Weakness in the Empire Fed Manufacturing survey this morning came on the heels of ugly China GDP data overnight (along with really ugly property investment, youth unemployment, and retail sales), prompted bond yields and commodities to drop overnight, but on a quiet-ish day (volume-wise), the day session saw things end quite differently.

Stocks just won’t stop – Small Caps and Nasdaq soared higher today from the cash open. The Dow and S&P also ended comfortably green on the day. Some late-day profit-taking wiped a little lipstick off this pig…

And, of course, another massive short-squeeze unwound all of Friday’s losses in the “most shorted” names…

Source: Bloomberg

The Telco trouncing accelerated today as Jefferies put the owners of cell-phone towers on its list of “stock pans” ahead of earnings season and BMO reiterated that it’s cautious on tower stocks in the near term…

Source: Bloomberg

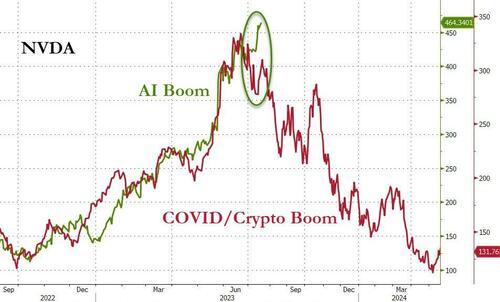

Despite more threats from the Biden administration to ban chip sales to China, NVDA powered ahead, decoupling (for now) from its 2021 analog…

Source: Bloomberg

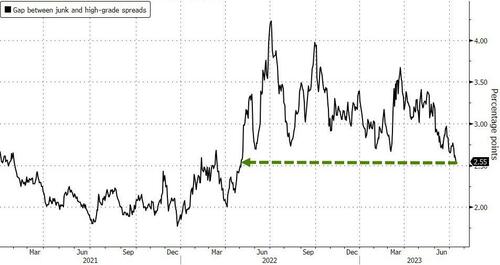

Credit markets are seemingly convinced of a soft-landing as the HY-IG spread fell back to its lowest in 15 months…

Source: Bloomberg

Treasuries were mixed today and traded a roller-coaster – yields tumbled overnight and then soared back during the US day-session. 30Y ended marginally higher in yield while the belly outperformed…

Source: Bloomberg

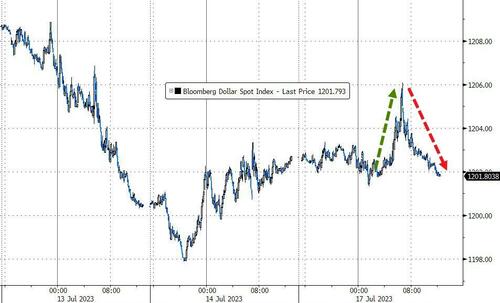

The dollar was very marginally lower after a pump and dump around the Empire Fed data…

Source: Bloomberg

Bitcoin broke back below $30,000 late in the day, below Friday’s spike-lows…

Source: Bloomberg

Oil fell overnight following ugly China GDP data but early in the European session it exploded higher (and quickly tumbled back down) after Reuters printed a headline about Saudi extending production cuts through the end of 2024 (only to retract the story within minutes).

Gold limped marginally lower on the day but bounced back nicely from a plunge around the Empire Fed data (and London Fixing)…

Finally, billionaire investor and Baupost Group CEO Seth Klarman said during the latest episode of ‘Capital Allocators with Ted Seides’, that he’s “not convinced that we’ve even begun to sort out that bubble.”

“You had a bubble, it was really a credit bubble, that became an everything bubble,” he noted, and “Super-low interest rates, at times zero rates, made capital easily available and incredibly cheap.”

“That led to startup manias and SPACs and meme stocks and crypto, all kinds of speculative activity.”

“You had a lot of hiccups between ’98 and ‘,01 and then the Great Financial Crisis was a really ugly 12 months or so,” he said.

“I’m just not sure why you couldn’t have more trouble.”

“We haven’t seen a lot of bodies float up,” Klarman concluded. “I don’t know what that means, but I’d be worried.”