After a Q1 that was stellar across the board (with some exceptions), Q2 was more mixed for financial markets and assets.

As DB’s Henry Allen writes in his monthly asset performance review note, some assets did really well, with tech stocks seeing a strong outperformance thanks to excitement around AI. That extended to other risk assets, and volatility continued to fall as there were no signs of broader financial contagion after the bank crisis in March. However, sovereign bonds lost ground after inflation remained sticky and central banks kept taking rates higher. Commodities also struggled across the board, with Brent crude oil prices down for a 4th consecutive quarter because while no other market has priced in recession, oil has… twice. All-in-all, Allen writes that we had one of the most even quarters in a while in performance terms, with 22 of the 38 non-currency assets in the Deutsche Bank sample ending Q2 in positive territory. But the strong Q1 means that more assets are still positive over the year as a whole, with 31 out of 38 in positive territory on a YTD basis.

Quarter in Review – The high-level macro overview

Following the significant market turmoil in mid-March, Q2 got off to an uncertain start as investors pondered whether there might be more bank failures. In particular, First Republic Bank came under growing pressure before it was closed on May 1, making it the third FDIC bank to fail this year after SVB and Signature. JPMorgan acquired most of its assets (with a taxpayer loan courtesy of the FDIC, making the transaction effectively a gift to king Jaime), and on May 4 the KBW Banks Index closed at its lowest level in over two years. But for the time being at least, what was remarkable in Q2 was how isolated the financial turmoil proved. In fact by June, the VIX index of equity volatility had fallen back to its lowest level since the start of the pandemic, ending the quarter at just 13.59pts.

With the financial turmoil looking more contained, central banks maintained their focus on persistent levels of inflation. Indeed, whilst headline inflation continued to decline in Q2, core inflation remained much more stubborn. For instance, US core PCE inflation was still at 4.6% in the latest data for May, which was barely beneath the 4.7% level from three months earlier. Likewise in the Euro Area, core inflation was still at 5.4% in June, only slightly beneath its 5.7% level back in March.

Elevated inflation meant that central banks kept taking their policy rates higher. The Fed hiked by another 25bps in May, and although they paused in June for the first time in over a year, their dot plot signalled two further rate hikes for the rest of 2023. Meanwhile at the ECB, they hiked by 25bps in both May and June, taking their deposit rate up to 3.5%. That was given added support by strong data, with the US economy in particular continuing to show signs of resilience. Indeed, nonfarm payrolls for April (+294k) and May (+339k) were still rising at a robust pace, and the numbers of continuing jobless claims have been on a downward trend since their peak in early April.

With inflation remaining persistent and central banks staying hawkish, that meant sovereign bonds struggled in Q2. US Treasuries were down -1.4%, bringing an end to two consecutive quarterly gains, whilst German bunds saw a more modest -0.4% decline. However, it was gilts (-6.0%) that saw the worst performance, falling to their lowest levels since the mini-budget turmoil last October. That followed several upside inflation surprises in the UK, where the CPI inflation rate is the highest in the G7, as well as an unexpected 50bp hike from the Bank of England in June. Markets are also pricing in a more aggressive tightening cycle for the Bank of England relative to other central banks, with overnight index swaps pricing in a terminal rate that’s above 6%.

Despite the concerns about inflation and the selloff for sovereign bonds, risk assets mostly had a decent time over Q2. For instance, the S&P 500 advanced by +8.7% in total return terms, which follows a +7.5% gain in Q1 and marks its best quarter since Q4 2021. In Japan, the Nikkei (+18.5%) just had its second-best quarterly performance of the last decade, and is one of the very few financial assets that has advanced in every month of 2023 so far. In Europe, the STOXX 600 (+2.7%) was more subdued, but it still recorded a 3rd consecutive quarterly advance as well.

At the sectoral level, tech stocks were the big outperformer once again, with the NASDAQ up +13.1%, and the FANG+ index of megacap tech stocks up +25.2%. That was thanks to strong excitement about the potential of AI to improve productivity and boost economic growth. Indeed, one of the standout company performances over Q2 was Nvidia (+52.3%). Their share price surged in late May after they reported earnings with an outlook far above expectations, thanks to demand for AI processors. And on a YTD basis, Nvidia has now risen by +189.5%. However, with tech stocks having outperformed so strongly in recent months, it’s worth noting that the equal-weighted S&P 500 hasn’t done as well as its standard counterpart, rising by a smaller +4.0% over Q2.

Another factor supporting markets was a resolution of the US debt ceiling, which led to significant market volatility for a brief period. Indeed, yields on T-bills maturing around the X-date briefly traded with a 7 handle, demonstrating how investors were demanding extra compensation to hold the bills at risk of default. However, on May 27 a deal was reached, which was then signed into law by President Biden on June 3.

Which assets saw the biggest gains in Q2?

- Equities: Global equities advanced for a third consecutive quarter, with the S&P 500 (+8.7%), STOXX 600 (+2.7%) and the Nikkei (+18.5%) all advancing. Not everywhere was positive however, and the Shanghai Composite (-1.1%) lost ground, whilst the MSCI Emerging Markets Index (+1.0%) only posted a modest gain.

- British Pound: Despite UK equities and bonds underperforming, the pound was actually the strongest-performing G10 currency, with a +3.0% rise against the US Dollar. That now takes it up to $1.27 and marks its third consecutive quarterly gain.

Which assets saw the biggest losses in Q2?

- Sovereign Bonds: It was a rough quarter for sovereign bonds as inflation remained sticky and central banks kept hiking rates. Gilts were the worst performer with a -6.0% decline, but Treasuries (-1.4%) and bunds (-0.4%) also lost ground. Italian BTPs (+0.8%) were one of the few outperformers, and the spread of Italian 10yr yields over bunds tightened by -13.5bps over Q2, in line with the broader positivity for risk assets.

- Commodities: It was a tough time for commodities in Q2, with losses across the board. Brent crude oil prices fell by -6.1%, with WTI also down by -6.6%. Among metals, copper (-8.6%) saw a strong decline, and both gold (-2.5%) and silver (- 5.5%) fell back too. And for agricultural goods, there were declines for wheat (- 8.1%) and corn (-16.0%).

- Japanese Yen: With no sign of the Bank of Japan tightening policy yet, the Japanese Yen lost further ground over the quarter, leaving it at 144 per US Dollar. Over the quarter as a whole, it weakened -7.9%, bringing its YTD losses to -9.1%.

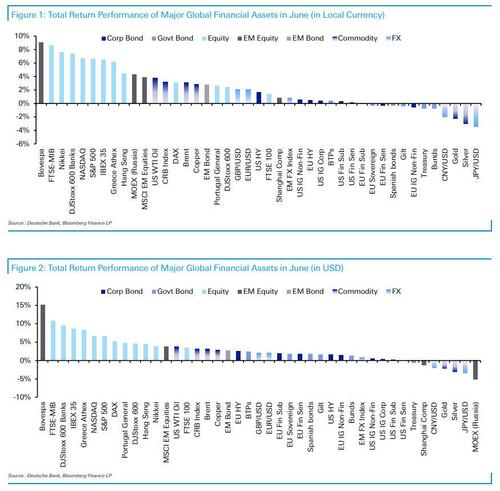

Finally, here is a summary of the best performing assets in June…

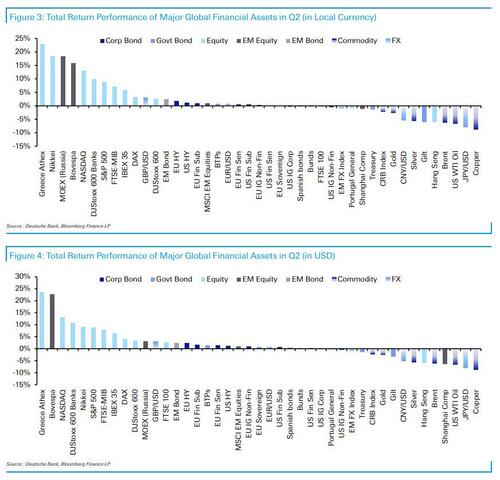

… in Q2:

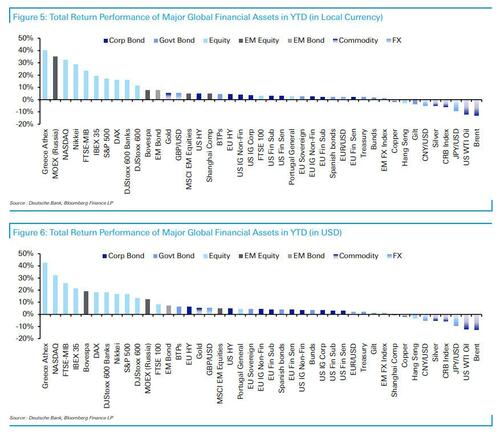

… and in the first half of 2023:

Full report available to professional subscribers.