Here we go again:

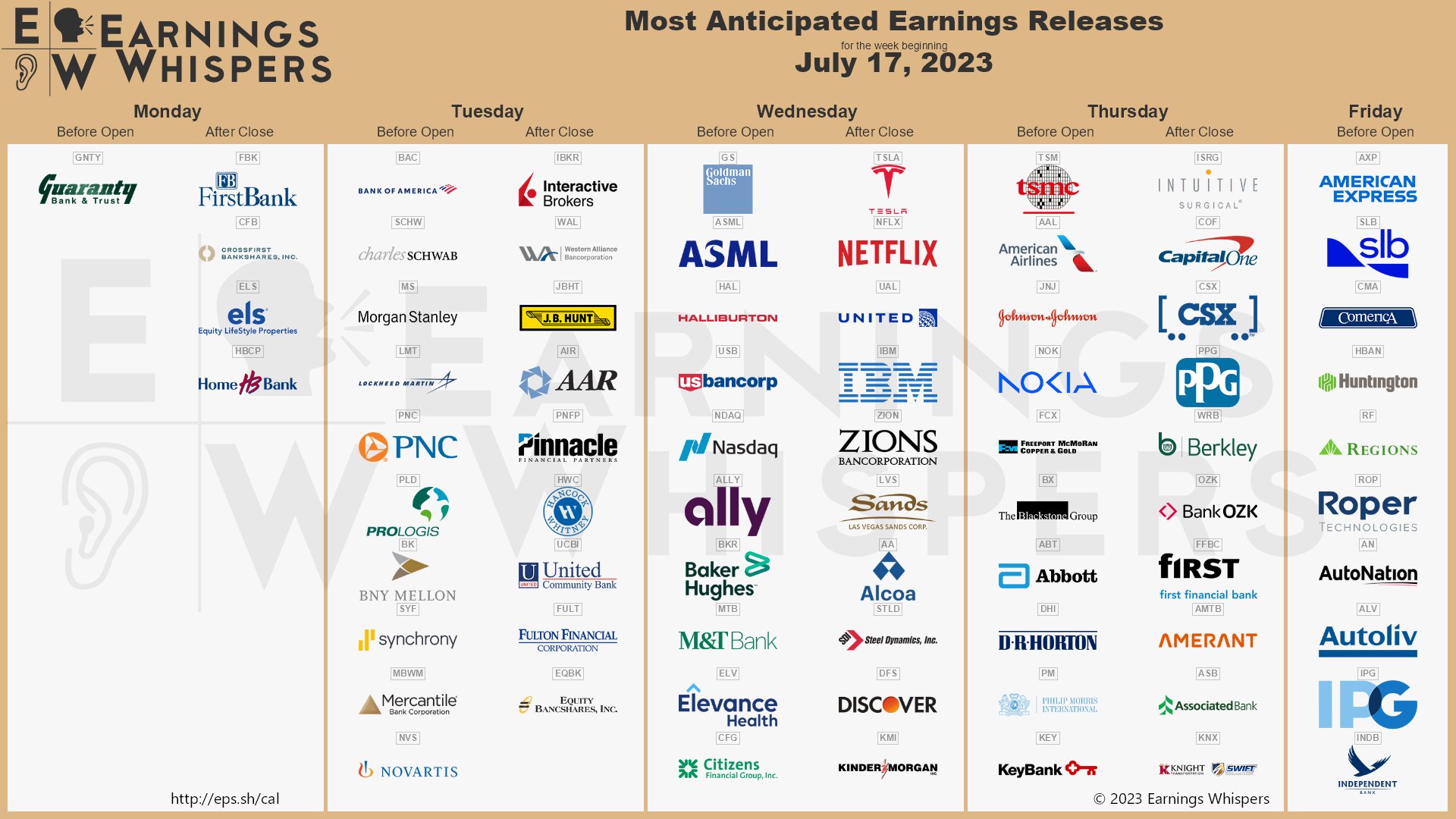

10% of the S&P 500 report this week and half report in the next two weeks but it’s not the earnings themselves we’re concerned with (Q2 was pretty good), but the outlook for the rest of 2023 as we have a bi-polar Economy that is both overheating and flashing Recession signals at the same time.

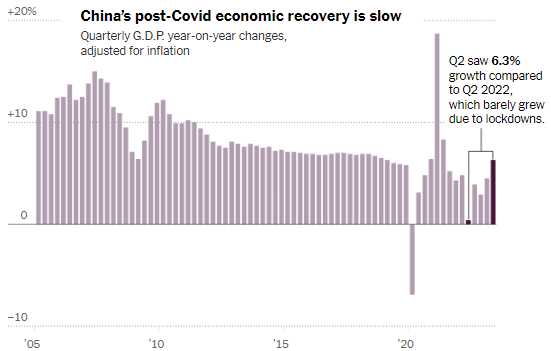

China just reported “only” 6.3% GDP growth in Q2 but that’s misleading as it’s being compared to near 0% last Q2, when the country was still in lockdown. A more accurate measure of the economy would compare the second quarter of 2023 with the previous three months after the abandonment of the “zero Covid” policy. By this measure, the second quarter’s output was only 0.8% higher than the first quarter, indicating a slower growth rate of a little over 3% annually compared to around 9% in Q1.

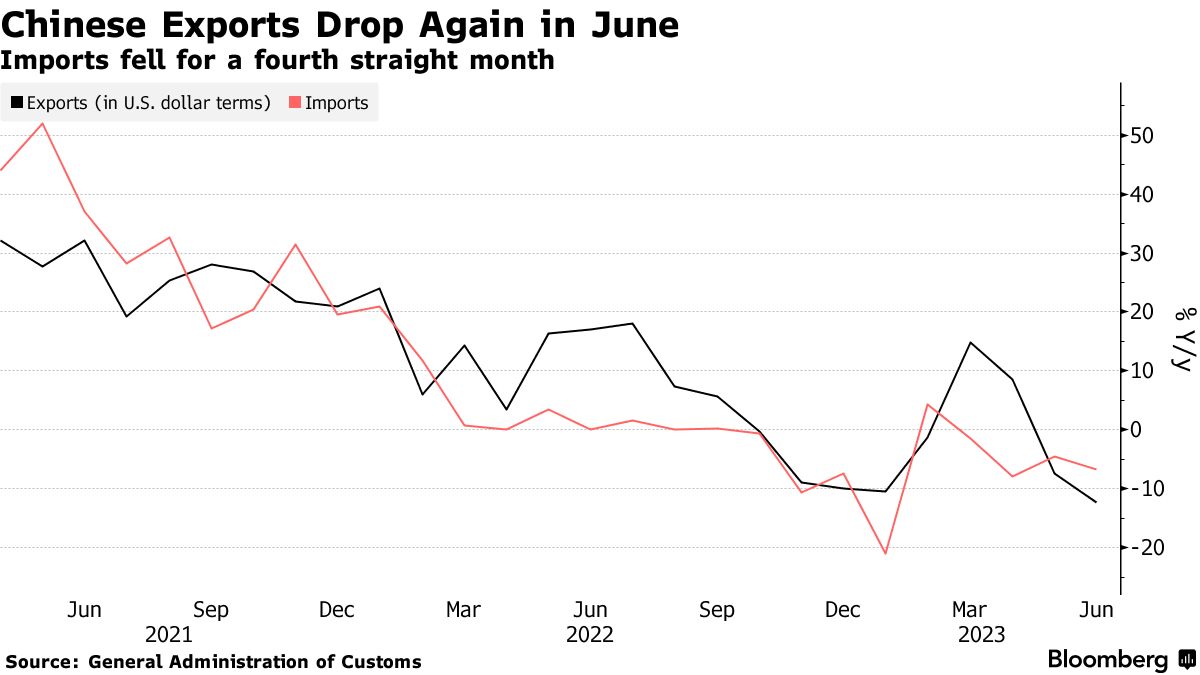

Several warning signs indicate China’s economic struggles. Exports experienced a significant decline, deflationary trends emerged, housing prices decreased, investment stumbled, and foreign companies showed reluctance to invest in China. Local governments faced financial shortages, and some cities, like Baoding, had to suspend essential services like bus operations. The Renminbi fell against the Dollar, and the stock market also experienced a decline.

Additional economic challenges persist in China, such as Industrial Production growth of 4.4% and Retail Sales growth of 3.1%, both lower than previous levels. Exports in June fell by 12.4% compared to the unusually strong performance in the same month of the previous year. The pandemic has also affected workers’ incomes, with high unemployment rates among 16-to-24-year-olds.

To sum things up – Europe still has Inflation and almost zero growth, China seems to be entering a Recession and the US markets are pretending everything is awesome – what could possibly go wrong? Oh, and why are China’s exports down? Almost entirely because of low demand from the US! Awesome!

Speaking of AWESOME – we finally got our pullback in Oil we’ve been waiting for since last week so congrats to all who played along on a very nice win. Our goal was $75 so the rest is just bonus money and $74.50 should be the stop now.

Speaking of AWESOME – we finally got our pullback in Oil we’ve been waiting for since last week so congrats to all who played along on a very nice win. Our goal was $75 so the rest is just bonus money and $74.50 should be the stop now.

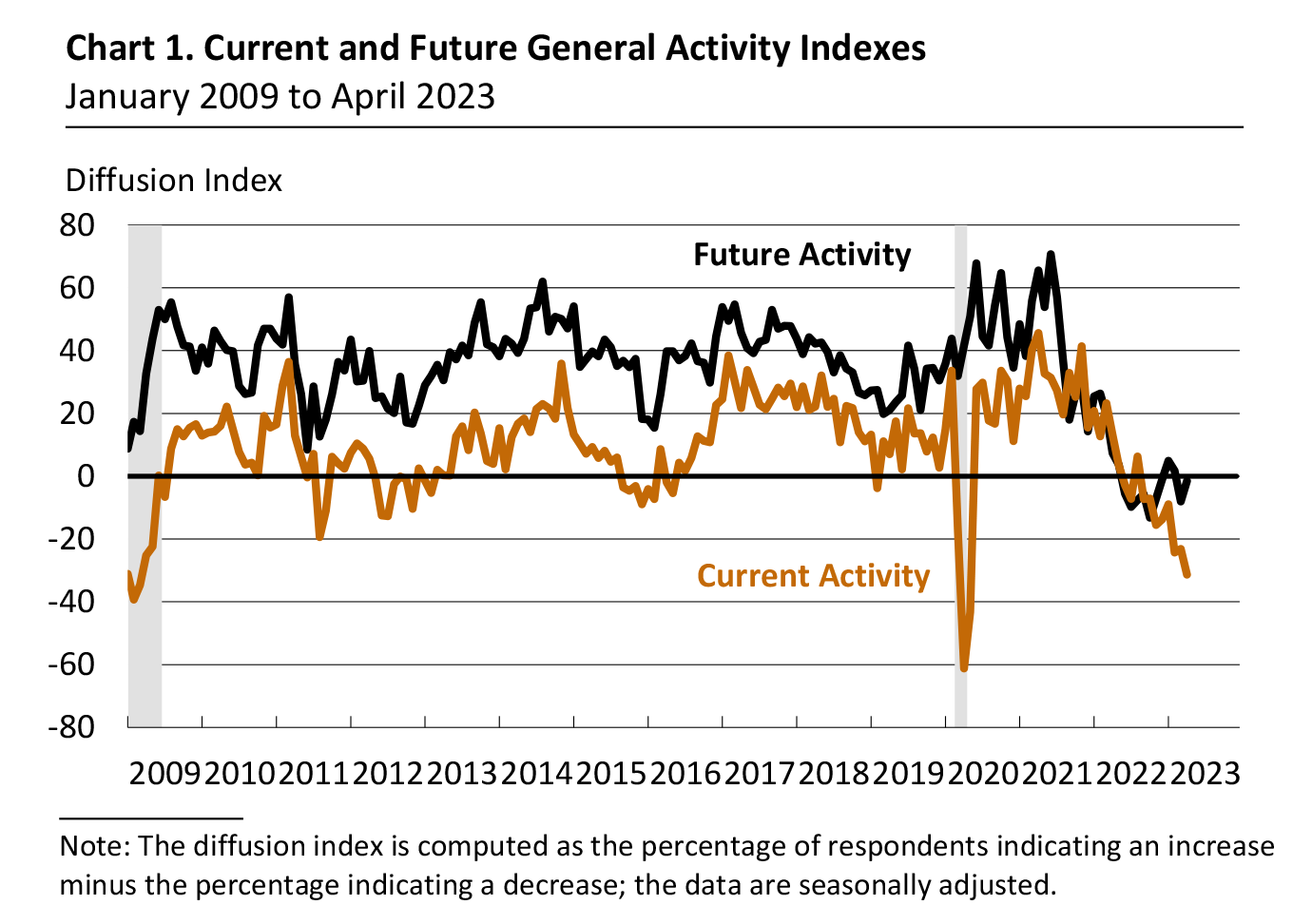

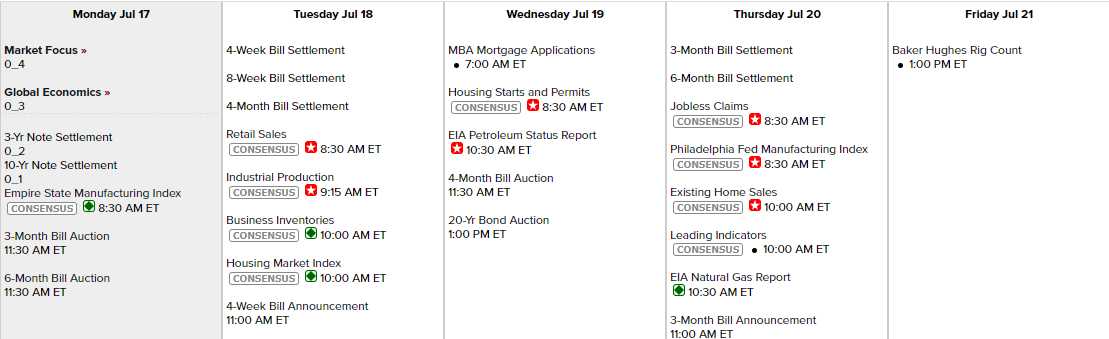

This might now be it as the Dollar is still sleeping at 99.50 with the Fed coming up next week to raise rates again. Meanwhile, this week, we have Empire State Manufacturing, which has SUCKED for 2 years now, so we need to see that turning around.

The rest of the week we have Retail Sales and Industrial Production tomorrow, Housing Starts Wednesday and the Philly Fed, Existing Home Sales and Leading Economic Indicators, which have also sucked on Thursday.

What we don’t have this week is Fed Speak, ahead of their meeting so it’s all about the CEO speak this week – until Powell speaks next Wednesday, anyway – so awesome!

8:30 Update: Empire State Manufacturing came in at 1.1 and that’s down from 6.6 in June so the bump we saw in June was just a bounce – we’ll see if that’s true for the indexes as well…