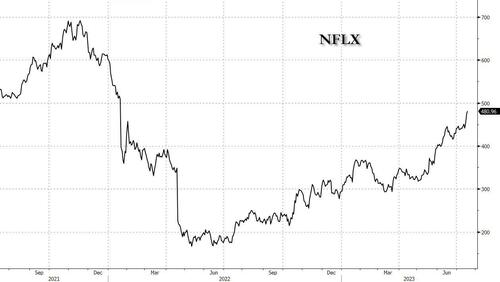

After suffering a historic collapse at the end of 2021, when in the span of five months Netflix lost 75% of its value, the company has enjoyed a remarkable recovery over the past year when it rose by nearly 200%, from a low of $166 to the current price of $481, which is the highest since January of 2022.

Curiously, the meltup has continued despite several earnings reports that were at best mixed (just last quarter, NFLX not only missed on subs but also slashed guidance) and yet amid the unprecedented squeeze in all things tech, the OG video streamer is again trading north of $200BN in market cap despite a Hollywood strike that could mothball the company’s movie and production pipeline for months.

So with much of the recent meltup contingent on NFLX reporting (much) stronger earnings than it did one quarter ago, including more than 2 million new streaming subs (at a time when NFLX has cracked down aggressively on password sharing), boosting revenue to $8.7 billion, and operating margin to 21%, all eyes were on the company’s earnings, especially after the company confirmed that it has quietly shuttered its cheapest ad-free tier. Previously, the ‘Basic’ tier of Netflix allowed users to watch all of the shows and movies on the platform in standard definition, without advertising, for $9.99 a month. Now, the company’s cheapest ad-free options are the standard and premium tiers which cost $15.49 and $19.99 per month, respectively, suggesting the company is suddenly scrambling to boost ASP in what may be a margin chase.

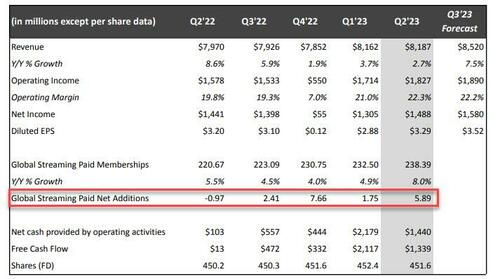

With that in mind, and considering that options were pricing in a powerful 8% swing after hours today, here is what NFLX reported for its second quarter:

- EPS $3.29, beating estimates of $2.86, and above the $3.20 a year ago

- Revenue $8.19 billion, +2.7% y/y, missing estimates of $8.3 billion

- Streaming paid net change +5.89 million vs. -970,000 y/y, smashing estimates of +2.07 million

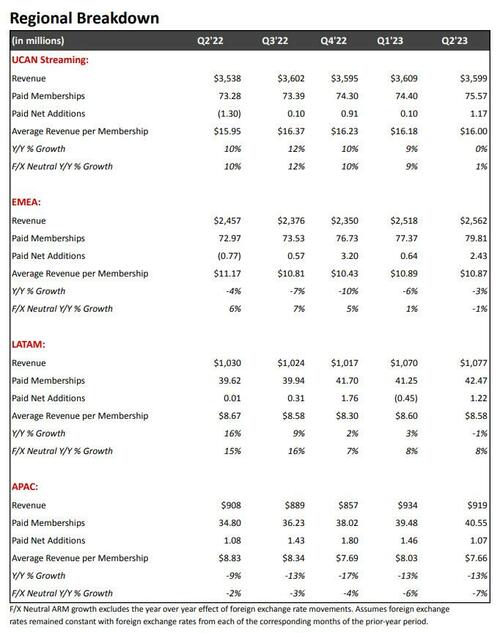

- UCAN streaming paid net change +1.17 million vs. -1.30 million y/y, beating estimate +89,183

- EMEA streaming paid net change +2.43 million vs. -770,000 y/y, beating estimate +541,832

- LATAM streaming paid net change +1.22 million vs. +10,000 y/y, beating estimate +323,125

- APAC streaming paid net change +1.07 million, -0.9% y/y, missing estimate +1.20 million

- Streaming paid memberships 238.4 million, +8% y/y, beating estimate 234.5 million

- Operating margin 22.3% vs. 19.8% y/y, beating estimate 19.1%

- Operating income $1.83 billion, +16% y/y, beating estimate $1.58 billion

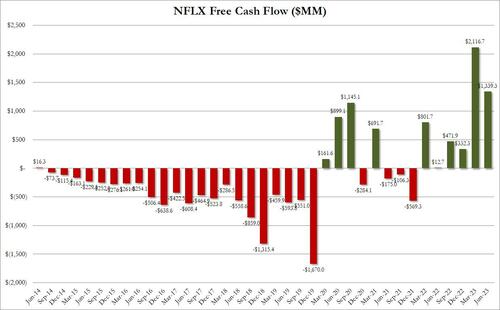

- Free cash flow $1.34 billion vs. $13 million y/y, beating estimate $542.3 million

And visually:

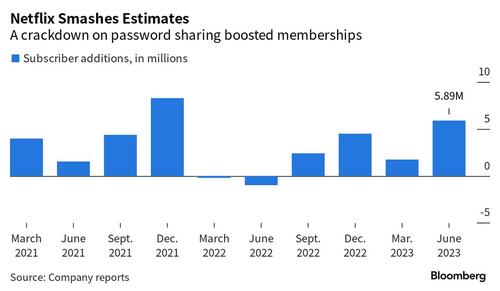

As noted above, the crackdown on password sharing meant a blowout in new subscribers, as the company added a whopping 5.89 million customers, more than double Wall Street’s estimates. The results marked the company’s best second quarter since the depths of the pandemic three years ago and far surpass Wall Street forecasts of 2.07 million new subscribers.

As a reminder, in May, Netflix started charging people in more than 100 countries to continue sharing their passwords, a key part of its plan to accelerate growth after a sluggish 2022. Viewers using someone else’s subscription can now either pay to keep sharing or set up their own account.

While the plan has been controversial with users, and analysts weren’t sure how it would impact the company’s growth (the company warned that it would see an uptick in cancellations at the start of the crackdown and that it would see more growth in the back half of this year) in recent weeks, third-party data indicated that Netflix was seeing a surge in customers.

The company finished the quarter with 238.4 million members, up 8% from a year ago, and above the 234.5 million expected.

Here is the regional detail:

What was strange however, is that while NFLX smashed subscriber estimates, adding more than double the subs that analysts expected, revenue missed. This suggests that the average revenue per new sub came in far below estimates, and will eventually send margins sharply lower.

Yet while the current quarter was generally solid, setting aside the discrepancy marked above, what spooked investors was the company’s unexpectedly soft revenue guidance.

Here is the outlook for Q3:

- Sees revenue $8.5 billion, estimate $8.67 billion

- Sees operating income of $1.890BN

- Sees EPS $3.52, estimate $3.23

- Sees operating margin 22%, estimate 21%

Some more details from the company:

- For Q3, NFLX forecasts revenue of $8.5B, up 7% year over year on both a reported and F/X neutral basis, a slight acceleration from our Q2’23 F/X neutral revenue growth rate of 6%. Our revenue growth in Q3 will come from growth in average paid memberships.

- We expect F/X neutral ARM to be flat to slightly down year over year, as we are lapping price increases in 2022 and we generally haven’t had price increases in our largest revenue markets since the first half of last year (limited during paid sharing rollout). Revenue from advertising and our extra member feature are not yet material enough to offset these factors.

- We anticipate Q3’23 paid net adds will be similar to Q2’23 paid net additions. We expect that our revenue growth will accelerate more substantially in Q4’23 as we further monetize account sharing between households and steadily grow our advertising revenue.

And here is full year 2023:

- Still sees operating margin 18% to 20%, estimate 19%

- NFLX now expects at least $5B in FCF for 2023, up from the prior estimate of at least $3.5B. The updated expectation reflects lower cash content spend in 2023 than we originally anticipated due to timing of production starts and the ongoing WGA and SAG-AFTRA strikes.

Oddly enough, while the Hollywood strike is boosting free cash flow, it has no adverse impact on revenue?

Still, the big miss in Q3 revenue was enough to snuff any hopes for a post-earnings rally because despite the blowout Q2 results, the stock is tumbling after hours, and was last down 5% after hours.

Going back to the company’s results, net cash generated by operating activities in Q2 was $1.4B vs. $0.1B in the prior year period. Free cash flow in Q2’23 amounted to $1.3B compared with about breakeven in the year ago quarter.

NFLX finished Q2 with gross debt of $14.5B (in-line with our $10B-$15B targeted range) and cash and short term investments of $8.6B. During the quarter, NFLX repurchased 1.8M shares for $645M. We now have $3.4B of capacity remaining under our $5B share buyback authorization. And since the company is currently running a bit above its targeted minimum cash level , it expects to increase stock repurchase activity in the second half of 2023.

Alas not even that was enough to boost the stock after hours, and following the disappointing guidance, NFLX was down about 5% after some wild earlier swings. Still, with options pricing in an 8% swing after hours, tomorrow bears will find that their puts are worth far less than they thought they would be (as for calls, RIP).