Oil prices ended higher again today, with WTI at the upper-end of its recent range and Brent with its highest close since late April.

“Crude prices are getting a boost as expectations grow for the oil market to remain tight despite all lingering growth concerns. The IEA expects strong demand from China and developing nations. The short-term crude demand outlook shouldn’t be that bad as everyone is taking a vacation that requires some travel this summer,” Edward Moya, Senior Market Analyst, at Oanda wrote in a note Tuesday afternoon.

The first sign of an inflection in the demand will be a larger than expected crude draw…

API

-

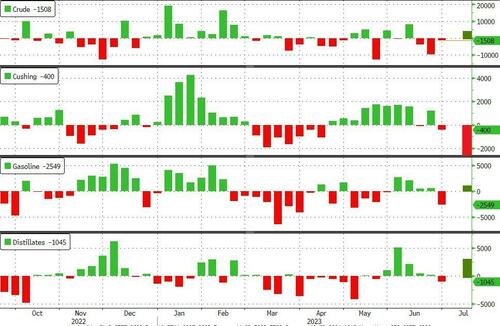

Crude +3.026mm (-1.00mm exp)

-

Cushing -2.15mm – biggest draw since May 2022

-

Gasoline +1.00mm (-1.1mm exp)

-

Distillates +2.908mm (+150k exp)

Crude complex bulls will be disappointed by significant (and surprising) inventory builds for crude, gasoline and distillates last week…

Source: Bloomberg

WTI continued its recent resurgence today, trading within pennies of $75 at the high end of the recent range (and back to ‘Saudi Cut’ levels…

After the API data, WTI leaked lower…

Reports this week from major forecasting agencies may firm the market’s perspective on demand, with the Energy Information Administration releasing its monthly Short-Term Energy Outlook on Tuesday, while OPEC and the International Energy Agency will issue their monthly outlooks on Thursday. “The market will be looking out for any change in their demand growth outlooks, not least considering how the bulk of the 2023 growth has been penciled in to occur during the next few months,” Saxo Bank wrote.