Moments ago, the Treasury held this week’s lone coupon auction in the form of a 20Y sale (really a 19Y-10M reopening) which came in solid, if not quite as stellar as last week’s auctions.

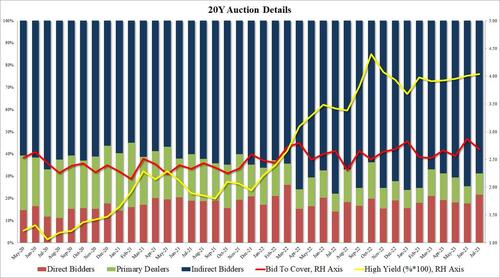

The high yield of 4.036% was above last month’s 4.010% and the highest since last November’s 4.072%; it also tailed the When Issued 4.035% by one modest basis point.

The bid to cover was 2.68, which while below last month’s 2.87 was just above the recent average of 2.67,

The internals were ok, with Indirects taking down 68.8%, below both last month’s 74.6% and the six-auction average of 72.1%; and with Directs taking down 21.7%, or the second highest on record (only the 26.0% in March 2022 was higher), Dealers were left holding 9.6% of the auction, just below the 9.7% recent average.

Overall, this was a mediocre auction with solid if hardly stellar demand, and pretty much what one would expect for a relatively boring day like today when things are just drifting.