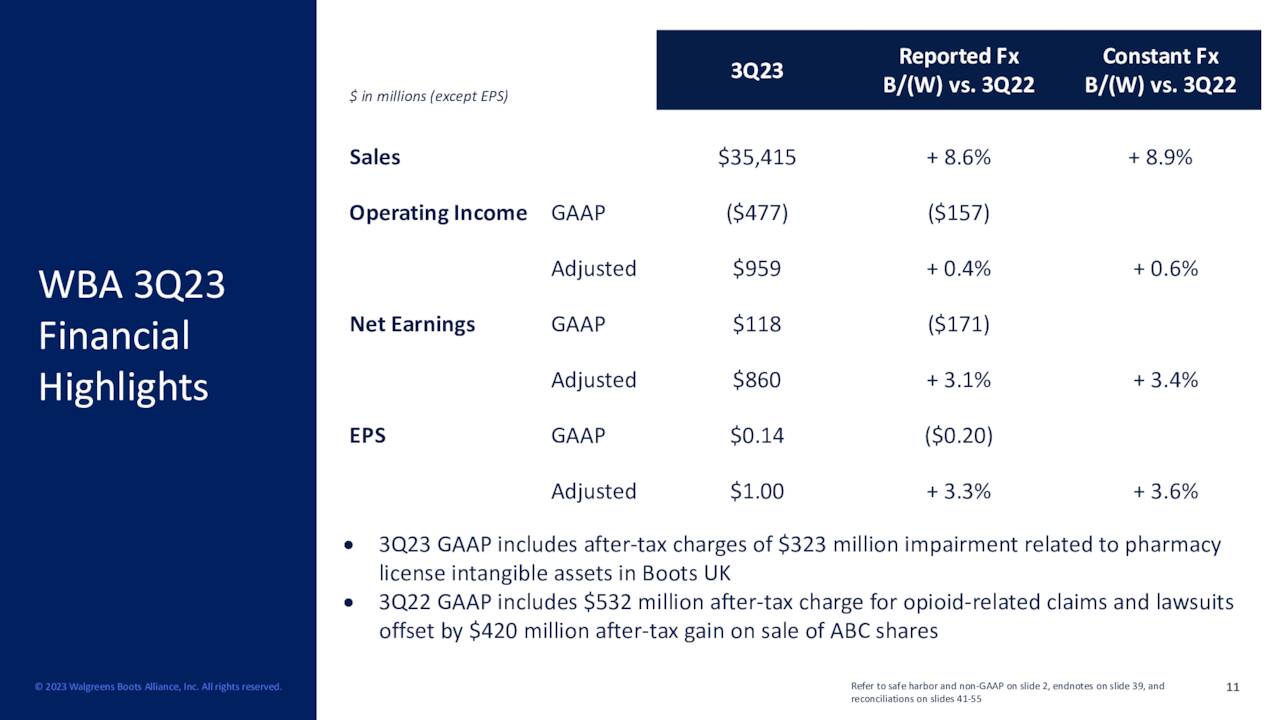

Nonetheless, top-line sales were $35.4Bn, which was up 9% from last year with more people out shopping with their newer HealthCare segment up 22% but margins dropped to 19% from 20.3% last year as WBA did only 800,000 Covid shots vs 4.7M a year ago.

Despite sales growth, “significantly lower demand for COVID-related services, a more cautious and value-driven consumer, and a recently weaker respiratory season created margin pressures in the quarter,” Chief Executive Rosalind Brewer said.

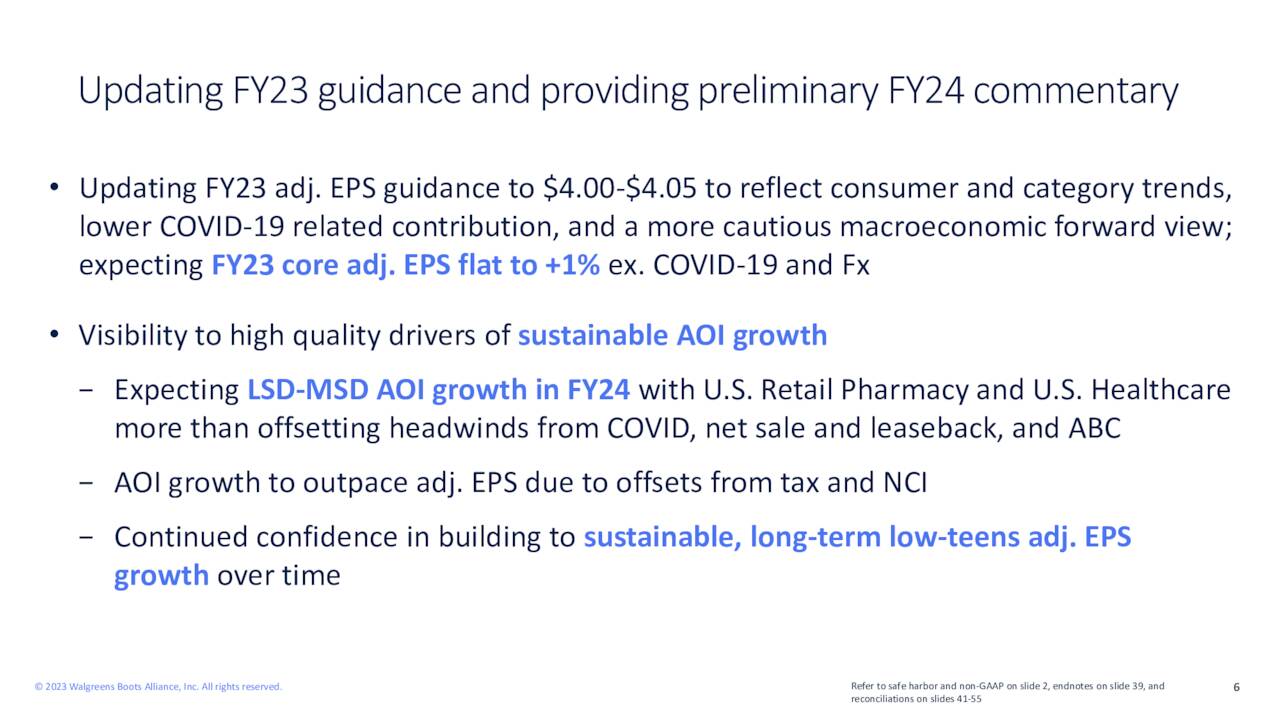

On the whole, WBA adjusted 2023 earnings expectations to $4-4.05 from $4.45-4.65 so a good 10% drop in expectations but $4 is still a 7.25 p/e – it’s insane to see people bailing out on this like they are going under. Yes, the Government is cracking down on Pharma pricing but WBA gets the same co-pays either way.

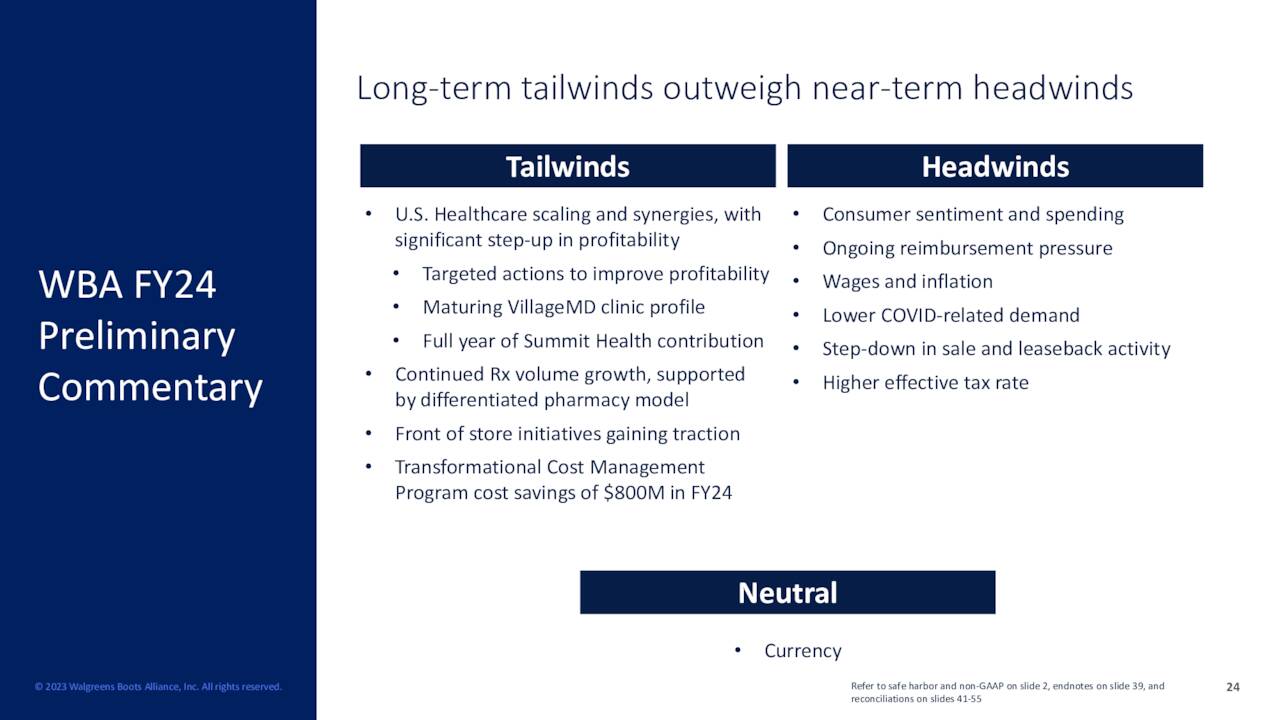

Here’s a few highlights from their Earnings Call Presentation:

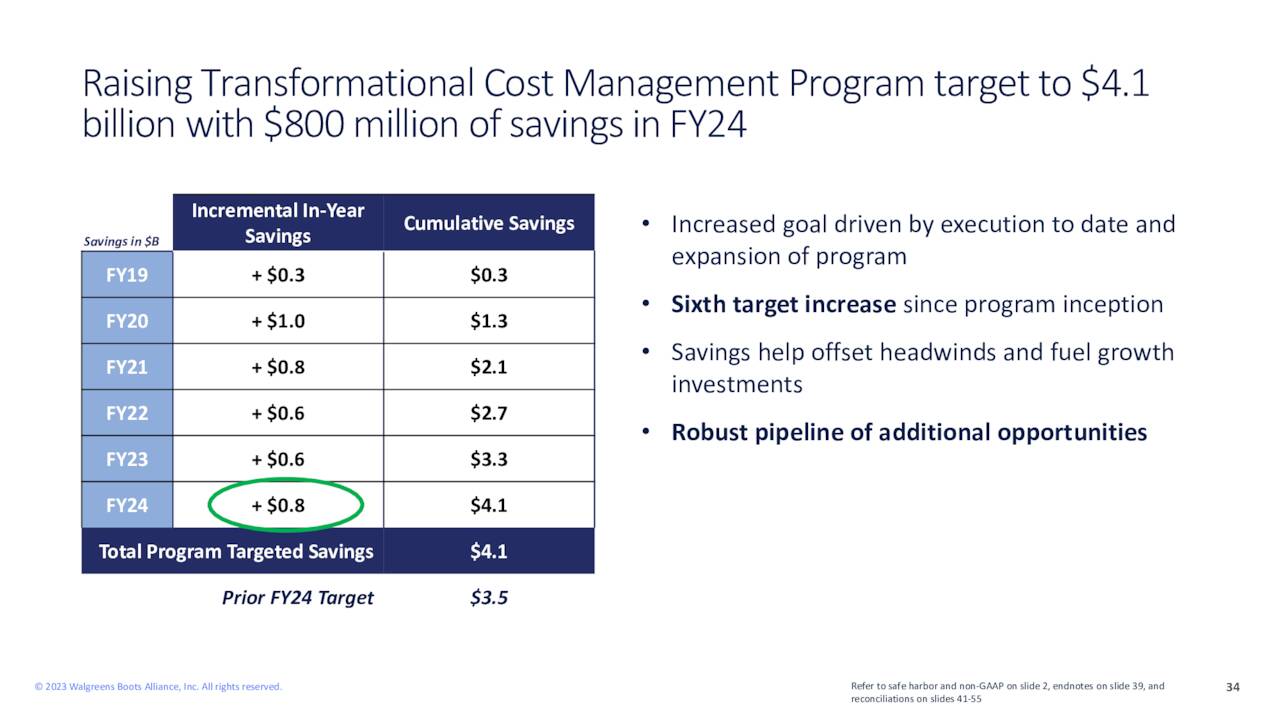

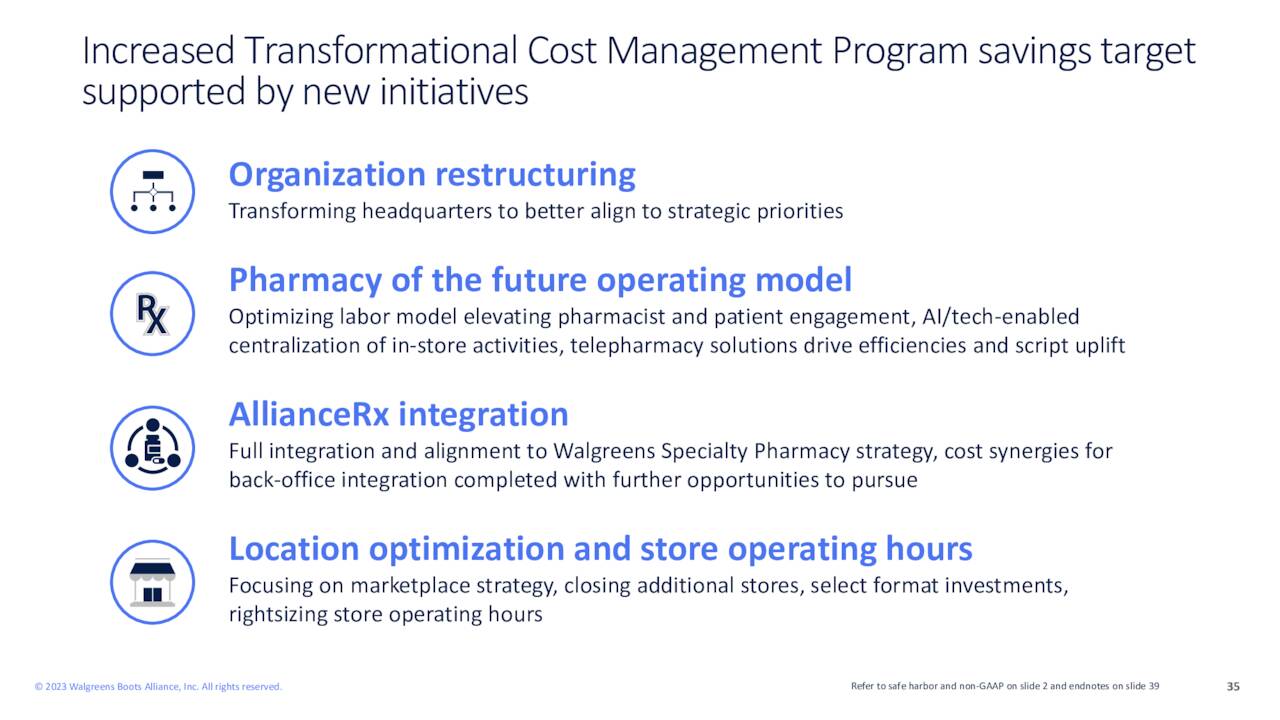

Now, when you are reading these slides, you have to keep things in perspective. WBA has $140Bn in sales and drops 2.85% to the bottom line so when you hear that Village MD will grow from $150M to $200M in the next two years – you should yawn. On the other hand, $800M in cost savings should be very doable as it’s only 0.5% of sales so you can imagine that can be done without burning down stores but $800M would add 20% to profits – that’s a realistic goal!

Like many companies with substantial overseas revenues, they were hurt by the strong Dollar but that’s kind of a great excuse and Boots is actually showing very nice growth in the UK.

They took an impairment charge and, for some reason, pharmacies are being held responsible for dispensing opiods that were prescribed by doctors. These are one-time items and certainly don’t mean their business is bad (though they will sell a lot less opiods going forward).

That’s a good slide! This is why it’s great to dig into these early reporting companies – they can give you great insight into their sector and the macros.

Sounds like it’s worth more than $28.50 to me! They do pay a fat $1.92 dividend so it is tempting to buy the stock but then we could also PROMISE to buy the stock by selling short puts. The 2025 $27.50 puts should be $5+ this morning and that nets us in for $22.50 at worse and $5 is far more money than we’d be paid in dividends for the next 18 months so why bother owning the stock?

-

- In our Short-Term Portfolio (STP), we like to make short put bets to offset our hedges so let’s sell 10 WBA 2025 $30 puts for $5 ($5,000) and, if it fails, we can always move the stock to the Long-Term Portfolio (LTP) and turn it into a play.

In the Income Portfolio, let’s add the following:

-

- Sell 15 WBA 2025 $27.50 puts for $3.65 ($5,475)

- Buy 20 WBA 2025 $27.50 calls for $4.20 ($8,400)

That’s net $2,925 on the uncovered calls which were $7 ($14,000) last week so massive upside potential (we intend to cover on the bounce) and the worst-case is we own 1,500 shares at net $29.45 – a bit over the current price. Then we can sell calls to reduce that basis.

Frankly, that’s so good I’d like to put it in all of our Portfolios but, for the sake of diversity, we’ll just play it like this for now.

I think earnings season is going to be fun this year!