“Because I’m easy come, easy go,

“Because I’m easy come, easy go,

Little high, little low,

Any way the wind blows doesn’t really matter to

Me, to me” – Queen

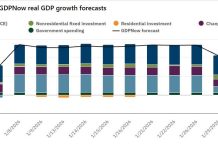

Markets are off about 1% this morning as ADP reported 497,000 new jobs in June, more than doubling the consensus estimate of our leading Economorons of 225,000.

I just spent a the first half of yesterday’s Webinar talking about how jobs and payrolls will continue to drive inflation for a long, long time but it feels way too soon to say “I told you so” – though it certainly is a good thing that we doubled down on our hedges in our $700/Month Portfolio yesterday morning – just in case reality happened.

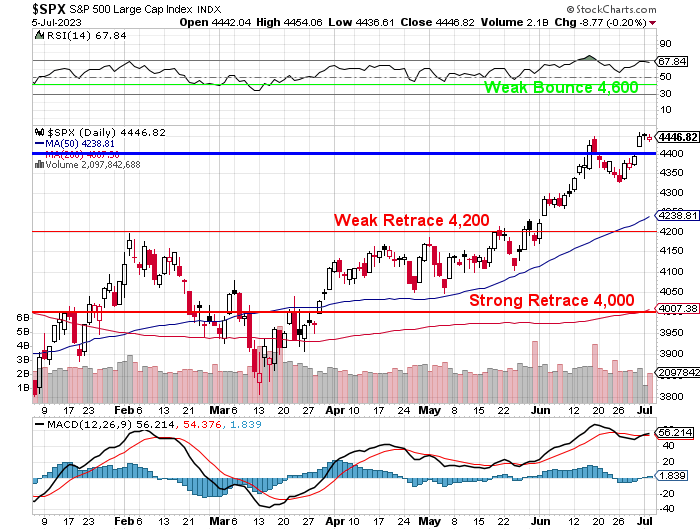

We’ll be testing the 4,400 line from the top (again) and we’ll see if it holds up as support this time. If not, back to our old chart, where we’ll expect a visit to the 4,000 line – a 10% overall correction from where we are.

That makes some sense as the Fed is hiking rates 10% (0.5%) from where they are now (5%) and, this morning, Dallas Fed President and Superman’s ex-girlfriend, Lorie Logan said that “a more restrictive policy is needed for the FOMC to reach their goals” and that last meeting was just a pause ahead of more hikes.

Logan noted that forecasts released at the June FOMC meeting showed an expectation of more increases, and said “it is important for the FOMC to follow through on the signal we sent in June,” adding “two-thirds of FOMC participants projected at least two more rate increases this year.”

Logan noted that forecasts released at the June FOMC meeting showed an expectation of more increases, and said “it is important for the FOMC to follow through on the signal we sent in June,” adding “two-thirds of FOMC participants projected at least two more rate increases this year.”

“I remain very concerned about whether inflation will return to target in a sustainable and timely way,” Logan said, adding “the continuing outlook for above-target inflation and a stronger-than-expected labor market calls for more-restrictive monetary policy,” the policymaker said.

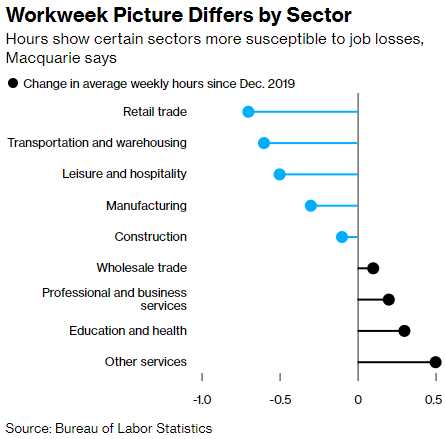

As you can see, the Fed is far, far away from quelling the Biden jobs boom. We get the official Non-Farm Payroll Report tomorrow morning but there’s also an underlying current of weakness, especially in the Retail, Transportation and Hospitality sectors, where the average workweek has been declining by 0.5%, which may not seem like a lot but it’s very statistically significant because it means hundreds of thousands of jobs could be cut with no impact on the employers.

As you can see, the Fed is far, far away from quelling the Biden jobs boom. We get the official Non-Farm Payroll Report tomorrow morning but there’s also an underlying current of weakness, especially in the Retail, Transportation and Hospitality sectors, where the average workweek has been declining by 0.5%, which may not seem like a lot but it’s very statistically significant because it means hundreds of thousands of jobs could be cut with no impact on the employers.

Notice the areas where we have significant overtime (job shortages) are generally specialties that the laid off service workers are unlikely to match up for. That then is a mis-matched labor force that can cause problems for the economy.

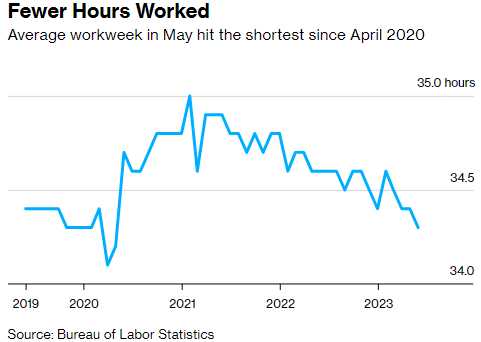

In May, the average number of hours worked in the US hit the lowest level since the entire country was shut down during Covid – that’s NOT GOOD! In fact, yesterday we were talking about how ridiculous it was to expect people to live on the nation’s $7.25 Minimum Wage, which is still the law in 20 US States. $7.25 works out to $290 for 40 hours a week but, at 34 hours, it’s just $255 – ask a person who makes $1,200/month whether they can spare $45/week!

In May, the average number of hours worked in the US hit the lowest level since the entire country was shut down during Covid – that’s NOT GOOD! In fact, yesterday we were talking about how ridiculous it was to expect people to live on the nation’s $7.25 Minimum Wage, which is still the law in 20 US States. $7.25 works out to $290 for 40 hours a week but, at 34 hours, it’s just $255 – ask a person who makes $1,200/month whether they can spare $45/week!

Another concerning bit of data in the report is that workers who stayed in their jobs experienced a 6.4% pay increase in June from a year ago. For those who changed jobs however, the median rise in annual pay was 11.2% – that means there is still a LOT of pressure on employers to increase wages to retain staff in a tight environment – VERY inflationary!

We’ll see what kind of correction we get today but Shel-Bot told us yesterday that Non-Farm Payrolls will also be more than expected tomorrow – so maybe another sell-off to come on that data as well.

Be careful out there!