The Fed wants us well-prepared for more hikes – apparently or, perhaps, some scary inflation data likes ahead?

The Fed wants us well-prepared for more hikes – apparently or, perhaps, some scary inflation data likes ahead?

In speeches yesterday, Federal Reserve Vice Chair for Supervision Michael Barr acknowledged the progress made in monetary policy but states that there is still work to be done while San Francisco Fed President Mary Daly and Cleveland Fed Chief Loretta Mester also agree that a couple more rate increases are needed to ensure inflation returns to the desired level.

The Federal Open Market Committee (FOMC) is expected to resume rate increases at its next meeting. Daly emphasizes that the risks of not doing enough to curb inflation outweigh the risks of doing too much, although the gap between the two is narrowing. She notes signs of the economy slowing down and better balance between supply and demand.

The officials express concern about core inflation, with underlying inflation remaining sticky despite a slower annual pace in the personal consumption expenditures price index. They consider inflation to be the primary problem and anticipate new inflation data to be released in the coming week.

Atlanta Fed President Raphael Bostic offers a contrasting view, suggesting that policymakers can be patient for now due to evidence of an economic slowdown. He believes the current policy is in the restrictive territory and that the signs of the economy slowing down indicate that the restrictiveness is working.

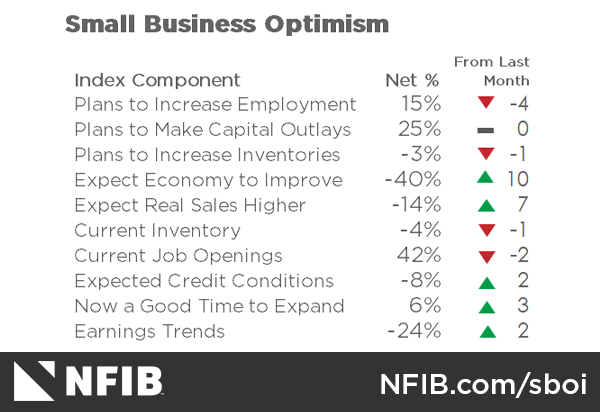

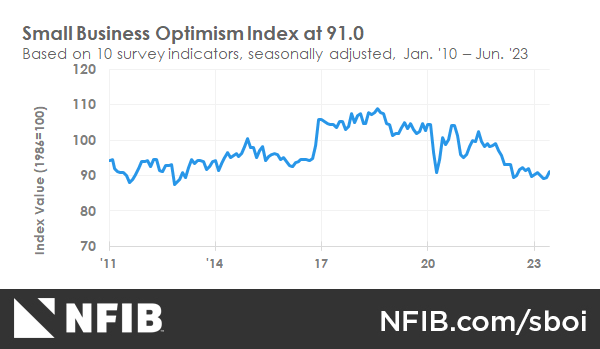

Despite the rate hikes, Small Business Optimism is back to 91, from 89.4 in May. The index consists of 10 indicators derived from questions addressing various aspects of small business operations. The index has been below its 48-year average of 98 for eight consecutive months as of August 2022, indicating a general lack of confidence among small business owners. The main challenges facing small businesses are, of course, Inflation and Worker Shortages.

Despite the rate hikes, Small Business Optimism is back to 91, from 89.4 in May. The index consists of 10 indicators derived from questions addressing various aspects of small business operations. The index has been below its 48-year average of 98 for eight consecutive months as of August 2022, indicating a general lack of confidence among small business owners. The main challenges facing small businesses are, of course, Inflation and Worker Shortages.

Notice the increase is driven by 10% more people (still -40%) expect the economy to improve than they did last month. Keep in mind that’s NOT that they are saying thing HAVE improved – just that they expect them to…

Also of great concern is the net -24% expecting earnings growth. The net percent is the difference between the percentage of owners who answered positively and the percentage of owners who answered negatively to a given question. For example, if 30% of owners reported higher earnings and 54% reported lower earnings (the rest flat), the net percent would be -24% (30% – 54%).

Either way – it makes you wonder what the Russell is so excited about in the past month?

Either way – it makes you wonder what the Russell is so excited about in the past month?

In August of last year, the Russell was at 2,000 and the Optimism Index was at 98-that made sense. The Russell 2,000 are not exactly “small businesses” but they should be a lot closer to that outlook than the S&P 500 yet the S&P 500 is only up 5% since June and the Russell is up 10% – strange dreams…

When you are in a very bullish market – especially a narrowly traded one with low volumes, data reconciliation is what we fear. Like the pending CRE collapse – it simply hasn’t been taken into account in the markets and, until we are able to put numbers on these issues – we ignore them at our own peril.

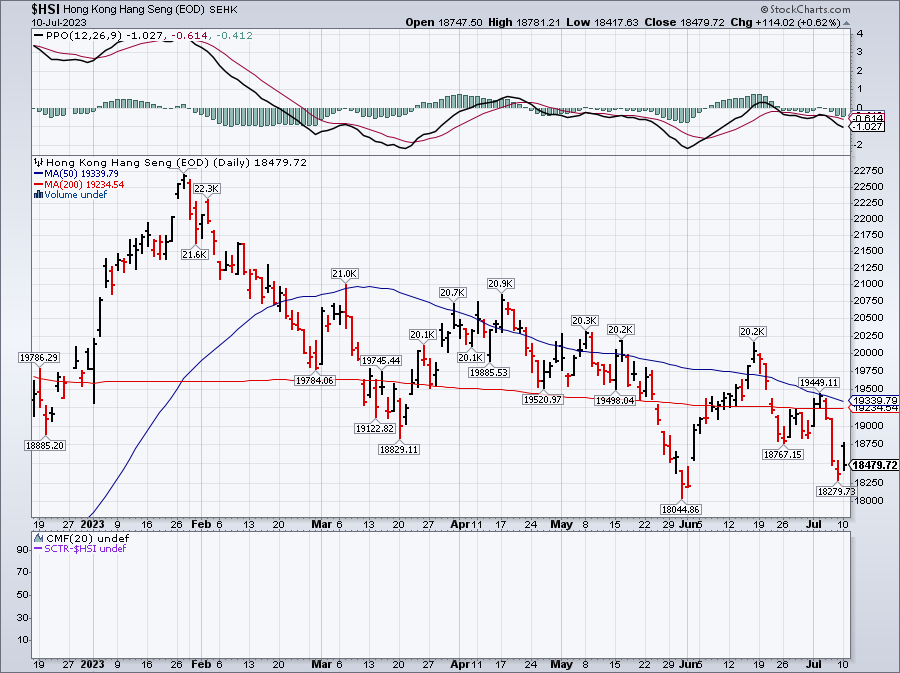

For example, the reopening trade in China, which had driven the outperformance of many U.S. stocks with China exposure, is losing steam due to soft Chinese Economic Growth and ongoing Geopolitical Tensions. China’s consumer price inflation hit a 28-month low in June, raising concerns about DEflation. Furthermore, investors have been pulling money out of China equity funds for 10 consecutive weeks, reflecting waning confidence.

Recent data on retail sales, factory output, exports, and investment in China have been weaker than expected and many U.S.-based companies rely on China as a major market and a source of growth.

The end of pandemic-era restrictions in China had initially raised hopes for a strong recovery, but those expectations have faded. Companies in industries such as energy and travel that do business in China are facing challenges due to trends like higher unemployment and weaker consumer confidence – this is something that we didn’t take into account that explains the continued weakness in travel stocks, despite great travel numbers in the US this year.

While U.S. stocks with significant exposure to China have generally performed well this year, the recent weakness in the Chinese economy raises concerns going into the second-quarter earnings season. The Chinese economy’s weakness contrasts with the resilience of the U.S. economy, which has been supported by artificial intelligence technology and has remained strong, so far, despite interest rate increases.

Furthermore, restrictions on the sale of computer chips needed for AI technology could impact the long-term outlook for semiconductor stocks. Chinese firms have already faced restrictions on buying certain chips, and possible export controls from the U.S. to China may lead to a loss of opportunities. This is a concern because many companies driving growth in sectors like information technology and consumer discretionary have high revenue exposure to China.

Analysts expect overall earnings results for the S&P 500 to decline in the second quarter but low expectations going into the earnings season suggest that weakness from China may not lead to significant disappointments. However, if company forecasts for the second half of the year are weaker than expected, it could still lead to an overall decline in stock prices, especially for companies with significant exposure to the Chinese market.