We bought 3 more stocks yesterday.

We bought 3 more stocks yesterday.

We had to – in case the rally is real. It’s hard to tell but our logic (which we discussed in yesterday’s Live Trading Webinar) is that they are value stocks anyway – so we don’t mind adding more in a downturn. If the market goes up, we’ll make some nice returns for our Income Portfolio and we have identified 22 other stocks we’ll be discussing for our other Member Portfolios into the Holiday Weekend.

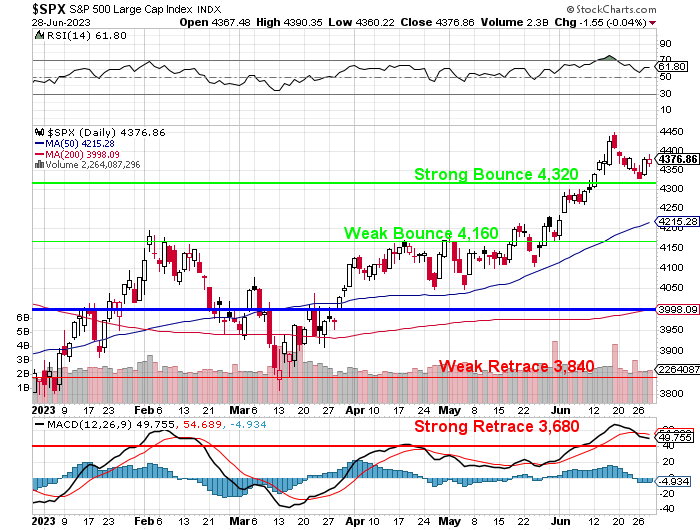

So far we’ve added BCS, BXMT and T as the Strong Bounce Line on the S&P 500 is holding up well in this low-volume week. As I noted yesterday, I’m still a bit concerned because last August, the S&P 500 fell from 4,300 back to 3,800 in October, down 11.6% in 3 months – triggered by lackluster earnings. It’s been pretty much all uphill since March but we’ll have to see if Q2 earnings live up to the hype.

I have said before that inflation should have taken us up over 4,400 as we’ve been using the 4,000 line for our base value since the 2020 crash but, unfortunately, every time we check the actual earnings of the S&P components, we can’t find a reason to justify moving that blue line higher.

The fact that we were able to find 25 stocks on our Watch List to buy while there’s supposedly a rally on is a little concerning but we know this is a very narrow-based rally and out “enthusiasm” for new stocks is based on the “rising tide lifting all ships” theory.

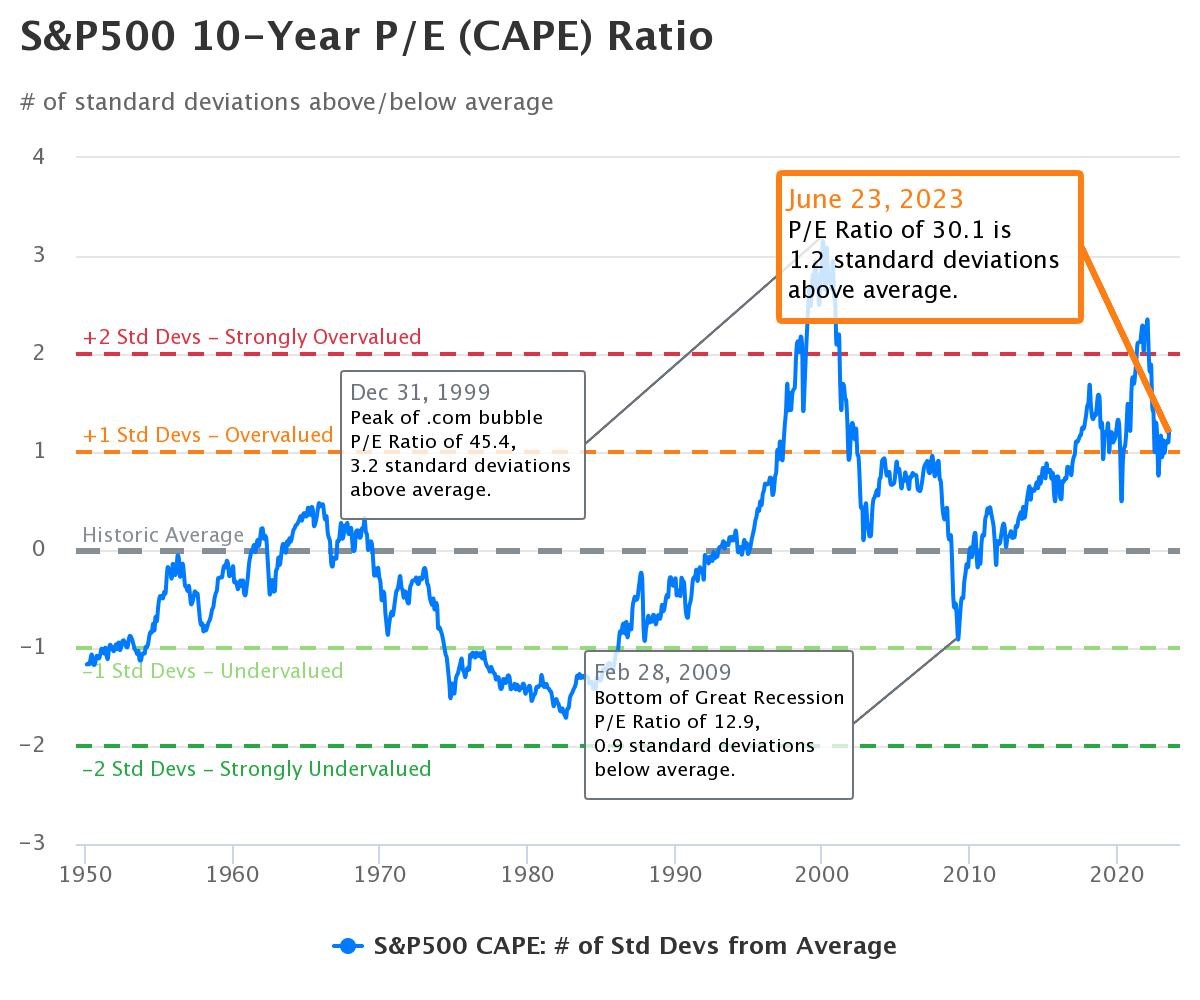

Again, not that we don’t love the stocks we have on our Watch List – it’s just that we’re not entirely sure the market isn’t going to crash back next week – after the windows are fully dressed tomorrow. That’s right, Q2 is coming to a close and half the year is over and, as you can see from the chart below – we’re clearly high in the valuation channel already:

The key takeaway here is that 30x means it takes the stocks you buy 30 years to return your investment – that’s 3.33% non-compounded interest. The problem with this at the moment is that 10-year notes return 3.76% and 1-year notes return 5.35% – MILES above what you make risking your money in the markets.

“But,” you might protest, “I’m making money, my stocks are going higher.” Unfortunately, it’s not the earnings of the stocks that are going higher – just the price you are paying for those earnings and the price you expect others to pay you – something known as “The Greater Fool Theory” for a reason.

As I discussed yesterday, Index prices and Stock prices are only a snapshot of what’s really happening at any given moment and sentiment plays a big factor in the perspective of your picture. Take a picture of a fly on your table and you think of swatting it but take a picture of a fly up very close and you think of running – it’s just perspective – it’s the same fly.

As I discussed yesterday, Index prices and Stock prices are only a snapshot of what’s really happening at any given moment and sentiment plays a big factor in the perspective of your picture. Take a picture of a fly on your table and you think of swatting it but take a picture of a fly up very close and you think of running – it’s just perspective – it’s the same fly.

On the other hand, value is value and we’ve selected 25 stocks that haven’t gone wild and should present a good value that will hold up – even if stocks around them begin to cool down. If the rally is real, however, and moving into spectacular territory, these stocks should play a bit of catch-up and give us some very exciting returns. From our December 28th Watch List (Members Only) – here’s a few of our pics that have already taken off:

See – SPECTACULAR! But there are still perfectly good stocks that simply haven’t been recognized yet and those are the ones we are focusing on ahead of earnings though WBA, for example, we just added because they missed earnings – as we thought they were oversold. We used to have an Earnings Portfolio that specifically took advantage of that situation but we simply added WBA to the LTP in Tuesday morning’s Report.

There’s always something to buy and we don’t like to overstuff our portfolios when we don’t have good information and, hopefully, Q2 earnings will provide better information but, for now, we’re adding a little bit ahead of earnings – in case they are better than we expect.

Keep in mind, we wouldn’t be doing any of this if we didn’t have our hedges. The Fed claimed yesterday that all 23 major banks passed their “stress test” but, oddly enough – they said the same thing last quarter when there were 26 banks last year – 3 of them have collapsed since then. Actually though, if you read the report, it does contain this note:

“The banks in this year’s test hold roughly 20 percent of the office and downtown commercial real estate loans held by banks. The large projected decline in commercial real estate prices, combined with the substantial increase in office vacancies, contributes to projected loss rates on office properties that are roughly triple the levels reached during the 2008 financial crisis.”

See, everything is fine! <end sarcasm font>