A quiet-ish day on the macro front today as the ‘main events’ lie ahead of us but Wholesale Sales disappointedly declined and Consumer Credit rose dramatically less than expected.

However, a murder of Fed Speakers certainly made clear how they feel, all singing from the same hymn-sheet – ‘High(er) For Long(er)’ it is:

-

*BARR: INFLATION IS STILL FAR TOO HIGH, RATES CLOSE TO RESTRICTIVE BUT FED STILL HAS WORK TO DO

-

*MESTER: INTEREST RATES NEED TO MOVE UP SOMEWHAT FURTHER, WILL NEED TO HOLD RATES AT PEAK FOR A WHILE

-

*DALY: INFLATION PRINTING TOO HIGH; LIKELY TO NEED A COUPLE MORE RATE HIKES, RISK OF DOING TOO LITTLE ON RATES OUTWEIGH DOING TOO MUCH

-

*BOSTIC: MAY NEED TO DO MORE ON RATES IF INF. EXP. UNANCHOR, COMFORTABLE TO LET RESTRICTIVENESS PLAY OUT

Small Caps ripped at the cash open as big-tech tumbled – with Nasdaq rebalancing plans weighing on the S&P and Nasdaq. Late-day melt-up dragged Nasdaq barely green…

Today’s shift took the Nasdaq 100 down to recent support relative to the Russell 2000…

Growth stocks underperformed Value…

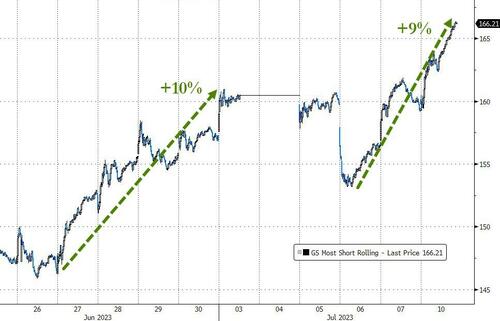

A massive short-squeeze has been underlying the moves of the last three days with ‘most shorted’ stocks up 9% from Thursday’s post-open (ADP plunge) lows…

Source: Bloomberg

Despite The Fed’s proposals to increase capital requirements for smaller ‘large banks’, regional banks managed gains today…

Treasury bonds were aggressively bid across the board with the belly outperforming (5Y -12bps, 30Y -1bps)…

Source: Bloomberg

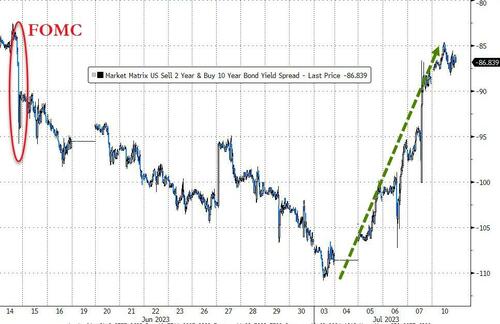

Which steepened the yield curve (2s10s) significantly – now back at its least inverted since June’s FOMC…

Source: Bloomberg

The 2Y Yield extended its decline from the pre-SVB peak levels in March…

Source: Bloomberg

The dollar was clubbed like a baby seal today as the yen eyed a four-month retracement level at 141.42 after falling below the June 15 high, the pound nears its 2023 high, and the euro challenging the top of a two-year triangle formation. The dollar index is back in a comfortable recent trading range…

Source: Bloomberg

Bitcoin rallied today after positive comments from former SEC Chair on ETF regulatory hurdles.

₿𝗥𝗘𝗔𝗞𝗜𝗡𝗚: Former SEC Chairman says

the #bitcoin ETFs could be approved.‘We have insitutions that know markets better than anybody, and they are putting their names and reputations behind bitcoin.’

‘I find that remarkable.’pic.twitter.com/7SNJaR5odo

— Documenting ₿itcoin 📄 (@DocumentingBTC) July 10, 2023

BTC broke out of its recent range but only modestly…

Source: Bloomberg

Oil prices were lower on the day…

Gold was flat on the day, despite a puke lower into the London Fixing…

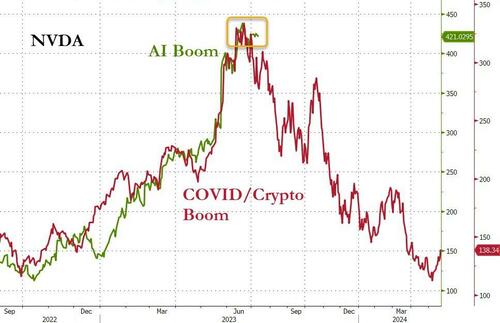

Finally, can NVDA extend from here or is the COVID/Crypto-Boom pull-forward deja-vu about to happen all over again…

Source: Bloomberg

We will know soon as earnings loom. Let’s just hope it’s not all hype…”We are nowhere near achieving artificial general intelligence (AGI). Those who believe AGI is imminent are almost certainly wrong.”