Thank goodness for AI!

Thank goodness for AI!

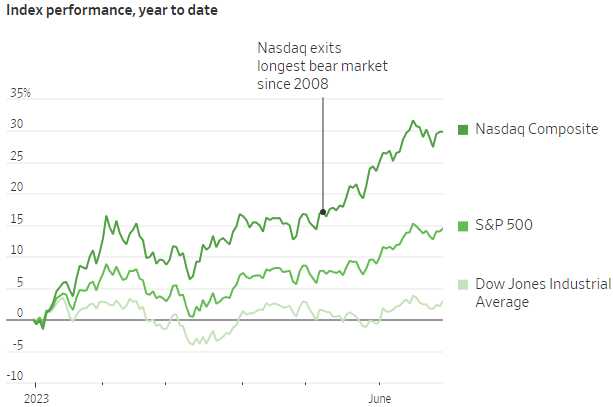

The Nasdaq is up 30% for the year and the S&P 500 is up 15 and the Dow, well there’s also the Dow… Still, on the whole, it’s been an exciting first half though the big, big winner (aside from NVDA) is Bitcoin, which is up 80% in 6 months. These are, then, sort of mixed signals but, fortunately, Crypto currencies are not measured against the index basket of Fiat currencies or inflation would be 80% higher than it is now. That would make the Fed very unhappy!

Bitcoin is up DESPITE the SEC suing the World’s biggest crypto-currency exchanges, mainly because both Fidelity and Black Rock are setting up Bitcoin ETFs – it’s going to be a very interesting year in crypto.

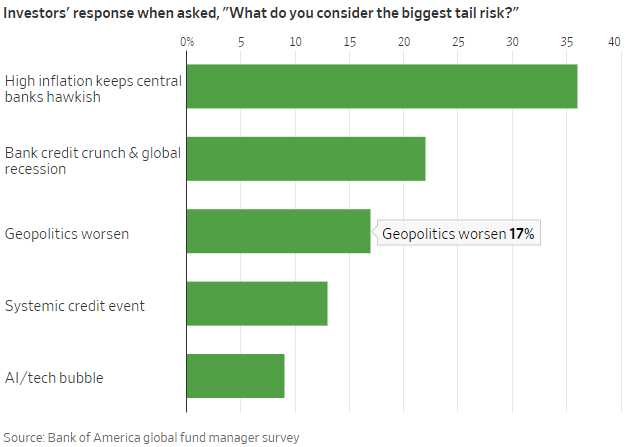

Sure we had a major banking crisis associated with Crypto this year but people have forgotten that already (it was March, after all). Only 22% of all Fund Managers surveyed were worried about “Bank Credit Crunch & Global Recession” and NOT EVEN 10% were worried about a bubble in tech after a 30% Nasdaq rally – what could possibly go wrong?

The Fed’s rate increases haven’t ended the economic expansion. Commerce Department data on Wednesday showed Gross Domestic Product increased at a 2% annualized pace in the first quarter, significantly faster than the previous estimate of 1.3%. The Labor Market has continued to add jobs at a pace well above its pre-pandemic average as well.

This morning, Personal Income was up 0.4% in May and that was flat from last month but Personal Spending fell sharply to 0.1% vs 0.6% last month – indicating a very sudden slowdown on that front. In related news, PCE prices fell from 0.4% in April to 0.1% in May but, overall, it’s still off the charts high:

As I have warned in the past, Personal Income and Personal Spending have to line up – especially as Consumers have now racked up record levels of debt trying to keep up with inflation. There simply is no more left to borrow and no one wants to refinance their homes at 6% – that piggy bank is closed!

So, if Income doesn’t go up, Spending has to come down and so slows the economy. I know it seems pretty obvious but apparently not to people who are paying 30x for the average S&P stock and 40x on the Nasdaq.

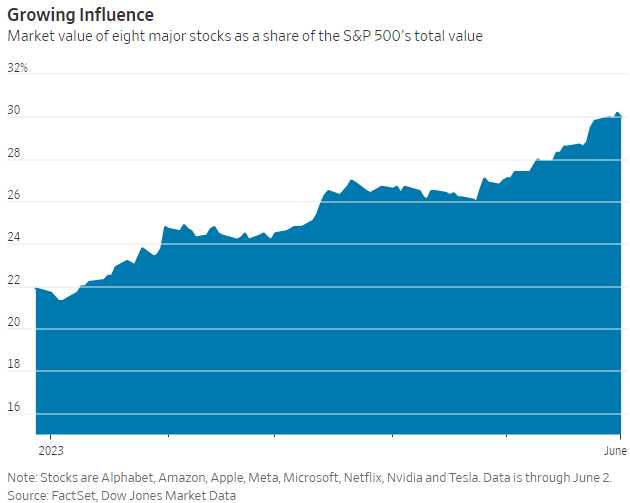

Unfortunately, the gains are so narrowly based. Just 8 of 500 stocks in the S&P are responsible for 8% of the 15% gain in the entire index and that’s from June 2nd – they are more like 10% of the 15% by now! NVDA alone just jumped 33% from last month, TSLA 30% in June and META is up 40% since April.

Unfortunately, the gains are so narrowly based. Just 8 of 500 stocks in the S&P are responsible for 8% of the 15% gain in the entire index and that’s from June 2nd – they are more like 10% of the 15% by now! NVDA alone just jumped 33% from last month, TSLA 30% in June and META is up 40% since April.

Just those 3 stocks are worth $2.6Tn in market cap and NVDA projects $20Bn in earnings and TSLA projects $12Bn in earnings and META should make $31Bn for a combined $63Bn in earnings and all you have to do is multiply that by 41 to get to $2.6Tn – what us worry?

Effectively 40x earnings is a 2.5% annual return while 1-Year Treasury Notes are paying 5%. Just like the way Personal Spending and Personal Incomes need to converge at some point, so do interest rates and market multiples as they are both places people invest their cash to get returns. Either stocks will come down or rates will go up – one day.

Have a great Fourth of July!

-

- Phil