After a turbulent week for stocks and especailly for bonds, where 10yr yields closed the week above pre-SVB levels for the first time since that major accident and 2yr yields traded briefly above 5% for the first time too, the direction of travel in markets over the next several weeks will be set by US CPI on Wednesday and as DB’s Jim Reid writes this morning, “will take something remarkable elsewhere for it not be the most important event this week.”

Additionally, there is also plenty of Fed speak before and after the release (at least 9 Fed speakers on deck) so their response to it and to payrolls last Friday will be very closely watched too. The other highlights in the US include the Beige Book (Wednesday), PPI, jobless claims (both Thursday), and the University of Michigan survey (Friday) which includes the important inflation expectations series. In addition, Friday sees JPMorgan, Citigroup and BlackRock report as Q2 earnings season slowly starts this week.

Over in Europe, notable economic indicators include the Euro and German ZEW survey (tomorrow), UK’s labour stats (tomorrow), and the UK monthly GDP report (Thursday). The ECB account of their June meeting (Thursday) will be another interesting release given the increased pricing of a September hike in markets of late.

Staying with central banks, the Bank of Canada decision on Wednesday will also be of note. Markets are expecting a 25bps hike now after strong Canadian payrolls on Friday.

Going through a few points in more detail now.

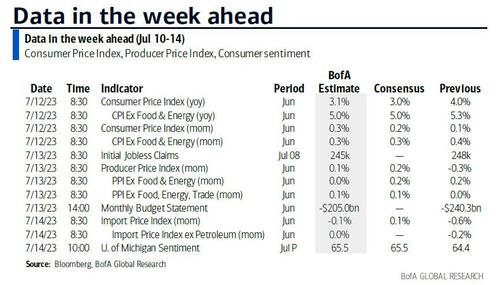

For US CPI, DB economists (full preview available in full here to pro subs) expect a +0.20% mom gain for headline CPI (vs. +0.12% previously, consensus +0.3%) and a +0.28% increase for core (vs. +0.44%, consensus +0.3%) which would have the YoY rate for the former dropping by a full percentage point to 3.1%, while that for the latter would drop by 30bps to 5.0%, both in line with consensus. This would leave the three- (4.6% vs. 5.0%) and six-month annualized (4.8% vs. 5.1%) core rates still well above the Fed’s target.

Another piece of the inflation puzzle will come from the University of Michigan’s consumer sentiment survey on Friday. The focus will likely be on whether the drop in 12-month inflation expectations will prove sustainable, after the latest reading of 3.3% was the lowest since March 2021 (consensus 3.1% this month) and now converging back to the long-term series which is at 3% at the moment.

In the UK, the labor market stats tomorrow (including the crucial wages number) will be important given recent big Gilt moves.

There will be a few events to watch in geopolitics as well this week, starting with US President Biden’s current trip to Europe from yesterday to Thursday. It will also include NATO’s annual summit in Vilnius held tomorrow and Wednesday, where Ukraine’s potential membership path will be a key point to watch. The G20 finance ministers and central bankers meeting will take place in Gandhinagar on July 14-18.

Finally, as noted above, earnings season begins this Friday when we get JPMorgan, Citigroup and BlackRock report Q2 earnings.

Here is a day-by-day calendar of events courtesy of DB

Monday July 10

- Data: US May wholesale trade sales, consumer credit, China June CPI, PPI, Japan June Economy Watchers Survey, bank lending, May trade balance, Canada May building permits

- Central banks: Fed’s Barr, Daly, Mester and Bostic speak, ECB’s Herodotou speaks, BoE’s Governor Bailey speaks

Tuesday July 11

- Data: US June NFIB small business optimism, UK May weekly earnings, June jobless claims change, Japan June M2, M3, machine tool orders, Italy May industrial production, Germany and Eurozone July ZEW survey

- Central banks: ECB’s Villeroy speaks

Wednesday July 12

- Data: US June CPI, Japan June PPI, May core machine orders

- Central banks: Fed’s Beige Book, Fed’s Bostic, Barkin, Kashkari and Mester speak, ECB’s Vujcic and Lane speak, BoE’s Governor Bailey speaks, BoE’s financial stability report, BoE’s Breeden and Foulger speak, BoC decision

Thursday July 13

- Data: US June PPI, monthly budget statement, initial jobless claims, China June trade balance, UK May monthly GDP, trade balance, industrial production, index of services, construction output, Germany May current account balance, Eurozone May industrial production

- Central banks: ECB’s account of the June meeting, Fed’s Waller speaks

- Earnings: PepsiCo, Delta Air Lines

Friday July 14

- Data: US July University of Michigan survey, June import and export price index, Japan May capacity utilization, Italy May trade balance, general government debt, Eurozone May trade balance, Canada June existing home sales, May manufacturing sales

- Earnings: JPMorgan Chase, Citigroup, BlackRock, UnitedHealth, Wells Fargo, EQT AB, Ericsson

* * *

Finally, focusing on just the US, Goldman writes that the key economic data releases this week are the CPI report on Wednesday and the University of Michigan preliminary report on Friday. There are several speaking engagements from Fed officials, including governors Barr and Waller, and presidents Daly, Mester, Bostic, Barkin, and Kashkari.

Monday, July 10

- 10:00 AM Wholesale inventories, May final (consensus -0.1%, last -0.1%)

- 10:00 AM Fed Governor Barr speaks: Fed Vice Chair for Supervision Michael Barr will participate in a discussion at the Bipartisan Policy Center on bank supervision and regulation, including new capital requirements. A moderated Q&A is expected. On June 20, Barr said, “Instead of thinking of a stressful scenario and then seeing how it would play through on, say, the balance sheet of a firm, you look at a bank and you say, well, what would it take to break this institution? What are the different ways this institution could die, or a piece of it, a significant piece of it?” He added, “We’re not an institution that moves quickly on supervisory issues. We tend to have a culture that makes it difficult for the institution to act quickly with respect to supervision.”

- 11:00 AM San Francisco Fed President Daly (FOMC non-voter) speaks: San Francisco Fed President Mary Daly will discuss inflation and bank supervision at the Brookings Institution. A moderated Q&A is expected. On May 22, Daly said, “We have to be extremely data-dependent…Meeting-by-meeting decisions become really the most prudent path…If we’ve tightened too much, we can easily create an unforced error.”

- 11:00 AM Cleveland Fed President Mester (FOMC non-voter) speaks: Cleveland Fed President Loretta Mester will discuss the economic and policy outlook at a virtual event hosted by the University of California at San Diego. Speech text and a Q&A with audience are expected. On May 26, Mester said, “What I’d like to do is get…to a level of the funds rate where I could say, OK, in my mind, there’s [an equal probability the next move is] up or down, whenever that move would be. And I don’t think we’re there yet because I think inflation has just…remained stubborn.”

- 12:00 PM Atlanta Fed President Bostic (FOMC non-voter) speaks: Federal Reserve Bank of Atlanta President Raphael Bostic will participate in a discussion at the Cobb Chamber of Commerce. A Q&A with audience and media is expected. On June 29, Bostic said, “We have reached a level of the nominal federal funds rate that should be sufficient to move inflation toward the 2% target over an acceptable timeframe.” He added, “The data, survey results, and on-the-ground intelligence constitute a reasonable case that gradual disinflation will continue…I believe that will happen, even if the Committee does not increase the federal funds rate.”

Tuesday, July 11

- 06:00 AM NFIB small business optimism, June (consensus 89.9, last 89.4)

Wednesday, July 12

- 08:30 AM CPI (mom), June (GS +0.25%, consensus +0.3%, last +0.1%); Core CPI (mom), June (GS +0.22%, consensus +0.3%, last +0.4%); CPI (yoy), June (GS +3.08%, consensus +3.1%, last +4.0%); Core CPI (yoy), June (GS +4.93%, consensus +5.0%, last +5.3%): We estimate a 0.22% increase in June core CPI (mom sa), which would lower the year-on-year rate by four tenths to 4.9%. Our forecast reflects a pullback in auto prices (used -1.2%, new -0.2%, mom sa) reflecting lower used car auction prices and the further rebound in new car inventories and incentives. We also expect declines in travel categories due to residual seasonality, as well as additional moderation in shelter categories (we estimate +0.47% for both rent and OER). On the positive side, we expect another large gain in the car insurance category as carriers continue to offset higher repair and replacement costs. We estimate a 0.25% rise in headline CPI, reflecting higher food (+0.2%) and energy (+0.7%) prices.

- 08:30 AM Richmond Fed President Barkin (FOMC non-voter) speaks: Richmond Fed President Tom Barkin will discuss inflation at a local chamber of commerce. A Q&A with audience is expected. On June 16, Barkin said, “I want to reiterate that 2% inflation is our target, and that I am still looking to be convinced of the plausible story that slowing demand returns inflation relatively quickly to that target. If coming data doesn’t support that story, I’m comfortable doing more. I recognize that creates the risk of a more significant slowdown, but the experience of the ’70s provides a clear lesson: If you back off inflation too soon, inflation comes back stronger, requiring the Fed to do even more, with even more damage. That’s not a risk I want to take.”

- 09:45 AM Minneapolis Fed President Neel Kashkari (FOMC voter) speaks: Minneapolis Fed President Neel Kashkari will participate in a panel discussion on banking solvency and monetary policy at NBER’s Summer Institute event. On May 22, Kashkari said, “Do we then start raising again in July? Potentially, and so that’s the most important thing to me is that we’re not taking it off the table. Markets seem very optimistic that rates are going to fall now. I think that they believe that inflation is going to fall, and then we’re going to be able to respond to that. I hope they’re right. But nobody should be confused about our commitment to getting inflation back down to 2%.”

- 01:00 PM Atlanta Fed President Bostic (FOMC non-voter) speaks: Atlanta Fed President Raphael Bostic will participate in a discussion on financial inclusion at the bank’s 2023 Payments Inclusion Forum. A moderated Q&A with audience is expected.

- 02:00 PM Beige book, July FOMC meeting period: The Fed’s Beige Book is a summary of regional economic anecdotes from the 12 Federal Reserve districts. The Beige Book for the June FOMC meeting period noted that economic activity was little changed overall in April and early May. Consumer spending was steady or higher in most districts and although expectations for growth deteriorated slightly, contacts largely expected further expansion in activity. In this month’s Beige book, we look for anecdotes related to the impact of stress in the banking system on lending, growth, and sentiment, as well as commentary related to the evolution of labor market tightness and inflationary pressures.

- 02:00 PM Senate Banking Committee Markup on Fed Nominations: The Senate Banking Committee will hold an executive session on the nominations of Philip Jefferson as Fed vice chair, Lisa Cook for a full term as governor, and Adriana Kugler as a governor.

- 04:00 PM Cleveland Fed President Mester (FOMC non-voter) speaks: Cleveland Fed President Loretta Mester will discuss FedNow at an NBER Summer Institute event. Speech text and a Q&A with audience are expected.

Thursday, July 13

- 08:30 AM PPI final demand, June (GS +0.2%, consensus +0.2%, last -0.3%); PPI ex-food and energy, June (GS +0.2%, consensus +0.2%, last +0.2%); PPI ex-food, energy, and trade, June (GS +0.2%, consensus +0.1%, last flat)

- 08:30 AM Initial jobless claims, week ended July 8 (GS 240k, consensus 250k, last 248k); Continuing jobless claims, week ended July 1 (consensus 1,720k, last 1,720k)

- 06:45 PM Fed Governor Waller speaks: Fed Governor Christopher Waller will deliver remarks on the economic outlook at an event hosted by Money Marketeers. Speech text and a moderated Q&A with audience are expected. On June 16, Waller said, “We’re seeing policy rates having some effects on parts of the economy. The labor market is still strong, but core-kind of inflation is just not moving and that’s going to require probably some more tightening to try to get that going down.” He added, “I do not support altering the stance of monetary policy over worries of ineffectual management at a few banks.”

Friday, July 14

- 08:30 AM Import price index, June (consensus -0.1%, last -0.6%); Export price index, June (consensus flat, last -1.9%)

- 10:00AM: University of Michigan consumer sentiment, July preliminary (GS 65.0, consensus 65.5, last 64.4); University of Michigan 5-10-year inflation expectations, July preliminary (GS 3.0%, consensus 3.0%, last 3.0%): We expect the University of Michigan consumer sentiment index to increase by 0.6pt to 65.0 and for the report’s measure of long-term inflation expectations to be unchanged at 3.0%, reflecting flattish gasoline prices and diminished uncertainty related to banking stress.

Source: DB, Goldman, BofA