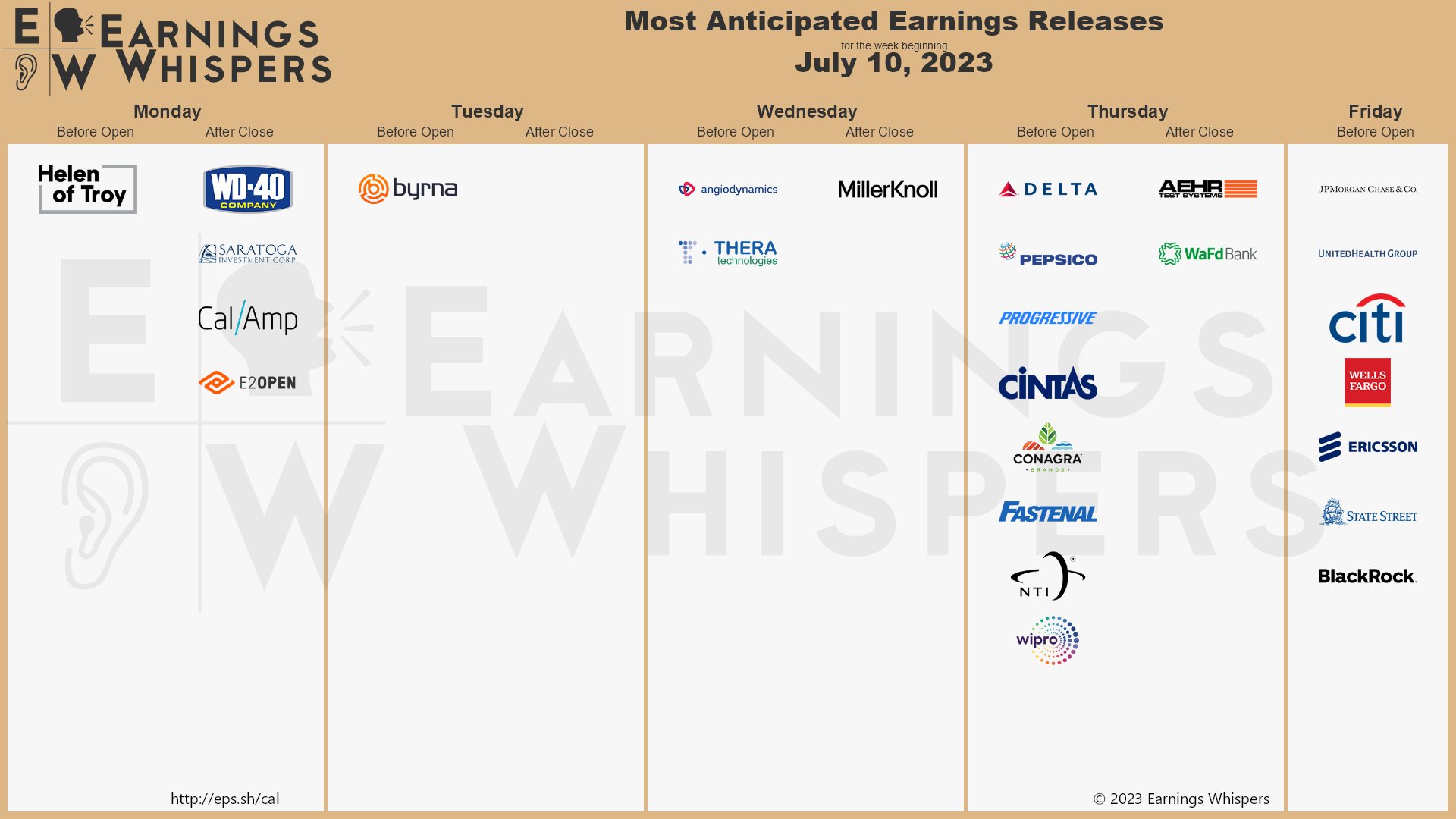

Earnings doesn’t officially start until Friday.

That’s when the Big Banks begin to report and that may be a problem because the Federal Reserve Economic Data (FRED) system shows a significant increase in bank borrowing from the Federal Home Loan Bank (FHLB) system and the newly established Bank Term Funding Program (BTFP) – an increase that indicates the potential of additional banking failures – dozens of them!

The linked article suggests that we keep a close eye on the Fed’s Discount Window, which is essentially emergency lending for banks. An increase in utilization there would indicate the banks resorting to that program are in dire staits. Troubled banks typically prefer accessing liquidity from the marketplace or repo market due to lower costs. However, if those options are not feasible, they turn to the FHLB, even though it is expensive and comes with draconian terms. The FHLB can be seen as a “stealth bailout” for banks.

The Fed’s next meeting is in two weeks on July 26th and we will have heard from most of the significant (remaining) banks by then. Looking at the Regional Bank Index (KRE) – not much is expected other than, perhaps, survival. We’re not very far off the Mach lows, maybe 20% – but that’s after falling almost 50% and way more than that off the highs of last year.

As noted by the Wall Street Journal, we are now at a critical juncture in Commercial Real Estate where the math simply fails us. An example they use is a grain mill, which would cost $7.4M to build, would only appraise for $2.4M when completed – so there’s no bank that can approve the construction project.

This is what’s happening all over the country in small towns to small businesses as lending has become nearly impossible for the banks, who have to deal with the reality of math as the American Dream is no longer considered an asset.

Low property values and decades of disinvestment make it challenging for new projects to be financially viable. The lack of collateral, such as property value, becomes a major barrier for rural entrepreneurs to secure financing from banks. And, keep in mind that small businesses in rural economies account for 42% of jobs compared to 28% in metropolitan areas.

The appraisal gap is attributed to the limited pool of businesses in rural communities, making it challenging to find comparable properties. Rising construction costs further exacerbate the gap along with, of course, higher interest rates. Rising labor costs aren’t helping either – it’s hard to run a plantation when you have to pay all the workers, isn’t it?

The U.S. Chamber of Commerce reports that financing is now the biggest challenge for entrepreneurs who want to start or grow their businesses. Some of the barriers they face are the disappearance of community banks, the rise of service-based businesses with no collateral, and the venture capital’s focus on high growth potential.

:max_bytes(150000):strip_icc()/What-If-Its-A-Hoax-56a74f4c5f9b58b7d0e8f300.jpg) The SBA also acknowledges that most U.S. banks view loans for exporters as risky, which makes it harder for them to get loans for things like day-to-day operations, advance orders with suppliers, and debt refinancing. Insurance issues are also becoming an issue in many parts of the country as wildfires, tornadoes, hurricanes, flooding, drought, heat and blackouts are all on the rise and impacting businesses on a too-regular basis.

The SBA also acknowledges that most U.S. banks view loans for exporters as risky, which makes it harder for them to get loans for things like day-to-day operations, advance orders with suppliers, and debt refinancing. Insurance issues are also becoming an issue in many parts of the country as wildfires, tornadoes, hurricanes, flooding, drought, heat and blackouts are all on the rise and impacting businesses on a too-regular basis.

This is another one of those slow-moving macros that simply is not going to go away. In the 1920s, rural farms and businesses were suffering and Wall Street ignored them because they were putting all their money into GE, GM, X, KO and SHLD (Sears) – not the Kent farm or Sam’s General Store. Of course, the joke was on them because Sams General Store became WMT…

Anyway, the point is that then, as now, rural businesses represent half the economy and their problems will most assuredly be all of our problems – in time.

Meanwhile, it’s not a huge data week with 2 Fed Speakers today, but that’s it for the week and then Consumer Credit this afternoon. Small Business Optimism early tomorrow, CPI on Wednesday along with the Atlanta Fed and the Beige Book. Thursday we get PPI and Friday is Consumer Sentiment. Next week gets hot and heavy with lots more earnings and pre-Fed data – all leading up to another rate hike!

It’s going to be a long week, they expect us to work all 5 days…